Press release

Crypto Asset Management Market to Reach US$2.28 Bn by 2031 with 22.4% CAGR Driven by AI and ML Integration

✅Overview of the Crypto Asset Management MarketThe crypto asset management market is experiencing exponential growth as digital currencies become increasingly mainstream in the global financial ecosystem. According to the latest study by Persistence Market Research, the market size is projected to grow from US$1.1 billion in 2024 to US$2.28 billion by 2031, registering a CAGR of 22.4% over the forecast period. This rapid rise is fueled by increasing institutional adoption of cryptocurrencies, growing interest from high-net-worth individuals, and the expansion of digital financial services. Crypto asset management platforms simplify complex processes such as buying, storing, and tracking digital assets, making them essential tools for both retail and institutional investors.

Portfolio management platforms form the leading segment of the market due to their ability to offer advanced analytics, real-time insights, and automated decision-making tools. These platforms leverage cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML) to optimize asset allocation, minimize risk, and improve returns. Regionally, North America leads the global market, driven by the presence of key fintech players, a mature financial infrastructure, and high cryptocurrency awareness among investors. The region's regulatory clarity, compared to many others, also makes it a fertile ground for growth and innovation in crypto asset management solutions.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/34765

✅Key Market Insights

➤ The global crypto asset management market is expected to grow at a CAGR of 22.4% from 2024 to 2031.

➤ Portfolio management solutions dominate the market, owing to growing demand for automated and AI-driven tools.

➤ North America holds the largest market share due to strong fintech ecosystems and favorable regulatory conditions.

➤ AI and ML integration enhances accuracy and efficiency in asset tracking and decision-making.

➤ Rising interest from institutional investors continues to drive demand for secure and compliant asset management platforms.

✅What is the best way to manage crypto assets in 2024?

The best way to manage crypto assets in 2024 is through crypto asset management platforms that offer secure, automated, and AI-powered tools for portfolio tracking and risk management. These platforms not only provide real-time insights into market performance but also help optimize transactions, diversify holdings, and ensure compliance with evolving regulatory frameworks. With institutional interest growing and the crypto landscape becoming more complex, using a robust management solution is crucial to safeguard investments and maximize returns.

✅Market Dynamics

Market Drivers: The growing adoption of blockchain technology in financial services, coupled with rising institutional investments in cryptocurrencies, is a significant market driver. Enhanced transparency, decentralized finance (DeFi) offerings, and the ability to automate operations using AI and ML are pushing the demand for professional asset management services in the crypto space. Moreover, users increasingly seek seamless solutions for managing diverse portfolios spread across multiple exchanges and wallets, further fueling demand.

Market Restraining Factor: Despite the promising outlook, regulatory uncertainties and cyber-security risks remain major roadblocks. The lack of universal regulatory frameworks across regions often leads to confusion and cautious adoption. Additionally, the decentralized nature of cryptocurrencies makes them vulnerable to cyberattacks, data breaches, and fraud, which may hinder mass acceptance of crypto asset management platforms.

Key Market Opportunity: The market offers tremendous potential in emerging economies and underbanked regions, where blockchain and digital currencies can bridge gaps in financial inclusion. Expanding cloud-based and mobile-first crypto management platforms in these areas could unlock vast user bases. Additionally, the development of decentralized asset management solutions could open up new revenue streams and offer more user control over assets.

✅Market Segmentation

The crypto asset management market is segmented based on deployment type, end-user, and application. By deployment, cloud-based platforms dominate due to their scalability, reduced infrastructure costs, and ability to offer seamless updates. These platforms are increasingly preferred by fintech startups and even large financial institutions that wish to maintain operational agility. On the other hand, on-premises solutions are still used by certain institutions that prioritize data security and compliance control over flexibility.

Based on end-users, the market is split between institutional investors and individual investors. Institutional investors currently hold a dominant share, driven by increasing allocations to cryptocurrencies by hedge funds, family offices, and mutual funds. These investors require comprehensive tools for performance analytics, tax optimization, and regulatory reporting. However, the retail segment is catching up quickly, thanks to rising awareness and the availability of user-friendly platforms that enable non-technical users to manage crypto assets efficiently.

✅Regional Insights

North America remains the epicenter of the crypto asset management market, accounting for the largest revenue share globally. Factors such as early adoption of blockchain technology, strong presence of fintech innovators, and increasing investments from venture capital firms contribute to its leadership. Additionally, regulatory bodies like the SEC and CFTC provide relatively clearer guidelines compared to other regions, encouraging further institutional engagement.

Europe and Asia-Pacific are witnessing rapid growth as well. In Europe, countries like Switzerland, Germany, and the UK are taking steps to legitimize crypto operations through structured legal frameworks, making it an attractive market for asset management services. In Asia-Pacific, countries like Japan, Singapore, and South Korea are at the forefront, supported by government-backed blockchain initiatives and growing public adoption of crypto trading and investing.

✅Company Insights

✦ Coinbase Inc.

✦ Binance Holdings Ltd.

✦ BitGo Inc.

✦ Gemini Trust Company, LLC

✦ Crypto Finance AG

✦ Grayscale Investments, LLC

✦ Anchorage Digital

✦ Bakkt Holdings, Inc.

✦ Paxos Trust Company

✦ Ledger SAS

For Customized Insights on Segments, Regions, or Competitors, Request Personalized Purchase Options @ https://www.persistencemarketresearch.com/request-customization/34765

✅Key Industry Developments

In 2023, Coinbase expanded its institutional crypto asset management offerings, adding features such as custodial integration, risk management tools, and real-time compliance monitoring. This move was in response to increased institutional interest and demand for enterprise-grade security.

Meanwhile, Gemini Trust Company collaborated with major financial advisors to launch a managed crypto investment product designed specifically for family offices and high-net-worth clients. The product includes automated portfolio balancing and tax-optimized selling strategies, highlighting a shift toward more sophisticated asset management solutions.

✅Innovation and Future Trends

Innovation in the crypto asset management market is being driven by the integration of blockchain analytics, decentralized finance (DeFi), and artificial intelligence. Platforms are evolving from simple tracking tools to intelligent systems that offer real-time trading alerts, predictive modeling, and fraud detection. These innovations aim to reduce manual oversight and improve investor confidence in volatile market environments.

Looking ahead, tokenization of real-world assets (RWAs) is expected to be a game-changer. As more physical assets like real estate and commodities become tokenized, crypto asset managers will need to handle a more diverse range of asset classes. The emergence of multi-asset platforms, capable of managing both traditional and crypto assets under a unified interface, will define the future landscape of digital investment management.

✅Explore the Latest Trending "Exclusive Article" @

• https://www.linkedin.com/pulse/microscope-camera-market-growth-trends-future-outlook-2025-svsuf/

• https://www.instagram.com/p/DJoY3XHx8xP/

• https://in.pinterest.com/pin/1049549888164614193

✅Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

✅About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crypto Asset Management Market to Reach US$2.28 Bn by 2031 with 22.4% CAGR Driven by AI and ML Integration here

News-ID: 4065054 • Views: …

More Releases from Persistence Market Research

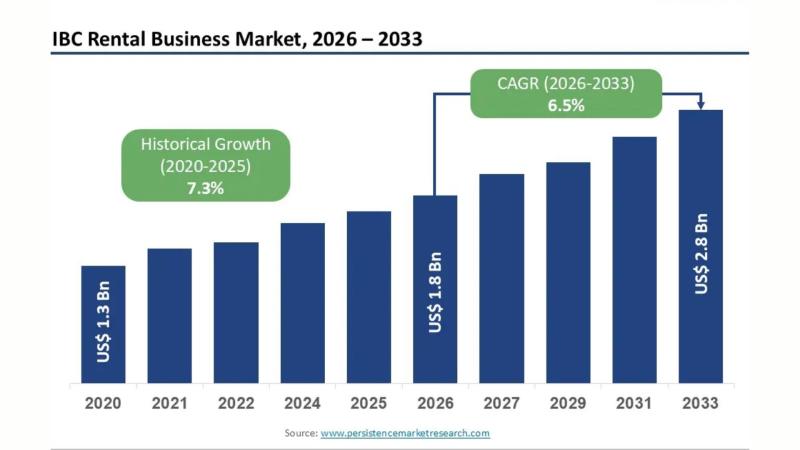

IBC Rental Business Market Projected to Grow to US$2.8 Bn by 2033 Driven by Cost …

Introduction: Rising Demand for Flexible Bulk Packaging Solutions

The global industrial packaging landscape is undergoing a significant shift as companies seek cost-effective, reusable, and sustainable solutions for bulk liquid and material transportation. Intermediate Bulk Containers (IBCs) have emerged as an indispensable packaging format across industries such as chemicals, pharmaceuticals, food & beverages, and agriculture. However, instead of purchasing IBCs outright, many businesses are now opting for rental services to reduce capital…

Shipping Supply Market Expected to Touch US$99.6 Bn by 2033 Driven by E-Commerce …

Introduction: The Backbone of Global Trade and Commerce

The shipping supply market plays a vital role in enabling global trade, industrial operations, and modern retail distribution. From corrugated boxes and pallets to protective packaging and labeling materials, shipping supplies ensure safe transportation of goods across domestic and international supply chains. As globalization intensifies and consumer expectations for fast, damage-free delivery grow, demand for efficient, durable, and sustainable shipping materials has accelerated…

Barrier Coatings for Packaging Market to Hit US$20.6 Bn by 2033 Driven by Rising …

Introduction: The Growing Need for Advanced Packaging Protection

Barrier coatings for packaging have become an essential component in modern packaging solutions, offering protection against moisture, oxygen, light, grease, and contaminants. As global supply chains expand and consumer expectations for longer shelf life increase, manufacturers are turning toward high-performance barrier coatings to preserve product integrity. These coatings enhance the functional performance of packaging materials while supporting lightweight and flexible packaging formats. Their…

Bean Bag Chairs Industry Shows Consistent Expansion Amid Furniture Innovation - …

Introduction

The global Bean Bag Chairs Market has experienced consistent growth over the past decade, driven by changing consumer lifestyles, increasing preference for flexible and informal seating, and the rising popularity of contemporary interior décor. Bean bag chairs are widely used across residential, commercial, and hospitality spaces due to their comfort, portability, lightweight design, and aesthetic appeal. Made using durable fabrics and filled with materials such as expanded polystyrene beads, these…

More Releases for Crypto

Top 10 Crypto Watchlist: Apeing's Upcoming Crypto Presale

Crypto Watchlist: 10 Altcoins Gain Momentum as Apeing's Upcoming Crypto Presale Climbs Search Rankings

The market never announces its turning points. One week feels unstoppable, the next feels empty. Charts still exist, indicators still flash, and opinions still flood timelines. Yet when fear creeps in, action disappears. People wait. They hesitate. They promise themselves clarity will arrive tomorrow.

That pause is where most losses begin. Crypto does not reward comfort. It rewards…

Top 10 Crypto Watchlist: Apeing's Upcoming Crypto Presale

Crypto Watchlist: 10 Altcoins Gain Momentum as Apeing's Upcoming Crypto Presale Climbs Search Rankings

The market never announces its turning points. One week feels unstoppable, the next feels empty. Charts still exist, indicators still flash, and opinions still flood timelines. Yet when fear creeps in, action disappears. People wait. They hesitate. They promise themselves clarity will arrive tomorrow.

That pause is where most losses begin. Crypto does not reward comfort.…

7 Breakthrough Crypto Stars: $APEING Dominates 1000x Crypto

Time is running out for anyone serious about catching the next 1000x crypto rocket. Apeing ($APEING) https://www.apeing.com/ is making waves for early movers, offering whitelist access that could define who wins big and who watches from the sidelines. This isn't a drill. Phase 1 entry is still open, and history has proven that hesitation is the kryptonite of crypto gains. Savvy investors and meme-lovers alike are already strategizing their moves,…

Crypto Asset Management Service Market Next Big Thing | Barracuda, Crypto Financ …

Latest Study on Industrial Growth of Crypto Asset Management Service Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Crypto Asset Management Service market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the…

Crypto Consulting Services Market Key Players: Crypto Greeks, Crypto Consulting …

The crypto consulting services market refers to the industry that provides advice, guidance, and support to individuals and organizations that are involved in the cryptocurrency and blockchain space. This market has emerged in response to the increasing demand for expertise in this area, as more and more people are becoming interested in cryptocurrencies and blockchain technology.

Download a FREE Sample Report at https://www.reportsnreports.com/contacts/requestsample.aspx?name=6994775

The below companies that are profiled have been…

Crypto Consulting Services Market is Touching New Level | Crypto Greeks, NGS Cry …

Crypto Consulting Services Market is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support (2023-2029). The market Study is segmented by key a region that is accelerating the marketization. This section also provides the scope of different segments and applications that can potentially influence the market in the future. The detailed information is based on…