Press release

Biodiversity and Natural Capital Credit Market Poised for Massive Growth Due to ESG and Policy Shifts

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the " Biodiversity and Natural Capital Credit Market- (By Credit Type (Biodiversity Credits (Habitat/Ecosystem Conservation Credits, Restoration Credits, Species Conservation Credits, Avoided Loss Credits), Natural Capital Credits (Carbon Sequestration, Soil Quality Improvement, Watershed Services, Pollination Services), Hybrid/Bundled Credits (Combined Carbon and Biodiversity Credits, Landscape-level Conservation Credits, Ecosystem Service Packages))), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."According to the latest research by InsightAce Analytic, the Biodiversity and Natural Capital Credit Market is valued at USD 5.7 Bn in 2024 , and it is expected to reach USD 48.7 Bn by the year 2034, with a CAGR of 24.1% during the forecast period of 2025-2034.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/3064

A market-based mechanism called the Biodiversity and Natural Capital Credit was created to acknowledge, protect, and restore the ecological worth of natural ecosystems and biodiversity. The world's stocks of natural assets, such as forests, soil, water, wetlands, and air, that offer vital ecosystem services like carbon sequestration, water purification, and pollination are referred to as natural capital. In contrast, biodiversity includes the variety of life on Earth, including species, habitats, and genetic diversity.

Government policies and regulations that support biodiversity protection, growing investor interest in biodiversity and natural capital as an asset class, consumer demand for eco-friendly products, international frameworks like the Kunming-Montreal Global Biodiversity Framework, and corporate ESG commitments and net-positive biodiversity goals are all expected to contribute to the market's growth. Additionally, while terrestrial ecosystems have been the focus of much attention, freshwater and marine environments are becoming more and more crucial for maintaining biodiversity globally.

List of Prominent Players in the Biodiversity and Natural Capital Credit Market:

• Terrasos SAS

• BioCarbon Partners LP.

• EcoEnterprises Fund

• Zero Imprint Ltd.

• Ekos Kāmahi Ltd

• Climate Asset Management Limited

• Biodiversity Solutions Ltd

• GreenCollar Group

• Earthbanc

• DGB GROUP N.V.

• The Landbanking Group

• ClimateTrade

• Wildlife Works Services

• Nature Metrics Ltd

• New Forests Advisory Pty Limited

• GreenVest

• CreditNature Ltd

• South Pole

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-04

Market Dynamics:

Drivers-

The growing demand for carbon-neutral and environmentally sustainable products, as well as the growing awareness of the significance of biodiversity preservation, are driving the growth of the Biodiversity and Natural Capital Credit sector. Additionally, there are significant prospects for the development of financial instruments linked to biodiversity, the expansion into freshwater and marine habitats, and the integration of carbon markets with biodiversity and natural capital credits. It is anticipated that the growing use of technology for biodiversity verification and monitoring will further boost market expansion.

Challenges:

The Biodiversity and Natural Capital Credit market faces obstacles like high transaction costs, a lack of consistent assessment techniques, and doubts about the sustainability of conservation initiatives. Verification issues and disjointed rules may obstruct market development. Additionally, one of the most urgent problems is the absence of defined and consistent methods for assessing biodiversity outcomes. In the absence of a standardized methodology for evaluating the effects on biodiversity, the market may encounter challenges in guaranteeing the dependability and efficiency of credits.

Regional Trends:

Europe's Biodiversity and Natural Capital Credit market is anticipated to report a major market share in terms of revenue fueled by strong legal frameworks, well-established environmental regulations, and large financial investments in conservation and sustainability initiatives. The market has grown as a result of the European Union's Green Deal, which sets lofty targets to cut carbon emissions and save biodiversity. Additionally, over the projection period, the Asia Pacific is expected to increase at the fastest rate due to rapid urbanization, economic expansion, and growing awareness of the region's environmental issues. Numerous governments in this area are also aggressively advancing carbon markets and sustainability.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/3064

Segmentation of Biodiversity and Natural Capital Credit Market-

By Credit Type-

• Biodiversity Credits

o Habitat/Ecosystem Conservation Credits

o Restoration Credits

o Species conservation Credits

o Avoided Loss Credits

• Natural Capital Credits

o Carbon Sequestration

o Soil Quality Improvement

o Watershed Services

o Pollination Services

• Hybrid/Bundled Credits

o Combined Carbon and Biodiversity Credits

o Landscape-level Conservation Credits

o Ecosystem Service Packages

By Region-

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/biodiversity-and-natural-capital-credit-market/3064

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Biodiversity and Natural Capital Credit Market Poised for Massive Growth Due to ESG and Policy Shifts here

News-ID: 4053364 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

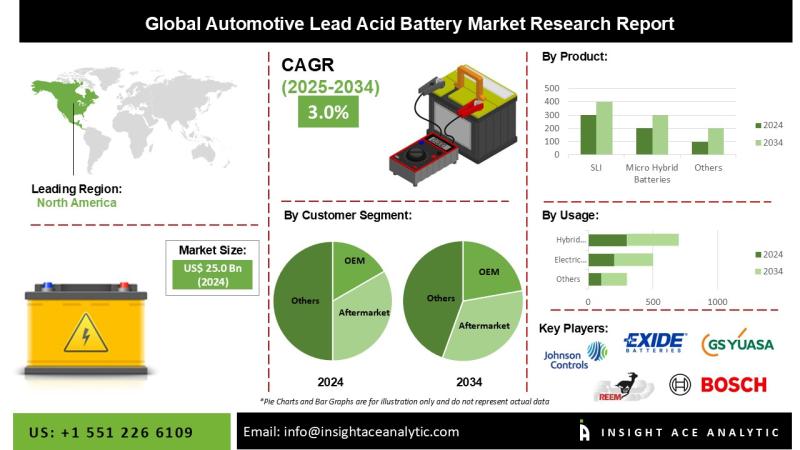

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

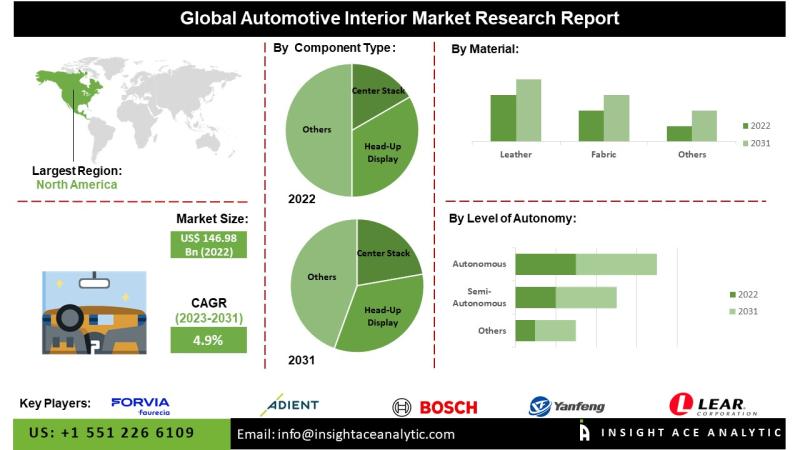

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

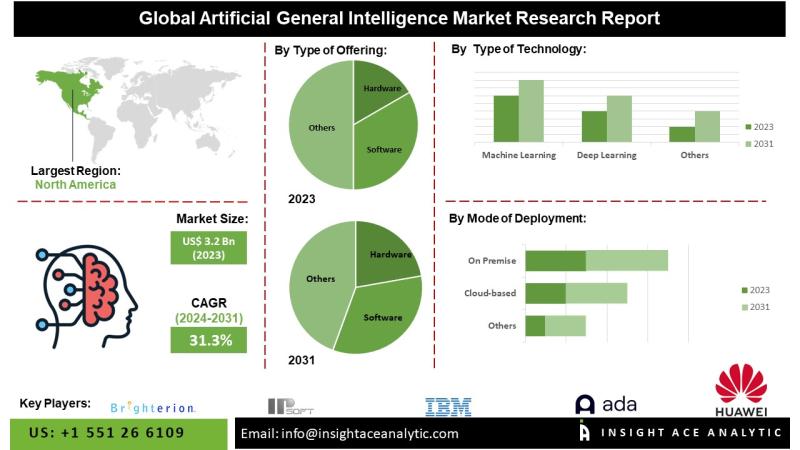

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

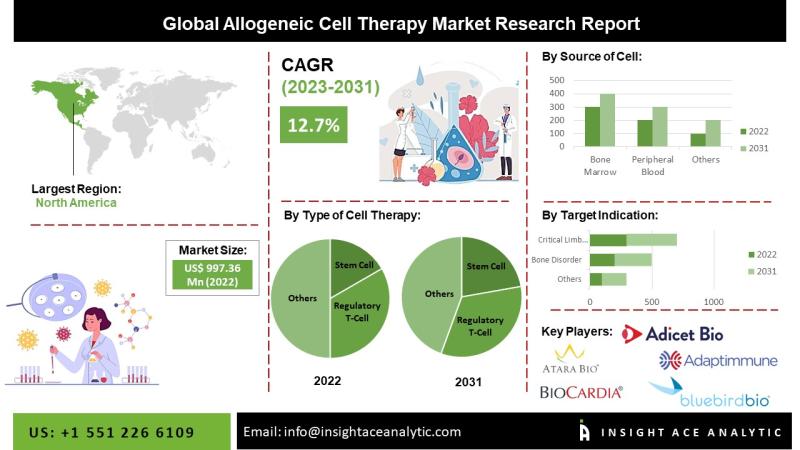

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…