Press release

Medical Professional Liability Insurance Market Forecast 2025-2034: Comprehensive Analysis And Growth Opportunities

The Medical Professional Liability Insurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Projected Growth of the Medical Professional Liability Insurance Market?

The medical professional liability insurance market size will grow from $14.64 billion in 2024 to $16.23 billion in 2025 at a compound annual growth rate (CAGR) of 10.8%. The growth in the historic period can be attributed to increasing instances of accidents, rising awareness, increasing medical costs, a rising number of claims, and the rise of telemedicine.

The medical professional liability insurance market is expected to grow to $24.34 billion in 2029 at a CAGR of 10.7%. Growth is driven by the need to reduce fraudulent claims, improve claim services, rising medical malpractice claims, TH*Care costs, and patient expectations. Trends include AI and machine learning, digital TH*Care records, risk management, and data analytics integrati

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19578

What Are the Different Medical Professional Liability Insurance Market Segments?

The medical professional liability insurancemarket covered in this report is segmented -

1) By Type: Occurrence-Based Policies, Claims-Based Policies

2) By Claim Type: Medication Errors, Surgical Errors, Misdiagnosis Or Delayed Diagnosis, Childbirth Injuries, Other Claim Types

3) By Coverage: Up To US$1 Million, US$1 Million To US$5 Million, US$5 Million To US$20, Above US$20 Million

4) By Distribution Channel: Agents And Brokers, Direct Response, Banks, Other Distribution Channels

5) By Application: Individual, Commercial

Subsegments:

1) By Occurrence-Based Policies: General Occurrence-Based Liability Policies, Specialty Occurrence-Based Liability Policies, Tail Coverage for Occurrence Policies, Claims-Made vs. Occurrence Coverage Comparison

2) By Claims-Based Policies: Standard Claims-Made Liability Policies, Extended Reporting Period (ERP) Policies, Retroactive Coverage Claims-Based Policies, Tail Coverage for Claims-Made Policies.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19578&type=smp

What Are the Primary Drivers Shaping the Medical Professional Liability Insurance Market?

The rise in medical accidents is expected to fuel the growth of the medical professional liability insurance market. Medical accidents, caused by human error, system failures, or unforeseen complications, lead to unintentional injuries or complications during medical care. This type of insurance ensures that both medical providers and patients are protected in the event of an incident. According to the Association of Health Care Journalists in January 2024, medical errors result in 251,000 fatalities annually in the USA, accounting for 9.5% of all deaths in the country, which drives the need for professional liability insurance in the TH*Care sector.

Which Companies Are Leading in the Medical Professional Liability Insurance Market?

Major companies operating in the medical professional liability insurance market are AXA SA, Allianz SE, Munich Reinsurance Company, American International Group Inc. (AIG), Chubb Limited, Aviva PLC, The Hartford Financial Services Group Inc., MCIC Vermont LLC, Zurich Insurance Group Ltd., Hiscox Ltd., Towergate Insurance Brokers, Berkshire Hathaway Inc., ProAssurance Corporation, Medical Professional Mutual Insurance Company (ProMutual), Beazley PLC, CoverWallet Inc., MagMutual LLC, Assicurazioni Generali S.p.A., Kerry London Limited, The Doctors Company, Blackfriars Insurance Brokers Ltd.

What Are the Latest Developing Trends in the Medical Professional Liability Insurance Market?

Companies in the medical professional liability insurance market are focusing on AI-driven platforms to streamline policy management, real-time risk assessment, and claims processing. In October 2023, Indigo, a U.S.-based company specializing in AI, launched a medical professional liability insurance platform using machine learning to improve efficiency, offering real-time quoting and binding capabilities for brokers.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/medical-professional-liability-insurance-global-market-report

What Are the Top Revenue-Generating Geographies in the Medical Professional Liability Insurance Market?

Asia-Pacific was the largest region in the medical professional liability insurance market in 2024. The regions covered in the medical professional liability insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Medical Professional Liability Insurance Market?

2. What is the CAGR expected in the Medical Professional Liability Insurance Market?

3. What Are the Key Innovations Transforming the Medical Professional Liability Insurance Industry?

4. Which Region Is Leading the Medical Professional Liability Insurance Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Medical Professional Liability Insurance Market Forecast 2025-2034: Comprehensive Analysis And Growth Opportunities here

News-ID: 4047998 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Approaches Influencing the R …

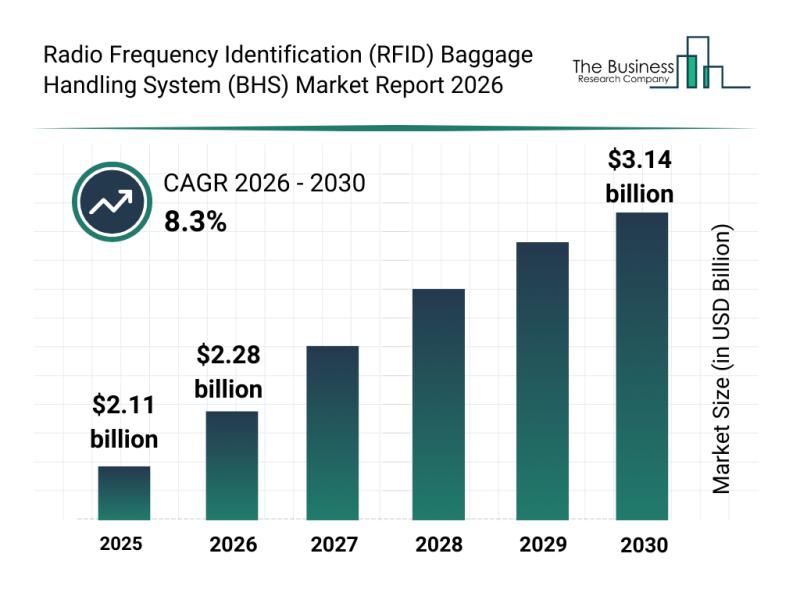

The radio frequency identification (RFID) baggage handling system (BHS) market is set to experience significant growth over the coming years, driven by advancements in airport technology and evolving passenger needs. As airports continue to modernize and automate their operations, the demand for efficient baggage handling solutions is increasing rapidly. This overview explores the market's size, influential players, emerging trends, and key segments shaping its future.

Projecting the Radio Frequency Identification Baggage…

Leading Industry Participants Reinforce Their Presence in the Process Informatio …

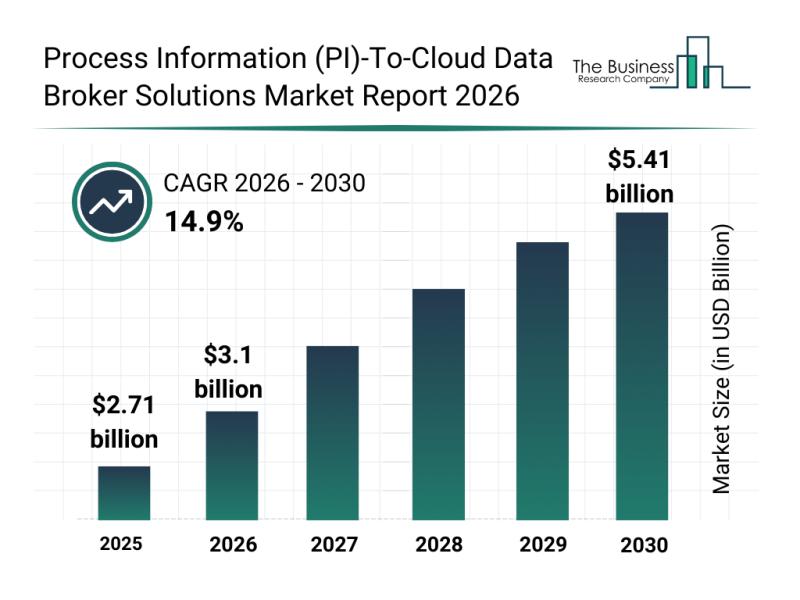

The process information (PI)-to-cloud data broker solutions industry is positioned for significant expansion as digital transformation accelerates across industrial sectors. Increasing demand for real-time data access and seamless integration between operational technology (OT) and information technology (IT) systems is driving rapid innovations and investments. Let's explore the market size projections, key players, emerging trends, and segment insights shaping this evolving landscape.

Projected Market Size Growth in the Process Information (PI)-To-Cloud Data…

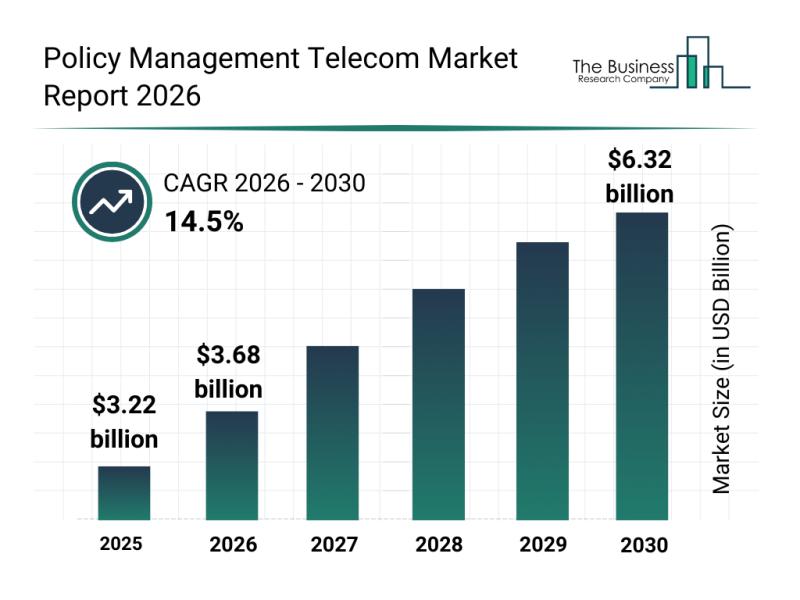

Future Perspective: Key Trends Shaping the Policy Management Telecom Market Up t …

The policy management telecom sector is set to experience significant expansion over the coming years, driven by technological advances and growing network demands. This evolving market is playing a crucial role in supporting the complex needs of modern telecom operators, enabling more efficient management and automation of network policies. Below, we explore the current market size projections, leading companies, key trends, and segmentation details that define this dynamic industry.

Strong Growth…

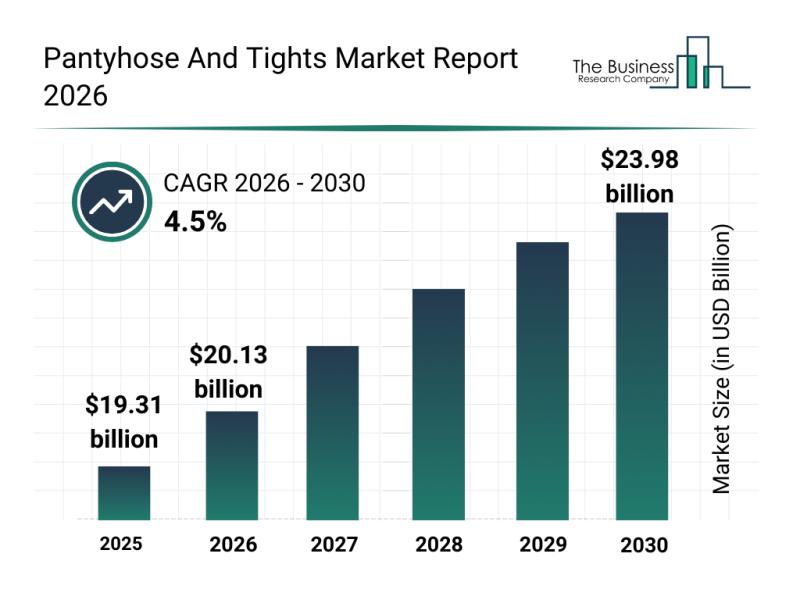

Competitive Analysis: Key Market Leaders and New Entrants in the Pantyhose and T …

The pantyhose and tights market is set to witness consistent growth as consumer preferences evolve and new trends gain traction. With increasing emphasis on sustainability, comfort, and style, this sector is poised for meaningful expansion through 2030. Let's dive into the market's valuation, key players, emerging trends, and segmentation to understand the trajectory of this dynamic industry.

Forecasted Market Value and Growth Rate of the Pantyhose and Tights Market

The…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…