Press release

ATM Market Outlook 2025 to 2033: Trends, Forecast & Strategic Analysis

According to the latest report by IMARC Group, titled "ATM Market Size, Share, Trends, and Forecast by Solution, Screen Size, Application, ATM Type, and Region 2025-2033", offers a comprehensive analysis of the ATM market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. the global ATM market size was valued at USD 24.4 billion in 2024, and is projected to reach USD 36.3 billion by 2033, at a CAGR of 4.06% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.3% in 2024. The rise of digital transformation, increasing convenience and accessibility provided by ATMs, rapid growth in globalization and international tourism, and integration of innovative technologies, such as biometric authentication, are some of the major factors propelling the market.Get Sample Free Copy of Report at : https://www.imarcgroup.com/atm-market/requestsample

Technological Innovation and AI Integration:

The ATM market is undergoing a profound transformation driven by rapid technological innovation and the integration of artificial intelligence (AI). Modern ATMs have evolved far beyond their traditional role as cash-dispensing machines, now serving as multifunctional digital service points that offer a wide range of banking and financial services. AI is at the forefront of this evolution, enabling ATMs to personalize user interactions based on transaction history and preferences, predict maintenance needs to reduce downtime, and enhance security through advanced fraud detection algorithms. For example, leading manufacturers are deploying AI-powered ATMs capable of forecasting cash demand, optimizing cash management, and identifying potential security threats in real time.

These intelligent features not only improve operational efficiency but also significantly enhance the customer experience, making transactions faster, more secure, and more convenient. The adoption of biometric authentication-such as fingerprint, facial recognition, and iris scanning-is accelerating, replacing traditional PIN-based systems and offering users a seamless, secure, and cardless banking experience. The convergence of AI, biometrics, and contactless technology is redefining the ATM landscape, empowering financial institutions to deliver next-generation services while addressing the growing demand for digital-first, self-service banking solutions.

Enhanced Security and Fraud Prevention:

Security remains a paramount concern for both consumers and financial institutions, driving significant investment in advanced ATM security features. The increasing sophistication of cyber threats-such as malware, phishing, and card skimming-has prompted the adoption of robust security measures, including biometric authentication, one-time passwords, and end-to-end encryption. Biometric solutions, in particular, are gaining traction as they provide an additional layer of protection and eliminate the risk of PIN compromise. The integration of EMV (Europay, Mastercard, and Visa) chip technology in payment cards has further reduced the incidence of card skimming, while real-time monitoring and remote management solutions enable financial institutions to proactively detect and respond to security incidents.

The rise of AI-driven security applications, such as CMS Info Systems' "Algo," exemplifies the industry's commitment to safeguarding ATM networks against evolving threats. These innovations not only protect sensitive customer data but also help build trust and confidence among users, which is critical for maintaining high transaction volumes and customer loyalty. Regulatory requirements and the need for compliance with data protection standards are also driving the adoption of advanced security technologies, ensuring that ATMs remain a safe and reliable channel for banking services. As the threat landscape continues to evolve, ongoing investment in security innovation will be essential to sustain market growth and meet the expectations of increasingly security-conscious consumers.

Expanding Access and Financial Inclusion:

The ATM market is experiencing robust growth in developing regions, where expanding access to banking services and financial inclusion initiatives are driving demand for convenient, reliable, and secure cash access points. In countries such as India, persistent reliance on cash-especially in rural and semi-urban areas-coupled with government-led financial inclusion programs, is fueling the deployment of new ATMs and the modernization of existing networks. Regulatory support for white-label and off-site ATMs is further accelerating market expansion, enabling non-bank entities to offer ATM services and extend banking access to underserved populations. Technological advancements, including biometric ATMs and cash recyclers, are improving efficiency and reducing operational costs, making it more feasible for financial institutions to serve remote and low-income communities.

Urbanization is also playing a key role, increasing transaction volumes and creating new opportunities for ATM deployment in high-traffic locations such as malls, airports, and retail centers. The integration of ATMs with digital payment systems and mobile banking platforms is enhancing their appeal, allowing users to initiate transactions on their smartphones and complete them at ATMs through features such as QR code scanning and NFC (Near Field Communication). These innovations are not only making banking more accessible but also supporting the broader shift toward digital financial services. As the global population becomes increasingly connected and urbanized, the demand for multifunctional, user-friendly ATMs is expected to remain strong, particularly in emerging markets where cash remains a dominant payment method. The ATM market's future growth will be shaped by its ability to deliver secure, convenient, and inclusive banking solutions that meet the evolving needs of diverse customer segments.

Leading Key Players Operating in the ATM Industry:

• Diebold Inc.

• Wincor Nixdorf AG

• NCR Corporation

• Triton Systems of Delaware

• Hitachi-Omron Terminal Solutions

• GRG Banking Equipment Co. Ltd.

• OKI Electric Industry co. Ltd.

• Nautilus Hyosung Corporation

• HESS Cash Systems GmbH & Co KG

• Fujitsu Ltd.

• Euronet Worldwide

• Brink's Company

ATM Market Trends:

The ATM market is experiencing a dynamic shift as technological advancements and changing consumer behaviors redefine the role of automated teller machines in the financial ecosystem. Cloud connectivity and IoT integration are enabling ATMs to function as smart, connected devices capable of supporting video interactions, faster data processing, security monitoring, and real-time software updates. This connectivity also facilitates digital signage for advertising and personalized service messaging, transforming ATMs into interactive customer engagement points. Mobile technology is increasingly integrated into ATM operations, with features such as QR code and NFC-based transactions allowing users to initiate and complete banking activities seamlessly from their smartphones. The rise of contactless and cardless transactions is addressing hygiene concerns and streamlining the user experience, while biometric authentication is becoming the new standard for secure access.

Security remains a top priority, with financial institutions investing in advanced anti-skimming, encryption, and remote monitoring solutions to protect against fraud and cyber threats. The market is also seeing a growing emphasis on accessibility, with ATMs designed to serve users with special needs and support a wider range of financial services, including bill payments, mobile top-ups, and even loan applications. In developing regions, government initiatives and regulatory support are driving the expansion of ATM networks, particularly in rural and underserved areas where cash reliance remains high. As the industry continues to innovate, the ATM market is evolving into a critical component of the digital banking ecosystem, offering secure, convenient, and inclusive financial services to a diverse and growing customer base.

Buy Now : https://www.imarcgroup.com/checkout?id=1429&method=1670

ATM Industry Segmentation:

Analysis by Solution:

• Deployment Solutions

o Onsite ATMs

o Offsite ATMs

o Work Site ATMs

o Mobile ATMs

• Managed Services

Analysis by Screen Size:

• 15" and Below

• Above 15"

Analysis by Application:

• Withdrawals

• Transfers

• Deposits

Analysis by ATM Type:

• Conventional/Bank ATMs

• Brown Label ATMs

• White Label ATMs

• Smart ATMs

• Cash Dispensers

Breakup by Region:

• North America (United States, Canada)

• Europe (Germany, France, United Kingdom, Italy, Spain, Others)

• Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

Key Highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Porter's Five Forces Analysis

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain

• Comprehensive Mapping of the Competitive Landscape

Related Report By IMARC Group:

• Digital Twin Market Report 2025 - https://www.imarcgroup.com/digital-twin-market/requestsample

• Digital Transformation Market Report 2025 - https://www.imarcgroup.com/digital-transformation-market/requestsample

• Digital Lending Platform Market Report 2025 - https://www.imarcgroup.com/digital-lending-platform-market/requestsample

• eSIM Market Report 2025 - https://www.imarcgroup.com/esim-market/requestsample

• Smart TV Market Report 2025 - https://www.imarcgroup.com/smart-tv-market/requestsample

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ATM Market Outlook 2025 to 2033: Trends, Forecast & Strategic Analysis here

News-ID: 4051623 • Views: …

More Releases from IMARC Group

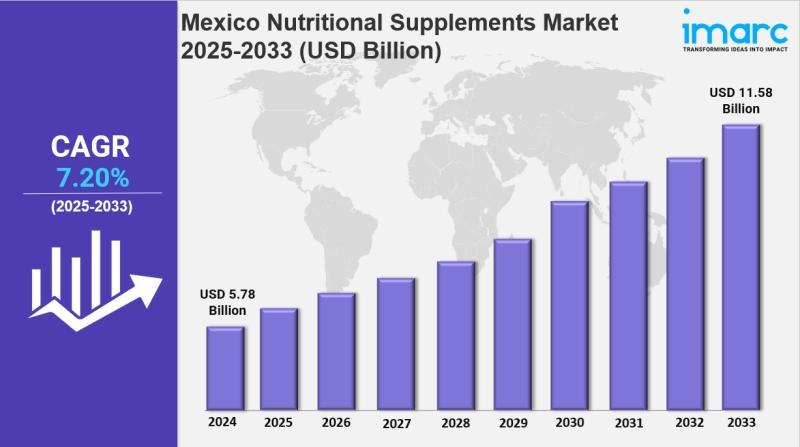

Mexico Nutritional Supplements Market Size, Growth, Latest Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Mexico Nutritional Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, Consumer Group, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico nutritional supplements market size was valued at USD 5.78 Billion in 2024. It is…

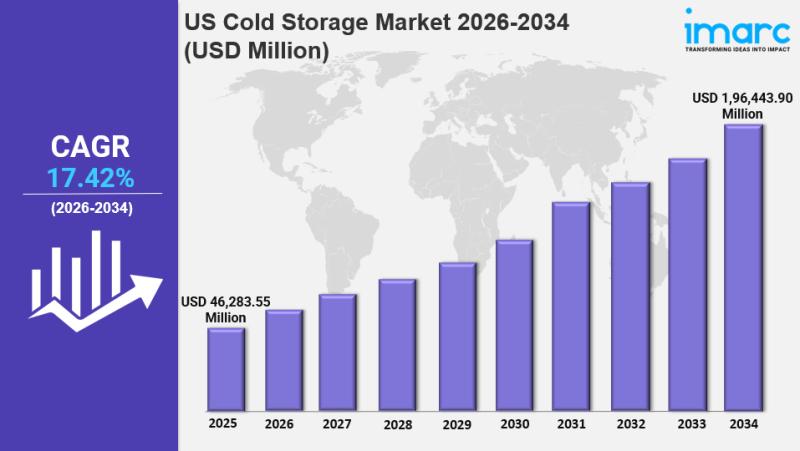

US Cold Storage Market Size, Trends, Growth and Forecast 2026-2034

IMARC Group has recently released a new research study titled "US Cold Storage Market Size, Share, Trends and Forecast by Warehouse Type, Construction Type, Temperature Type, Application, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The US cold storage market size reached USD 46,283.55 Million in 2025 and is projected to grow…

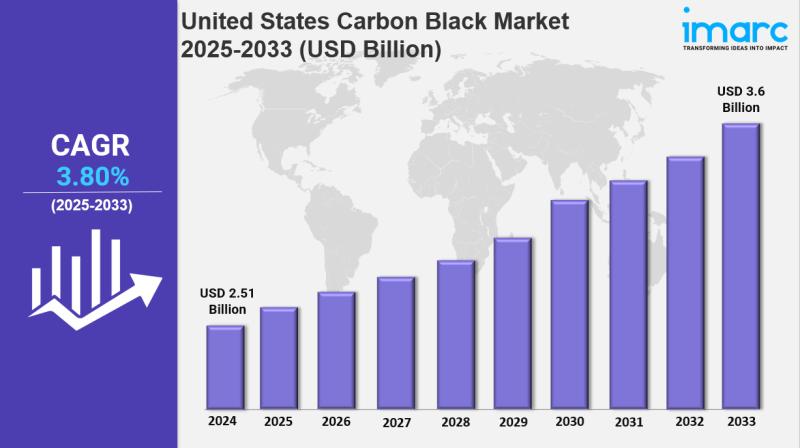

United States Carbon Black Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "United States Carbon Black Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States carbon black market size was valued at USD 2.51 Billion in 2024 and is projected to…

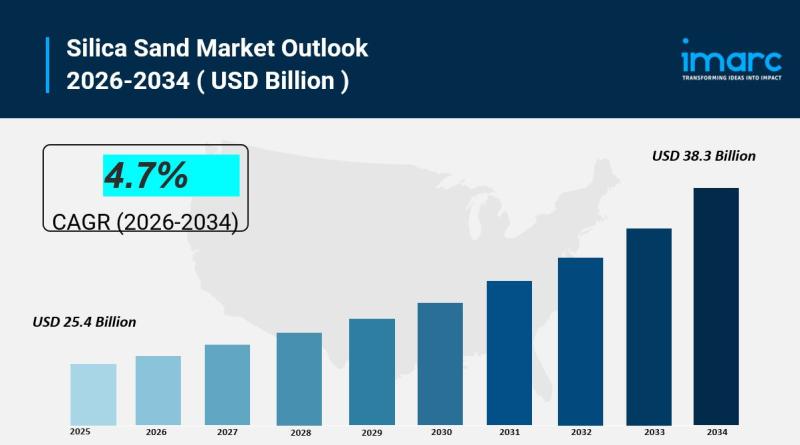

Silica Sand Market is Projected to Reach USD 38.3 Billion by 2034 | At CAGR 4.7%

Silica Sand Market Overview:

The global Silica Sand Market was valued at USD 25.4 Billion in 2025 and is forecast to reach USD 38.3 Billion by 2034, growing at a CAGR of 4.7% during 2026-2034. This growth is driven by increasing demand from the construction and glass manufacturing industries, continual advancements in hydraulic fracturing technology in oil and gas extraction, and rapid changes in environmental and regulatory landscapes.

The silica sand market…

More Releases for ATM

ATM Managed Services Market Expands: AI, Cloud & ATM-as-a-Service Drive Transfor …

ATM Managed Services Market size was valued at USD 10.5 Billion in 2024 and is projected to reach USD 16.2 Billion by 2033, exhibiting a CAGR of 5.2% from 2026 to 2033.

What are the potential factors contributing to the growth of the ATM Managed Services Market?

The ATM Managed Services Market is experiencing growth due to several key factors. The increasing demand for cost-effective banking operations is a major driver, as…

Prominent Automatic Teller Machine (ATM) Security Market Trend for 2025: Innovat …

"Which drivers are expected to have the greatest impact on the over the automatic teller machine (atm) security market's growth?

The surge in automated teller machine (ATM) fraud incidents is projected to fuel the expansion of the automated teller machine (ATM) security market in the future. An ATM is a specific type of computerized device that allows individuals to conduct a range of banking activities without requiring human assistance or a…

Global ATM Market by Types(On-site ATM,Off-site ATM,Work Site ATM,Mobile Site AT …

The global ATM market has the potential to grow with xx million USD with growing CAGR in the forecast period from 2021f to 2026f.

Global ATM Market Overview

This market research report consists of a number of sections that provide data on the current state of the market, industry trends, and future prospects. It also includes analysis of key players and their positions in the market. The increasing adoption…

Contactless ATM (Cardless ATM) Market: Industry Future Developments, Competitive …

The Contactless ATM (Cardless ATM) market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status…

Global Contactless ATM (Cardless ATM) Industry Professional Market Size Survey b …

This report also researches and evaluates the impact of Covid-19 outbreak on the Contactless ATM (Cardless ATM)�industry, involving potential opportunity and challenges, drivers and risks. We present the impact assessment of Covid-19 effects on Contactless ATM (Cardless ATM)�and market growth forecast based on different scenario (optimistic, pessimistic, very optimistic, most likely etc.).

�

Scope of the Report:

The report presents the market outlook for the Indian Phospho Gypsum product from the year 2019…

Global Contactless ATM (Cardless ATM) Market Expected to Witness a Sustainable G …

LP INFORMATION offers a latest published report on Contactless ATM (Cardless ATM) Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This intelligence Contactless ATM (Cardless ATM) Market report by LP INFORMATION includes investigations based on the current scenarios, historical records, and future predictions. An accurate data of various aspects such as type, size, application, and end user have been scrutinized…