Press release

United States Commercial Insurance Market Size, Growth & Trends Forecast 2025-2033

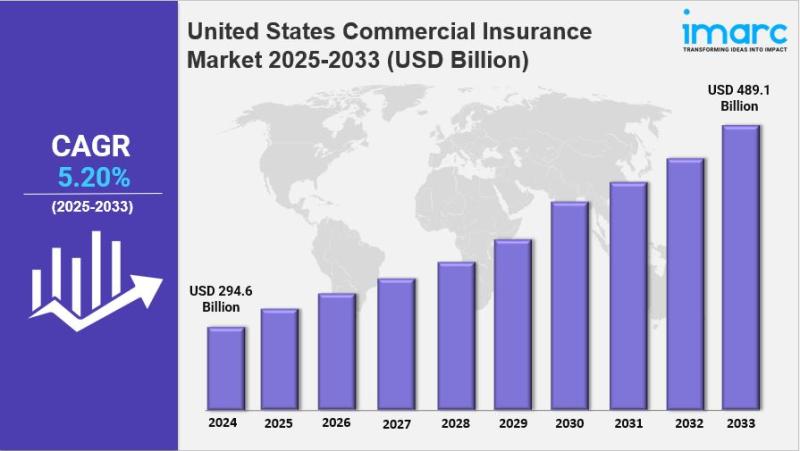

Market Overview 2025-2033The United States commercial insurance market size reached USD 294.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 489.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The United States Commercial Insurance Market is witnessing significant expansion, fueled by heightened risk awareness, regulatory changes, and evolving business landscapes. Key trends include a surge in demand for cyber insurance and tailored coverage options, with leading providers emphasizing technology integration and customer-centric solutions.

Key Market Highlights:

✔️ Strong expansion driven by heightened risk awareness and regulatory changes.

✔️ Growing demand for specialized coverage, including cyber and liability insurance.

✔️ Increased focus on technology integration and customer-centric service models.

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-commercial-insurance-market/requestsample

United States Commercial Insurance Market Trends and Driver:

The United States Commercial Insurance Market is undergoing transformative changes as businesses adapt to an increasingly complex risk landscape. With the rise of digital technologies and the growing prevalence of cyber threats, companies are prioritizing comprehensive coverage solutions.

This shift is reflected in the growing demand for cyber insurance, which addresses the unique challenges posed by data breaches and cyberattacks. As organizations invest in their digital infrastructure, the need for tailored insurance products that mitigate these risks has become paramount.

In 2025, the United States Commercial Insurance Market Size is expected to expand significantly, driven by the increasing awareness of potential liabilities and the necessity for robust risk management strategies.

Businesses across various sectors are recognizing the importance of protecting their assets, leading to a surge in demand for specialized insurance products. This growth is further supported by regulatory changes that compel organizations to maintain adequate coverage, ensuring compliance and financial stability.

Market Share within the United States Commercial Insurance sector is shifting as new entrants and established players innovate to meet evolving client needs. Insurers are leveraging technology to enhance service delivery, streamline claims processing, and offer personalized coverage options.

This competitive landscape is fostering a culture of innovation, where companies that embrace digital transformation can capture a larger share of the market. The integration of artificial intelligence and data analytics is enabling insurers to assess risks more accurately and tailor their offerings accordingly.

Overall, the United States Commercial Insurance Market Growth is poised to accelerate as businesses continue to navigate uncertainties and adapt to emerging risks.

The focus on sustainability and corporate responsibility is also influencing insurance practices, with companies seeking coverage that aligns with their values. As the market evolves, stakeholders must remain vigilant and responsive to trends, ensuring they are equipped to address the challenges and opportunities that lie ahead.

Buy Report Now: https://www.imarcgroup.com/checkout?id=5395&method=1190

United States Commercial Insurance Market Segmentation: The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

• Liability Insurance

• Commercial Motor Insurance

• Commercial Property Insurance

• Marine Insurance

• Others

Breakup by Enterprise Size:

• Large Enterprises

• Small and Medium-sized Enterprises

Breakup by Distribution Channel:

• Agents and Brokers

• Direct Response

• Others

Breakup by Industry Vertical:

• Transportation and Logistics

• Manufacturing

• Construction

• IT and Telecom

• Healthcare

• Energy and Utilities

• Others

Breakup by Region:

• Northeast

• Midwest

• South

• West

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=5395&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Commercial Insurance Market Size, Growth & Trends Forecast 2025-2033 here

News-ID: 4047887 • Views: …

More Releases from IMARC Group

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

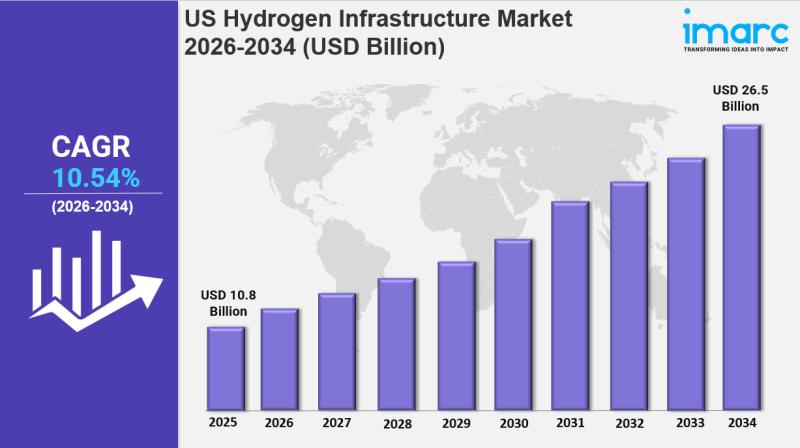

US Hydrogen Infrastructure Market Size, Growth, Latest Trends and Forecast 2026- …

IMARC Group has recently released a new research study titled "US Hydrogen Infrastructure Market Report by Production (Steam Methane Reforming, Coal Gasification, Electrolysis, and Others), Storage (Compression, Liquefaction, Material Based), Delivery (Transportation, Refinery, Power Generation, Hydrogen Refueling Stations), and Region 2026-2034" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The U.S. hydrogen infrastructure market…

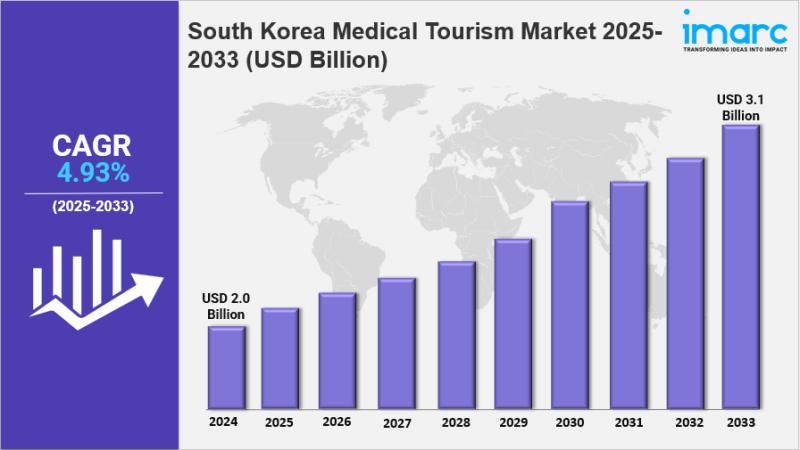

South Korea Medical Tourism Market Size, Share, Industry Overview, Trends and Fo …

IMARC Group has recently released a new research study titled "South Korea Medical Tourism Market Report by Type (Outbound, Inbound, Intrabound), Treatment Type (Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, and Others) 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Medical Tourism Market Overview

The South Korea…

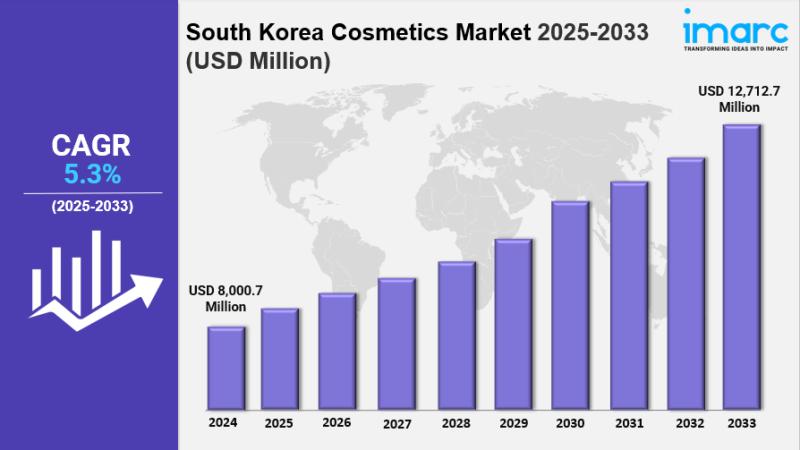

South Korea Cosmetics Market Size, Share, Industry Overview, Trends and Forecast …

IMARC Group has recently released a new research study titled "South Korea Cosmetics Market Report by Product Type (Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, and Others), Category (Conventional, Organic), Gender (Men, Women, Unisex), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, and Others), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…