Press release

Booming Housing Finance Market Set to Hit $33,298.79 billion by 2031 , Driven by Affordable Housing Demand and Real Estate Growth

According to the report published by Allied Market Research, the global housing finance market generated $4,520.67 billion in 2021, and is projected to reach $33,298.79 billion by 2031, growing at a CAGR of 22.3% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape, and regional landscape. The report is a useful source of information for new entrants, shareholders, frontrunners, and others in introducing necessary strategies for the future and taking essential steps to significantly strengthen and heighten their position in the market.Download Sample Report- https://www.alliedmarketresearch.com/request-sample/17596

COVID-19 Scenario:

The housing finance market experienced a negative impact due to the presence of strict regulatory mandates imposed by the governments of various countries across the globe.

There was a huge financial crisis among people living in both developing and developed countries due to the outbreak of COVID-19, which led to the closure of various shops, businesses, manufacturing facilities, and warehouses.

This subsequently resulted in decreased expenditure among customers. Preferences of consumers during the pandemic, in terms of buying real estate, were reversed, owing to imminent job losses and pay cuts, forcing customers to postpone purchases of new homes.

In addition, an increase in business uncertainty led to a decline in new building & new land purchase rates among the business owners, which further hampered the growth of the market during the COVID-19 pandemic.

The report offers detailed segmentation of the global housing finance market based on application, providers, and region. The report provides a comprehensive analysis of every segment and their respective sub-segment with the help of graphical and tabular representation. This analysis can essentially help market players, investors, and new entrants in determining and devising strategies based on the fastest growing segments and highest revenue generation that is mentioned in the report.

Inquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/17596

Based on application, the home purchase segment held the largest market share in 2021, holding nearly one-third of the global market, and is expected to maintain its leadership status during the forecast period. The home improvement segment, on the other hand, is expected to cite the fastest CAGR of 24.1% during the forecast period.

Based on providers, the banks segment held the major market share in 2021, holding more than one-third of the global market, and is expected to maintain its leadership status during the forecast period. The real estate agents segment, on the other hand, is expected to cite the fastest CAGR of 24.8% during the forecast period.

Based on region, the market across North America held the largest market share in 2021, holding nearly two-fifths of the global market. The Asia-Pacific region, on the other hand, is expected to maintain its leadership status during the forecast period. In addition, the same segment is expected to cite the fastest CAGR of 25.1% during the forecast period.

If you have any special requirements, request customization@

https://www.alliedmarketresearch.com/request-for-customization/17596?reqfor=covid

The key players analyzed in the global housing finance market report include Bank of America Corporation, Charles Schwab & Co., Citigroup, Inc., CREDIT SUISSE GROUP AG, Dewan Housing Finance Corporation Ltd., Goldman Sachs, HSBC Group, JPMorgan Chase & Co., LIC Housing Finance Ltd., Lloyd's Banking Group, Morgan Stanley, Royal Bank of Canada, Royal Bank of Scotland plc., UBS, Wells Fargo, Divvy Homes, Inc., and Pronto Housing.

The report analyses these key players in the global housing finance market. These market players have made effective use of strategies such as joint ventures, collaborations, expansion, new product launches, partnerships, and others to maximize their foothold and prowess in the industry. The report helps analyze recent developments, product portfolios, business performance, and operating segments by prominent players in the market.

Key Benefits For Stakeholders:

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the housing finance market analysis from 2021 to 2031 to identify the prevailing housing finance market opportunities.

In-depth analysis of the housing finance market share assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global housing finance market forecast.

The report includes the analysis of the regional as well as global housing finance market trends, key players, market segments, application areas, and market growth strategies.

Housing Finance Market Key Segments:

By Application:

Home Purchase

Refinance

Home Improvement

Other Purpose

By Providers:

Banks

Housing Finance Companies

Real Estate Agents

Others

By Region:

North America (U.S., Canada, and Mexico)

Europe (U.K., Germany, France, Italy, Spain, Russia, Netherlands, Belgium, Poland, and Rest of Europe)

Asia-Pacific (China, Japan, India, South Korea, Australia, Malaysia, Thailand, Philippines, Indonesia, and Rest of Asia-Pacific)

LAMEA (Latin America, Middle East and Africa)

Trending Reports:

Student Travel Insurance Market https://www.alliedmarketresearch.com/student-travel-insurance-market-A323727

Cash Management System Market https://www.alliedmarketresearch.com/cash-management-system-market-A323743

Corporate Secretarial Services Market https://www.alliedmarketresearch.com/corporate-secretarial-services-market-A121486

Aviation Consulting Market https://www.alliedmarketresearch.com/aviation-consulting-market-A324243

Commercial flood insurance Market https://www.alliedmarketresearch.com/commercial-flood-insurance-market-A324203

Payroll Card Market https://www.alliedmarketresearch.com/payroll-card-market-A323720

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Booming Housing Finance Market Set to Hit $33,298.79 billion by 2031 , Driven by Affordable Housing Demand and Real Estate Growth here

News-ID: 4057857 • Views: …

More Releases from Allied Market Research

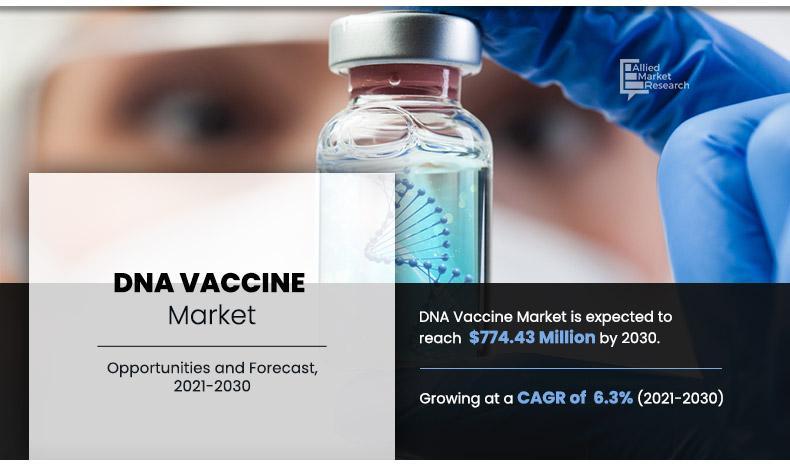

Global DNA Vaccine market to Hit $774.43M by 2030 (6.3% CAGR) Driven by Rising C …

DNA vaccines represent a groundbreaking approach to immunization, leveraging the power of genetics to stimulate a robust immune response. Unlike traditional vaccines that use weakened or inactivated pathogens, DNA vaccines introduce a small piece of genetic material to instruct cells to produce specific proteins that trigger an immune response. This article explores the potential of DNA vaccines, highlighting their unique advantages, advancements, and the transformative impact they may have on…

Aviation Weather RADAR Market Strategies, In-depth Analysis, Key Players and Geo …

The aviation weather RADAR system is the tool used by pilots for strategic and tactical planning of a safe flight trajectory. Each aircraft has a radar antenna mounted in the nose of the aircraft. This antenna catches signals, which are then processed by a computer, enabling the pilots to view the same and make necessary weather predictions. Since the aviation industry is highly competitive, the generated profits are attributed to…

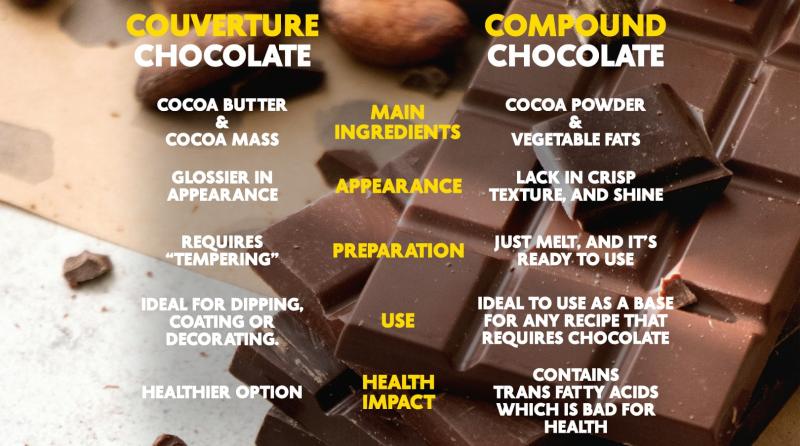

Chocolate Couverture Market by Growth, Emerging Trends and Forecast by 2023-2032

Chocolate couverture is high-quality chocolate with extra cocoa butter, which imparts glossy texture, and is used to cover sweets and cakes. Couverture chocolate bars contain cocoa solids, cocoa butter, sugar, and other basic chocolate bar ingredients. The major change is with the texture of cocoa that is ground to a finer texture than regular chocolates and contains more cocoa butter. Various forms of chocolate coverture are available in the market…

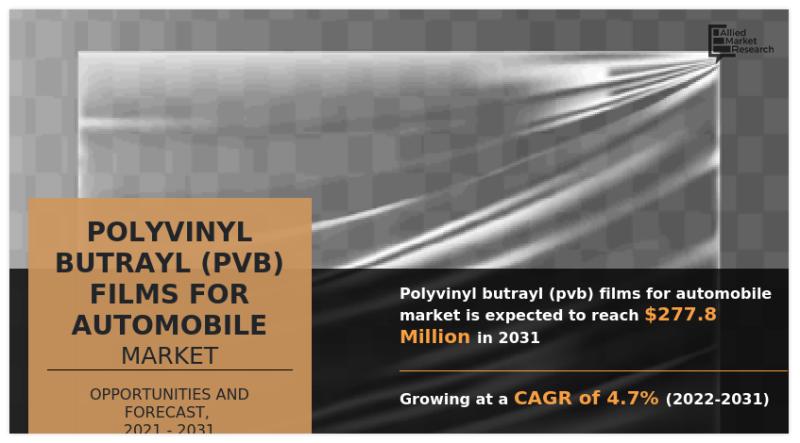

Trends in Polyvinyl Butrayl (PVB) Films for Automobile Market 2026: Transforming …

As per the report published by Allied Market Research, the global polyvinyl butrayl (PVB) films for automobile market was pegged at $189.2 million in 2021, and is expected to reach $227.8 million by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

The report provides an in-depth analysis of top segments, changing market trends, value chain, key investment pockets, competitive scenario, and regional landscape. The report is…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…