Press release

Increasing Natural Disasters Fueling the Growth of the Parametric Insurance Market Due to Climate Change and Rising Economic Losses: An Emerging Driver Transforming The Parametric Insurance Market Landscape

Our market reports now include the latest updates on global tariffs, trade impacts, and evolving supply chain dynamics.What Is the Projected Growth of the Parametric Insurance Market?

The parametric insurance sector has seen notable expansion lately. Its market size, which is projected to be $18.71 billion in 2024, is predicted to escalate to $21.22 billion in 2025, boasting a compound annual growth rate (CAGR) of 13.4%. This substantial growth during the historic period can be credited to several factors, including the rising occurrence of natural disasters, technology advancements, the need for expedited claim processing, increased mindfulness about climate change, globalization, and solid business risk management.

The market size of parametric insurance is predicted to undergo a rapid expansion in the coming years. By 2029, it's projected the market will reach $34.59 billion, showing a compound annual growth rate (CAGR) of 16.6%. This impending growth during the forecast period can be ascribed to factors such as the increasing impact of climate change, the growth of emerging markets, the incorporation of AI and big data analytics, government backing and regulation, and a rising consumer desire for customization. Key trends expected during this period consist of the integration of blockchain technology, extending coverage to new risk types, partnering with Insurtech startups, augmented use of satellite and remote sensing data, and a higher uptake in the sectors of agriculture and crop insurance.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/customise?id=23787&type=smp

What Are the Different Parametric Insurance Market Segments?

The parametric insurance market covered in this report is segmented -

1) By Insurance Type: Index-Based Insurance, Weather-Based Insurance, Catastrophe Bonds, Other Types

2) By Policy Duration: Short-Term Policies, Long-Term Policies, Seasonal Policies

3) By Distribution Channel: Direct Sales, Brokers, Online Platforms

4) By Industry Vertical: Agriculture, Aerospace And Defence, Mining, Construction, Energy And Utilities, Manufacturing, Other Industry Verticals

Subsegments:

1) Index-Based Insurance: Commodity Price Index Insurance, Financial market Index Insurance, Livestock Mortality Index Insurance

2) Weather-Based Insurance: Rainfall Index Insurance, Wind Speed Index Insurance, Freeze Or Frost Index Insurance, Drought Index Insurance

3) Catastrophe Bonds: Peril-Specific Catastrophe Bonds, Industry Loss Warranty (ILW) Bonds, Parametric Catastrophe Bonds, Aggregate Catastrophe Bonds, Multi-Peril Catastrophe Bonds

4) Other Types: Flight Delay Parametric Insurance, Cyber Attack Parametric Insurance, Pandemic Parametric Insurance, Power Outage Parametric Insurance, Political Risk Parametric Insurance

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=23787&type=smp

What Are the Primary Drivers Shaping the Parametric Insurance Market?

The surging occurrences of natural disasters are predicted to stimulate the expansion of the parametric insurance market. Such disasters, which include catastrophic incidents such as earthquakes, hurricanes, and floods, result in destruction, fatalities, and considerable financial losses. The escalation in these disasters can be attributed to climate change, as the increase in global temperature triggers more frequent and intense climatic occurrences like hurricanes, floods, and wildfires, leading to more significant devastation and loss of lives. Parametric insurance, characterized by swift payouts activated by specific predefined circumstances, presents a viable solution for handling the financial risks tied to these incidents. For example, AON, an insurance corporation based in the UK, highlighted that worldwide economic losses from natural disasters for the year 2022 amounted to $313 billion. The insured losses reached $132 billion, marking it as the fifth most expensive year for the insurance companies. The repercussions were also noticed in the reinsurance market, with US reinsurance premiums witnessing an upsurge of up to 35% by 2023. Hence, the amplified frequency of natural disasters is propelling the expansion of the parametric insurance market.

Which Companies Are Leading in the Parametric Insurance Market?

Major companies operating in the parametric insurance market are Berkshire Hathaway Inc., Allianz SE, Zurich Insurance Group Ltd., Chubb Limited, Tokio Marine Holdings, Inc., Swiss Reinsurance Company, AIG (American International Group), Lloyds Banking Group, Marsh & McLennan, QBE Insurance Group Limited, SCOR SE, Aon plc, Everest Re Group, Ltd., Willis Towers Watson, PartnerRe Ltd., AXA SA, Munich Reinsurance Company, Hannover Re, Neptune Flood Incorporated, Jumpstart Insurance SolutionsInc.

Major players in the parametric insurance market are prioritizing the use of AI-powered predictive analytics to better gauge risk, improve accuracy in designing triggers, and make quick, data-based payouts. AI-powered predictive analytics employs machine learning and statistical calculations to analyze present and past data, pinpointing patterns and trends to predict future results and guide decision-making. For example, in March 2025, Arbol, Inc., a FinTech firm and climate risk coverage platform based in the US, integrated AI-powered predictive analytics and parametric insurance to utilize real-time weather data, machine learning, and IoT sensors. This innovative approach assures rapid, automated payouts and financial security for specialty crop producers exposed to climate dangers. Arbol also includes blockchain technology to automate the issuance of policies, payment of premiums, and processing of claims, thereby increasing transparency and cutting down administrative expenses.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/parametric-insurance-global-market-report

What Are the Top Revenue-Generating Geographies in the Parametric Insurance Market?

North America was the largest region in the parametric insurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the parametric insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Parametric Insurance Market?

2. What is the CAGR expected in the Parametric Insurance Market?

3. What Are the Key Innovations Transforming the Parametric Insurance Industry?

4. Which Region Is Leading the Parametric Insurance Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Increasing Natural Disasters Fueling the Growth of the Parametric Insurance Market Due to Climate Change and Rising Economic Losses: An Emerging Driver Transforming The Parametric Insurance Market Landscape here

News-ID: 4058541 • Views: …

More Releases from The Business Research Company

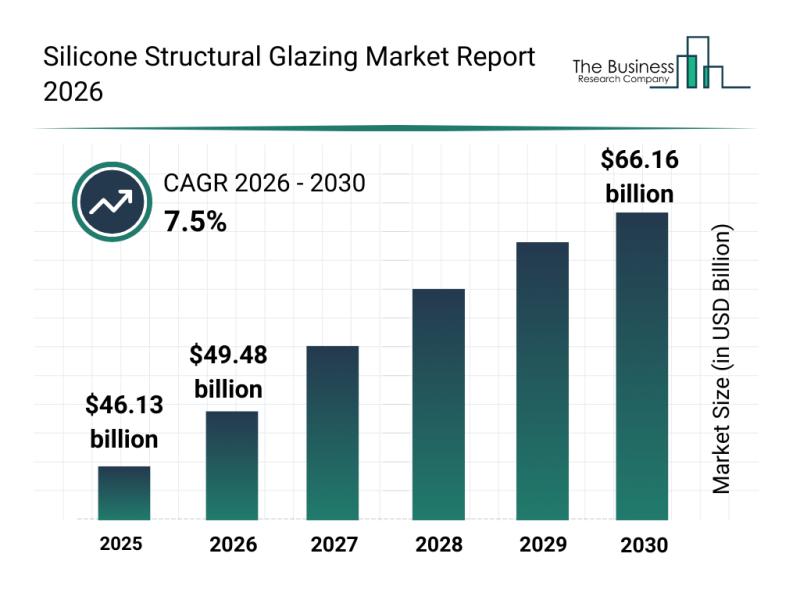

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

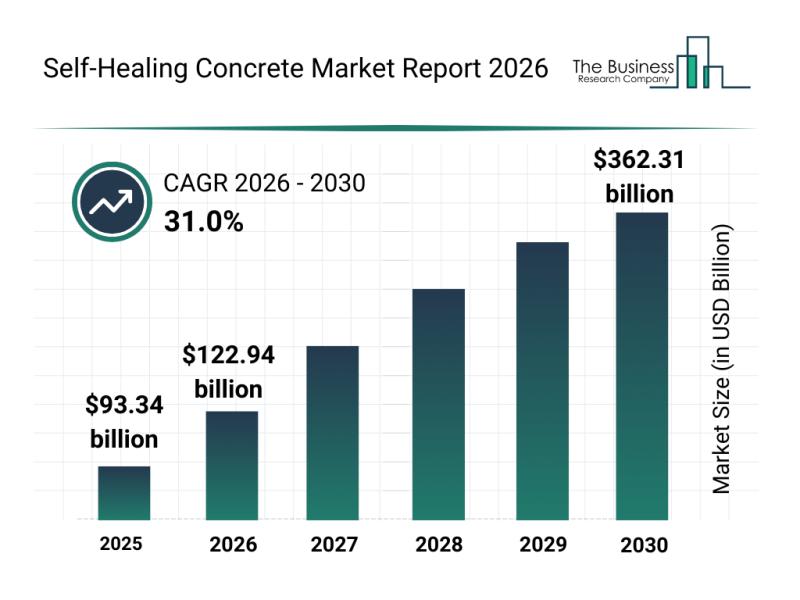

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

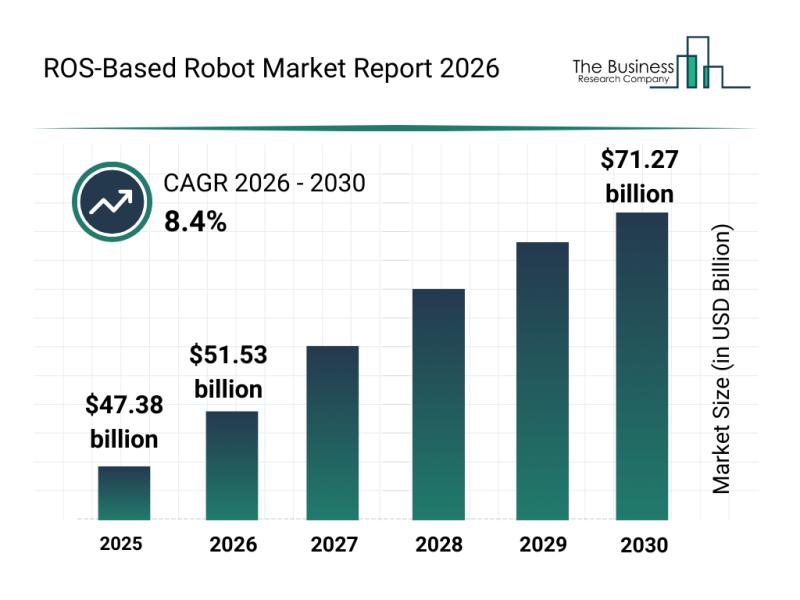

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

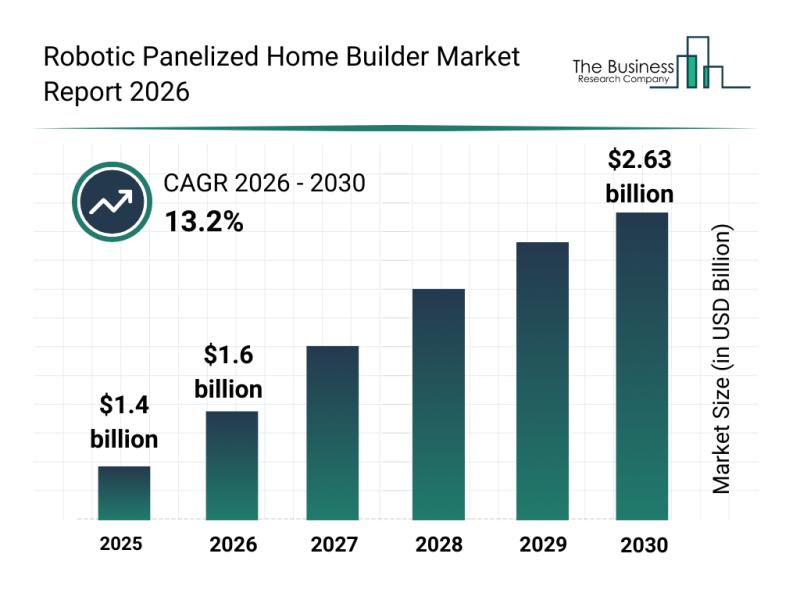

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…