Press release

AI in the Credit-Scoring Market Growth and Restrain Factors Analysis Report

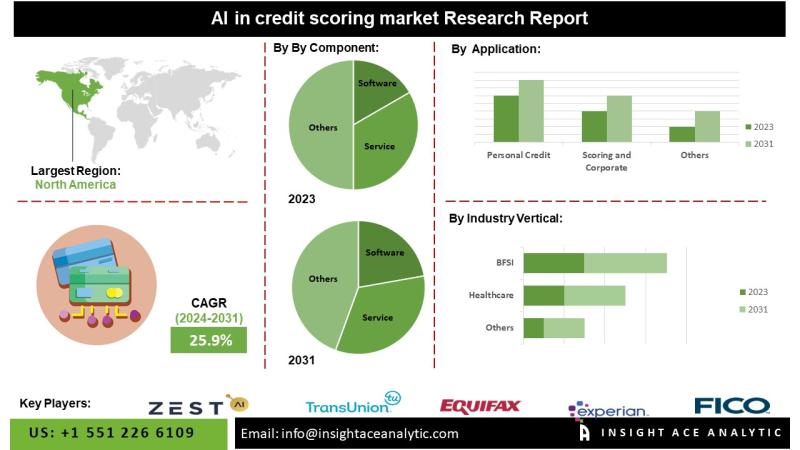

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI In The Credit-Scoring Market - (By Component (Software and Service), By Application (Personal Credit Scoring and Corporate Credit Scoring), By Industry Vertical (BFSI (Banking, Financial Services, Insurance), Retail, Healthcare, Telecommunications, Utilities, and Real Estate)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."According to the latest research by InsightAce Analytic, the Global AI In The Credit-Scoring Market is expected to grow with a CAGR of 25.9% during the forecast period of 2024-2031.

Get Free Access to Demo Report, Excel Pivot and ToC:

https://www.insightaceanalytic.com/request-sample/2578

The adoption of artificial intelligence (AI) and machine learning (ML) within the credit scoring landscape is advancing at a steady pace, though its alignment with broader national development agendas remains in the early stages. Financial institutions, including banks and fintech startups, are increasingly recognizing the transformative potential of these technologies to promote financial inclusion and stimulate economic growth. Central to this evolution is the use of alternative data sources, sophisticated AI and ML algorithms, and scalable cloud infrastructure. These tools are being employed to develop more inclusive credit assessment models, particularly targeting underbanked populations. This innovation is enabling the delivery of tailored financial services to individuals and communities that have historically been excluded from conventional financial systems.

While AI holds considerable promise for revolutionizing credit scoring, its implementation presents several challenges. The global AI-powered credit scoring market is being propelled by continuous advancements in ML algorithms and the expanding availability of big data.

List of Prominent Market Players in the AI credit scoring market:

• FICO (Fair Isaac Corporation)

• Experian

• Equifax

• TransUnion

• Zest AI

• LenddoEFL

• Kreditech

• CreditVidya

• CreditXpert

• Upstart

• Pagaya

• Underwrite.ai

• Kensho Technologies

• Scienaptic

• DataRobot

• Deserve

• ClearScore

• ScoreData

• CredoLab

• Trust Science

• Other Prominent Players

Market Dynamics:

Drivers:

Enhanced Data Processing Capabilities: AI models can analyze vast datasets with high precision, identifying patterns and trends that traditional methods may overlook. This leads to more accurate credit assessments. Real-Time Credit Scoring: The ability of AI to process data rapidly facilitates real-time credit evaluations, enabling prompt decision-making in the financial sector. Operational Efficiency: Automation of credit scoring processes reduces reliance on manual procedures, thereby decreasing operational costs for financial institutions. Inclusion of Alternative Data: AI's capacity to incorporate non-traditional data sources-such as digital footprints and online behavior-expands credit access to individuals with limited credit histories, broadening the customer base.

Enquiry Before Buying:

https://www.insightaceanalytic.com/enquiry-before-buying/2578

Challenges:

Algorithmic Bias: AI models may inadvertently perpetuate existing biases present in training data, leading to discriminatory outcomes in credit assessments. Data Quality and Privacy: Effective AI models require high-quality data. Additionally, handling sensitive financial information raises significant data privacy concerns, necessitating strict compliance with regulations like the General Data Protection Regulation (GDPR). Model Interpretability: The complexity of AI algorithms can make it difficult for stakeholders to understand decision-making processes, emphasizing the need for explainable AI approaches to foster trust among consumers and regulators.

Regional Trends:

North America is anticipated to maintain the largest market share in the AI-driven credit scoring sector throughout the forecast period. This dominance is attributed to the region's advanced technological infrastructure, substantial investments in AI and big data analytics, and the presence of leading financial institutions and fintech companies. In particular, the United States has seen extensive adoption of AI technologies by banks and financial services firms aiming to refine credit scoring models, reduce default rates, and offer more personalized financial products.

Europe also holds a significant share of the market, driven by the increasing digitalization of financial services, a considerable unbanked population, and proactive integration of AI technologies by emerging economies.

Recent Developments:

• In Jan 2024, Intuit Inc., the worldwide financial technology platform responsible for Intuit TurboTax, Credit Karma, , and Mailchimp, has declared that Credit Karma members and Online customers now have the ability to complete and submit their 2023 tax returns using TurboTax directly within the Credit Karma and Online product interfaces.

Get Specific Chapter/Information From The Report:

https://www.insightaceanalytic.com/customisation/2578

Segmentation of AI in credit scoring market-

By Component

• Software

• Service

By Application

• Personal Credit Scoring

• Corporate Credit Scoring

By Industry Vertical

• BFSI

o Banking,

o Financial Services,

o Insurance

• Retail,

• Healthcare,

• Telecommunications,

• Utilities,

• Real Estate

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Get More Information:

https://www.insightaceanalytic.com/report/ai-in-the-credit-scoring-market/2578

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.https://www.insightaceanalytic.com/images_data/148861653.JPG

Contact Us:

info@insightaceanalytic.com

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

Follow Us on LinkedIn @ bit.ly/2tBXsgS

Follow Us On Facebook @ bit.ly/2H9jnDZ

Twitter: https://twitter.com/Insightace

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI in the Credit-Scoring Market Growth and Restrain Factors Analysis Report here

News-ID: 4057690 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

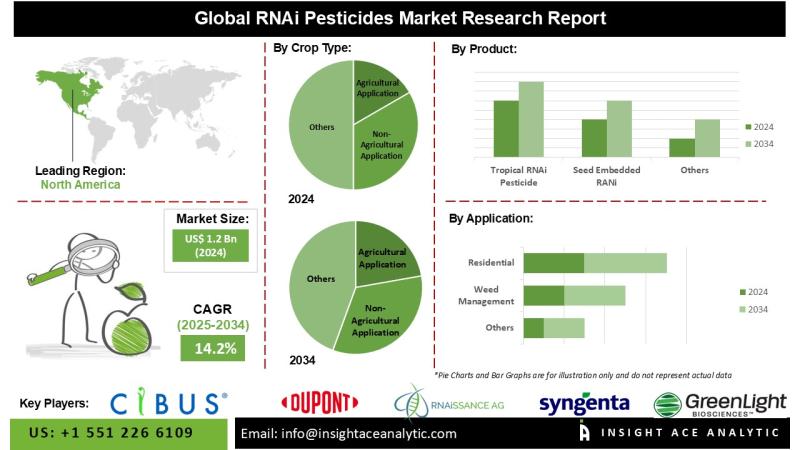

RNAi Pesticides Market Report on the Untapped Growth Opportunities in the Indust …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "RNAi Pesticides Market"-, By Application (Insect Pest Control, Weed Management, Disease Management, Resistance Management), By Crop Type (Agricultural Application, Non-Agricultural Application), By Product (Tropical RNAi Pesticide, Seed Embedded RANi, Transgenic RNAi, Others), By Formulation (Liquid Formulation, Granular Formulation, Powder Formulation, Others), Industry Trends, and Global Forecasts, 2025-2034 And Segment Revenue and Forecast To 2034."

The RNAi…

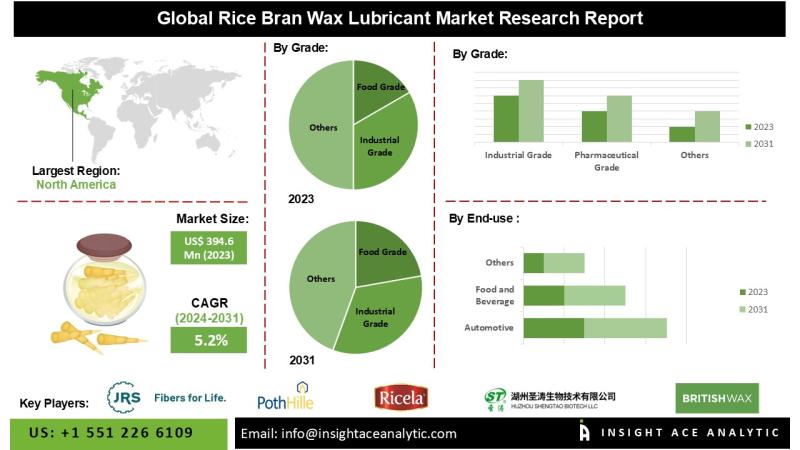

Rice Bran Wax Lubricant Market Know the Scope and Trends

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Rice Bran Wax Lubricant Market - (By Grade (Food Grade, Industrial Grade, Pharmaceutical Grade), End-use (Automotive, Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Chemicals, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Rice Bran Wax Lubricant Market is valued at US$ 394.6 million…

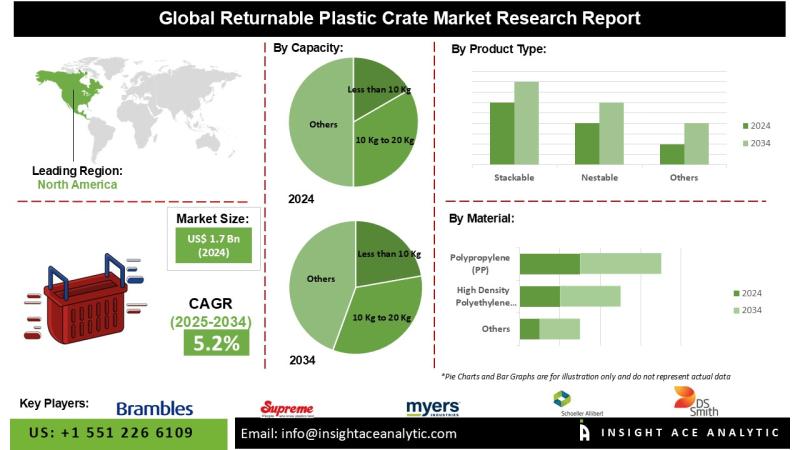

Returnable Plastic Crate Market Exclusive Report with Detailed Study Analysis

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Returnable Plastic Crate Market - (By Capacity (Less than 10 kg, 10 kg to 20 kg, 21 to 35 kg, 36 to 50 kg, Above 50 kg), By Product Type (Stackable, Nestable, Collapsible), By Material (High-Density Polyethylene (HDPE), Polypropylene (P.P.), Others), By Application (Agriculture, Grocery, Dairy, Bakery, Seafood & Meat, Others)), Trends, Industry Competition…

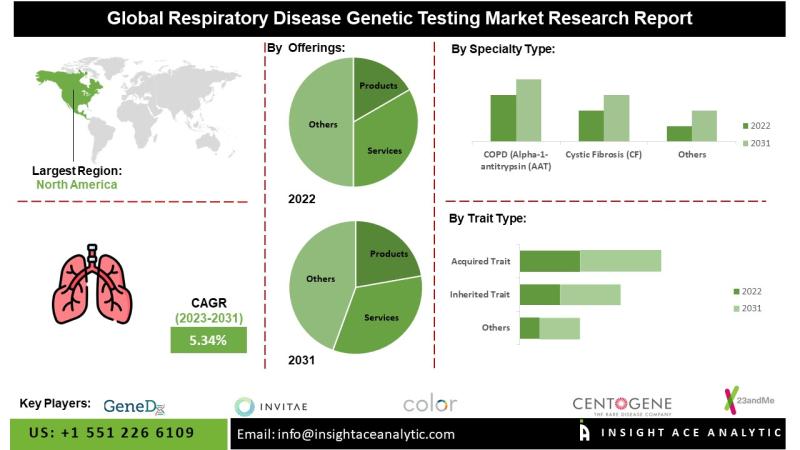

Respiratory Disease Genetic Testing Market Exclusive Report on the Latest Revenu …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Respiratory Disease Genetic Testing Market- (By Offerings (Products (Kits and Consumables), Services, Others), By Disease Type (COPD (Alpha-1-antitrypsin (AAT), Cystic Fibrosis (CF), Diffuse Lung Disease/Surfactant Dysfunction (RHD (Respiratory Distress Syndrome), PPHN (Persistent Pulmonary Hypertension of the Newborn)), Interstitial lung disease, Pulmonary Arterial Hypertension, Pulmonary Hypoplasia, Primary Ciliary Dyskinesia, Other Diseases (BPD)), By Offerings (PCR, NGS…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…