Press release

Canada Property and Casualty Insurance Market to Grow at Over 4% CAGR by 2030, driven by Auto Insurance Demand

Mordor Intelligence has published a new report on the Canada Property and Casualty Insurance Market, offering a comprehensive analysis of trends, growth drivers, and future projections.Introduction

Canada's property and casualty insurance market is experiencing stable and moderate growth. Covering both personal and commercial risks, the sector includes key lines such as auto, property, liability, and specialized coverage. As of 2024, the market is supported by a mature regulatory framework, widespread insurance penetration, and growing use of technology in policy management and claims. The projected compound annual growth rate (CAGR) of over 4% through 2030 highlights consistent demand across urban and regional segments.

Auto insurance continues to be the backbone of the industry, not only due to its mandatory nature in every province but also because of a large insured vehicle base and ongoing developments around telematics and usage-based insurance. Digital transformation, although gradual, is becoming a bigger influence in how products are delivered and consumed.

Report Overview: https://www.mordorintelligence.com/industry-reports/property-casualty-insurance-market-in-canada?utm_source=openpr

Key Trends

Auto Insurance Leads in Written Premiums

Auto insurance remains the dominant category in Canada's P&C insurance sector. It accounted for approximately 43% of the net written premiums in recent years. With compulsory insurance in every province and an active vehicle fleet, auto policies continue to deliver steady revenue. Provinces like British Columbia, Saskatchewan, and Manitoba operate public auto insurance systems, while others rely on competitive private insurers. This hybrid model creates a diversified risk landscape and competition in customer service, pricing, and product differentiation.

Usage-based insurance programs are growing in popularity. Customers, particularly younger drivers, are drawn to behavior-based pricing. Insurers are using telematics to gather driving data and provide incentives for safer habits. This is also helping insurers manage claim costs more efficiently.

Growth of Specialized Insurance Lines

While auto and property lines lead in volume, specialized insurance categories are becoming more significant. These include boiler and machinery, marine, aircraft, and surety & fidelity products. Together, they contribute over 7% of the total market premiums. These lines serve commercial and industrial sectors, especially in construction, logistics, and infrastructure maintenance. The growth in these sectors-driven by public investment and modernization-adds a layer of opportunity for insurance providers offering tailored coverage.

Increasing Shift Toward Digital Channels

Though the Canadian insurance landscape is still heavily reliant on agents and brokers, direct-to-consumer channels are slowly gaining traction. Consumers are using websites and mobile applications to compare, purchase, and manage policies. Digital platforms are particularly effective in personal auto and tenant insurance, where product complexity is lower. This shift is also reducing administrative costs and speeding up claims processing.

Insurers are investing in AI tools to support fraud detection and improve underwriting decisions. Smart algorithms and data analytics are being tested to enhance customer profiling and risk selection. While digital penetration is not yet dominant, the groundwork being laid today is expected to shape how Canadians interact with insurers in the coming years.

Market Segmentation

The Canadian P&C insurance market is segmented by type and distribution channel.

By Type:

Auto Insurance - Most significant, mandatory across all provinces.

Property Insurance - Includes residential and commercial real estate coverage.

Liability Insurance - Covers legal and compensation costs for third-party claims.

Specialized Lines - Covers less common areas such as marine, aviation, and equipment.

Accident & Sickness - Smaller share, overlaps with life and health insurance categories.

By Distribution Channel:

Direct Sales - Through insurer websites and call centers.

Agents & Brokers - Still the leading method for policy distribution.

Banks and Affiliated Institutions - Offering packaged insurance through existing customer bases.

Other Channels - Includes affinity partnerships and online aggregators.

Agents and brokers continue to dominate the commercial insurance segment, especially for business clients requiring custom coverage. Direct channels, on the other hand, are favored for standard products with less need for consultation.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players

The market is led by a number of well-established insurance providers. According to the report, some of the major players include:

Intact Financial Corporation - One of Canada's largest P&C insurers. Intact operates through multiple channels and offers personal, commercial, and specialty products. Its strong digital focus and broad distribution help it maintain leadership.

Aviva Canada Inc. - A subsidiary of the UK-based Aviva group. Known for its auto and home insurance offerings, Aviva also serves commercial clients. The company has been investing in digital platforms and partnerships to improve customer service.

Desjardins General Insurance Group - Part of the larger Desjardins financial group, it provides personal and business insurance, with a strong focus in Quebec and Ontario. Its cooperative model adds a community-oriented approach to service.

The Co-operators Group Limited - A Canadian-owned cooperative that offers a full suite of insurance products, including agriculture and environmental risk coverage. The group also emphasizes sustainable investing and corporate social responsibility.

TD Insurance - A bank-owned insurance arm offering bundled policies with other TD financial products. It focuses heavily on digital accessibility and affordability for retail customers.

These players operate in both personal and commercial lines and have continued to invest in digital tools, customer support systems, and product diversification. While competition is strong, regulatory support and consumer trust provide a stable environment for long-term performance.

Explore more about Canada property and casualty insurance market competitive landscape: https://www.mordorintelligence.com/industry-reports/property-casualty-insurance-market-in-canada/companies?utm_source=openpr

Conclusion

The property and casualty insurance market in Canada continues to grow at a moderate yet stable pace. Auto insurance dominates the landscape, but property, liability, and specialized lines are also expanding. The shift toward digital interaction, while gradual, is influencing how insurers communicate with policyholders and assess risks.

The market benefits from a healthy mix of public and private participants, along with a strong regulatory foundation. With increasing use of data analytics, better fraud management, and growing interest in customized policies, Canadian insurers are positioning themselves to serve a changing economy.

While challenges such as climate risks and pricing pressures remain, the overall outlook through 2030 is positive, supported by steady consumer demand and industry innovation in operations and product offerings.

For more market analysis visit Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/property-casualty-insurance-market-in-canada?utm_source=openpr

Industry Related Reports

New Zealand Property And Casualty Insurance Market: New Zealand Property And Casualty Insurance Market is Segmented by Insurance Type (home, Motor, and Other Insurance Types) and Distribution Channel (direct, Agency, Bank, and Other Distribution Channels).

Get More Insights: https://www.mordorintelligence.com/industry-reports/property-casualty-insurance-market-in-new-zealand?utm_source=openpr

Netherlands Property and Casualty Insurance Market: Netherlands Property and Casualty Insurance Market is Segmented by Product Type (Motor Vehicle, Fire, Transport, and Other Product Types) and by Distribution Channel (Direct, Agents, Brokers, Online, and Other Distribution Channels).

Get More Insights: https://www.mordorintelligence.com/industry-reports/property-casualty-insurance-market-in-netherlands?utm_source=openpr

Greece Property and Casualty Insurance Market: Greece Property and Casualty Insurance Market is Segmented by Type (Home, Motor, and Other Types) and by Distribution Channel (Direct, Agency, Bank, and Other Distribution Channels).

Get More Insights: https://www.mordorintelligence.com/industry-reports/property-casualty-insurance-market-in-greece?utm_source=openpr

Germany Property and Casualty Insurance Market: The Germany Property And Casualty Insurance Market report segments the industry into By Insurance Type (Auto Insurance, Homeowners Insurance, Commercial Property Insurance, Fire Insurance, General Liability Insurance, Other Insurance Types (Health Insurance And Legal Insurance)), By Distribution Channel (Direct Business, Agency, Banks, Other Distribution Channels (Credit Institutions).

Get More Insights: https://www.mordorintelligence.com/industry-reports/property-casualty-insurance-market-in-germany?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Canada Property and Casualty Insurance Market to Grow at Over 4% CAGR by 2030, driven by Auto Insurance Demand here

News-ID: 4061354 • Views: …

More Releases from Mordor Intelligence

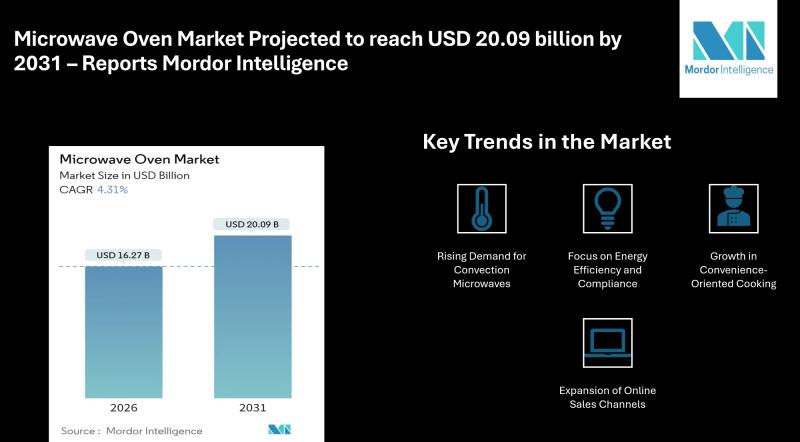

Microwave Oven Market Projected to reach USD 20.09 billion by 2031 - Reports Mor …

Mordor Intelligence has published a new report on the microwave oven market offering a comprehensive analysis of trends, growth drivers, and future projections.

Microwave Oven Market Overview:

The microwave oven market was valued at USD 15.60 billion in 2025 and estimated to grow from USD 16.27 billion in 2026 to reach USD 20.09 billion by 2031, at a CAGR of 4.31%. This growth reflects steady demand across residential and commercial…

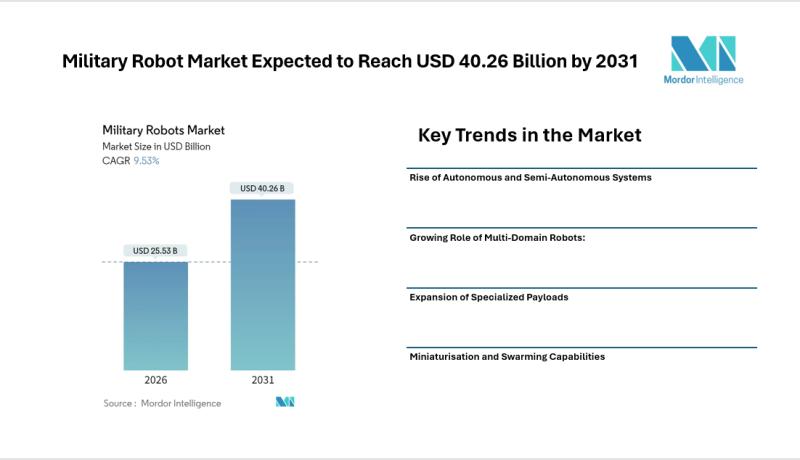

Military Robot Market Expected to Reach USD 40.26 Billion by 2031 - Mordor Intel …

Introduction

According to Mordor Intelligence, the military robot market is expected to grow from USD 23.31 billion in 2025 to USD 25.53 billion in 2026 and is forecast to reach USD 40.26 billion by 2031 at 9.53% CAGR over 2026-2031.

Beyond pure combat roles, robots are increasingly deployed for logistics, explosive ordnance disposal (EOD), and surveillance tasks that reduce human exposure to danger. This broadening uptake underscores the shifting…

Soybean Market Size Projected to Reach USD 229.4 Billion by 2031 as Biofuels, Fe …

Market Momentum Anchored by Agriculture, Energy, and Food Systems

The soybean market size was valued at USD 160 billion in 2025 and is estimated to reach USD 169.9 billion in 2026, with projections indicating growth to USD 229.4 billion by 2031. This expansion reflects the crop's strategic importance across food supply chains, livestock nutrition, and bio-based energy markets.

The soybean market growth outlook remains positive as soybeans continue to serve multiple end-use…

Football Market Size Forecast to Reach USD 4.31 Billion by 2031, Driven by Youth …

The global Football Market has been witnessing steady growth, reflecting the sport's enduring popularity and expanding commercial opportunities. The market size reached USD 3.76 billion in 2026 and is projected to attain USD 4.31 billion by 2031, representing a CAGR of 2.77% during the forecast period. This growth is underpinned by strong fan engagement, rising participation rates among youth and women, and increased investments in professional leagues and grassroots programs.…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…