Press release

Emerging Trends Influencing The Growth Of The Variable Life Insurance Market: Variable Life Insurers Drive Growth Through New Product Offerings

The Variable Life Insurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Expected Variable Life Insurance Market Size During the Forecast Period?

The variable life insurance market has experienced strong growth in recent years. It will grow from $130.97 billion in 2024 to $138.44 billion in 2025, at a compound annual growth rate (CAGR) of 5.7%. This growth is attributed to the appeal of the investment component, estate planning and wealth transfer, market participation, flexibility in premium payments, and tax advantages.

The variable life insurance market is expected to experience strong growth, reaching $185.43 billion in 2029 with a CAGR of 7.6%. The growth will be driven by increasing awareness of financial planning, demographic shifts, risk management, and customized policies. Major trends include predictive analytics for risk assessment, online sales expansion, collaboration with insurtech startups, wellness incentives, and customer education initiatives.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=2466

What Are the High-Growth Segments in the Variable Life Insurance Market?

The variable life insurance market covered in this report is segmented -

1) By Type: Fixed Premium, Variable Universal Life Insurance

2) By Components: Death Benefits, Add-On Benefits

3) By End-User: Agency, Brokers, Bancassurance, Digital And Direct Channel

Subsegments:

1) By Fixed Premium: Standard Fixed Premium, Enhanced Fixed Premium

2) By Variable Universal Life Insurance: Investment-Linked Variable Universal Life, Flexible Premium Variable Universal Life

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=2466&type=smp

What Key Drivers Are Expected to Influence Future Variable Life Insurance Market Growth?

The overall growth of the insurance industry is expected to stimulate the expansion of the variable life insurance market. The increase in insurance industry awareness, a growing middle class, and economic development are major drivers of this growth. As more people gain access to insurance products, including variable life insurance, which allows policyholders to invest premiums in various investment options like stocks and bonds, the market is expanding. For example, in December 2023, the average annual premium for homeowners' insurance in Florida was about $6,000, compared to the national average of $1,700. This growth in the insurance sector is significantly driving the growth of the variable life insurance market.

Which Companies Hold the Largest Share Across Different Variable Life Insurance Market Segments?

Major companies operating in the variable life insurance market include Berkshire Hathaway Inc., Ping An Insurance (Group) Company of China Ltd., Allianz SE, AXA SA, Japan Post Holdings Co Ltd., MetLife Inc., Munich Reinsurance Group, Prudential plc, New York Life Insurance Company, American International Group Inc., Allstate Corporation, Nationwide Mutual Insurance Company, Swiss Reinsurance Company Ltd, Chubb Limited, Nippon Life Insurance Company, Zurich Insurance Group AG, Massachusetts Mutual Life Insurance Company, Northwestern Mutual Life Insurance Company, Aflac Incorporated, Lincoln National Corporation, Principal Financial Group Inc., Aviva plc, Manulife Financial Corporation, Protective Life Corporation, The Penn Mutual Life Insurance Company, AIA Group Limited, Ohio National Financial Services Inc., John Hancock Life Insurance Company (USA), Generali Assicurazioni SPA, Metropolitan Life Insurance Company

What Variable Life Insurance Market Trends Are Gaining Traction Across Different Segments?

New product development is becoming a significant trend in the variable life insurance market, with companies launching innovative life insurance products to enhance their market standing. For example, in November 2022, Prudential Financial, Inc., a US-based insurance company, introduced Prudential FlexGuard Life, a flexible index-variable universal life insurance policy. This policy offers death benefit protection, various ways to grow cash value, and early access to benefits in case of chronic or terminal illness. It provides customers with the flexibility to adapt the policy to their changing needs and gives them access to cash values for a unique opportunity to leave a legacy.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/variable-life-insurance-global-market-report

What Are the Emerging Geographies for The Variable Life Insurance Market Growth?

The countries covered in the variable life insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Variable Life Insurance Market?

2. What is the CAGR expected in the Variable Life Insurance Market?

3. What Are the Key Innovations Transforming the Variable Life Insurance Industry?

4. Which Region Is Leading the Variable Life Insurance Market?

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Emerging Trends Influencing The Growth Of The Variable Life Insurance Market: Variable Life Insurers Drive Growth Through New Product Offerings here

News-ID: 4063448 • Views: …

More Releases from The Business Research Company

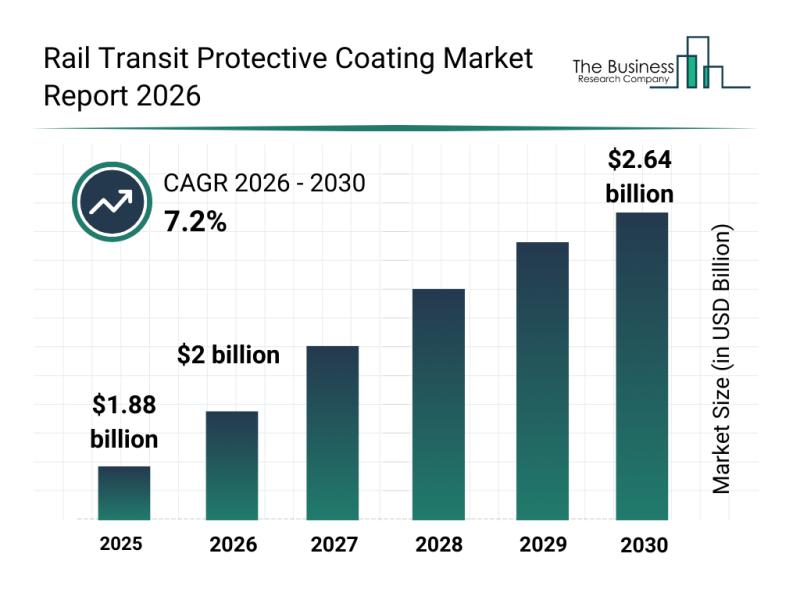

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

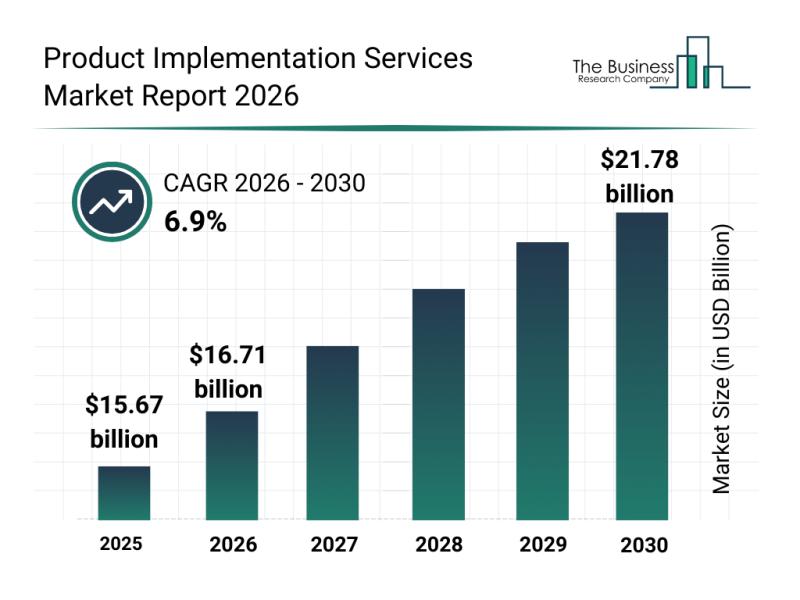

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

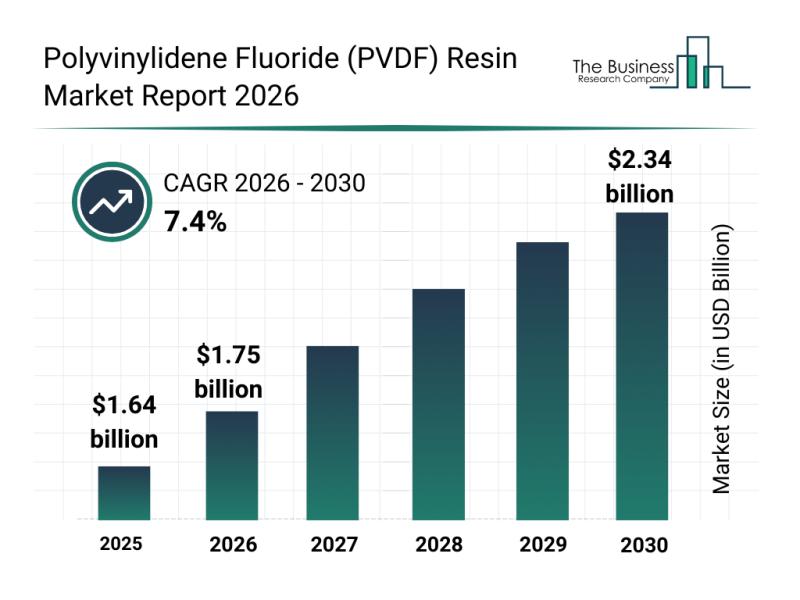

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

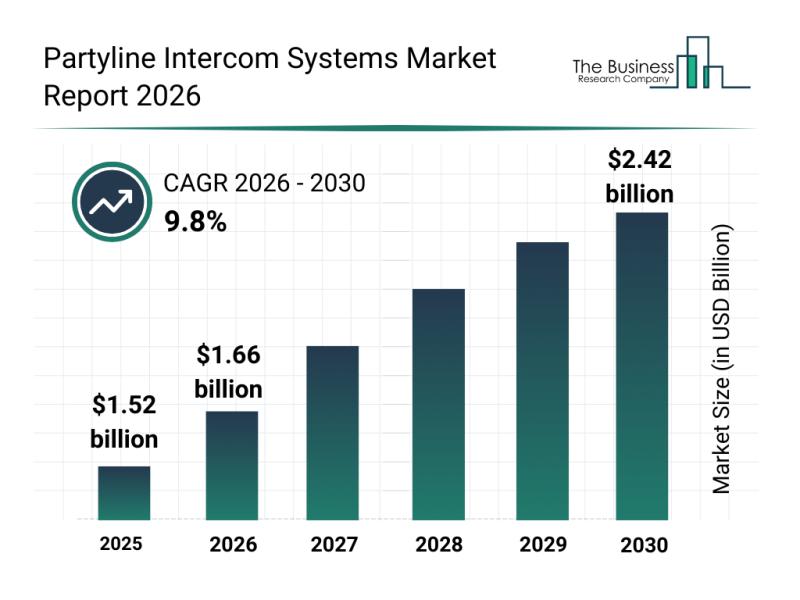

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…