Press release

New Trends of Guaranteed Auto Protection (GAP) Insurance Market Increasing Demand with Key Players 2032

"The Guaranteed Auto Protection (GAP) Insurance market is experiencing substantial growth driven by several factors including the increasing volume of auto loans, longer loan terms, and the potential for negative equity in vehicle financing. GAP insurance plays a crucial role in protecting consumers from financial loss in the event of vehicle theft or total loss, especially when the outstanding loan balance exceeds the vehicle's actual cash value. Technological advancements in the insurance industry, such as digital distribution channels and sophisticated risk assessment models, are contributing to market expansion. Furthermore, the growing awareness among consumers about the financial risks associated with auto loans is fueling the demand for GAP insurance products. This market plays a critical role in providing financial security and stability to vehicle owners, contributing to overall economic resilience. The increasing focus on financial literacy and responsible lending practices further supports the adoption of GAP insurance, ensuring that consumers are adequately protected against unforeseen financial setbacks related to vehicle ownership. This market also addresses global challenges related to consumer protection and financial stability, particularly in regions with high rates of auto loan defaults.

Get the full PDF sample copy of the report: (TOC, Tables and figures, and Graphs) https://www.consegicbusinessintelligence.com/request-sample/1407

Market Size:

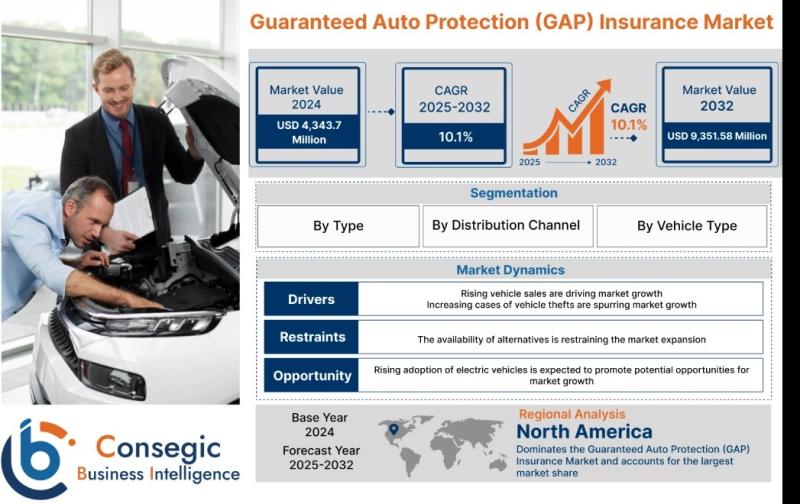

The Guaranteed Auto Protection (GAP) Insurance Market size is estimated to reach over USD 9,351.58 Million by 2032 from a value of USD 4,343.70 Million in 2024 and is projected to grow by USD 4,703.28 Million in 2025, growing at a CAGR of 10.10% from 2025 to 2032.

Definition of Market:

The Guaranteed Auto Protection (GAP) Insurance market encompasses financial products designed to cover the difference between the outstanding balance on a vehicle loan and the vehicle's actual cash value (ACV) at the time of its total loss or theft. This insurance acts as a safety net, protecting borrowers from potentially owing a significant sum on a vehicle they can no longer use. Key components of this market include:

GAP Insurance Products: These are the policies offered by insurance companies, credit unions, and other financial institutions to cover the ""gap"" between the loan balance and the vehicle's ACV.

Distribution Channels: These include insurance companies, credit unions, banks, auto dealerships, and online platforms through which GAP insurance policies are sold.

Underwriting and Risk Assessment: This involves evaluating the risk associated with each borrower and pricing the GAP insurance policy accordingly. Factors considered may include the borrower's credit score, the vehicle's value, and the loan terms.

Claims Processing: This process involves handling claims filed by policyholders after a vehicle is declared a total loss or stolen, verifying the claim, and paying out the difference between the loan balance and the ACV.

Reinsurance: This involves insurance companies transferring a portion of their risk to other insurance companies in order to manage their exposure.

Key terms related to the market include:

Actual Cash Value (ACV): The fair market value of a vehicle at the time of loss, considering depreciation.

Loan-to-Value (LTV): The ratio of the loan amount to the vehicle's value.

Total Loss: When a vehicle is damaged beyond repair or stolen and not recovered.

Negative Equity: When the outstanding loan balance exceeds the vehicle's ACV.

Get Discount On Report @ https://www.consegicbusinessintelligence.com/request-discount/1407

Market Scope and Overview:

The scope of the Guaranteed Auto Protection (GAP) Insurance market is broad, encompassing various vehicle types (passenger cars, commercial vehicles), distribution channels (insurance companies, credit unions, dealerships), and types of GAP insurance (finance GAP, vehicle replacement GAP, return to invoice GAP). The market operates within the larger automotive finance and insurance industries, providing a crucial layer of financial protection for borrowers. Its technologies include sophisticated underwriting models, claims processing systems, and digital distribution platforms. Applications extend across the entire lifecycle of auto loans, from origination to claims settlement. The market serves a diverse range of consumers, including individuals, families, and businesses that finance vehicle purchases. The market's importance lies in its ability to mitigate financial risk and promote responsible lending practices.

The GAP Insurance market plays a vital role in the context of global trends in automotive finance and insurance. With the increasing prevalence of auto loans, longer loan terms, and the rising cost of vehicles, the risk of negative equity has become a significant concern for borrowers. GAP insurance helps address this concern by providing a financial safety net in the event of a total loss or theft. Furthermore, the market aligns with the growing emphasis on consumer protection and financial literacy. By ensuring that borrowers are adequately protected against unforeseen financial losses, GAP insurance promotes financial stability and reduces the risk of loan defaults. The market also supports the overall health of the automotive finance industry by encouraging responsible lending and protecting lenders from potential losses due to negative equity.

Top Key Players in this Market

Assurant Inc., Direct Gap Ltd., Car Care Plan Ltd, Berkshire Hathaway Inc., Nationwide Mutual Insurance Company, Allstate Insurance Company, Zurich Insurance Group Ltd., Arch Capital Group Ltd., Infinity Insurance, Assurity Solutions Ltd.

Market Segmentation:

The Guaranteed Auto Protection (GAP) Insurance market is segmented by type, distribution channel, and vehicle type. By type, the market includes Finance GAP Insurance (covers the difference between the loan balance and ACV), Vehicle Replacement GAP Insurance (covers the cost of replacing the vehicle with a new one), Return to Invoice (RTI) GAP Insurance (covers the difference between the loan balance and the original purchase price), and others. By distribution channel, the market is divided into Insurance Companies, Credit Unions, and Others. By vehicle type, the market includes Passenger Cars and Commercial Vehicles. Each segment contributes to market growth by catering to specific needs and preferences of consumers and businesses, offering tailored GAP insurance solutions through diverse channels for various types of vehicles.

Market Drivers:

Increasing Volume of Auto Loans: The growing number of vehicle purchases financed through loans drives demand for GAP insurance.

Longer Loan Terms: Extended loan terms increase the risk of negative equity, making GAP insurance more attractive.

Potential for Negative Equity: The gap between loan balance and vehicle value due to depreciation creates a need for GAP insurance.

Rising Vehicle Prices: Higher vehicle costs lead to larger loan amounts, increasing the potential financial loss in the event of a total loss.

Growing Consumer Awareness: Increased awareness of financial risks associated with auto loans drives demand for protection products like GAP insurance.

Market Key Trends:

Digital Distribution Channels: Online platforms and mobile apps are becoming increasingly popular for purchasing GAP insurance.

Customized GAP Insurance Products: Insurers are offering tailored policies to meet specific consumer needs and preferences.

Integration with Auto Financing: GAP insurance is being offered as an integral part of auto loan packages.

Advanced Underwriting Models: Sophisticated risk assessment models are being used to price GAP insurance policies more accurately.

Focus on Customer Experience: Insurers are investing in improving customer service and claims processing to enhance customer satisfaction.

Market Opportunities:

The Guaranteed Auto Protection (GAP) Insurance market presents several growth prospects. Expanding into emerging markets with growing auto loan volumes offers significant potential. Developing innovative GAP insurance products tailored to specific vehicle types or consumer segments can create new revenue streams. Leveraging digital technologies to enhance distribution and customer experience can improve market penetration. Furthermore, partnerships with auto dealerships and financial institutions can drive sales and increase market share. Innovations in risk assessment and claims processing can lead to more efficient and profitable operations.

Market Restraints:

The Guaranteed Auto Protection (GAP) Insurance market faces several challenges. High initial costs of GAP insurance policies can deter some consumers. Geographic limitations may restrict the availability of GAP insurance in certain regions. Regulatory complexities and compliance requirements can increase operational costs. Limited awareness among consumers about the benefits of GAP insurance can hinder market growth. Competition from alternative financial products and services may also pose a challenge.

Market Challenges:

The Guaranteed Auto Protection (GAP) Insurance market faces a complex array of challenges that require strategic navigation and innovation. One significant challenge is the fluctuating economic environment. Economic downturns can lead to increased unemployment and reduced consumer spending, impacting the demand for auto loans and, consequently, GAP insurance. In such scenarios, consumers may prioritize essential expenses over optional financial protection products. Furthermore, the interest rate environment plays a crucial role. Rising interest rates can increase the cost of auto loans, making vehicles less affordable and potentially reducing the number of new loans originated. This, in turn, can negatively affect the GAP insurance market.

Another challenge lies in the evolving regulatory landscape. Insurance regulations vary significantly across regions and are subject to change. Compliance with these regulations can be complex and costly, particularly for insurers operating in multiple jurisdictions. Moreover, regulatory scrutiny of insurance products, including GAP insurance, is increasing, with a focus on ensuring transparency and fair pricing. Insurers must adapt to these evolving regulatory requirements to avoid penalties and maintain a positive reputation.

Technological disruption also presents a significant challenge. The rise of online insurance platforms and direct-to-consumer sales channels is changing the competitive landscape. Traditional insurers must invest in digital capabilities to remain competitive and meet the evolving expectations of tech-savvy consumers. Additionally, the use of data analytics and artificial intelligence in underwriting and claims processing is transforming the insurance industry. Insurers must embrace these technologies to improve efficiency, reduce costs, and enhance customer experience.

Consumer awareness and perception also pose a challenge. Many consumers are not fully aware of the benefits of GAP insurance or the risks associated with negative equity in auto loans. This lack of awareness can hinder market growth. Insurers must invest in educating consumers about the value of GAP insurance and the importance of protecting themselves against financial loss. Furthermore, some consumers may perceive GAP insurance as an unnecessary expense or a product that primarily benefits the lender. Addressing these misconceptions and building trust with consumers is crucial for driving adoption.

Competition from alternative financial products and services is another challenge. Consumers have access to a wide range of financial products that can provide similar protection to GAP insurance, such as extended warranties, vehicle service contracts, and personal loans. Insurers must differentiate their GAP insurance offerings and demonstrate their unique value proposition to attract customers. This may involve offering more comprehensive coverage, better customer service, or more competitive pricing.

Fraudulent claims also pose a significant challenge for the GAP insurance market. Fraudulent claims can increase costs for insurers and lead to higher premiums for consumers. Insurers must invest in robust fraud detection and prevention measures to mitigate this risk. This may involve using data analytics to identify suspicious claims, conducting thorough investigations, and collaborating with law enforcement agencies to prosecute fraudulent actors.

Market Regional Analysis:

The Guaranteed Auto Protection (GAP) Insurance market exhibits varying dynamics across different regions. In North America, the market is well-established with high levels of consumer awareness and a mature automotive finance industry. The demand for GAP insurance is driven by high vehicle ownership rates and a prevalence of auto loans. Europe also presents a significant market opportunity, with increasing vehicle sales and a growing emphasis on consumer protection. The Asia-Pacific region is experiencing rapid growth, fueled by rising disposable incomes and a burgeoning middle class. The market in Latin America and the Middle East is relatively nascent, but offers potential for expansion as automotive finance becomes more widespread. Factors influencing regional market dynamics include regulatory frameworks, consumer preferences, economic conditions, and the maturity of the automotive finance industry.

Frequently Asked Questions:

What is the projected growth rate of the GAP Insurance market?

The GAP Insurance market is projected to grow at a CAGR of 10.10% from 2025 to 2032.

What are the key trends in the GAP Insurance market?

Key trends include digital distribution channels, customized GAP insurance products, and integration with auto financing.

What are the most popular Market types?

Finance GAP Insurance and Vehicle Replacement GAP Insurance are among the most popular types in the market.

Follow Us on:

https://www.linkedin.com/company/deeptech-news/

https://www.linkedin.com/company/insights-futures/

https://www.linkedin.com/company/market-techpulse/

https://www.linkedin.com/company/market-radar-report/

https://www.linkedin.com/company/surveypulse-trends/

https://www.linkedin.com/company/market-insight-digest/

https://www.linkedin.com/company/diamonds-market-research-analytics/

https://www.linkedin.com/company/diamonds-business-intelligence-consulting/

https://www.linkedin.com/company/data-grid25/

https://www.linkedin.com/company/campaign-insight-grid/

https://www.linkedin.com/company/novaedge-market-consulting/

https://www.linkedin.com/company/data-craft-studio/

https://www.linkedin.com/company/searchsavvy-solutions/

https://www.linkedin.com/company/optisphere-seo/

https://www.linkedin.com/company/stratos-edge-consulting/

https://www.linkedin.com/company/news-insight/

https://www.linkedin.com/company/tech-disrupts-insight/

https://www.linkedin.com/company/tech-network25/"

Contact Us:

Consegic Business intelligence Pvt Ltd

Baner Road, Baner, Pune, Maharashtra - 411045

(US) (505) 715-4344

info@consegicbusinessintelligence.com

sales@consegicbusinessintelligence.com

Web - https://www.consegicbusinessintelligence.com/

About Us:

Consegic Business Intelligence is a data measurement and analytics service provider that gives the most exhaustive and reliable analysis available of global consumers and markets. Our research and competitive landscape allow organizations to record competing evolutions and apply strategies accordingly to set up a rewarding benchmark in the market. We are an intellectual team of experts working together with the winning inspirations to create and validate actionable insights that ensure business growth and profitable outcomes.

We provide an exact data interpretation and sources to help clients around the world understand current market scenarios and how to best act on these learnings. Our team provides on-the-ground data analysis, Portfolio Expansion, Quantitative and qualitative analysis, Telephone Surveys, Online Surveys, and Ethnographic studies. Moreover, our research reports provide market entry plans, market feasibility and opportunities, economic models, analysis, and an advanced plan of action with consulting solutions. Our consumerization gives all-inclusive end-to-end customer insights for agile, smarter, and better decisions to help business expansion.

Connect with us on:

LinkedIn - https://www.linkedin.com/company/consegic-business-intelligence/

YouTube - https://www.youtube.com/@ConsegicBusinessIntelligence22

Facebook - https://www.facebook.com/profile.php?id=61575657487319

X - https://x.com/Consegic_BI

Instagram - https://www.instagram.com/cbi._insights/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Trends of Guaranteed Auto Protection (GAP) Insurance Market Increasing Demand with Key Players 2032 here

News-ID: 4052029 • Views: …

More Releases from Consegic Business Intelligence Pvt. Ltd

Europe Pharmaceutical Manufacturing Equipment Market 2025 Industry Updates, Futu …

Introduction:

The Pharmaceutical Manufacturing Equipment Market is experiencing robust growth, driven by a confluence of factors reshaping the landscape of pharmaceutical production. Increasing global demand for pharmaceuticals, fueled by an aging population and the rise of chronic diseases, necessitates advanced and efficient manufacturing processes. Technological advancements, such as continuous manufacturing, automation, and digitalization, are revolutionizing traditional methods, improving production efficiency, reducing costs, and enhancing product quality. Stringent regulatory requirements and the…

Europe Vibration Damping Materials Market Size 2025 Overview, Manufacturers, Typ …

Introduction:

The Vibration Damping Materials market is experiencing significant growth, driven by the increasing demand for noise and vibration reduction across various industries. Key drivers include stringent environmental regulations, the growing automotive industry, particularly the electric vehicle (EV) sector, and the need for enhanced comfort and safety in residential and commercial buildings. Technological advancements in materials science are also playing a pivotal role, with the development of more efficient and durable…

Europe Lightweight Aggregates Market Size 2025 Emerging Technologies, Opportunit …

Introduction:

The Lightweight Aggregates Market is experiencing substantial growth driven by several key factors. Primarily, the increasing demand for sustainable and eco-friendly construction materials is fueling the adoption of lightweight aggregates. These materials offer superior insulation properties, reduced transportation costs, and contribute to the overall reduction of the carbon footprint of construction projects. Technological advancements in the production and application of lightweight aggregates are also playing a crucial role, enhancing their…

Europe Visible Light Communication Market Share, Growth, Size, Industry Trends, …

Introduction:

The Visible Light Communication (VLC) market is experiencing significant growth, driven by the increasing demand for faster, more secure, and energy-efficient communication technologies. VLC leverages light waves for data transmission, offering a complementary solution to traditional radio frequency (RF) based wireless communication. Key drivers include the proliferation of LED lighting, growing concerns about RF spectrum congestion, and the need for secure communication in sensitive environments. Technological advancements, such as improved…

More Releases for GAP

Hawaii Gap Inspires Young Adults with Environmental Leadership Gap Year Program

Kaneohe, Hawaii - Hawaii Gap, a non-profit organization dedicated to fostering environmental stewardship, is thrilled to announce the opening of its transformative Environmental Leadership gap year program in September, 2025. This unique 10-week program offers a powerful opportunity for recent high school graduates or those taking a gap year to immerse themselves in the breathtaking Hawaiian environment while developing critical leadership skills to champion environmental causes. The program is held…

Closing the Resource Gap: Our New Feature Resource Request & Gap Reporting

Walnut Creek, California, December 11, 2023 - eResource Scheduler, a leading provider of resource management software, proudly announces the launch of its groundbreaking feature, Resource Request & Gap Reporting. This innovative addition further solidifies eResource Scheduler's commitment to empowering organizations with advanced tools for resource scheduling and management.

In response to the evolving needs of businesses striving for operational excellence, eResource Scheduler has developed an intuitive solution to address the resource…

Battling the Security Skills Gap

Building and nurturing future talent through industry leadership

The information security industry is battling a skills gap that is predicted by the ONS to be a generation long. As skills are scarce, recruitment has become difficult and expensive, this will continue and businesses, public sector and government alike all face security threats stemming from this scarcity. Those threats affect us all, in all walks of life.

In July, the UK Government issued…

GAP Insurance Market to Witness Huge Growth by 2029 | Direct Gap, Allianz, Motor …

The Latest research study released by HTF MI "Global GAP Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying the importance of different factors that aid market growth. Some of the Major Companies covered in this Research are AXA,…

Bridging The Gap

With the recent pandemic, college students across Tampa Bay have found themselves unemployed. By no fault of their own, their jobs have literally been wiped out. Restaurants and retail stores across the country have closed with no end in sight. These young adults find themselves forced to stay inside and furthermore, are losing their motivation every day.

We are stepping up as leaders in our community and creating jobs for…

Global Capacitive Air Gap (GAP) Sensor Market Growth 2019-2024

Market Research Report Store offers a latest published report on Capacitive Air Gap (GAP) Sensor Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This report focuses on the key global Capacitive Air Gap (GAP) Sensor players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.

Click to view the…