Press release

United States IPTV Market Size, Share & Report 2025-2033

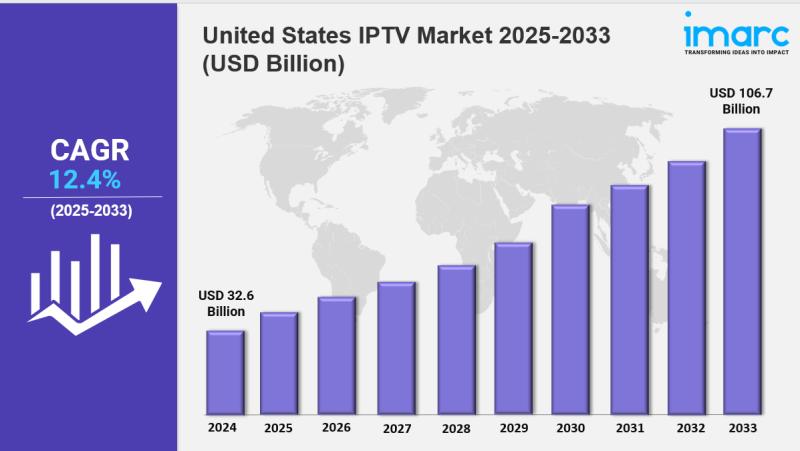

Market Overview 2025-2033United States IPTV market size reached USD 32.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 106.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.4% during 2025-2033. The market is expanding due to increasing demand for on-demand content, widespread broadband access, and the shift away from traditional cable services. Growth is driven by technological advancements, personalized viewing experiences, and the rise of streaming platforms, making the industry more dynamic, user-centric, and competitive.

Key Market Highlights:

✔️ United States IPTV Market is witnessing steady growth due to rising demand for on-demand content and high-speed internet access.

✔️ Cord-cutting trends are accelerating IPTV adoption across households.

✔️ Market players are investing in personalized, ad-supported IPTV platforms.

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-iptv-market/requestsample

United States IPTV Market Trends and Drivers:

The United States IPTV market is changing rapidly. This shift is driven by consumer demand for personalized content. Viewers are exploring niche interests, like true crime shows or K-dramas, and specialized sports. To meet these needs, providers use AI to create tailored content streams. This push for personalization goes beyond simple suggestions. Users want interactive features too. They expect options like adjustable camera angles for live sports, user-made playlists, and social viewing. Platforms like YouTube TV and Sling TV are investing heavily in these technologies.

They see 2024 as a key year for using AI to help discover content. At the same time, data privacy issues are rising. Providers must balance personalization with clear data use policies. The trend of "bundled customization," like Hulu + Live TV's add-ons for premium networks and ad-free options, highlights this shift. It shows that personalization is becoming a major growth driver in this crowded market. The rollout of next-gen broadband, especially fiber-optic networks and 5G technology, is changing how people access IPTV in urban and rural areas.

Companies like Verizon and AT&T are speeding up fiber installations. This upgrade supports 4K/8K streaming with nearly no delay, which is key for live events and cloud gaming. The link between 5G and IPTV shines in mobile viewing. About 68% of U.S. users watch IPTV on smartphones. They expect smooth transitions between devices without losing quality. In 2024, this growth is driving IPTV providers to team up with real estate developers. They aim to include smart TV features in new homes. Yet, challenges remain, such as the digital divide in some areas and rising infrastructure costs.

Federal programs like the Broadband Equity Access and Deployment (BEAD) program aim to help with last-mile connectivity. This situation shows that infrastructure can both boost market growth and create barriers needing attention. The rise of exclusive streaming originals, like Netflix's Stranger Things and Disney+'s Marvel series, has fragmented content libraries. This forces consumers to manage multiple subscriptions. To address this, IPTV providers are moving toward "aggregator platforms." These platforms combine live TV, SVOD, AVOD, and FAST channels into one interface. Services like Philo and FuboTV now bundle Netflix, Max, and Paramount+ into single billing systems.

This reduces churn and improves user experiences. Advertisers are also shifting budgets to FAST (Free Ad-Supported Television) channels, which grew 21% YoY in 2024. This targets cost-conscious viewers. At the same time, niche IPTV services, like YuppTV for South Asian content, are becoming popular. This shows a demand for culturally specific offerings. However, content licensing issues and royalty disputes remain a challenge. An example is the 2024 standoff involving Warner Bros. Discovery and Roku-threaten aggregator sustainability, signaling a need for standardized industry frameworks.

The IPTV landscape in the United States is shaped by three key forces: democratization of premium content, technological convergence, and regulatory recalibration. Traditional cable cord-cutting has leveled off at 42% of households. However, IPTV adoption is on the rise, expected to hit 140 million subscribers by 2033. This growth is fueled by Gen Z's desire for flexible, on-the-go viewing. In mid-2024, a tipping point occurred as major providers adopted hybrid monetization models. They combined subscriptions, transactional VOD, and targeted ads to manage content costs. This change is clear in platforms like Peacock, which saw a 60% revenue increase from tiered subscriptions (ad-lite vs. ad-free) and shoppable ads.

On the tech side, IPTV is merging with smart home systems. Currently, 33% of U.S. users access services through voice-activated assistants like Alexa and Google Home. Meanwhile, AR/VR integrations for immersive sports and concerts are starting to gain traction. Regulatory pressures are increasing. In 2024, net neutrality debates returned due to FCC proposals to reclassify broadband. This change could affect data throttling for IPTV traffic. Also, copyright enforcement on live-streamed events, like UFC fights and concerts, has led to lawsuits.

These cases show the ongoing legal issues in digital content distribution. Sustainability is another concern. Data centers for IPTV use 3% of global electricity. This has led companies like Amazon and Apple to pledge carbon-neutral streaming. Looking ahead, market strength will depend on balancing innovation with ethical data use, fair infrastructure, and cooperative content licensing. This approach will help position IPTV as the core of America's digital entertainment future.

Checkout Now: https://www.imarcgroup.com/checkout?id=20635&method=1190

United States IPTV Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Subscription Type:

• Subscription Based IPTV

• Subscription Free IPTV

Breakup by Transmission Type:

• Wired

• Wireless

Breakup by Device Type:

• Smartphones and Tablets

• Smart TVs

• PCs

• Others

Breakup by Streaming Type:

• Video IPTV

• Non-Video IPTV

Breakup by Service Type:

• In-House Service

• Managed Service

Breakup by End User:

• Residential

• Enterprises

Breakup by Region:

• Northeast

• Midwest

• South

• West

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=20635&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States IPTV Market Size, Share & Report 2025-2033 here

News-ID: 4050211 • Views: …

More Releases from IMARC Group

Hydrogen Fluoride Manufacturing Plant DPR 2026: Investment Cost, Market Growth & …

Setting up a hydrogen fluoride manufacturing plant positions investors within a strategically important segment of the global specialty chemicals and fluorochemicals industry, driven by increasing demand for semiconductor manufacturing, refrigerant production, and pharmaceutical intermediates. As modern industrial processes advance, electronics manufacturing expands, and the need for high-purity fluorine compounds grows, hydrogen fluoride continues to gain traction across semiconductor fabrication, aluminum production, and petroleum refining worldwide. Rising demand from high-tech industries,…

Vinyl Acetate Ethylene Production Plant Cost 2026: Industry Overview and Profita …

Setting up a Vinyl Acetate Ethylene Production Plant positions investors in one of the most stable and essential segments of the specialty chemicals and polymer value chain, backed by sustained global growth driven by growing construction activity, rising demand for high-performance dry-mix mortars, increasing use in paints and coatings, and the dual-benefit advantages of delivering flexible, low-VOC polymer binder solutions that meet both industrial performance standards and evolving environmental compliance…

Fluff Pulp Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a fluff pulp manufacturing plant positions investors within a strategically important segment of the global hygiene products and absorbent materials industry, driven by increasing demand for disposable hygiene products, absorbent personal care items, and medical applications. As consumer hygiene standards advance, disposable product adoption expands, and the need for high-quality absorbent materials grows, fluff pulp continues to gain traction across baby diapers, adult incontinence products, feminine hygiene items,…

Fire Alarms Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Pro …

Setting up a fire alarms manufacturing plant positions investors within a strategically important segment of the global safety and security equipment industry, driven by increasing demand for fire detection and safety systems, stringent building safety regulations, and growing awareness of fire protection measures. As modern construction practices advance, smart building integration expands, and the need for advanced fire safety infrastructure grows, fire alarms continue to gain traction across commercial buildings,…

More Releases for IPTV

Best Buy IPTV: A Complete Guide to Choosing Premium IPTV Services

Understanding Best Buy IPTV in the Modern Streaming Era

The demand for flexible, high-quality television streaming has reshaped how audiences consume entertainment worldwide. Best Buy IPTV https://iptvwar.com/best-buy-iptv-2026/ has emerged as a widely searched term because viewers are actively seeking reliable, high-definition, and legally compliant IPTV services that deliver exceptional value. We focus on clarity, performance, and long-term usability when evaluating IPTV solutions that truly deserve the label best buy.

IPTV, or…

1 Dollar IPTV Launches New 24-Hour IPTV Free Trial

1 Dollar IPTV has officially launched its new next-generation high-performance IPTV server, delivering the fastest and most stable streaming experience in the company's history. Alongside the upgrade, the company is offering all new users an exclusive 24-hour IPTV free trial, giving them full access to more than 30,000 live and on-demand channels at no cost.

Access free trial using the link below

https://1dollariptv.net/free-trial/

The new server infrastructure features dramatically improved stability, reduced buffering,…

Secure IPTV Service 2026

Exclusive Offer - 15% OFF + Free 24H Trial

Before reading this full guide on Secure IPTV Service 2026, claim your exclusive offer:

15% OFF all plans

24-hour free trial to test everything privately

Encrypted, secure, and global IPTV access

Activate your offer instantly on WhatsApp:

WHATSSAP

Introduction - Why Security Is the Future of IPTV in 2026

The IPTV industry has evolved dramatically in recent years. In 2026, the…

Buy IPTV:

What is IPTV?

Internet protocol Television (IPTV) is different from cables. It feels like traditional TV but without any cable limitations. IPTV delivers live television channels, sports and demand content.

How IPTV works?

IPTV works more smatter then TV cables. https://opplexiptv.com/ Instead of broadcast towers and dishes it send your content or massage through your internet connection. The videos and audio breaks down into small data packets and send through internet using…

5 Best IPTV Services in the USA in 2025 With Viking IPTV

Image: https://lh7-rt.googleusercontent.com/docsz/AD_4nXdlaob-dljXJMYBULAO0PCNkCHtLoTJlQ7nA_dObyfRlcffaXm2WOo4BN2cZ22DcxCf5FW6Lntay-BuyNIcXNbt80YfulYnl8Y5x2I_ybzijCS7SNe_TAIUPvZCEmu8eBxzvY14?key=2x6i3kqxMWh8NQfbFSUfHA

Tired of buffering, missing channels, or overpriced cable? IPTV is the future of digital streaming, and in the USA, millions are switching to smarter, more affordable IPTV solutions. But not all services are created equal. That's why we reviewed and tested dozens of IPTV providers to uncover the best IPTV services for 2025 - based on pricing, channel variety, video quality, and customer support.

Whether you're after live sports in…

JeanSAT's Guide on IPTV Technology: Legal Insights into Code IPTV, Abonnement IP …

JeanSAT, a leading provider of IPTV technology in France, releases a comprehensive guide on legal IPTV services, focusing on Code IPTV, Abonnement IPTV, and IPTV Premium, while promoting ethical and licensed media consumption.

France - September 30, 2024 - JeanSAT, a recognized leader in the IPTV industry, announces the release of an insightful guide on IPTV technology, highlighting how users can leverage Code IPTV, Abonnement IPTV, and IPTV Premium [https://codeiptv.fr/] for…