Press release

The Rising Insurance Demand Propelling The Growth Of The Annuity Market: Key Factor Driving The Growth In The Annuity Market

The Annuity Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Expected Annuity Market Size During the Forecast Period?

The expansion of the annuity market has been impressive in the past years. The market, which stood at $6.08 billion in 2024 is projected to escalate to $6.45 billion in 2025, propelled by a compound annual growth rate (CAGR) of 6.2%. Factors contributing to this growth during the historical period include an increase in life expectancy, growth in disposable income, heightened concerns about the solvency of social security, a rise in the number of people retiring, and an increase in financial advisors.

The annuity market is projected to witness significant expansion in the coming years. The market size is predicted to reach $8.12 billion by 2029, growing at a Compound Annual Growth Rate (CAGR) of 5.9%. Factors contributing to this growth in the forecast period can be traced to the rising elder demographic, heightened utilization of digital interfaces, growing interest in variable annuities, escalating healthcare expenses impacting retirement strategy, and ongoing novelty in annuity product services. Dominant trends for the forecast period encompass technological progress, the inclusion of blockchain technology, digital annuity platforms, hybrid annuity products, and the emergence of robo-advisors.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19290

What Are the High-Growth Segments in the Annuity Market?

The annuitymarket covered in this report is segmented -

1) By Type: Immediate Annuities, Deferred Annuities, Fixed Annuities, Variable Annuities

2) By Distribution Channel: Insurance Agencies And Brokers, Banks, Other Distribution Channels

3) By Application: Child, Adult, Elder

Subsegments:

1) By Immediate Annuities: Single Premium Immediate Annuities (SPIA), Periodic Payment Immediate Annuities, Life-Only Immediate Annuities, Joint and Survivor Immediate Annuities

2) By Deferred Annuities: Fixed Deferred Annuities, Variable Deferred Annuities, Fixed Indexed Deferred Annuities, Multi-Year Guarantee Annuities (MYGA)

3) By Fixed Annuities: Fixed-Rate Annuities, Fixed Indexed Annuities, Immediate Fixed Annuities, Deferred Fixed Annuities

4) By Variable Annuities: Variable Annuities With Equity Investment Options, Variable Annuities with Bond Investment Options, Indexed Variable Annuities, Guaranteed Minimum Withdrawal Benefit (GMWB) Variable Annuities.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19290&type=smp

What Key Drivers Are Expected to Influence Future Annuity Market Growth?

Anticipated growth in the annuity market is projected to be fuelled by the increasing demand for insurance. This surge in insurance demand is attributed to heightened financial protection awareness, burgeoning uncertainties and the necessity to secure oneself against various threats such as health, life, property and disruptions in business. Annuities play a vital role within insurance, as they furnish policyholders with an assured stream of income, generally during retirement, thereby promising long-term financial stability. For example, as per information from Allianz SE, a financial services company based in Germany, the global insurance sector saw a striking growth of 7.5% in May 2023. This figure represents the swiftest expansion witnessed since the Global Financial Crisis (GFC). Insurers globally generated premiums worth €6.2 trillion ($6.7 trillion) across diverse segments, including life insurance at €2,620 billion ($2,835 billion), property and casualty at €2,153 billion ($2,329 billion), and health insurance at €1,427 billion ($1,545 billion). Hence, the escalating demand for insurance is fuelling the expansion of the annuity market.

Which Companies Hold the Largest Share Across Different Annuity Market Segments?

Major companies operating in the annuity market are New York Life Insurance Company, TIAA-CREF Life Insurance Company, Massachusetts Mutual Life Insurance Company, USAA Life Insurance Company, Corbridge Financial, Lincoln National Life Insurance Company, Pacific Life Insurance Company, Jackson National Life Insurance Company, Athene Annuity and Life Company, Brighthouse Financial Inc., Western & Southern Life Assurance Company, F&G Annuities & Life Inc., Allianz Life Insurance Company of North America, ICICI Prudential Life Insurance Company Limited, Ameritas Life Insurance Corporation of New York, American National Insurance Company, Global Atlantic Financial Group, Atlantic Coast Life Insurance Company, Securian Life Insurance Company, OneAmerica Financial Partners Inc., Aspida Life Insurance Company, CL Life and Annuity Insurance Company, Clear Spring Life and Annuity Company, Nationwide Mutual Insurance Company

What Trends Are Driving Growth in The Annuity Market?

Leading firms in the annuity market are concentrating on the creation of innovative products such as long-term, tax-deferred retirement products in order to enhance their competitive position in the market. These retirement products represent financial tools that assist people in saving and investing for retirement, deferring the tax on their investment profits until they start making withdrawals. The structure of these products is such that they allow for the accumulation of funds over a longer duration, facilitating compounded growth devoid of immediate tax implications. For example, in May 2024, Guardian Life Insurance Company of America, located in the US, rolled out Guardian MarketPerform, a Registered Index-Linked Annuity (RILA) - a new financial product aimed at bettering retirement planning for individuals. This product is designed to provide a balance between potential growth and protection from market fluctuations, addressing the rising worries many in the US have regarding their retirement funds.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/annuity-global-market-report

What Are the Emerging Geographies for The Annuity Market Growth?

North America was the largest region in the annuity market in 2024. The regions covered in the annuity market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Annuity Market?

2. What is the CAGR expected in the Annuity Market?

3. What Are the Key Innovations Transforming the Annuity Industry?

4. Which Region Is Leading the Annuity Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Rising Insurance Demand Propelling The Growth Of The Annuity Market: Key Factor Driving The Growth In The Annuity Market here

News-ID: 4048393 • Views: …

More Releases from The Business Research Company

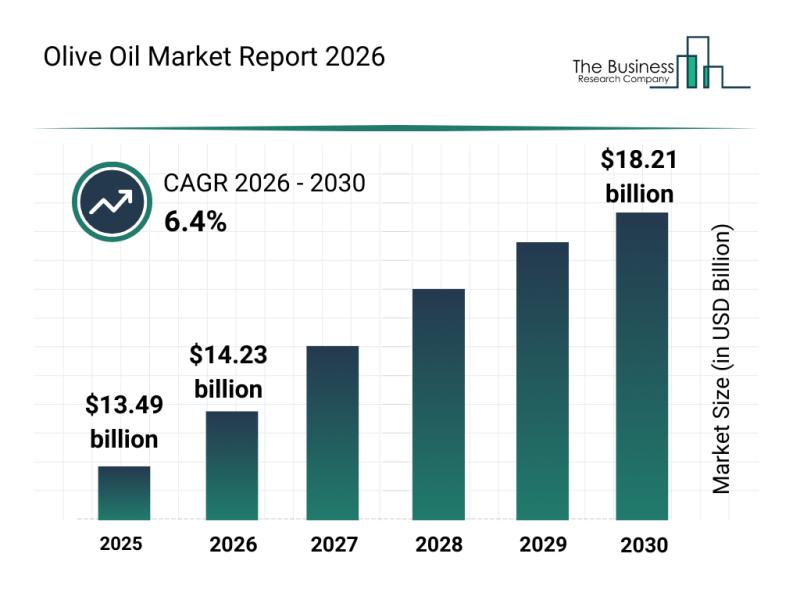

Segment Evaluation and Major Growth Areas in the Olive Oil Market

The olive oil market is poised for significant expansion in the coming years, driven by changing consumer preferences and evolving industry practices. As demand shifts towards healthier and more sustainable products, the olive oil sector is positioned to experience robust growth. Let's explore the market's size, key players, emerging trends, and detailed segment analysis to understand what lies ahead.

Projected Growth and Market Size for Olive Oil by 2030

The…

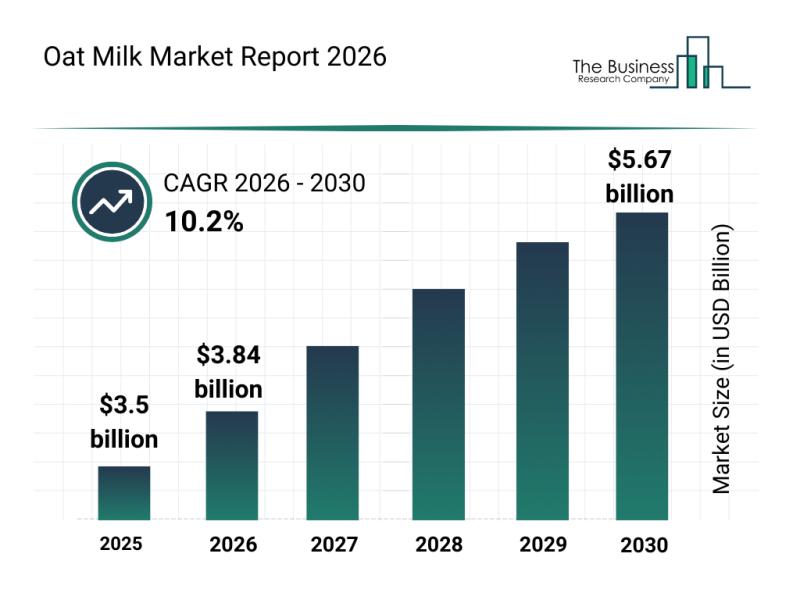

Emerging Growth Patterns Driving Expansion in the Oat Milk Market

The oat milk market is gearing up for significant expansion as consumer preferences shift towards healthier, plant-based alternatives. With growing awareness of sustainability and dietary needs, this sector is attracting considerable attention from both manufacturers and consumers alike. Let's explore how the oat milk market is projected to grow, who the key players are, and what trends and segments are shaping its future.

Projected Growth and Market Size of the Oat…

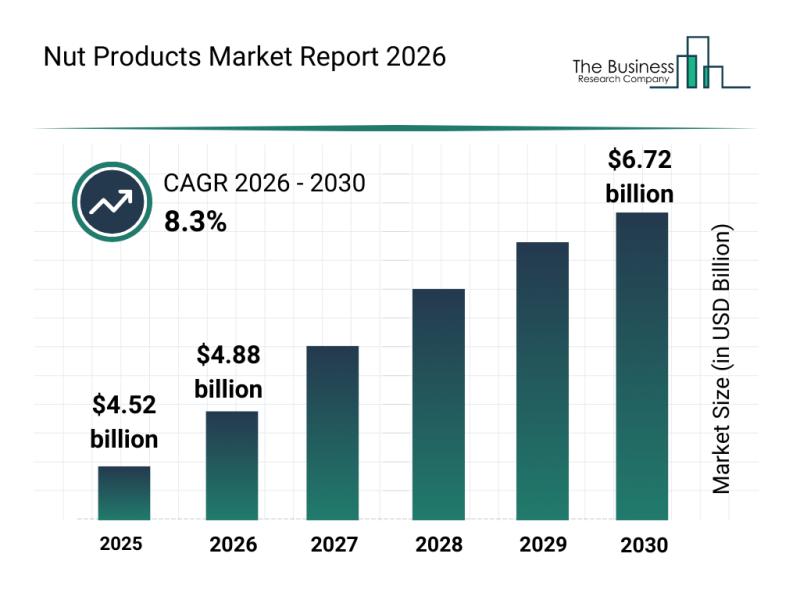

Market Segmentation, Industry Trends, and Competitive Landscape in the Nut Produ …

The nut products market is poised for substantial expansion over the coming years, driven by evolving consumer preferences and innovative offerings. As health consciousness rises and new snacking habits develop, this sector is attracting increasing attention from manufacturers and buyers alike. Let's explore the anticipated market growth, key players, emerging trends, and detailed segmentation shaping the future of nut products.

Strong Growth Outlook for the Nut Products Market Size Through 2030…

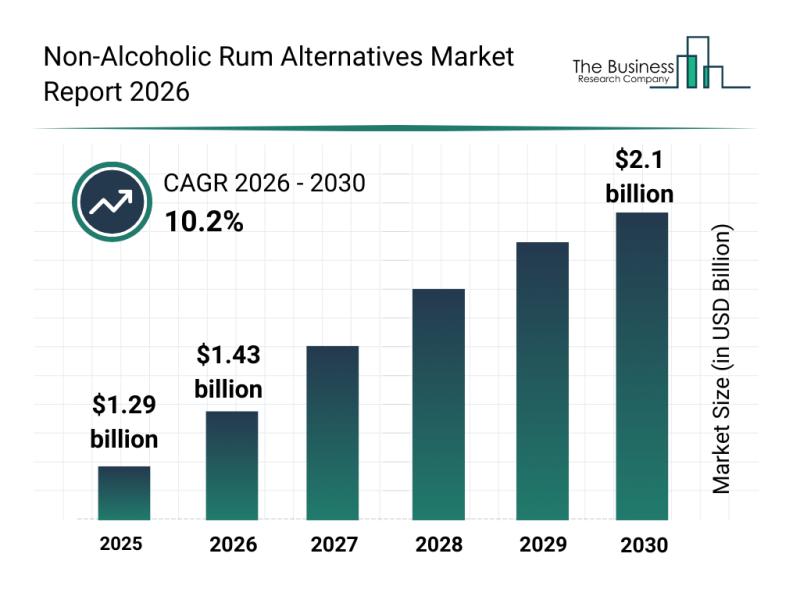

Segment Analysis and Major Growth Areas in the Non-Alcoholic Rum Alternatives Ma …

The non-alcoholic rum alternatives market is gaining significant traction as consumers seek flavorful, alcohol-free options. This sector is expected to experience strong growth driven by evolving consumer preferences and innovations in product offerings. Let's explore the current market size, key players, industry trends, and segmentation that define this expanding marketplace.

Forecasted Market Value and Growth of the Non-Alcoholic Rum Alternatives Market

The market for non-alcoholic rum alternatives is projected to…

More Releases for Annuities

Cary Annuities Agents Publish 2025 Guide Comparing MYGAs & Fixed Annuities

Image: https://www.globalnewslines.com/uploads/2025/10/1759743671.jpg

Matador Insurance Services has released a new blog post to help pre-retirees in Cary, NC, and beyond understand the key differences between MYGAs and Fixed Annuities when planning for retirement.

Cary, NC - October 6, 2025 - The experienced Cary, North Carolina annuities [https://matador-insurance.com/cary-nc/annuities/] agents at Matador Insurance Services recently published a new educational blog titled MYGAs vs. Fixed Annuities [https://matador-insurance.com/blog/myga-vs-fixed-annuity-what-pre-retirees-should-know-2025/]. The 2025 guide is designed to inform pre-retirees about…

Annuities Insurance Market Boosting the Growth Worldwide | OneAmerica, Fidelity, …

Advance Market Analytics published a new research publication on "Global Annuities Insurance Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Annuities Insurance market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Annuities Insurance Market Next Big Thing | American National., Fidelity., John …

Advance Market Analytics published a new research publication on "Annuities Insurance Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Annuities Insurance market was mainly driven by the increasing R&D spending across the world.

Get inside Scoop of the report, request…

Annuities Insurance Market to see Booming Business Sentiments | John Hancock Ann …

Advance Market Analytics published a new research publication on "Global Annuities Insurance Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Annuities Insurance market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Seniors With Annuities Can Benefit From Long-Term Care Insurance Planning Strate …

Millions of seniors who currently own non-qualified annuities can now benefit from a new strategy that can reduce future tax liabilities and increase benefits should long-term care be needed.

A non-qualified annuity is funded with after-tax dollars. The money used to purchase the annuity has already been taxed by the Internal Revenue Service. With non-qualified annuities, the earnings grow tax-deferred until withdrawals are made. At that time, the earnings portion of…

Annuities Insurance Market is Set To Fly High in Years to Come

Advance Market Analytics published a new research publication on "Annuities Insurance Market Insights, to 2027″ with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Annuities Insurance market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in…