Press release

Debt Collection Software Market Size to Hit USD 11.3 Billion, Globally, by 2033 at 8.89% CAGR

Market Overview:The debt collection software market is experiencing rapid growth, driven by AI-driven automation, cloud-based solutions, and regulatory compliance focus. According to IMARC Group's latest research publication, "Debt Collection Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033", offers a comprehensive analysis of the industry, which comprises insights on the global debt collection software market share. The global market size was valued at USD 4.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.3 Billion by 2033, exhibiting a CAGR of 8.89% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/debt-collection-software-market/requestsample

Our report includes:

• Market Dynamics

• Market Trends and Market Outlook

• Competitive Analysis

• Industry Segmentation

• Strategic Recommendations

Factors Affecting the Growth of the Debt Collection Software Industry:

• AI-Driven Automation

Artificial intelligence is changing the debt collection software landscape by automating processes, enhanced efficiencies, and reduced workload. AI-powered tools analyze debtor behavior to potentially send personalized communication, and develop tailored recovery strategies. AI technology works to reduce manual errors to assist recovery, providing you with quicker and more proper debt collections. Businesses benefit from predictive analytics that allow them to focus collection efforts on high-value accounts, and facilitate better decision-making. As many businesses see debt volumes rising, AI integration makes it easier to comply with complicated regulations while preserving the goodwill of the customer by impacting the debt collection experience and freeing up time for more empathetic and data-driven communication. Demand for sophisticated software solutions will only increase.

• Cloud-Based Solutions

Cloud-based debt collection applications are becoming increasingly popular, due to its ability to scale and cost savings. The main reasons for the appeal of cloud-based solutions are real-time data access and automatic updates. Businesses no longer need to invest significant amounts on IT infrastructure to be able to access their own real-time data which can be integrated with their various financial systems. Small and medium enterprises benefit from the flexibility of cloud deployment, which saves capital expenditures while being able to deliver improved debt management services. Many of the cloud-based debt collection systems offer enhanced data security features that improve privacy, which make these products attractive to many industries such as healthcare and finance. The growth trajectory toward digitalization creates significant demand for cloud-based applications that enable remote work, and lead to improved engagement of debtors.

• Regulatory Compliance Focus

Strict regulatory parameters continuously reshape the debt collection softwareecosystem, as businesses legally try to safeguard themselves from risk and avoid costly mistakes. There are a limited number of software companies providing compliance management tools which will help businesses satisfy regulatory constraints (e.g. Fair Debt Collection Practices Act). Automated componentry to collect and manage compliance and, regulatory change information minimizes the burden of businesses to manually track state and governmental changes to laws and legislation. Monitoring regulations is paramount in multi-regulatory jurisdictions where non-compliance can result in hefty penalties. More companies want to make sure that the financial viability of their operations can comply with regulations, but also rapidly collect from consumers. Therefore, as the debt collection industry continues to find more efficiencies on the operational front, businesses will demand software solutions that provide reasonable levels of reporting and transparency about collection status to bona-fide users, trust and accountability. Creating the tools that provide transparency to consumers of their debt account status and reporting on payment plans.

Buy Full Report: https://www.imarcgroup.com/checkout?id=4528&method=1670

Leading Companies Operating in the Global Debt Collection Software Industry:

• AgreeYa.com

• Chetu Inc.

• Debtrak

• EbixCash Financial Technologies

• Experian Information Solutions Inc.

• Fair Isaac Corporation

• Katabat Corporation (Ontario System)

• Nucleus Software Exports Ltd.

• Pegasystems Inc.

• Seikosoft

• TietoEVRY

• TransUnion LLC

Debt Collection Software Market Report Segmentation:

By Component:

• Software

• Services

Software leads with 65.2% market share in 2024, driven by digital transformation in financial institutions that enhances debt recovery processes through advanced functionalities and integration.

By Deployment Mode:

• On-premises

• Cloud-based

On-premises solutions dominate due to their security and control advantages, allowing organizations to manage sensitive data internally and integrate seamlessly with existing systems.

By Organization Size:

• Small and Medium Enterprises

• Large Enterprises

Large Enterprises hold 55.0% market share in 2024, requiring robust debt collection software to manage extensive financial data, optimize recovery strategies, and accommodate diverse debtor profiles.

By End User:

• Financial Institutions

• Collection Agencies

• Healthcare

• Government

• Telecom and Utilities

• Others

Financial Institutions lead the market by utilizing debt collection software to manage customer debts efficiently, improve cash flow, enhance customer relationships, and leverage data-driven insights.

Regional Insights:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

North America captures over 30.7% market share in 2024, fueled by the adoption of advanced technologies, a robust ecosystem of key players, and the integration of cloud-based solutions for efficient debt recovery.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=4528&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Debt Collection Software Market Size to Hit USD 11.3 Billion, Globally, by 2033 at 8.89% CAGR here

News-ID: 4051269 • Views: …

More Releases from IMARC Group

United States AI Governance Market Size, Growth, Latest Insights and Forecast 20 …

IMARC Group's Latest Research Reveals a CAGR of 28.10% from 2026-2034, Supported by Expanding Certification, Auditing, and Impact Assessment Processes

NEW YORK, USA - The United States artificial intelligence (AI) governance industry is witnessing rapid expansion as organizations intensify efforts to implement responsible AI practices. According to the latest market intelligence report by IMARC Group, the United States AI Governance Market, valued at USD 81.6 Million in 2025, is projected to…

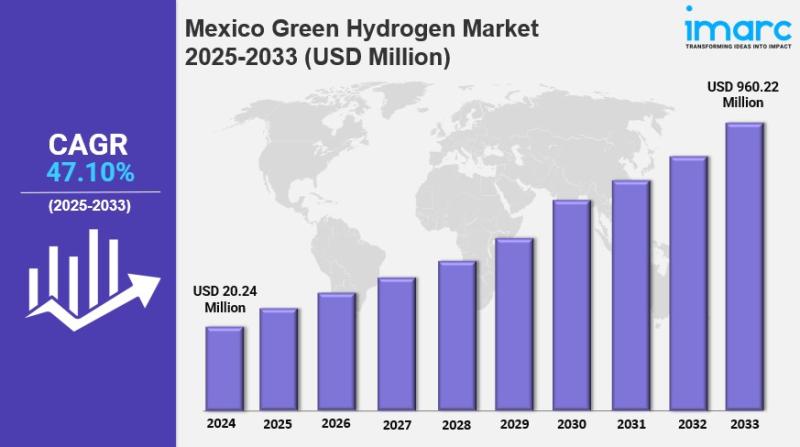

Mexico Green Hydrogen Market Size, Share, Demand, Trends & Forecast to 2033

IMARC Group's Latest Research Reveals a CAGR of 47.10% from 2025-2033, with Renewable-Powered Electrolysis and Export-Oriented Projects Accelerating Market Expansion

NEW YORK, USA - The Mexico green hydrogen industry is entering a high-growth phase, supported by national decarbonization initiatives and rising global demand for clean fuels. According to the latest report by IMARC Group, the Mexico Green Hydrogen Market reached a value of USD 20.24 Million in 2024 and is projected…

U.S. Pet Insurance Market Growth, Outlook & Key Players Analysis 2033

IMARC Group's Latest Research Reveals a CAGR of 10.8% from 2025-2033, with Customized Coverage Plans and Digital Platforms Accelerating Market Expansion

NEW YORK, USA - The U.S. pet insurance industry is witnessing rapid and sustained growth. According to a new market intelligence report by IMARC Group, the U.S. Pet Insurance Market, valued at USD 2.0 Billion in 2024, is projected to reach USD 5.1 Billion by 2033, registering a compound annual…

United States Home Healthcare Market Set to Reach USD 186.5 Billion by 2034, Dri …

PRESS RELEASE

FOR IMMEDIATE RELEASE

Date: February 24, 2026

Contact: sales@imarcgroup.com | +1-201-971-6302 | www.imarcgroup.com

IMARC-Style Industry Analysis Reveals a CAGR of 6.70% During 2026-2034, Supported by Expansion of Telehealth and Remote Patient Monitoring

The United States Home Healthcare Market reached a value of USD 103.7 Billion in 2025 and is projected to grow to USD 186.5 Billion by 2034, exhibiting a steady CAGR of 6.70% during 2026-2034.

Market growth is primarily driven by the rapidly…

More Releases for Software

Takeoff Software Market May See a Big Move | Sage Software, Bluebeam Software, Q …

Latest Study on Industrial Growth of Takeoff Software Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Takeoff Software market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…

Robot Software Market Analysis by Software Types: Recognition Software, Simulati …

The Insight Partners provides you global research analysis on “Robot Software Market” and forecast to 2028. The research report provides deep insights into the global market revenue, parent market trends, macro-economic indicators, and governing factors, along with market attractiveness per market segment. The report provides an overview of the growth rate of the Robot Software market during the forecast period, i.e., 2021–2028.

Download Sample Pages of this research study at: https://www.theinsightpartners.com/sample/TIPRE00007689/?utm_source=OpenPR&utm_medium=10452…

HR Software Market Analysis by Top Key Players Zenefits Software, Kronos Softwar …

HR software automates how companies conduct business with relation to employee management, training and e-learning, performance management, and recruiting and on-boarding. HR professionals benefit from HR software systems by providing a more structured and process oriented approach to completing administrative tasks in a repeatable and scalable manner. Every employee that is added to an organization requires management of information, analysis of data, and ongoing updates as progression throughout the company…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market Analysis by Top Key Players – Zenefits Software, Kronos Sof …

HR software helps HR personnel automate many necessary tasks, such as maintaining employee records, time tracking, and benefits, which allows HR professionals to focus on recruiting efforts, employee performance and engagement, corporate wellness, company culture, and so on. These human management tools can be purchased and implemented as on premise or cloud-based software.

This market studies report on the Global HR Software Market is an all-inclusive study of the enterprise sectors…