Press release

Rising Demand for Personalized Claims Assistance Fueling Market Growth Due To AI-Driven Customer Support: A Key Driver Powering Artificial Intelligence (AI) In Insurance Claims Processing Market Growth In 2025

Our market reports now include the latest updates on global tariffs, trade impacts, and evolving supply chain dynamics.What Is the Current Artificial Intelligence (AI) In Insurance Claims Processing Market Size and Its Estimated Growth Rate?

The market size for artificial intelligence (AI) in insurance claims processing has experienced a rapid expansion in the last few years. The market is expected to swell from $0.39 billion in 2024 to $0.46 billion in 2025, with a compound annual growth rate (CAGR) of 16.8%. The historical growth has been catalyzed by an increased need for fraud detection, a surge in insurance claim volumes, advancements in machine learning algorithms, regulatory pressure towards digital transformation, and a growing inclination towards automation in the insurance sector.

In the foroming years, the market size of artificial intelligence (AI) in insurance claims processing is projected to witness substantial growth, expanding to a value of $0.85 billion in 2029 with a 16.6% compound annual growth rate (CAGR). This growth during the forecast period is linked to the increased unification of AI with blockchain, the escalating demand for instant claim processing, the rising usage of AI-enabled chatbots, the broadening application of predictive analytics for evaluating risks, and the growing preference for cloud-based AI solutions. Key market trends for the forecast period encompass claim automation empowered by AI, improved fraud detection utilizing deep learning, the application of natural language processing (NLP) for claim documentation, the growth of AI-driven self-service portals, and the increasing significance of AI in formulating personalized insurance policies.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/customise?id=23623&type=smp

How Are Emerging Segments Shaping the Artificial Intelligence (AI) In Insurance Claims Processing Market Landscape?

The artificial intelligence (AI) in insurance claims processing market covered in this report is segmented -

1) By Offering: Software, Services

2) By Deployment Model: On-Premise, Cloud

3) By Technology: Machine Learning, Natural Language Processing, Computer Vision, Other Technologies

4) By Enterprise Size: Large Enterprises, Small And Medium-Sized Enterprises (SMEs)

5) By End-User: Life And Health Insurance, Property And Casualty Insurance

Subsegments:

1) By Software: AI-Based Underwriting Software, Fraud Detection Software, Claims Processing Software, Customer Engagement Platforms

2) By Services: Managed Services, Professional Services, Consulting Services, Support And Maintenance

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=23623&type=smp

Which Growth Factors Are Influencing Artificial Intelligence (AI) In Insurance Claims Processing Market Expansion?

The growth of artificial intelligence (AI) within the insurance claims processing market is expected to be driven by the escalating need for personalised claims assistance. This encompasses AI-powered solutions that offer customised support, such as monitoring claims in real-time and automated advice to fit the requirements of policyholders. As policyholders expect speedier, more tailored assistance, interest in personalised claims support is increasing. Insurance providers are putting more emphasis on boosting customer experience through customised communication and services. AI advances personalised claims assistance by enabling expedited processing, precise assessments, proactive updates, and customised customer support via data-driven automation. For example, Higson, a Polish insurance tech firm, indicated in October 2024 that customisation in insurance contributes to a revenue lift of 10-15%, and up to a 20% increase in customer retention. Additionally, 95% of customers are willing to share data, and 88% are in search of customised services. Thus, the mounting demand for personalised claims assistance is stimulating the application of artificial intelligence (AI) in the insurance claims processing market.

Who Are the Dominant Players Across Different Artificial Intelligence (AI) In Insurance Claims Processing Market Segments?

Major companies operating in the artificial intelligence (AI) in insurance claims processing market are ICICI Lombard General Insurance Company Ltd, CCC Intelligent Solutions Inc., Quantiphi, Sapiens International, Blue Prism Limited, ScienceSoft USA Corporation, Harbinger Group, Newgen Software Technologies Limited, Vlink Inc., LeewayHertz, Astera Software, Damco Group, Ravin AI Ltd., ZestyAI, Tractable Ltd., Sprout.ai, CLARA Analytics Inc., V7 Ltd., Alula Technologies Ltd., Simplifai Systems Limited, Perceptiviti Data Solutions Private Limited.

What Are the Latest Developing Trends in the Artificial Intelligence (AI) In Insurance Claims Processing Market?

Top-tier businesses involved in the AI insurance claim processing sector are intensifying their dedication towards creating innovative solutions, such as agentic artificial intelligence automation, to elevate efficiency and enhance precision in claim evaluations. Agentic AI automation pertains to AI mechanisms that operate independently, possessing a certain level of discretion in decision-making, and are capable of executing tasks or initiating actions without perpetual human supervision. For example, in February 2025, a firm based in Norway named Simplifai, which specializes in AI solutions, unveiled their agentic artificial intelligence (AI) platform, a state-of-the-art automation system constructed to simplify the claims processing, underwriting, and customer service procedures. This AI-driven solution allows insurance companies to augment their operational efficiency, improve accuracy, and provide smooth customer interactions, while simultaneously shrinking claim resolution durations and lessening administrative burdens.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/artificial-intelligence-ai-in-insurance-claims-processing-global-market-report

Which Geographic Regions Are Expected to Dominate the Artificial Intelligence (AI) In Insurance Claims Processing Market in the Coming Years?

North America was the largest region in the artificial intelligence (AI) in insurance claims processing market in 2024. The regions covered in the artificial intelligence (AI) in insurance claims processing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Artificial Intelligence (AI) In Insurance Claims Processing Market?

2. What is the CAGR expected in the Artificial Intelligence (AI) In Insurance Claims Processing Market?

3. What Are the Key Innovations Transforming the Artificial Intelligence (AI) In Insurance Claims Processing Industry?

4. Which Region Is Leading the Artificial Intelligence (AI) In Insurance Claims Processing Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Demand for Personalized Claims Assistance Fueling Market Growth Due To AI-Driven Customer Support: A Key Driver Powering Artificial Intelligence (AI) In Insurance Claims Processing Market Growth In 2025 here

News-ID: 4058605 • Views: …

More Releases from The Business Research Company

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Fl …

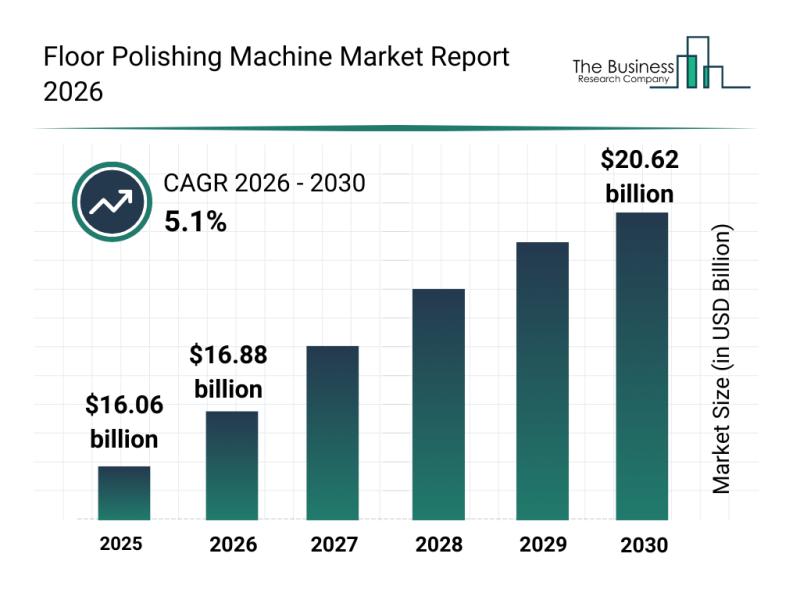

The floor polishing machine industry is on the verge of significant expansion as advancements in technology and growing demand from various sectors drive market momentum. This report will explore the current market valuation, key players, prominent trends, and notable segments shaping the future of floor polishing machinery.

Market Valuation Outlook for Floor Polishing Machines by 2030

The floor polishing machine market is poised for substantial growth in the coming years, expected…

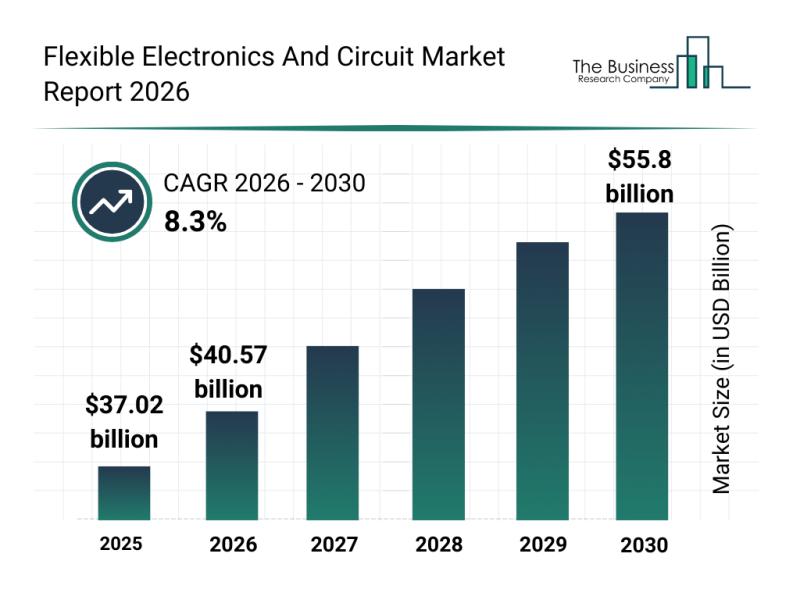

Competitive Landscape: Key Market Leaders and New Entrants in the Flexible Elect …

The flexible electronics and circuit sector is positioned for impressive expansion in the coming years, driven by rapid technological advancements and increasing applications across various industries. As innovation pushes the boundaries of what flexible technology can do, this market is set to experience significant growth and transformation.

Projected Market Valuation and Growth in Flexible Electronics and Circuit Market

The flexible electronics and circuit market is anticipated to reach a valuation of…

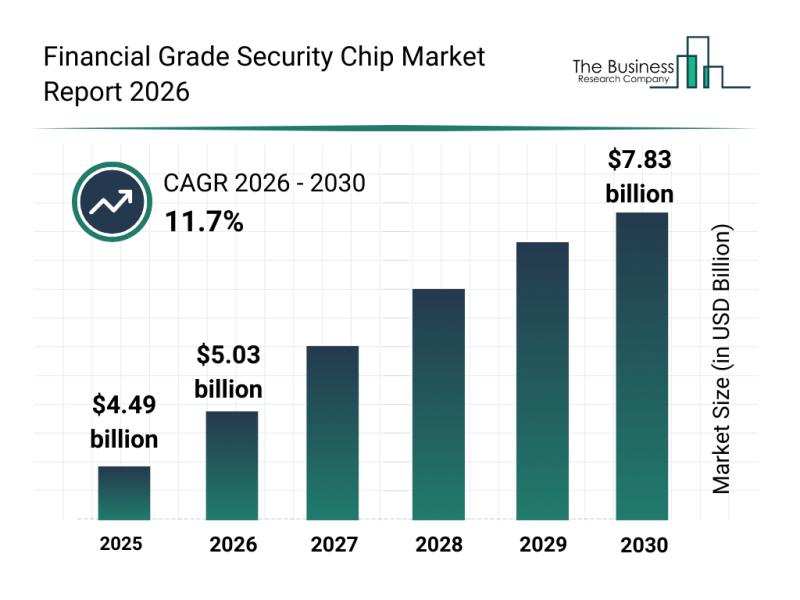

Financial Grade Security Chip Market Overview: Major Segments, Strategic Develop …

The financial grade security chip market is on a trajectory of significant expansion, driven by the increasing demand for robust digital security solutions in an evolving technological landscape. As digital transactions and connected devices become more prevalent, the market is set to experience substantial growth fueled by innovation and heightened security standards.

Financial Grade Security Chip Market Size and Long-Term Growth Outlook

The market for financial grade security chips is projected…

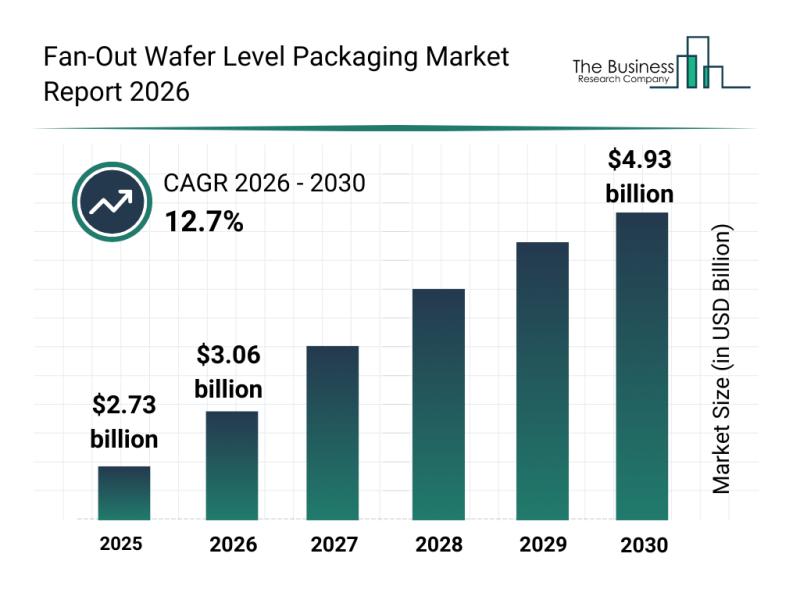

Analysis of Key Market Segments Influencing the Fan-Out Wafer Level Packaging Ma …

The fan-out wafer level packaging sector is set to experience significant expansion in the coming years, driven by growing demand across various high-tech industries. With advancements in semiconductor integration and increasing needs in automotive and communication technologies, this market is positioned for impressive growth and innovation. Here, we explore the market size projections, leading companies, key trends, and segment dynamics shaping the future of fan-out wafer level packaging.

Forecasted Market Size…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…