Press release

Future Scope of Banking Encryption Software Market Expects to See Significant Growth During 2025-2032

"The Banking Encryption Software Market is experiencing a period of significant expansion, driven by the escalating sophistication of cyber threats and the stringent regulatory landscape governing financial institutions. This market plays a crucial role in safeguarding sensitive financial data, protecting customer assets, and maintaining the integrity of banking operations. Key drivers fueling this growth include the increasing frequency and severity of data breaches, the growing adoption of cloud-based banking services, and the rising demand for secure mobile banking solutions. Technological advancements such as homomorphic encryption, quantum-resistant cryptography, and blockchain-based security solutions are further propelling market innovation and adoption. The Banking Encryption Software Market is also vital in addressing global challenges related to financial crime, data privacy, and regulatory compliance, contributing to a more secure and trustworthy financial ecosystem. It ensures the privacy of customer data, prevents fraud, and maintains the operational integrity of banking systems, fostering trust among consumers and stakeholders. The market's evolution is not only a response to immediate security threats but also a proactive measure to build a resilient and secure financial infrastructure for the future. This involves continuous adaptation to new technological landscapes and evolving regulatory requirements to ensure comprehensive protection against emerging cyber risks. As the financial industry becomes increasingly interconnected and digitized, the demand for robust encryption solutions will continue to surge, solidifying the Banking Encryption Software Market's position as a cornerstone of modern banking security.

Get the full PDF sample copy of the report: (TOC, Tables and figures, and Graphs) https://www.consegicbusinessintelligence.com/request-sample/1706

Market Size:

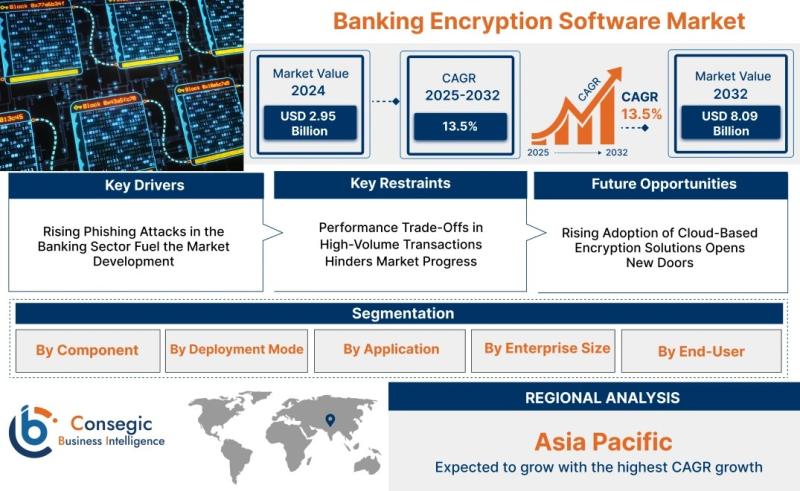

The Banking Encryption Software Market size is estimated to reach over USD 8.09 Billion by 2032 from a value of USD 2.95 Billion in 2024. The market is projected to grow by USD 3.29 Billion in 2025, growing at a CAGR of 13.50% from 2025 to 2032.

Definition of Market:

The Banking Encryption Software Market encompasses the various software solutions and related services designed to protect sensitive data within the banking and financial services sector through encryption techniques. Encryption involves converting readable data into an unreadable format, or ciphertext, to prevent unauthorized access. Key components of this market include:

Encryption Software Tools: These are the core software programs that perform encryption and decryption operations on data at rest and in transit.

Key Management Systems (KMS): KMS are vital for securely generating, storing, distributing, and managing cryptographic keys used in encryption processes.

Consulting Services: Expert advice and guidance provided to banking institutions on the selection, implementation, and optimization of encryption solutions to meet specific security needs and regulatory requirements.

Integration & Deployment Services: Services that facilitate the seamless integration of encryption software with existing banking systems and infrastructure, ensuring minimal disruption and maximum security.

Support & Maintenance Services: Ongoing technical support, software updates, and maintenance services to ensure the continued effectiveness and reliability of encryption solutions.

Key terms related to this market include: Symmetric Encryption (using the same key for encryption and decryption), Asymmetric Encryption (using a public key for encryption and a private key for decryption), Data at Rest Encryption (encrypting data stored on servers, databases, and storage devices), Data in Transit Encryption (encrypting data as it travels between systems), Key Rotation (periodically changing cryptographic keys), and HSM (Hardware Security Module) (a dedicated hardware device for managing cryptographic keys).

Get Discount On Report @ https://www.consegicbusinessintelligence.com/request-discount/1706

Market Scope and Overview:

The Banking Encryption Software Market's scope extends across various technologies, applications, and industries within the financial sector. Technologies include advanced encryption algorithms, key management systems, data masking techniques, and secure communication protocols. The applications are diverse, ranging from securing customer data and financial transactions to protecting sensitive internal communications and databases. The industries served span retail banking, investment banking, commercial banking, and other financial institutions. This market is critical for ensuring compliance with stringent regulatory standards such as GDPR, PCI DSS, and CCPA, which mandate the protection of sensitive financial data. The market also addresses the growing threat of cyberattacks, including ransomware, phishing, and malware, which target financial institutions to steal sensitive data and disrupt operations.

The importance of the Banking Encryption Software Market is underscored by its role in mitigating financial fraud, safeguarding customer trust, and maintaining the stability of the global financial system. Global trends such as the increasing adoption of cloud computing, mobile banking, and digital payment systems are driving demand for robust encryption solutions. Furthermore, the rise of fintech companies and the proliferation of online banking platforms have expanded the attack surface for cybercriminals, making encryption a critical component of banking security. The market is also influenced by the growing awareness of data privacy and the increasing demand for transparency in financial services. As consumers become more concerned about the security of their financial data, banks are investing in advanced encryption technologies to demonstrate their commitment to data protection and build stronger customer relationships. The Banking Encryption Software Market is therefore not only a response to immediate security threats but also a strategic investment in building a resilient and trustworthy financial ecosystem.

Top Key Players in this Market

IBM Corporation (USA) Microsoft Corporation (USA) Broadcom Inc. (USA) Thales Group (France) McAfee, LLC (USA) Intel Corporation (USA) Sophos Ltd. (UK) Trend Micro Incorporated (Japan) TaskUs (USA) ESET (Slovakia)

Market Segmentation:

The Banking Encryption Software Market is segmented based on various factors, which include:

By Component: Software Encryption Tools, Key Management Systems, Services (Consulting, Integration & Deployment, Support & Maintenance). Each component plays a vital role in ensuring comprehensive data protection, with software tools handling the encryption process, KMS managing cryptographic keys, and services providing the necessary expertise and support.

By Deployment Mode: On-Premise, Cloud-Based, Hybrid. On-premise solutions offer greater control over data security, while cloud-based solutions provide scalability and cost-effectiveness. Hybrid models combine the benefits of both, offering a balance between control and flexibility.

By Application: Data Encryption, Communication Encryption, File & Disk Encryption, Database Encryption. These applications cover different aspects of data protection, from securing stored data and communications to encrypting files and databases, ensuring that sensitive information is protected at all times.

By Enterprise Size: Small & Medium Enterprises (SMEs), Large Enterprises. Large enterprises typically require more complex and robust encryption solutions, while SMEs may opt for simpler, more cost-effective options.

By End-User: Retail Banking, Investment Banking, Commercial Banking, Others. Each end-user segment has specific security needs and regulatory requirements, which influence the type of encryption software they adopt.

Market Drivers:

Increasing Frequency and Severity of Cyber Attacks: The rising number of sophisticated cyber threats targeting financial institutions is driving the demand for robust encryption solutions.

Stringent Regulatory Compliance: Regulations such as GDPR, PCI DSS, and CCPA mandate the protection of sensitive financial data, compelling banks to adopt encryption technologies.

Growing Adoption of Cloud-Based Banking Services: The migration of banking operations to the cloud requires enhanced security measures, including encryption, to protect data in transit and at rest.

Rising Demand for Secure Mobile Banking Solutions: The increasing use of mobile banking apps necessitates robust encryption to protect sensitive financial data transmitted over mobile networks.

Advancements in Encryption Technologies: Innovations such as homomorphic encryption, quantum-resistant cryptography, and blockchain-based security solutions are driving market growth.

Market Key Trends:

Integration of AI and Machine Learning in Encryption Solutions: AI and ML are being used to enhance threat detection, automate key management, and improve the overall effectiveness of encryption systems.

Adoption of Homomorphic Encryption: Homomorphic encryption allows computations to be performed on encrypted data without decrypting it first, enabling secure data processing in the cloud.

Focus on Quantum-Resistant Cryptography: As quantum computing technology advances, there is a growing focus on developing encryption algorithms that are resistant to quantum attacks.

Increasing Use of Blockchain-Based Security Solutions: Blockchain technology is being used to enhance the security of key management systems and data storage.

Growing Emphasis on Data Privacy and Transparency: Banks are investing in advanced encryption technologies to demonstrate their commitment to data protection and build stronger customer relationships.

Market Opportunities:

Expansion into Emerging Markets: There is significant growth potential in emerging markets with rapidly growing banking sectors and increasing adoption of digital financial services.

Development of Industry-Specific Encryption Solutions: Tailoring encryption solutions to the specific needs of different banking segments, such as retail banking, investment banking, and commercial banking, can create new market opportunities.

Integration of Encryption with Other Security Technologies: Combining encryption with other security technologies, such as multi-factor authentication, intrusion detection systems, and security information and event management (SIEM) systems, can provide a more comprehensive security solution.

Innovation in Key Management Systems: Developing more secure and user-friendly key management systems can drive adoption of encryption technologies.

Provision of Encryption-as-a-Service (EaaS): Offering encryption as a managed service can make it more accessible and affordable for smaller banks and financial institutions.

Market Restraints:

High Initial Costs: The initial investment in encryption software and hardware can be significant, particularly for smaller banks and financial institutions.

Complexity of Implementation: Integrating encryption solutions with existing banking systems and infrastructure can be complex and time-consuming.

Performance Overhead: Encryption can introduce performance overhead, which can impact the speed and efficiency of banking operations.

Lack of Skilled Professionals: There is a shortage of skilled professionals with expertise in encryption technologies, which can hinder adoption.

Regulatory Uncertainty: The regulatory landscape for encryption is constantly evolving, which can create uncertainty for banks and financial institutions.

Market Challenges:

The Banking Encryption Software Market faces several significant challenges that could impede its growth and adoption. One of the primary challenges is the ever-evolving nature of cyber threats. As cybercriminals become more sophisticated, encryption solutions must continuously adapt to stay ahead of new attack vectors. This requires ongoing research and development to create more robust and resilient encryption algorithms. Another significant challenge is the complexity of implementing and managing encryption across diverse banking systems and applications. Many banks rely on legacy systems that are not easily integrated with modern encryption technologies. This can lead to compatibility issues, performance bottlenecks, and increased costs. Key management is another critical challenge. Securely generating, storing, and distributing cryptographic keys is essential for maintaining the integrity of encryption systems. However, key management is often complex and prone to human error, which can create vulnerabilities. Cloud security also presents significant challenges. As more banks migrate their operations to the cloud, they must ensure that their data is protected both in transit and at rest. This requires robust encryption solutions that are compatible with cloud environments and can be easily managed across multiple cloud platforms. Furthermore, regulatory compliance is a major challenge for banks operating in multiple jurisdictions. Different countries and regions have different data protection laws and regulations, which can create a complex and fragmented compliance landscape. Banks must ensure that their encryption solutions meet all applicable regulatory requirements, which can be a costly and time-consuming process.

Another challenge is the shortage of skilled cybersecurity professionals. There is a global shortage of professionals with expertise in encryption technologies, which can make it difficult for banks to implement and manage their encryption solutions effectively. This shortage can also drive up the cost of cybersecurity services, making it more difficult for smaller banks to compete. Finally, the cost of encryption solutions can be a barrier to adoption for some banks. While encryption is essential for protecting sensitive data, it can also be expensive to implement and maintain. This can be a particular challenge for smaller banks with limited budgets. Overcoming these challenges will require a multi-faceted approach that includes ongoing investment in research and development, improved integration with legacy systems, enhanced key management practices, robust cloud security solutions, and increased education and training for cybersecurity professionals.

Market Regional Analysis:

The Banking Encryption Software Market exhibits distinct regional dynamics influenced by varying regulatory landscapes, technological adoption rates, and economic conditions. North America is a leading market due to its advanced technological infrastructure, stringent regulatory environment, and high awareness of cybersecurity threats. Europe also holds a significant share, driven by strong data protection laws such as GDPR and the presence of major financial institutions. The Asia-Pacific region is experiencing rapid growth, fueled by increasing digitalization of banking services, rising cybercrime rates, and supportive government initiatives promoting cybersecurity. Countries like China, India, and Japan are key markets in this region. Latin America and the Middle East & Africa (MEA) are emerging markets with increasing adoption of banking encryption software, driven by the need to protect sensitive financial data and comply with international standards. However, these regions face challenges such as limited cybersecurity expertise and infrastructure constraints. The United States is the major market, followed by Europe due to stringent regulations and a focus on data security. Emerging economies, especially China and India, are experiencing the highest growth rates due to rapid digitalization and increasing adoption of banking encryption software.

Frequently Asked Questions:

What is the projected growth rate of the Banking Encryption Software Market?

The Banking Encryption Software Market is projected to grow at a CAGR of 13.50% from 2025 to 2032.

What are the key trends driving the growth of this market?

Key trends include the increasing frequency and severity of cyber attacks, stringent regulatory compliance, growing adoption of cloud-based banking services, and rising demand for secure mobile banking solutions.

Which Market types are most popular in this market?

Software Encryption Tools and Key Management Systems are among the most popular market types.

Follow us on:

https://www.linkedin.com/company/future-trends-watch/

https://www.linkedin.com/company/global-innovation-insights/

https://www.linkedin.com/company/techfront-insights/

https://www.linkedin.com/company/nexus-innovations48/

https://www.linkedin.com/company/revolutionary-tech-talks/"

Contact Us:

Consegic Business intelligence Pvt Ltd

Baner Road, Baner, Pune, Maharashtra - 411045

(US) (505) 715-4344

info@consegicbusinessintelligence.com

sales@consegicbusinessintelligence.com

Web - https://www.consegicbusinessintelligence.com/

About Us:

Consegic Business Intelligence is a data measurement and analytics service provider that gives the most exhaustive and reliable analysis available of global consumers and markets. Our research and competitive landscape allow organizations to record competing evolutions and apply strategies accordingly to set up a rewarding benchmark in the market. We are an intellectual team of experts working together with the winning inspirations to create and validate actionable insights that ensure business growth and profitable outcomes.

We provide an exact data interpretation and sources to help clients around the world understand current market scenarios and how to best act on these learnings. Our team provides on-the-ground data analysis, Portfolio Expansion, Quantitative and qualitative analysis, Telephone Surveys, Online Surveys, and Ethnographic studies. Moreover, our research reports provide market entry plans, market feasibility and opportunities, economic models, analysis, and an advanced plan of action with consulting solutions. Our consumerization gives all-inclusive end-to-end customer insights for agile, smarter, and better decisions to help business expansion.

Connect with us on:

LinkedIn - https://www.linkedin.com/company/consegic-business-intelligence/

YouTube - https://www.youtube.com/@ConsegicBusinessIntelligence22

Facebook - https://www.facebook.com/profile.php?id=61575657487319

X - https://x.com/Consegic_BI

Instagram - https://www.instagram.com/cbi._insights/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future Scope of Banking Encryption Software Market Expects to See Significant Growth During 2025-2032 here

News-ID: 4057429 • Views: …

More Releases from Consegic Business Intelligence Pvt. Ltd

Europe Pharmaceutical Manufacturing Equipment Market 2025 Industry Updates, Futu …

Introduction:

The Pharmaceutical Manufacturing Equipment Market is experiencing robust growth, driven by a confluence of factors reshaping the landscape of pharmaceutical production. Increasing global demand for pharmaceuticals, fueled by an aging population and the rise of chronic diseases, necessitates advanced and efficient manufacturing processes. Technological advancements, such as continuous manufacturing, automation, and digitalization, are revolutionizing traditional methods, improving production efficiency, reducing costs, and enhancing product quality. Stringent regulatory requirements and the…

Europe Vibration Damping Materials Market Size 2025 Overview, Manufacturers, Typ …

Introduction:

The Vibration Damping Materials market is experiencing significant growth, driven by the increasing demand for noise and vibration reduction across various industries. Key drivers include stringent environmental regulations, the growing automotive industry, particularly the electric vehicle (EV) sector, and the need for enhanced comfort and safety in residential and commercial buildings. Technological advancements in materials science are also playing a pivotal role, with the development of more efficient and durable…

Europe Lightweight Aggregates Market Size 2025 Emerging Technologies, Opportunit …

Introduction:

The Lightweight Aggregates Market is experiencing substantial growth driven by several key factors. Primarily, the increasing demand for sustainable and eco-friendly construction materials is fueling the adoption of lightweight aggregates. These materials offer superior insulation properties, reduced transportation costs, and contribute to the overall reduction of the carbon footprint of construction projects. Technological advancements in the production and application of lightweight aggregates are also playing a crucial role, enhancing their…

Europe Visible Light Communication Market Share, Growth, Size, Industry Trends, …

Introduction:

The Visible Light Communication (VLC) market is experiencing significant growth, driven by the increasing demand for faster, more secure, and energy-efficient communication technologies. VLC leverages light waves for data transmission, offering a complementary solution to traditional radio frequency (RF) based wireless communication. Key drivers include the proliferation of LED lighting, growing concerns about RF spectrum congestion, and the need for secure communication in sensitive environments. Technological advancements, such as improved…

More Releases for Encryption

Evolving Market Trends In The Data Encryption Industry: Innovative Cloud-Based F …

The Data Encryption Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Data Encryption Market Size During the Forecast Period?

In recent years, the market size for data encryption has seen substantial growth. It's projected to expand from a worth of $18.08 billion…

Bank Encryption Software Market

According to Triton's report, the global bank encryption software market, which achieved $11.83 billion in 2021, is reported to record progress at 14.11% CAGR by 2028.

Bank Encryption Software Market - https://www.tritonmarketresearch.com/reports/bank-encryption-software-market#report-overview/?utm_source=PaidPRNew&utm_medium=OpenPR&utm_campaign=TritonPR

A recent study by Triton Market Research named 'Global Bank Encryption Software Market' includes the global analysis and forecast by Deployment Model (On-Premise, Cloud), Enterprise Type (Large Enterprises, Small & Medium Enterprises), Component (Software, Services), Encryption Type (Disk Encryption, Communication…

Email Encryption Market

The global Email Encryption industry research report provides an in-depth and methodical assessment of regional and global markets, as well as the most current service and product innovations and the global market's predicted size. The Email Encryption exploration does a complete request analysis to find the major suppliers by integrating all applicable products and services in order to understand the places of the top industry players in the Email Encryption…

Cyphertop Encryption Software Review

Cyphertop encryption software a simple, context-menu-based approach to encryption and secure deletion, and it also handles text-only encryption. It's a fine choice for keeping files safe.

Cyphertop review takes a close look at a popular encryption software. It appears affordable and straightforward, but it is powerful. Here is an analysis of all aspects to see if this is true.

Cyphertop comes with a 30-day trial, including everything you need to test it.…

Mobile Encryption Market: by Type (Disk Encryption, File/Folder Encryption, Comm …

Mobile encryption is the process of encoding all user data on an android device using symmetric encryption keys. Once the device is encrypted, all user created data would automatically encrypt before committing it to the disk and automatically decrypt data before returning it to the calling process. Encryption process doesn’t allows an unauthorized party to read data.

If any organization deals with a lot of mobile devices that carry critical data,…

Global Encryption Software Market

Global Encryption Software Market – Global Industry Analysis and Forecast (2018-2026) – By Component, Application, Deployment Type, Organization Size, Vertical, and Geography

Market Scenario

Global Encryption Software Market was valued US$ 3.45 Bn in 2017 and is expected to reach US$ 9.23 Bn by 2026, at a CAGR of 14% during a forecast period.

The global encryption software market based on component, application, deployment type, organization size, vertical, and region. In terms of…