Press release

Mexico Wealth Management Market Size, Share, Trends, Growth Analysis, Report 2025-2033

Market Overview 2025-2033The Mexico wealth management market size reached USD 82.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 238.7 Million by 2033, exhibiting a growth rate (CAGR) of 11.88% during 2025-2033. The market is witnessing steady expansion, driven by rising high-net-worth individuals, financial literacy, and economic growth. Key trends include digital advisory platforms, personalized investment strategies, and a growing focus on sustainable and impact investing by leading wealth management firms.

Key Market Highlights:

✔️ Steady growth driven by rising affluent population & financial awareness

✔️ Increasing adoption of digital wealth management platforms

✔️ Growing demand for personalized and sustainable investment solutions

✔️ Expansion of advisory services targeting millennials and HNWIs

✔️ Enhanced focus on regulatory compliance and transparency

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-wealth-management-market/requestsample

Mexico Wealth Management Market Trends and Drivers:

The Mexico wealth management market is experiencing a notable transformation driven by the rising affluence among its population. As the middle class expands and more individuals achieve higher income levels, there is a growing demand for sophisticated financial services. Wealth management firms are increasingly targeting high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), offering tailored investment solutions that cater to their unique financial goals.

This demographic shift is also prompting a greater interest in alternative investments, such as private equity, venture capital, and real estate, as affluent clients seek to diversify their portfolios beyond traditional asset classes. Moreover, the increasing availability of investment products and services, combined with a more favorable regulatory environment, is facilitating access to wealth management solutions for a broader audience. As financial literacy improves among the population, individuals are becoming more proactive in seeking professional advice to optimize their wealth accumulation strategies, further driving the growth of the wealth management sector in Mexico.

Another significant dynamic shaping the Mexico wealth management market is the rapid advancement of technology and the digital transformation of financial services. Wealth management firms are increasingly leveraging technology to enhance client engagement, streamline operations, and improve service delivery. The rise of fintech companies has introduced innovative solutions that are reshaping how wealth management services are offered, making them more accessible and user-friendly. Digital platforms enable clients to manage their investments more effectively, access real-time data, and receive personalized financial advice through robo-advisors and artificial intelligence-driven tools.

Additionally, the COVID-19 pandemic has accelerated the adoption of digital channels, as clients seek remote access to their financial services. Wealth management firms are investing in advanced analytics and customer relationship management systems to better understand client needs and preferences, allowing for more tailored investment strategies. As technology continues to evolve, the wealth management landscape in Mexico is expected to become increasingly competitive, with firms that embrace digital innovation likely to capture a larger share of the market.

The regulatory environment in Mexico is also a crucial factor influencing the wealth management market. Recent reforms aimed at enhancing transparency and protecting investors have created new compliance challenges for wealth management firms. The implementation of stricter anti-money laundering (AML) regulations and know-your-customer (KYC) requirements has necessitated a reevaluation of operational processes within these firms.

While these regulations aim to foster trust and integrity in the financial system, they also impose additional burdens on wealth managers to ensure compliance. Firms must invest in robust compliance frameworks and technologies to monitor transactions and verify client identities effectively. Furthermore, the evolving regulatory landscape requires wealth management professionals to stay informed about changes and adapt their strategies accordingly. As firms navigate these challenges, those that prioritize compliance while maintaining high service standards will be better positioned to build long-term relationships with clients and enhance their reputation in the market.

The Mexico wealth management market is witnessing a significant evolution, driven by a combination of socio-economic factors, technological advancements, and changing consumer preferences. With the rise of a more affluent middle class, there is an increasing demand for personalized financial services that cater to the unique needs of high-net-worth individuals. Clients are seeking comprehensive wealth management solutions that encompass investment management, estate planning, tax optimization, and retirement strategies.

As we approach 2025, the trend toward holistic financial planning is expected to gain momentum, with wealth management firms focusing on delivering integrated services that address clients' diverse financial goals. Additionally, the growing interest in sustainable and socially responsible investing is reshaping investment strategies, with clients increasingly favoring investments that align with their values. As a result, wealth managers are incorporating environmental, social, and governance (ESG) criteria into their offerings, appealing to a new generation of investors who prioritize ethical considerations alongside financial returns.

Furthermore, the integration of technology in wealth management is revolutionizing client interactions, allowing for enhanced communication and more efficient service delivery. Digital platforms are becoming essential tools for wealth managers, enabling them to provide real-time insights and facilitate seamless transactions. Overall, the Mexico wealth management market is poised for continued growth, characterized by a deeper understanding of client needs, a commitment to innovation, and a focus on sustainability as key drivers of demand.

Buy Report Now: https://www.imarcgroup.com/checkout?id=22156&method=980

Mexico Wealth Management Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Business Model:

• Human Advisory

• Robo Advisory

• Hybrid Advisory

Breakup by Provider:

• FinTech Advisors

• Banks

• Traditional Wealth Managers

• Others

Breakup by End User:

• Retail

• High Net Worth Individuals (HNIs)

Breakup by Region:

• Northern Mexico

• Central Mexico

• Southern Mexico

• Others

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22156&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion.

IMARC's services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mexico Wealth Management Market Size, Share, Trends, Growth Analysis, Report 2025-2033 here

News-ID: 4056013 • Views: …

More Releases from IMARC Group

Copper Busbars Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapE …

Setting up a copper busbars manufacturing plant positions investors in one of the most strategically critical segments of the global electrical infrastructure and power distribution value chain, driven by increasing demand for efficient power distribution systems, the accelerating expansion of renewable energy infrastructure, growing adoption of electric vehicles requiring robust high-current electrical connections, and rising investment in smart grids, data centers, and industrial automation worldwide.

Market Overview and Growth Potential:

The global…

Titanium Prices, Latest Trend, Demand, Index & Uses Feb 2026

North America - Titanium Prices February 2026

In North America, Titanium Prices reached USD 6.92 per kg in February 2026, marking a 2.4% decline compared to the previous month. The downward movement was primarily attributed to stable raw material availability and moderate demand from aerospace and industrial sectors. Despite the short-term correction, long-term demand fundamentals remain supported by infrastructure development and advanced manufacturing applications.

Regional Analysis: The price analysis can be extended…

Tin Prices Update: Northeast Asia Leads at USD 53.21/KG, Europe at USD 51.18/KG …

Northeast Asia - Tin Prices February 2026

In February 2026, Tin Prices in Northeast Asia reached USD 53.21 per kg, reflecting firm regional demand from electronics and solder manufacturing industries. Strong semiconductor production and steady industrial activity supported elevated pricing levels. Balanced supply conditions and active trade flows further reinforced the region's resilient tin market performance.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/tin-pricing-report/requestsample

Europe - Tin Prices February 2026

Tin prices in Europe stood at…

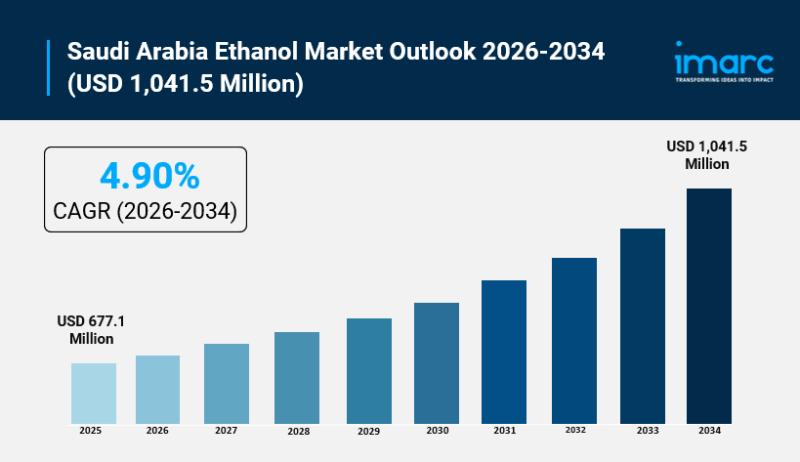

Saudi Arabia Ethanol Market Size to Exceed USD 1,041.5 Million by 2034 | CAGR of …

Saudi Arabia Ethanol Market Overview

Market Size in 2025: USD 677.1 Million

Market Forecast in 2034: USD 1,041.5 Million

Market Growth Rate 2026-2034: 4.90%

According to IMARC Group's latest research publication, "Saudi Arabia Ethanol Market Size, Share, Trends and Forecast by Type, Raw Material, Purity, Application, and Region, 2026-2034", The Saudi Arabia ethanol market size was valued at USD 677.1 Million in 2025 and is projected to reach USD 1,041.5 Million by 2034, growing…

More Releases for Mexico

Egg Freezing in Mexico: Leading Mexico City Clinics Launch 2026 Programs

Enlistalo Fertilidad offers expanded egg freezing services for international patients, including Americans, seeking fertility preservation.

Mexico City, Mexico - January 22, 2026 - Egg freezing is becoming an increasingly popular option for patients worldwide, and Mexico City continues to emerge as a leading destination for those seeking high-quality, affordable fertility care.

In 2026, Enlistalo Fertilidad stands out for its personalized approach, advanced medical standards, and focus on supporting international patients through every…

Human Resources Mexico Releases Employer Guide To Mexico 2026 Minimum Wage Compl …

Mexico's National Minimum Wage Commission (CONASAMI) has confirmed the new minimum wage levels that will take effect on January 1, 2026. The general daily minimum wage will increase to MXN [315.04], while the Northern Border Free Zone rate will rise to MXN [440.87] for 2026.

Image: https://www.globalnewslines.com/uploads/2025/12/d53f76670eba46736b7e94c6a16fb975.jpg

The adjustment reflects an estimated 13 percent increase for the general zone and about 5 percent for the Northern Border Free Zone compared to 2025.…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by Market Insights Reports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by MarketInsightsReports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico Rooftop Solar…

The Mexico Online On-demand Home Services Market , Major Keyplayers - Aliada Inc …

Mexico Online On-demand Home Services Market 2021

Mexico online on-demand home services market offer a range of services within the comfort of home as well as save time and money. Additionally, these services help in bridging the gap between the real-world services and instant online services with improved efficiency. Recently, the demand for Mexico online on-demand home services marekt has started witnessing huge growth due to convenience and accessibility. The growing…

Mexico Agriculture Market, Mexico Agriculture Industry, Mexico Agriculture Grain …

Mexico Agriculture has been crucial sector of the country’s economy traditionally and politically even if it currently accounts for a really little share of Mexico’s GDP. Mexico is one in all the cradles of agriculture with the Mesoamericans emerging domesticated plants like maize, beans, tomatoes, squash, cotton, vanilla, avocados, cacao, number sorts of spices, and more. Domestic turkeys and Muscovy ducks were the solely domesticated fowl within the pre-Hispanic amount and little dogs…