Press release

ATM Market, Powering Secure and Accessible Banking in a Rapidly Evolving Financial Ecosystem

Overview of the MarketThe Automated Teller Machine (ATM) Market continues to remain a critical pillar of the global financial infrastructure, even in an era increasingly dominated by digital banking. ATMs offer 24/7 access to cash withdrawals, deposits, account information, and other banking services, making them indispensable for both urban and rural populations. Their relevance is further amplified in emerging markets, where traditional bank branches may be limited. The ATM Market is evolving to integrate advanced functionalities like biometric authentication, contactless transactions, and video banking, aligning with broader shifts toward customer convenience and enhanced security.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/8368

The deployment segment leads the market, particularly in offsite locations such as retail outlets and transportation hubs, due to the rising demand for cash access points beyond bank premises. Regionally, Asia-Pacific dominates the global ATM Market, fueled by expanding banking infrastructure in developing nations such as India, Indonesia, and the Philippines. Government-led financial inclusion programs and rapid urbanization have contributed to the significant installation of ATMs across both urban and rural landscapes.

✦ Key Highlights from the Report:

✦ Asia-Pacific holds the largest share of the global ATM Market, driven by financial inclusion initiatives.

✦ Deployment in offsite locations leads the market due to demand for convenient banking access.

✦ Integration of biometric and contactless technologies is transforming traditional ATM functions.

✦ The rising need for cash availability in rural areas sustains demand despite digital banking growth.

✦ Managed services are gaining popularity, allowing banks to reduce operational costs.

✦ The increasing number of ATMs with multi-currency and cardless transaction features boosts adoption.

⚙️ Market Segmentation

The ATM Market can be segmented based on type, solution, and deployment location. By type, the market includes conventional/bank ATMs, smart ATMs, and cash dispensers. Smart ATMs are gaining traction for their ability to facilitate a wider range of services, including bill payments, check deposits, and even remote video assistance. Cash dispensers, typically limited to withdrawals, are still prominent in regions where basic banking services are needed.

In terms of solutions, the market is segmented into deployment (onsite, offsite, worksite, and mobile ATMs) and managed services. Managed services are increasingly adopted by financial institutions seeking to outsource ATM operations, maintenance, and security to third-party vendors for cost efficiency and technological upgrades. Onsite ATMs are typically located within bank branches, while offsite and mobile ATMs cater to high-traffic public areas and underserved regions, respectively. These deployment types provide banks the flexibility to expand their presence without incurring high real estate costs.

🌐 Regional Insights

Asia-Pacific is currently the largest and fastest-growing region in the global ATM Market. The widespread rollout of government-backed financial inclusion programs in countries like India (Pradhan Mantri Jan Dhan Yojana) and the rising penetration of banking services in rural communities have accelerated ATM deployment across the region. China and Indonesia are also experiencing robust ATM infrastructure growth supported by their expanding middle class and urban development.

In North America, the market is driven by technological innovation and consumer expectations for advanced functionalities, such as cardless withdrawals and contactless payments. The U.S. remains a key contributor with well-established banking networks and increasing demand for smart ATMs. Europe follows with consistent growth, particularly in countries like the UK and Germany, where ATMs are being upgraded to include cybersecurity enhancements and touchless interfaces. Latin America and the Middle East & Africa are witnessing steady development, with financial institutions targeting mobile and solar-powered ATMs to serve remote and off-grid areas.

🚀 Market Drivers

One of the main drivers of the ATM Market is the continued need for cash access despite the rise of digital payment systems. In many developing countries, cash remains a dominant mode of transaction, especially in informal economies. Furthermore, ATMs provide vital banking access in underbanked and rural areas where full-service branches are scarce. The integration of next-generation technologies such as biometric verification, facial recognition, and near-field communication (NFC) is enhancing user experience and increasing trust in ATM security.

Additionally, ATMs are now evolving into multifunctional service points capable of handling tasks such as utility bill payments, loan applications, and even insurance services. Banks are increasingly investing in smart ATMs to reduce footfall in branches and to offer 24/7 self-service banking. The flexibility and scalability of modern ATM infrastructure are key factors contributing to its global demand.

⚠️ Market Restraints

While the ATM Market shows promising growth, several challenges could hinder its progress. One major concern is the high cost associated with ATM installation, maintenance, and security. These costs are particularly burdensome for banks operating in remote or rural regions. Vandalism, cash theft, and skimming activities further increase the cost of operations, pushing some financial institutions to reevaluate the viability of ATM deployment in certain areas.

Moreover, the shift toward digital and mobile banking is reducing the foot traffic to ATMs in urbanized regions. Some countries are even observing ATM withdrawals in decline as consumers adopt mobile wallets and digital banking apps. Regulatory constraints, especially regarding data privacy and financial transactions, also pose challenges to ATM network expansion and service innovation.

🌟 Market Opportunities

The ATM Market is ripe with opportunities, particularly in emerging economies where financial inclusion remains a top priority. Governments and financial institutions are investing in cost-effective, solar-powered, and mobile ATMs to bring essential banking services to unbanked populations. These mobile solutions can be rapidly deployed in disaster-hit areas, rural zones, or events with large footfalls, ensuring uninterrupted access to cash.

There is also a rising opportunity in developing ATMs that support multiple languages and user-friendly interfaces, catering to diverse and aging populations. Additionally, the integration of AI and data analytics can transform ATMs into intelligent customer service points that offer personalized banking suggestions. As cryptocurrency and digital currencies gain acceptance, future ATMs could also offer crypto-to-cash conversions, adding new dimensions to their functionality.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/8368

📄 Reasons to Buy the Report:

✔ Understand the evolving role of ATMs in a digital-first banking environment.

✔ Identify emerging technologies and trends shaping the future of ATM infrastructure.

✔ Gain insights into regional growth patterns and market penetration strategies.

✔ Analyze key players and assess competitive benchmarks in the global landscape.

✔ Make informed investment and deployment decisions based on market projections.

💼 Company Insights

• NCR Corporation

• Diebold Nixdorf

• Hitachi-Omron Terminal Solutions

• GRG Banking

• Hyosung TNS

• Fujitsu Ltd.

• Hantle USA Inc.

• Triton Systems of Delaware LLC

• Euronet Worldwide Inc.

• Oki Electric Industry Co., Ltd.

Recent Developments:

In 2023, Diebold Nixdorf launched DN Series ATMs with advanced AI features and reduced energy consumption.

NCR Corporation expanded its Allpoint Network, offering surcharge-free ATM access in new geographies to increase user convenience.

Conclusion

The ATM Market remains a dynamic and essential segment of global financial services. While digital banking continues to expand, the ATM retains its relevance, particularly in regions where cash and physical banking access are crucial. With innovation driving smart functionalities and expanding deployments in underserved areas, ATMs are poised to offer broader financial services beyond cash withdrawals. Despite operational challenges and increasing digital adoption, the ATM Market is adapting through managed services, smart features, and regional customization. As financial inclusion and convenience remain key priorities worldwide, the ATM's role as a secure and accessible banking tool is set to grow stronger in the years ahead.

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web:

https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ATM Market, Powering Secure and Accessible Banking in a Rapidly Evolving Financial Ecosystem here

News-ID: 4052509 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

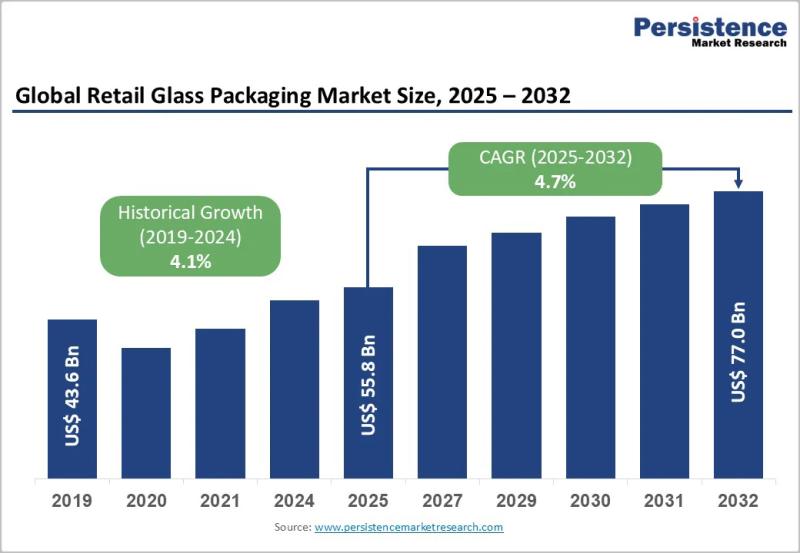

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for ATM

ATM Managed Services Market Expands: AI, Cloud & ATM-as-a-Service Drive Transfor …

ATM Managed Services Market size was valued at USD 10.5 Billion in 2024 and is projected to reach USD 16.2 Billion by 2033, exhibiting a CAGR of 5.2% from 2026 to 2033.

What are the potential factors contributing to the growth of the ATM Managed Services Market?

The ATM Managed Services Market is experiencing growth due to several key factors. The increasing demand for cost-effective banking operations is a major driver, as…

Prominent Automatic Teller Machine (ATM) Security Market Trend for 2025: Innovat …

"Which drivers are expected to have the greatest impact on the over the automatic teller machine (atm) security market's growth?

The surge in automated teller machine (ATM) fraud incidents is projected to fuel the expansion of the automated teller machine (ATM) security market in the future. An ATM is a specific type of computerized device that allows individuals to conduct a range of banking activities without requiring human assistance or a…

Global ATM Market by Types(On-site ATM,Off-site ATM,Work Site ATM,Mobile Site AT …

The global ATM market has the potential to grow with xx million USD with growing CAGR in the forecast period from 2021f to 2026f.

Global ATM Market Overview

This market research report consists of a number of sections that provide data on the current state of the market, industry trends, and future prospects. It also includes analysis of key players and their positions in the market. The increasing adoption…

Contactless ATM (Cardless ATM) Market: Industry Future Developments, Competitive …

The Contactless ATM (Cardless ATM) market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status…

Global Contactless ATM (Cardless ATM) Industry Professional Market Size Survey b …

This report also researches and evaluates the impact of Covid-19 outbreak on the Contactless ATM (Cardless ATM)�industry, involving potential opportunity and challenges, drivers and risks. We present the impact assessment of Covid-19 effects on Contactless ATM (Cardless ATM)�and market growth forecast based on different scenario (optimistic, pessimistic, very optimistic, most likely etc.).

�

Scope of the Report:

The report presents the market outlook for the Indian Phospho Gypsum product from the year 2019…

Global Contactless ATM (Cardless ATM) Market Expected to Witness a Sustainable G …

LP INFORMATION offers a latest published report on Contactless ATM (Cardless ATM) Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This intelligence Contactless ATM (Cardless ATM) Market report by LP INFORMATION includes investigations based on the current scenarios, historical records, and future predictions. An accurate data of various aspects such as type, size, application, and end user have been scrutinized…