Press release

Prepaid Card Market Trends, Demand Drivers, Competitive Landscape, and Forecast 2025-2032

"The prepaid card market is undergoing a period of explosive growth, fueled by a confluence of factors that are reshaping the global financial landscape. This market is not just about offering an alternative payment method; it's about fostering financial inclusion, driving digital transformation, and providing tailored solutions to diverse user needs. Key drivers include the increasing penetration of smartphones and mobile banking, particularly in developing economies, coupled with a growing preference for cashless transactions. Technological advancements, such as the integration of near-field communication (NFC) and contactless payment technologies, are enhancing the user experience and expanding the acceptance network for prepaid cards. Furthermore, governments worldwide are increasingly leveraging prepaid cards for disbursing social welfare benefits and tax refunds, recognizing their efficiency and transparency. The rise of the gig economy and the need for flexible payment solutions for independent contractors and freelancers are also contributing significantly to the market's expansion. Beyond convenience and security, the prepaid card market plays a critical role in addressing global challenges related to financial inclusion, providing access to financial services for unbanked and underbanked populations. By offering a secure and easily accessible means of managing funds, prepaid cards empower individuals to participate more fully in the digital economy, contributing to economic growth and social equity. The market also offers innovative solutions for businesses, allowing for streamlined expense management, employee incentives, and customer loyalty programs. As the market matures, we are seeing a shift towards personalized and customizable prepaid card solutions, catering to specific needs and preferences across various demographics and industries. The continued evolution of technology and the increasing focus on financial inclusion suggest that the prepaid card market will continue its upward trajectory, transforming the way individuals and businesses manage their finances in the years to come.

Get the full PDF sample copy of the report: (TOC, Tables and figures, and Graphs) https://www.consegicbusinessintelligence.com/request-sample/1035

Market Size:

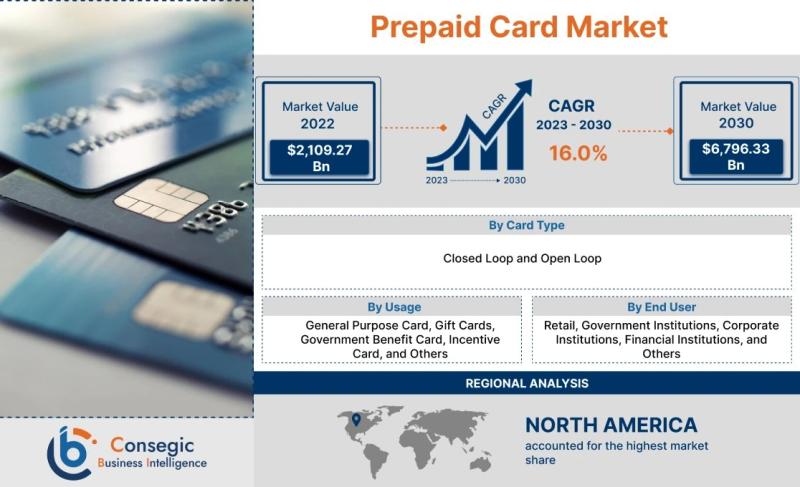

The Prepaid Card Market is estimated to reach over USD 6,796.33 Billion by 2030 from a value of USD 2,109.27 Billion in 2022, growing at a CAGR of 16.0% from 2023 to 2030.

Definition of Market:

The Prepaid Card Market encompasses a range of payment instruments that allow users to spend funds pre-loaded onto the card. Unlike credit cards, prepaid cards are not linked to a credit line and instead draw funds from a balance that the cardholder has previously deposited. The market includes the cards themselves, the associated processing services, and the infrastructure that supports their issuance and usage.

Key components of the market include:

Products: This includes physical prepaid cards and virtual prepaid cards, which exist only as digital codes. These cards come in various forms, such as reloadable, non-reloadable, and single-use.

Services: The market encompasses a suite of services, including card issuance, processing, activation, reloading, and customer support. These services are typically provided by financial institutions, payment processors, and third-party providers.

Systems: This refers to the technological infrastructure that enables the functionality of prepaid cards, including point-of-sale (POS) systems, online payment gateways, mobile payment platforms, and card management systems.

Key terms related to the market include:

Closed Loop Cards: Prepaid cards that can only be used at a specific merchant or within a specific network.

Open Loop Cards: Prepaid cards that can be used anywhere major credit or debit cards are accepted.

Reloadable Cards: Cards that can be loaded with funds multiple times.

Non-Reloadable Cards: Cards that can be used only once and then discarded.

General Purpose Cards: Prepaid cards that can be used for a wide range of transactions.

Gift Cards: Prepaid cards that are given as gifts and typically used at specific retailers.

Government Benefit Cards: Prepaid cards used by government agencies to disburse benefits such as unemployment insurance and social security payments.

Incentive Cards: Prepaid cards used by businesses to reward employees or customers.

Get Discount On Report @ https://www.consegicbusinessintelligence.com/request-discount/1035

Market Scope and Overview:

The scope of the prepaid card market is broad and encompasses various technologies, applications, and industries. From a technological standpoint, the market leverages magnetic stripe, EMV chip, and contactless (NFC) technologies to facilitate secure and convenient transactions. Applications range from general-purpose spending and gift-giving to government benefits disbursement and corporate incentive programs. Industries served include retail, financial services, government, healthcare, and transportation. The market's reach extends across geographical boundaries, with varying degrees of adoption and penetration in different regions. The market facilitates peer to peer payment options to the vast population which could be students, working individuals, or anyone who sends and recieve money to different places.

The prepaid card market plays a vital role in the larger context of global trends. Its growth is intrinsically linked to the increasing digitization of payments and the rise of the digital economy. As more consumers embrace online shopping and mobile payments, the demand for secure and convenient payment solutions like prepaid cards continues to rise. Furthermore, the market contributes to financial inclusion by providing access to financial services for unbanked and underbanked populations. Prepaid cards offer a safe and reliable alternative to cash, enabling individuals to participate more fully in the formal economy. The market is also aligned with the growing emphasis on transparency and efficiency in government operations, as prepaid cards offer a cost-effective and auditable means of disbursing benefits and making payments. Its a great alternative to use instead of cash so you don't have to withdraw cash from ATM.

Top Key Players in this Market

Mastercard, PayPal Holdings, Inc., Visa, American Express Company, JPMorgan Chase & Co., H&R Block Inc., Banco Bilbao Vizcaya Argentaria S.A, Brink's Incorporated, Green Dot Corporation, Netspend, Revolut

Market Segmentation:

The prepaid card market can be segmented based on card type, usage, and end-user.

By Card Type:

Closed Loop: These cards are restricted to use within a specific merchant or network. They offer targeted marketing and brand loyalty opportunities.

Open Loop: These cards can be used anywhere major credit/debit cards are accepted, providing greater flexibility and convenience.

By Usage:

General Purpose: Used for everyday purchases, offering a versatile payment solution.

Gift Cards: Primarily used as gifts, driving sales for retailers.

Government Benefit Cards: Used for disbursing government benefits, improving efficiency and reducing fraud.

Incentive Cards: Used by corporations to reward employees or customers, boosting morale and sales.

Others: Includes travel cards, payroll cards, and other specialized applications.

By End-User:

Retail: Retailers use prepaid cards for gift cards, loyalty programs, and payment solutions.

Government Institutions: Government agencies use prepaid cards for benefit disbursement and employee payments.

Corporate Institutions: Corporations use prepaid cards for employee incentives, expense management, and customer rewards.

Financial Institutions: Banks and credit unions offer prepaid cards as an alternative to traditional accounts.

Others: Includes healthcare providers, educational institutions, and other organizations.

Each segment contributes uniquely to market growth. Open loop cards drive overall transaction volume, while closed loop cards foster brand loyalty. Government benefit cards and corporate incentive cards offer targeted growth opportunities.

Market Drivers:

Several factors are driving the growth of the prepaid card market:

Technological Advancements: The increasing adoption of digital payment technologies, such as mobile wallets and contactless payments, is fueling the demand for prepaid cards. Easy integration with mobile payment apps makes it user friendly for users.

Financial Inclusion: Prepaid cards provide access to financial services for unbanked and underbanked populations, enabling them to participate in the digital economy.

Government Policies: Governments are increasingly using prepaid cards for disbursing benefits and making payments, recognizing their efficiency and transparency.

Growing E-commerce: As online shopping continues to grow, prepaid cards offer a secure and convenient way to make purchases online, especially for those without credit cards.

Corporate Incentive Programs: Businesses are using prepaid cards as incentives for employees and customers, driving sales and loyalty.

Increasing adoption of cashless transactions : Consumers are inclining towards less dependency on cash and want cashless payment options which boosts the prepaid card market.

Market Key Trends:

Significant trends in the prepaid card market include:

Mobile Integration: Prepaid cards are increasingly being integrated with mobile wallets and payment apps, offering greater convenience and accessibility.

Virtual Prepaid Cards: The demand for virtual prepaid cards is growing, as they offer a secure and convenient way to make online purchases.

Personalization: Prepaid card providers are offering personalized card designs and features to cater to individual preferences.

Contactless Payments: Contactless payment technology (NFC) is becoming increasingly prevalent in prepaid cards, enabling faster and more convenient transactions.

Focus on Security: Prepaid card providers are investing in advanced security measures to protect against fraud and data breaches.

Market Opportunities:

The prepaid card market offers several growth prospects:

Expansion in Emerging Markets: Untapped opportunities exist in emerging markets, where the unbanked population is large and the demand for financial services is growing.

New Applications: There is potential for prepaid cards to be used in new applications, such as healthcare payments and transportation ticketing.

Technological Innovations: Innovations in mobile payment technology and blockchain could create new opportunities for prepaid card providers.

Partnerships: Strategic partnerships between prepaid card providers and other companies, such as retailers and mobile network operators, can expand market reach and drive adoption.

Customizable Cards : Innovations in personalization of cards where the users can customize it according to themselves are one of the great opportunity.

Market Restraints:

The prepaid card market faces certain challenges:

Regulatory Compliance: The prepaid card industry is subject to complex and evolving regulations, which can increase compliance costs.

Fraud and Security Risks: Prepaid cards are vulnerable to fraud and security breaches, which can erode consumer trust.

Limited Awareness: Some consumers are still unaware of the benefits of prepaid cards, which can limit adoption.

Competition: The prepaid card market is highly competitive, with numerous players vying for market share.

Fees: Some prepaid cards charge fees for activation, reloading, and usage, which can deter some consumers.

Market Challenges:

The prepaid card market, despite its significant growth potential, faces a complex set of challenges that could impact its trajectory. One of the most pressing challenges is the evolving regulatory landscape. Governments worldwide are enacting stricter regulations to combat money laundering, terrorist financing, and other illicit activities, requiring prepaid card providers to implement robust compliance programs. These regulations often involve stringent Know Your Customer (KYC) requirements, transaction monitoring protocols, and reporting obligations, which can be costly and time-consuming to implement. The complexity of navigating these regulations across different jurisdictions adds another layer of difficulty, particularly for companies operating on a global scale.

Another significant challenge is the persistent threat of fraud and security breaches. Prepaid cards, like any other payment method, are susceptible to various forms of fraud, including card cloning, skimming, and online . As technology advances, so do the tactics of fraudsters, making it essential for prepaid card providers to invest heavily in advanced security measures to protect their customers and their assets. This includes implementing multi-factor authentication, real-time fraud detection systems, and encryption technologies. Furthermore, data breaches can have a devastating impact on consumer confidence and brand reputation, making data security a top priority. The cost of implementing and maintaining these security measures can be substantial, particularly for smaller players in the market.

Consumer perception and awareness also pose a challenge. While prepaid cards offer numerous benefits, such as financial inclusion and convenience, some consumers still view them with skepticism or lack a clear understanding of their features and benefits. This can be attributed to negative perceptions surrounding fees, concerns about security, or simply a lack of awareness about the various types of prepaid cards available and their intended uses. Overcoming these perceptions requires a concerted effort to educate consumers about the benefits of prepaid cards, address their concerns, and promote transparency in fee structures and security protocols. This can involve targeted marketing campaigns, educational resources, and partnerships with community organizations.

Competition from alternative payment methods is another significant challenge. The prepaid card market faces increasing competition from mobile wallets, peer-to-peer payment apps, and other digital payment solutions. These alternative payment methods often offer similar benefits to prepaid cards, such as convenience and security, and may also have lower fees or more attractive features. To remain competitive, prepaid card providers need to differentiate their offerings by providing unique value propositions, such as personalized rewards programs, enhanced security features, or seamless integration with other financial services. They also need to invest in innovation to stay ahead of the curve and meet the evolving needs of consumers.

Finally, ensuring accessibility and affordability for all users is a critical challenge. Prepaid cards have the potential to promote financial inclusion, but this potential can only be realized if the cards are readily accessible and affordable for low-income individuals and underserved communities. This requires addressing issues such as distribution channels, fee structures, and minimum balance requirements. Prepaid card providers need to work with community organizations and government agencies to ensure that their products are available to those who need them most and that the fees associated with using the cards are reasonable and transparent. This may involve offering low-fee or no-fee options, providing financial literacy resources, and establishing partnerships with local businesses to expand distribution networks.

Market Regional Analysis:

The prepaid card market exhibits varying dynamics across different regions.

North America: This region is a mature market with high adoption rates, driven by a strong financial infrastructure and a large unbanked population. Key trends include the increasing use of prepaid cards for government benefits and corporate incentives.

Europe: The European market is characterized by a growing preference for cashless transactions and increasing regulatory scrutiny. Key trends include the adoption of contactless payments and the rise of virtual prepaid cards.

Asia-Pacific: This region is experiencing rapid growth, driven by increasing smartphone penetration and a large unbanked population. Key trends include the adoption of prepaid cards for e-commerce and mobile payments.

Latin America: This region offers significant growth potential, driven by a large unbanked population and increasing government support for financial inclusion. Key trends include the use of prepaid cards for remittances and social welfare programs.

Middle East & Africa: This region is characterized by a growing demand for financial services and increasing adoption of mobile payments. Key trends include the use of prepaid cards for payroll and government payments.

Each region faces unique challenges and opportunities, influenced by factors such as economic development, regulatory environment, and consumer behavior.

Frequently Asked Questions:

Q: What is the projected growth rate of the Prepaid Card Market?

A: The Prepaid Card Market is projected to grow at a CAGR of 16.0% from 2023 to 2030.

Q: What are the key trends in the Prepaid Card Market?

A: Key trends include mobile integration, virtual prepaid cards, personalization, contactless payments, and a focus on security.

Q: What is the most popular Market type in the Prepaid Card Market?

A: Open loop cards are quite popular as it offers convenience of usage at most places where cards are accepted. This makes it highly versatile payment solution.

Follow Us on:

https://www.linkedin.com/company/deeptech-news/

https://www.linkedin.com/company/insights-futures/

https://www.linkedin.com/company/market-techpulse/

https://www.linkedin.com/company/market-radar-report/

https://www.linkedin.com/company/surveypulse-trends/

https://www.linkedin.com/company/market-insight-digest/

https://www.linkedin.com/company/diamonds-market-research-analytics/

https://www.linkedin.com/company/diamonds-business-intelligence-consulting/

https://www.linkedin.com/company/data-grid25/

https://www.linkedin.com/company/campaign-insight-grid/

https://www.linkedin.com/company/novaedge-market-consulting/

https://www.linkedin.com/company/data-craft-studio/

https://www.linkedin.com/company/searchsavvy-solutions/

https://www.linkedin.com/company/optisphere-seo/

https://www.linkedin.com/company/stratos-edge-consulting/

https://www.linkedin.com/company/news-insight/

https://www.linkedin.com/company/tech-disrupts-insight/

https://www.linkedin.com/company/tech-network25/"

Contact Us:

Consegic Business intelligence Pvt Ltd

Baner Road, Baner, Pune, Maharashtra - 411045

(US) (505) 715-4344

info@consegicbusinessintelligence.com

sales@consegicbusinessintelligence.com

Web - https://www.consegicbusinessintelligence.com/

About Us:

Consegic Business Intelligence is a data measurement and analytics service provider that gives the most exhaustive and reliable analysis available of global consumers and markets. Our research and competitive landscape allow organizations to record competing evolutions and apply strategies accordingly to set up a rewarding benchmark in the market. We are an intellectual team of experts working together with the winning inspirations to create and validate actionable insights that ensure business growth and profitable outcomes.

We provide an exact data interpretation and sources to help clients around the world understand current market scenarios and how to best act on these learnings. Our team provides on-the-ground data analysis, Portfolio Expansion, Quantitative and qualitative analysis, Telephone Surveys, Online Surveys, and Ethnographic studies. Moreover, our research reports provide market entry plans, market feasibility and opportunities, economic models, analysis, and an advanced plan of action with consulting solutions. Our consumerization gives all-inclusive end-to-end customer insights for agile, smarter, and better decisions to help business expansion.

Connect with us on:

LinkedIn - https://www.linkedin.com/company/consegic-business-intelligence/

YouTube - https://www.youtube.com/@ConsegicBusinessIntelligence22

Facebook - https://www.facebook.com/profile.php?id=61575657487319

X - https://x.com/Consegic_BI

Instagram - https://www.instagram.com/cbi._insights/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Prepaid Card Market Trends, Demand Drivers, Competitive Landscape, and Forecast 2025-2032 here

News-ID: 4049918 • Views: …

More Releases from Consegic Business Intelligence Pvt. Ltd

Europe Pharmaceutical Manufacturing Equipment Market 2025 Industry Updates, Futu …

Introduction:

The Pharmaceutical Manufacturing Equipment Market is experiencing robust growth, driven by a confluence of factors reshaping the landscape of pharmaceutical production. Increasing global demand for pharmaceuticals, fueled by an aging population and the rise of chronic diseases, necessitates advanced and efficient manufacturing processes. Technological advancements, such as continuous manufacturing, automation, and digitalization, are revolutionizing traditional methods, improving production efficiency, reducing costs, and enhancing product quality. Stringent regulatory requirements and the…

Europe Vibration Damping Materials Market Size 2025 Overview, Manufacturers, Typ …

Introduction:

The Vibration Damping Materials market is experiencing significant growth, driven by the increasing demand for noise and vibration reduction across various industries. Key drivers include stringent environmental regulations, the growing automotive industry, particularly the electric vehicle (EV) sector, and the need for enhanced comfort and safety in residential and commercial buildings. Technological advancements in materials science are also playing a pivotal role, with the development of more efficient and durable…

Europe Lightweight Aggregates Market Size 2025 Emerging Technologies, Opportunit …

Introduction:

The Lightweight Aggregates Market is experiencing substantial growth driven by several key factors. Primarily, the increasing demand for sustainable and eco-friendly construction materials is fueling the adoption of lightweight aggregates. These materials offer superior insulation properties, reduced transportation costs, and contribute to the overall reduction of the carbon footprint of construction projects. Technological advancements in the production and application of lightweight aggregates are also playing a crucial role, enhancing their…

Europe Visible Light Communication Market Share, Growth, Size, Industry Trends, …

Introduction:

The Visible Light Communication (VLC) market is experiencing significant growth, driven by the increasing demand for faster, more secure, and energy-efficient communication technologies. VLC leverages light waves for data transmission, offering a complementary solution to traditional radio frequency (RF) based wireless communication. Key drivers include the proliferation of LED lighting, growing concerns about RF spectrum congestion, and the need for secure communication in sensitive environments. Technological advancements, such as improved…

More Releases for Prepaid

Prepaid Wireless Service Market Size Analysis by Application, Type, and Region: …

USA, New Jersey- According to Market Research Intellect, the global Prepaid Wireless Service market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

Demand for flexible, reasonably priced mobile communication options is driving the expansion of the prepaid cellular service sector. Compared to postpaid options, prepaid…

The Prepaid Card Market in China is Projected to Reach US$404.63 billion by 2026 …

According to PayNXT360, the prepaid card market (value terms) in China increased at a CAGR of 9.7% during 2017-2021. Over the forecast period of 2022 to 2026, the market is expected to record a CAGR of 9.4%, increasing from US$282.11 billion in 2022 to reach US$404.63 billion by 2026.

This report provides a detailed data centric analysis of prepaid payment instruments, covering spend through prepaid cards and digital wallets across…

According to PayNXT360's Analysis, the Strong Growth of E-Commerce Propelled the …

Singapore has been aiming to embrace e-payments and phase out cash usage gradually. The country observed many fintech companies expand their business during 2021. Conventional banks are also focusing on digital wallets and innovative prepaid cards to compete against the new-age fintech companies. The strong growth of e-commerce also propelled the growth of digital wallets and prepaid cards.

According to PayNXT360, the prepaid card market (value terms) in Singapore increased at…

According to PayNXT360's Analysis, the Thriving E-Commerce Market Fueled by the …

Strong growth of the Turkish e-commerce market also widened the prepaid card market's growth opportunity.

The e-commerce market in Turkey recorded strong growth with the rising pandemic and reached new heights in 2021. According to PayNXT360, the e-commerce sales in Turkey increased more than 65% annually during this period. Moreover, with the increasing awareness and rising usage of contactless payment methods, PayNXT360 expects, with an environment well suited for innovation…

According to PayNXT360 Analysis, the United Kingdom Prepaid Card Market is Expec …

The government of the United Kingdom is adopting different initiatives to support the county's local and independent traders primarily to help them recover from the pandemic.

According to PayNXT360, the prepaid card market (value terms) in the United Kingdom increased at a CAGR of 8.7% during 2017-2021. Over the forecast period of 2022 to 2026, the market is expected to record a CAGR of 10.5%, increasing from US$43.91 billion in 2022…

Prepaid Card Customer Analytics

Summary

Prepaid Card Customer Analytics is a powerful interactive tool providing direct answers to the questions that are central to developing a customer-centric product and marketing strategy. It speeds up the analysis of the global prepaid card customer by offering essential insight at a country and demographic level across 29 countries.

Request Sample Report Here: http://www.reportbazzar.com/request-sample/?pid=439704&ptitle=Prepaid+Card+Customer+Analytics&req=Sample

Synopsis

– See exactly where to focus product development and marketing activity based on country level data on…