Press release

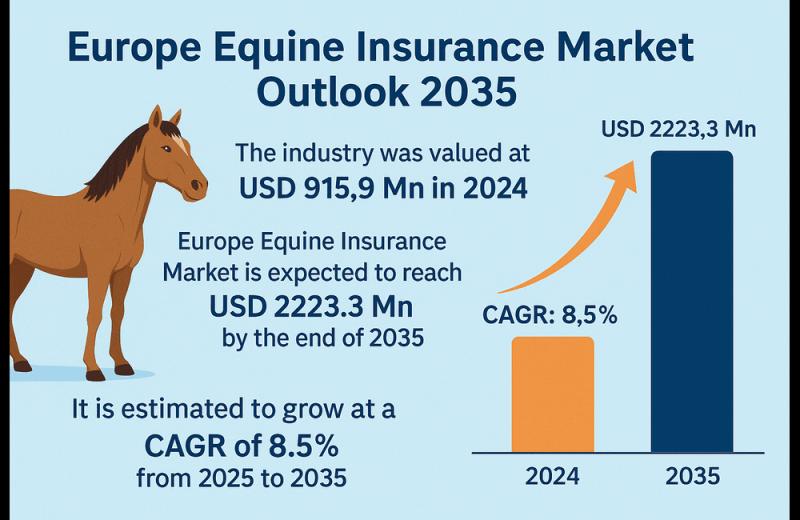

Europe Equine Insurance Market to Surpass USD 2.2 Billion by 2035

The Europe Equine Insurance Market was valued at USD 915.9 million in 2024 and is projected to reach USD 2,223.3 million by 2035. This growth reflects a robust CAGR of 8.5% from 2025 to 2035, driven by rising awareness about animal health, increasing equestrian sports participation, and the growing value of high-breed horses across the region.Making the insurance products much more accessible to horse owners and obtaining claims less complicated, this whole move entails digital business. Increasing competition and pressurizing pricing have increased their need to innovate and differentiate even more. Regulatory and market changes require flexibility and compliance from the insurer.

Unlock Full Market Insights: Get a Sample Report Now! https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86180

Market Segmentation

The Europe Equine Insurance Market can be segmented in several ways to understand its intricate dynamics:

By Service Type (Insurance Type):

Major Medical/Surgical: Covers significant veterinary expenses, including surgeries, diagnostics (X-rays, MRI, CT scans, ultrasounds), and emergency care.

Mortality: Provides coverage in case of the horse's death, often further categorized into Full Mortality and Limited Mortality.

Loss of Use: Compensates owners if a horse becomes permanently unable to perform its intended use (e.g., racing, breeding) due to illness or injury.

Theft and Straying Insurance: Protects against the financial loss if a horse is stolen or goes missing.

Breeding Infertility: Specifically designed for breeding operations, covering risks related to a mare's or stallion's inability to breed.

Personal Insurance/Rider Insurance: Covers the rider in case of accidents or injuries during equestrian activities.

Public Liability: Protects owners against claims for property damage or bodily injury caused by their horse to third parties.

Others: Includes specified perils, transit insurance (for horses being transported), and more specialized coverages like embryo and foal insurance.

By Sourcing Type (Mode of Operation):

Online: Growing in popularity, offering convenience and often streamlined processes for purchasing and managing policies.

Offline: Still a significant channel, including:

Insurance Agents: Traditional direct interaction with clients.

Brokers & Consultants: Offer a range of options from multiple insurers and provide expert advice.

Financial Institutes: Banks and other financial institutions may offer equine insurance products.

By Application (Horse Type/Purpose):

Recreational Horses: Horses owned for leisure riding and personal enjoyment.

Commercial Horses: Includes horses used in businesses such as riding schools, livery yards, and tourism.

Racehorses: High-value assets in the racing industry, requiring specialized and often extensive coverage.

Show Horses: Horses participating in disciplines like show jumping, dressage, and eventing.

Breeding Horses: Stallions and mares used for breeding purposes.

By Industry Vertical:

Individual Horse Owners: Private individuals owning horses for various purposes.

Equestrian Businesses: Riding schools, training stables, breeding farms, livery yards, etc.

Racing Industry: Racehorse owners, trainers, and associated entities.

Equestrian Event Organizers: Requiring liability and other coverages for events.

By Region:

United Kingdom: Holds the largest share of the European equine insurance market, driven by its rich equestrian culture and substantial horse population.

Germany: The second-largest market, with growing popularity of horse racing and equestrian sports.

France: A strong equestrian tradition contributes to significant demand.

Other European Countries: Including Sweden (with leading startups in equine health), Italy, and other nations with evolving equestrian sectors.

Regional Analysis

Europe, as a whole, is a leading region in the global equine insurance market. The demand is particularly strong in countries with a robust equestrian heritage and a high number of horse owners and participants in equestrian sports. The UK, Germany, and France are key contributors, showcasing significant market activity due to the prevalence of horse ownership, racing, and various equestrian disciplines. Increased expenditure on animal healthcare and strong animal welfare programs also bolster market growth across the continent.

Market Drivers and Challenges

Market Drivers:

High Value of Horses: The substantial financial investment in acquiring, breeding, training, and maintaining horses, especially high-performance or breeding animals, drives the need for financial protection.

Rising Veterinary Costs: Advancements in veterinary medicine and technology have led to more effective but also more expensive treatments, making insurance essential to manage unexpected healthcare expenses.

Growth of Equestrian Activities: Increasing participation in recreational riding, competitive equestrian sports (like show jumping, dressage, eventing, and racing), and breeding activities fuels the demand for comprehensive coverage.

Increased Awareness of Animal Welfare: Horse owners are increasingly prioritizing the health and well-being of their animals, leading to greater adoption of insurance policies that cover routine care and unexpected medical issues.

Customized Insurance Solutions: Insurers are offering more flexible and tailored policies that cater to the diverse needs of horse owners, from basic mortality coverage to extensive medical and liability plans.

Market Challenges:

High Premiums: The cost of equine insurance, particularly for high-value horses or comprehensive coverage, can be a deterrent for some owners.

Lack of Awareness: Despite increasing trends, some potential clients may still lack full awareness of the benefits and necessity of equine insurance.

Increased Competition and Pricing Pressures: The growing market attracts more players, leading to competitive pricing that can impact profitability for insurers.

Changing Regulations: Evolving regulations related to animal welfare, insurance practices, and international transport can pose compliance challenges.

Risk Assessment Complexity: Accurately assessing the risk associated with each horse, considering factors like breed, age, use, and health history, can be complex.

Market Trends

Specialized Equine Insurance: A shift towards more specialized and comprehensive plans encompassing medical, surgical, loss-of-use, and even breeding-related coverage.

Technological Integration: The increasing use of wearable technology and biometric monitoring for real-time data collection in high-performance stables, enabling more accurate risk assessment and flexible premium models.

Digitization and Online Platforms: Growth of online sales channels and digital transformation in the insurance sector for easier access to products, streamlined claims processing, and enhanced customer engagement.

Focus on Preventative Care: Some policies may incentivize preventative care and responsible ownership, potentially through wellness packages that cover routine check-ups and vaccinations.

Blockchain Technology: Emerging use of blockchain for enhanced policy management, reduced fraud, and faster claims processing.

Growing Demand for Transit Insurance: As international competitions and breeding programs become more prevalent, the need for insurance covering horses during transport (by air, land, or sea) is rising.

Future Outlook

The Europe Equine Insurance Market is poised for continued strong growth through 2035. The increasing professionalization of equestrian sports, the ongoing humanization of pets (including horses), and the continuous advancements in veterinary medicine will all contribute to a sustained demand for robust insurance solutions. The integration of technology will further enhance efficiency and personalization of offerings. The market is expected to become even more sophisticated, with AI-driven risk evaluations and subscription-based models potentially emerging.

Key Market Study Points

In-depth analysis of market segments (service type, sourcing type, application, industry vertical, and region).

Detailed market size and growth projections from 2025 to 2035.

Identification and evaluation of key market drivers, challenges, and opportunities.

Assessment of technological innovations and their impact on the market.

Competitive landscape analysis, including market share and company profiles of key players.

Understanding of regulatory frameworks and their influence on the market.

Regional market dynamics and growth prospects across European countries.

Competitive Landscape

The European equine insurance market features a mix of established insurance giants and specialized equine insurance providers. Key players leverage their expertise and industry knowledge to offer tailored coverage solutions. Competition is driven by product innovation, pricing strategies, and the ability to offer comprehensive and flexible policies. Some of the prominent players in the market include:

Agria Djurförsäkring

AXA XL

Carriagehouse Insurance

Equesure

NFU Mutual

Ecclesiastical Insurance

Zurich Insurance Group

Allianz SE

Generali Group

Hiscox Ltd

Liberty Specialty Markets

Convex Insurance

These companies are continuously looking to expand their offerings and geographical presence, often by partnering with technological companies or focusing on specialized solutions to gain a competitive edge.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=86180<ype=S

Recent Developments

Recent developments highlight the market's evolution towards specialization and technology integration:

Increased Specialization: Insurers are developing more nuanced policies to cover specific needs within the equestrian industry, such as high-performance horses, breeding stock, and different equestrian disciplines.

Technological Adoption: The uptake of wearable technology for horse monitoring and the exploration of blockchain for claims processing are gaining traction, leading to more data-driven risk assessments and potentially lower premiums for responsible owners.

Rising Value of Equine Assets: The continuous increase in the value of top-tier horses, particularly in racing and show jumping, drives the need for higher sum insured policies.

Focus on Holistic Welfare: Policies are beginning to encompass broader aspects of equine and rider welfare, including support for physiotherapy, rehabilitation, and mental health.

Strategic Partnerships: Traditional insurers are increasingly collaborating with insurtech companies to enhance their digital capabilities and offer more innovative solutions.

The Europe Equine Insurance Market is thus well-positioned for significant growth in the coming decade, driven by a combination of cultural affinity for horses, increasing investment in equine assets, and the ongoing evolution of veterinary care and insurance technology.

Explore Latest Research Reports by Transparency Market Research:

North America Hand-rolled Cigar Market - https://www.transparencymarketresearch.com/north-america-hand-rolled-cigar-market.html

North America Self-Propelled Cordless Lawn Mower Market - https://www.transparencymarketresearch.com/north-america-self-propelled-cordless-lawn-mower-market.html

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Want to know more? Get in touch now. -https://www.transparencymarketresearch.com/contact-us.html

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Europe Equine Insurance Market to Surpass USD 2.2 Billion by 2035 here

News-ID: 4064304 • Views: …

More Releases from transparencymarketresearch

Microgreens Market to Surge at 10.9% CAGR, Set to Reach USD 8.56 Billion by 2036

The global microgreens market was valued at USD 2,780.5 million in 2025 and is projected to reach USD 8,563.5 million by 2036. Driven by rising demand for nutrient-dense foods and growing adoption across foodservice and retail channels, the industry is expected to expand at a robust CAGR of 10.9% from 2026 to 2036.

The global microgreens market represents a specialized, high-value segment within the broader fresh produce and specialty horticulture industry,…

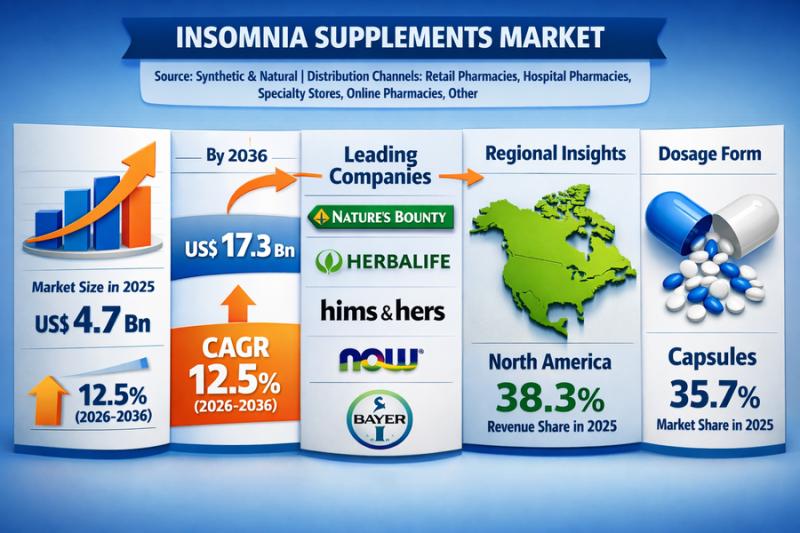

Insomnia Supplements Market Set to Reach US$ 17.3 Bn by 2036, Growing at a Robus …

The global insomnia supplements market was valued at USD 4.7 billion in 2025 and is projected to reach USD 17.3 billion by 2036, reflecting strong growth potential. The market is anticipated to expand at a CAGR of 12.5% from 2026 to 2036, driven by rising sleep disorder prevalence, increasing consumer focus on mental wellness, and growing demand for natural and non-prescription sleep aids.

The insomnia supplements market is expected to witness…

Fiber-Based Blister Pack Market Set to Surge at 21.5% CAGR Through 2036

The global fiber-based blister pack market was valued at US$ 1,633.8 million in 2025 and is projected to surge to US$ 13,591.8 million by 2036. Driven by rising demand for sustainable and eco-friendly packaging solutions, the market is expected to grow at a robust CAGR of 21.5% from 2026 to 2036.

Fiber-based blister packaging is a type of packaging that substitutes the usual plastic blister with paperboard or molded fiber components…

Psychotropic Drugs Market to Reach US$ 41.2 Bn by 2036, Growing at 5.4% CAGR

The global psychotropic drugs market was valued at USD 23.1 Bn in 2025 and is projected to reach USD 41.2 Bn by 2036. Driven by rising awareness of mental health disorders, increasing diagnosis rates, and ongoing pharmaceutical innovations, the industry is expected to grow at a CAGR of 5.4% from 2026 to 2036.

The primary drivers of the expanding psychotropic drugs market include the rising prevalence of mental disorders such as…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…