Press release

Factoring Services Market to Hit $5,872.00 Bn, Globally, by 2031 | Trends Overview

Factoring service is an oriented one, with highly efficient system with smart contract facilities, transactional security management, and fast funding. Factoring services often connects technologies such as distributed ledger technology (DTL), automated invoice, and accounting software to completely automate business processes. For instance, factoring services can handle all financial business operations and business entity sells its bill receivables to a third party at a discount to raise funds. Furthermore, the key factoring services market trends include rise in open account trading opportunities and need for alternate sources of financing for small & medium enterprises (SMEs) to meet immediate business goals are driving the global factoring services market. Moreover, increased awareness and understanding of supply chain financing benefits are boosting the factoring service market size. However, lack of a stringent regulatory framework for debt recovery mechanisms and foreign currency restrictions, and stamp duties are hampering the growth of the factoring service market. On the contrary, rise in technological advancements such as automated invoices are expected to offer remunerative opportunities for expansion during the factoring service market forecast.Allied Market Research published a report, titled, "Factoring Services Market by Provider (Banks, NBFCs), by Enterprise Size (Large Enterprises, SMEs), by Application (Domestic, International), by Industry Vertical (Construction, Manufacturing, Healthcare, Transportation & Logistics, Energy & Utilities, IT & Telecom, Staffing, Others): Global Opportunity Analysis and Industry Forecast, 2021-2031." According to the report, the global factoring services industry generated $3,271.45 billion in 2021, and is expected to reach $5,872.00 billion by 2031, witnessing a CAGR of 6.1% from 2022 to 2031.

Claim Your Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/A17187

Drivers, Restraints, and Opportunities

Increase in open account trading opportunities, rise in awareness & understanding of supply chain financing, and surge in need for alternate sources of financing for small & medium enterprises (SMEs) drive the growth of the global factoring services market. However, lack of strict regulatory frameworks for recovering debts and restrictions on foreign currency restrain the market growth. On the other hand, increase in technological advancements such as automated invoices present new opportunities in the coming years.

Key companies profiled

Advanon AG, ALAMI Technologies, Aldermore Bank PLC, AwanTunai, Barclays PLC, BNP Paribas, China Construction Bank, Deutsche Factoring Bank, Eurobank, Hitachi Capital (UK) PLC, HSBC Group, ICBC, KUKE Finance JS, Mizuho Financial Group, Inc, Riviera Finance of Texas, Inc, Societe Generale, and The Southern Bank Company Access Table PDF

The Manufacturing Segment to Maintain its Leadership Status During the Forecast Period

Based on industry vertical, the manufacturing segment accounted for the largest market share in 2021, contributing to nearly one-third of the global factoring services market, and is projected to maintain its leadership status during the forecast period. This is due to elimination of issues of manufacturing plant such as shortage of cash flow issues and ability to roll out payments to suppliers, raw materials providers, and expenses without incurring late fees, damaging business credit, or worrying about quitting of employees. However, the healthcare segment is estimated to witness the highest CAGR of 9.3% from 2022 to 2031, owing to patient claim process taking more than two months to process that creates a huge gap in working capital.

Ask Before You Buy: https://www.alliedmarketresearch.com/purchase-enquiry/A17187

The Banks Segment to Maintain its Lead Status by 2031

Based on provider, the banks segment held the largest market share in 2021, accounting for around four-fifths of the global factoring services market, and is expected to maintain its lead status by 2031. This is due to rise in digitization across the banking sector to fill the current gaps in financial services and surge in efficiency in the banking sector to provide improved customer experience. However, the NBFCs segment is projected to grow at the fastest CAGR of 7.5% from 2022 to 2031, owing to offering of factoring services to businesses with low rate and rapid payment time.

The Large Enterprise Segment to maintain its Lead Position during the Forecast Period

Based on enterprise size, the large enterprise segment contributed to the highest market share in 2021, holding nearly three-fourths of the global factoring services market, and is projected to maintain its lead position during the forecast period. This is due to increase in usage in a number of large enterprises such as education hubs, healthcare companies, and government sector. However, the SMEs segment is estimated to register the highest CAGR of 8.0% from 2022 to 2031. This is attributed to increase in their business reach and cost-effectiveness of factoring services.

Europe to Maintain its Dominance in Terms of Revenue by 2031

Based on region, Europe contributed to the largest market share in 2021, accounting for more than two-thirds of the global factoring services market, and is expected to maintain its dominance in terms of revenue by 2031. This is due to rapid adoption of factoring services in Central and Eastern Europe (CEE) and the strategic importance of receivables funded by the commercial banking sector. However, Asia-Pacific is projected to manifest the fastest CAGR of 7.6% during the forecast period. This is owing to rapid growth of economies with infrastructural and industrial growth in the region.

Leading Market Players

Advanon AG

ALAMI Technologies

Aldermore Bank

AwanTunai

Barclays

BNP Paribas

China Construction Bank

Deutsche Factoring Bank

Eurobank

Hitachi Capital (UK) PLC

HSBC group

ICBC

KUKE Finance JSC

Mizuho Financial Group, Inc.

Riviera Finance of Texas, Inc.

Societe Generale

The Southern Bank Company

Get Your Personalized Sample Report & TOC Now! https://www.alliedmarketresearch.com/request-for-customization/A17187

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the factoring services market analysis from 2022 to 2031 to identify the prevailing factoring services market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the factoring services market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global factoring services market trends, key players, market segments, application areas, and market growth strategies.

Key Market Segments

Industry Vertical

Construction

Manufacturing

Healthcare

Transportation & Logistics

Energy & Utilities

IT & Telecom

Staffing

Others

Provider

Banks

NBFCs

Enterprise Size

Large Enterprises

SMEs

Application

Domestic

International

By Region

North America

U.S.

Canada

Europe

United Kingdom

Germany

France

Italy

Spain

Netherlands

Rest of Europe

Asia-Pacific

China

India

Japan

South Korea

Australia

Singapore

Rest of Asia-Pacific

LAMEA

Latin America

Middle East

Africa

Top Trending Reports:

Open Banking Market

https://www.alliedmarketresearch.com/open-banking-market

Virtual Cards Market

https://www.alliedmarketresearch.com/virtual-cards-market-A17176

Reinsurance Market

https://www.alliedmarketresearch.com/reinsurance-market-A06288

Management Consulting Services Market

https://www.alliedmarketresearch.com/management-consulting-services-market-A19875

Canada Extended Warranty Market

https://www.alliedmarketresearch.com/canada-extended-warranty-market-A24713

Remittance Market

https://www.alliedmarketresearch.com/remittance-market

Family Office Market https://www.alliedmarketresearch.com/family-office-market-A323045

Cancer Insurance Market https://www.alliedmarketresearch.com/cancer-insurance-market-A264275

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Factoring Services Market to Hit $5,872.00 Bn, Globally, by 2031 | Trends Overview here

News-ID: 4050085 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

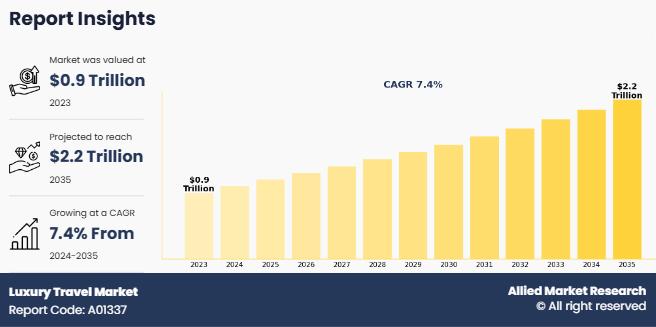

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…