Press release

Rise of Digital Lending Fuels Consumer Credit Market to Hit $24.3 Billion by 2032 at 7.8% CAGR

Allied Market Research published a report, titled, "Consumer Credit Market by Credit Type (Revolving Credits, and Non-Revolving Credits), Payment Method (Direct Deposit, Debit Card, and Others), and Issuer (Banks, NBFCs, and Others): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the consumer credit market was valued at $ 11.8 billion in 2022 and is estimated to reach $ 24.3 billion by 2032, exhibiting a CAGR of 7.8% from 2023 to 2032.Download Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/69302

Prime determinants of growth

The increase in demand for loans from individual and small businesses and the numerous benefits provided by consumer lenders are boosting the growth of the global consumer market. In addition, increase in the use of digital transformation technology positively impacts the growth of the consumer credit market. However, changes in interest rates and regulatory constraints and lack of security and privacy issues are hampering consumer credit market growth. On the contrary, the expansion of the Internet and the growth in the adoption of smartphones are expected to offer remunerative opportunities for the expansion of the consumer credit market during the forecast period.

The revolving credit segment to maintain its leadership status throughout the forecast period.

Based on the credit type, the revolving credit segment held the highest market share in 2022, accounting for nearly two-thirds of the global consumer credit market revenue, owing to rise in digital transformation in financial services and the demand for convenient financing options. However, the same segment is projected to manifest the highest CAGR of 8.2% from 2023 to 2032, owing to increase in the adoption of technology in the financial industry, including online lending platforms and digital loan processing.

The debit card segment to maintain its leadership status throughout the forecast period

Based on payment method, the debit card segment held the highest market share in 2022, accounting for more than half of the global consumer credit market revenue, owing to surging usage of virtual currencies and growing penetration of the internet. However, the same segment is projected to manifest the highest CAGR of 8.9% from 2023 to 2032, due to the increasing digitization of businesses and strong expansion of communication infrastructure have raised the risk of cyberattacks and exposed companies to several new risks and threats.

Get Customized Reports with your Requirements: https://www.alliedmarketresearch.com/request-for-customization/69302

Asia-Pacific to maintain its dominance by 2032

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for one-third of the global consumer credit market revenue, owing to rise in the adoption of consumer credit in small & medium enterprises to ensure effective flow of financial activities. However, the Asia-Pacific region is expected to witness the fastest CAGR of 10.8% from 2023 to 2032 and is projected to dominate the market during the forecast period, due to growth in the adoption of web-based and mobile-based business applications in the sector of banking.

Leading Market Players: -

Bank of America,

Barclays,

BNP Paribas,

China Construction Bank,

Citigroup,

Deutsche Bank,

HSBC,

Industrial and Commercial Bank of China (ICBC),

JPMorgan Chase,

Mitsubishi UFJ Financial,

Wells Fargo

The report provides a detailed analysis of these key players in the global consumer credit market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Inquiry before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/69302

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2023 to 2032 to identify the prevailing consumer credit market forecast.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the consumer credit market segmentation assists to determine the prevailing consumer credit market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global consumer credit market trends, key players, market segments, application areas, consumer credit market outlook and market growth strategies.

Trending Reports:

Vaults And Vault Doors Market https://www.alliedmarketresearch.com/vaults-and-vault-doors-market-A325371

Remote Deposit Capture Market https://www.alliedmarketresearch.com/remote-deposit-capture-market

Mortgage Brokerage Services Market https://www.alliedmarketresearch.com/mortgage-brokerage-services-market-A06699

RegTech Market https://www.alliedmarketresearch.com/regtech-market

Digital Remittance Market https://www.alliedmarketresearch.com/digital-remittance-market

Banking as a Service Market https://www.alliedmarketresearch.com/banking-as-a-service-market-A14258

Starter Credit Cards Market https://www.alliedmarketresearch.com/starter-credit-cards-market-A315471

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rise of Digital Lending Fuels Consumer Credit Market to Hit $24.3 Billion by 2032 at 7.8% CAGR here

News-ID: 4047670 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

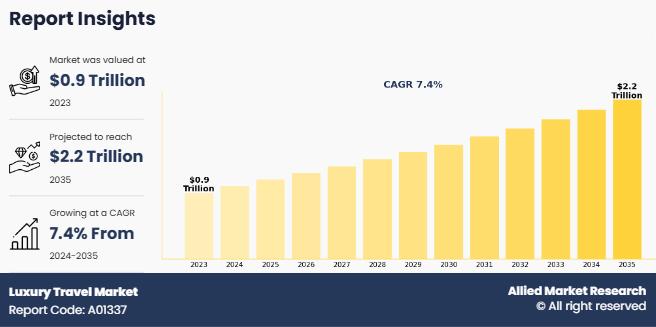

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…