Press release

Online Banking Market Insights: Emerging Opportunities, Size Estimation & Forecast to 2032

"Introduction:The Online Banking Market is experiencing a period of rapid expansion, driven by a confluence of factors that are reshaping the financial landscape. At its core, the market's growth is fueled by the increasing accessibility of the internet and mobile devices, coupled with a growing consumer preference for convenient and efficient banking solutions. Technological advancements, such as enhanced cybersecurity measures, sophisticated user interfaces, and the integration of artificial intelligence (AI) for personalized services, are further accelerating adoption rates. The market is also playing a crucial role in addressing global challenges. For example, online banking promotes financial inclusion by extending banking services to remote or underserved populations who may not have easy access to traditional brick-and-mortar branches. It also supports sustainability efforts by reducing paper consumption and minimizing the carbon footprint associated with physical banking operations. Furthermore, online banking platforms have become indispensable tools for businesses of all sizes, enabling seamless transactions, efficient cash flow management, and access to a wider range of financial services. As the global economy becomes increasingly digital, the Online Banking Market is poised to remain a critical enabler of economic growth and financial innovation, continually adapting to meet the evolving needs of consumers and businesses alike.

Get the full PDF sample copy of the report: (TOC, Tables and figures, and Graphs) https://www.consegicbusinessintelligence.com/request-sample/1395

Market Size:

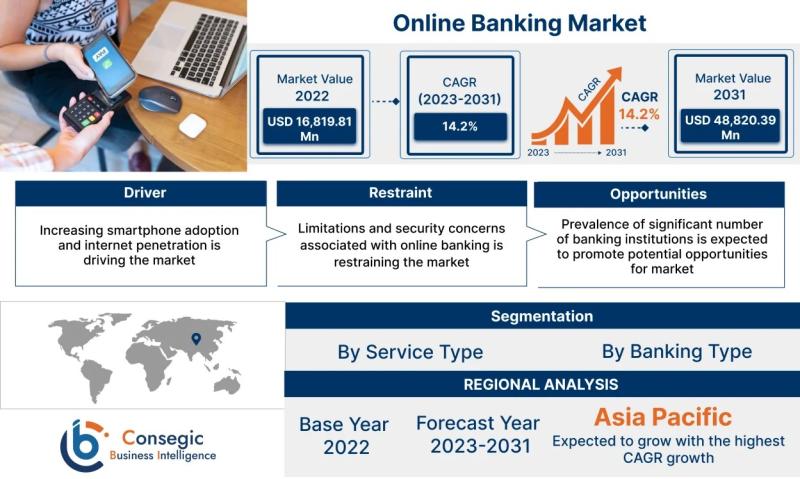

The Online Banking Market size is estimated to reach over USD 48,820.39 Million by 2031 from a value of USD 16,819.81 Million in 2023, growing at a CAGR of 14.2% from 2024 to 2031.

Definition of Market:

The Online Banking Market encompasses the provision of banking services and transactions conducted over the internet. It's a digital platform that allows customers to manage their finances, conduct transactions, and access various banking products and services from anywhere with an internet connection. This market's primary function is to offer a virtual alternative to traditional brick-and-mortar banking.

Key components of the online banking market include:

Products: These encompass a wide range of financial products offered online, such as checking accounts, savings accounts, loan applications, and investment services.

Services: This refers to the functionality provided by online banking platforms, including balance inquiries, fund transfers, bill payments, account management, and customer support.

Systems: These are the technological infrastructures that enable online banking, including secure websites, mobile apps, payment gateways, and data encryption systems.

Key terms related to the market:

Digital Banking: A broader term encompassing online banking, mobile banking, and other digital financial services.

E-banking: Another term for online banking, often used interchangeably.

Mobile Banking: Banking services accessed via mobile devices, typically through dedicated apps.

Payment Gateways: Secure platforms that facilitate online transactions.

Two-Factor Authentication (2FA): A security measure requiring two forms of identification to access online banking services.

Get Discount On Report @ https://www.consegicbusinessintelligence.com/request-discount/1395

Market Scope and Overview:

The Online Banking Market's scope is extensive, encompassing a wide array of technologies, applications, and industries. It leverages technologies such as secure web portals, mobile applications, cloud computing, data analytics, and advanced encryption protocols to deliver a seamless and secure banking experience. The applications of online banking are diverse, ranging from simple balance checks and fund transfers to complex investment management and loan applications. The market serves a multitude of industries, including retail, corporate, investment, and small and medium-sized enterprises (SMEs). Its reach extends to individual consumers seeking convenient financial management tools and large corporations requiring efficient cash management solutions.

The online banking market is crucial in the context of global trends towards digitization and financial inclusion. As businesses and consumers increasingly rely on digital channels for their daily activities, online banking has become an essential component of the modern financial ecosystem. It enables greater accessibility to financial services, particularly for individuals in remote areas or those with limited mobility. Furthermore, online banking promotes efficiency and cost savings for both banks and customers by reducing the need for physical branches and manual processes. The shift towards online banking aligns with broader sustainability goals by minimizing paper consumption and promoting environmentally friendly practices. As technology continues to evolve, the online banking market is expected to play an increasingly vital role in shaping the future of finance, driving innovation, and fostering greater financial inclusion on a global scale.

Market Segmentation:

The Online Banking Market is segmented by Service Type and Banking Type. By Service Type, it includes Informational Services (providing account information and statements), Transactional Services (enabling fund transfers and bill payments), and Communicative Services (offering customer support and personalized communication). By Banking Type, it is divided into Corporate Banking (catering to businesses and organizations), Retail Banking (serving individual customers), and Investment Banking (focused on investment-related services). Each segment contributes to market growth by addressing different customer needs and preferences.

Market Drivers:

Technological Advancements: The continuous evolution of technology, including mobile devices, high-speed internet, and secure encryption protocols, drives the adoption of online banking.

Increasing Internet Penetration: As more people gain access to the internet, the potential customer base for online banking expands.

Growing Smartphone Adoption: The widespread use of smartphones enables convenient access to online banking services through mobile apps.

Cost Savings: Online banking reduces operational costs for banks and offers cost-effective services for customers.

Enhanced Convenience: Online banking provides 24/7 access to banking services from anywhere, offering greater convenience compared to traditional banking.

Government Initiatives: Government policies promoting digital payments and financial inclusion encourage the use of online banking.

Increasing Demand for Personalized Services: Customers are increasingly seeking personalized banking experiences, which can be effectively delivered through online platforms.

Impact of Covid-19 Pandemic: The pandemic accelerated the adoption of online banking as people sought contactless and remote banking solutions.

Market Key Trends:

Mobile Banking Dominance: Mobile banking is becoming the preferred channel for online banking, with increasing usage of mobile apps for various banking activities.

Integration of AI and Machine Learning: Banks are leveraging AI and machine learning to enhance customer experience, improve fraud detection, and offer personalized services.

Focus on Cybersecurity: With increasing cyber threats, banks are investing heavily in cybersecurity measures to protect customer data and prevent fraud.

Rise of Open Banking: Open banking initiatives are enabling third-party developers to access banking data and build innovative financial services.

Emphasis on User Experience: Banks are focusing on improving the user interface and user experience of their online banking platforms to enhance customer satisfaction.

Adoption of Cloud Computing: Cloud computing is enabling banks to scale their online banking infrastructure and reduce IT costs.

Market Opportunities:

Expansion into Emerging Markets: There is significant growth potential in emerging markets with increasing internet penetration and smartphone adoption.

Development of New Online Banking Services: Banks can expand their service offerings by introducing new online banking products, such as digital wallets, peer-to-peer payments, and investment advisory services.

Partnerships with Fintech Companies: Collaborating with fintech companies can help banks innovate and offer cutting-edge online banking solutions.

Leveraging Data Analytics: Banks can leverage data analytics to gain insights into customer behavior and offer personalized services.

Enhancing Cybersecurity Measures: Investing in advanced cybersecurity technologies can help banks protect customer data and build trust.

Implementation of Blockchain Technology: Blockchain technology can be used to enhance the security and transparency of online banking transactions.

Market Restraints:

Security Concerns: Concerns about data security and fraud can deter some customers from using online banking.

Digital Literacy: Lack of digital literacy among some segments of the population can limit the adoption of online banking.

Internet Connectivity: Limited or unreliable internet connectivity in some regions can hinder access to online banking services.

Regulatory Compliance: Banks must comply with various regulations related to data privacy and security, which can increase compliance costs.

Legacy Systems: Outdated IT infrastructure can limit the ability of some banks to offer advanced online banking services.

Resistance to Change: Some customers may be resistant to adopting new technologies and prefer traditional banking methods.

Market Challenges:

The Online Banking Market, while exhibiting substantial growth potential, faces a myriad of challenges that could impede its progress. One of the most significant hurdles is the escalating threat of cybercrime. As online banking platforms become more sophisticated, so do the tactics employed by cybercriminals. Data breaches, phishing, and malware attacks pose a constant risk to customer data and financial assets. Banks must continually invest in advanced security measures, such as multi-factor authentication, biometric verification, and real-time fraud detection systems, to mitigate these threats. However, even the most robust security protocols can be vulnerable to human error or sophisticated hacking techniques, making cybersecurity a never-ending battle.

Another challenge lies in bridging the digital divide. While internet penetration is increasing globally, significant disparities persist, particularly in developing countries and rural areas. Lack of access to reliable internet connectivity and affordable devices can exclude a large segment of the population from the benefits of online banking. Additionally, digital literacy remains a barrier for many individuals, especially older adults and those with limited education. Banks must invest in educational programs and user-friendly interfaces to make online banking accessible to a wider audience. Furthermore, regulatory compliance presents a complex and evolving challenge. Banks must navigate a patchwork of regulations related to data privacy, consumer protection, and anti-money laundering, which vary across jurisdictions. Keeping up with these regulatory changes and ensuring compliance can be costly and time-consuming.

Moreover, the integration of legacy systems with modern online banking platforms can be a significant technical challenge. Many banks still rely on outdated IT infrastructure that is not easily compatible with new technologies. Upgrading these systems can be expensive and disruptive, but it is essential for enabling seamless integration and enhancing the user experience. Furthermore, competition from fintech companies is intensifying. Fintech firms are disrupting the traditional banking landscape by offering innovative and user-friendly financial services that often bypass traditional banking channels. Banks must adapt to this competitive environment by embracing innovation, partnering with fintech companies, and developing their own cutting-edge online banking solutions. Finally, maintaining customer trust is paramount. Any security breach or service disruption can erode customer confidence and damage a bank's reputation. Banks must prioritize transparency, communication, and customer support to build and maintain trust in their online banking platforms.

Market Regional Analysis:

The Online Banking Market exhibits varying dynamics across different regions, influenced by factors such as internet penetration, smartphone adoption, regulatory frameworks, and consumer preferences. North America and Europe have mature online banking markets, driven by high internet penetration rates, advanced technological infrastructure, and strong regulatory oversight. These regions are characterized by a high adoption of mobile banking and a focus on enhancing user experience and cybersecurity.

Asia-Pacific is the fastest-growing region, fueled by increasing internet and smartphone penetration, a large unbanked population, and government initiatives promoting digital payments. Countries like China and India are witnessing rapid growth in online banking adoption, driven by the convenience and accessibility of mobile banking apps. Latin America and the Middle East & Africa are also experiencing growth in online banking, driven by increasing smartphone adoption and a growing demand for financial inclusion. However, these regions face challenges such as limited internet connectivity, low digital literacy, and security concerns. Overall, the Online Banking Market is expected to continue its growth trajectory across all regions, with Asia-Pacific leading the way.

Frequently Asked Questions:

Q: What is the projected growth rate of the Online Banking Market?

A: The Online Banking Market is projected to grow at a CAGR of 14.2% from 2024 to 2031.

Q: What are the key trends in the Online Banking Market?

A: Key trends include the dominance of mobile banking, integration of AI and machine learning, a focus on cybersecurity, the rise of open banking, and an emphasis on user experience.

Q: What are the most popular Online Banking types?

A: Retail Banking and Corporate Banking are currently the most popular Online Banking types.

https://www.linkedin.com/company/data-leap-driven/

https://www.linkedin.com/company/tech-leaders-insights/

https://www.linkedin.com/company/technology-foresights/

https://www.linkedin.com/company/futureforward24/

https://www.linkedin.com/company/catalyst-consulting-groups/

https://www.linkedin.com/company/techs-trends-unplugged/

https://www.linkedin.com/company/dynamic-solutions-hub24/

https://www.linkedin.com/company/next-gen-autotech/

https://www.linkedin.com/company/smarttech-pulse/

https://www.linkedin.com/company/market-tech-radar/"

Contact Us:

Consegic Business intelligence Pvt Ltd

Baner Road, Baner, Pune, Maharashtra - 411045

(US) (505) 715-4344

info@consegicbusinessintelligence.com

sales@consegicbusinessintelligence.com

Web - https://www.consegicbusinessintelligence.com/

About Us:

Consegic Business Intelligence is a data measurement and analytics service provider that gives the most exhaustive and reliable analysis available of global consumers and markets. Our research and competitive landscape allow organizations to record competing evolutions and apply strategies accordingly to set up a rewarding benchmark in the market. We are an intellectual team of experts working together with the winning inspirations to create and validate actionable insights that ensure business growth and profitable outcomes.

We provide an exact data interpretation and sources to help clients around the world understand current market scenarios and how to best act on these learnings. Our team provides on-the-ground data analysis, Portfolio Expansion, Quantitative and qualitative analysis, Telephone Surveys, Online Surveys, and Ethnographic studies. Moreover, our research reports provide market entry plans, market feasibility and opportunities, economic models, analysis, and an advanced plan of action with consulting solutions. Our consumerization gives all-inclusive end-to-end customer insights for agile, smarter, and better decisions to help business expansion.

Connect with us on:

LinkedIn - https://www.linkedin.com/company/consegic-business-intelligence/

YouTube - https://www.youtube.com/@ConsegicBusinessIntelligence22

Facebook - https://www.facebook.com/profile.php?id=61575657487319

X - https://x.com/Consegic_BI

Instagram - https://www.instagram.com/cbi._insights/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Banking Market Insights: Emerging Opportunities, Size Estimation & Forecast to 2032 here

News-ID: 4047233 • Views: …

More Releases from Consegic Business Intelligence Pvt. Ltd

Europe Pharmaceutical Manufacturing Equipment Market 2025 Industry Updates, Futu …

Introduction:

The Pharmaceutical Manufacturing Equipment Market is experiencing robust growth, driven by a confluence of factors reshaping the landscape of pharmaceutical production. Increasing global demand for pharmaceuticals, fueled by an aging population and the rise of chronic diseases, necessitates advanced and efficient manufacturing processes. Technological advancements, such as continuous manufacturing, automation, and digitalization, are revolutionizing traditional methods, improving production efficiency, reducing costs, and enhancing product quality. Stringent regulatory requirements and the…

Europe Vibration Damping Materials Market Size 2025 Overview, Manufacturers, Typ …

Introduction:

The Vibration Damping Materials market is experiencing significant growth, driven by the increasing demand for noise and vibration reduction across various industries. Key drivers include stringent environmental regulations, the growing automotive industry, particularly the electric vehicle (EV) sector, and the need for enhanced comfort and safety in residential and commercial buildings. Technological advancements in materials science are also playing a pivotal role, with the development of more efficient and durable…

Europe Lightweight Aggregates Market Size 2025 Emerging Technologies, Opportunit …

Introduction:

The Lightweight Aggregates Market is experiencing substantial growth driven by several key factors. Primarily, the increasing demand for sustainable and eco-friendly construction materials is fueling the adoption of lightweight aggregates. These materials offer superior insulation properties, reduced transportation costs, and contribute to the overall reduction of the carbon footprint of construction projects. Technological advancements in the production and application of lightweight aggregates are also playing a crucial role, enhancing their…

Europe Visible Light Communication Market Share, Growth, Size, Industry Trends, …

Introduction:

The Visible Light Communication (VLC) market is experiencing significant growth, driven by the increasing demand for faster, more secure, and energy-efficient communication technologies. VLC leverages light waves for data transmission, offering a complementary solution to traditional radio frequency (RF) based wireless communication. Key drivers include the proliferation of LED lighting, growing concerns about RF spectrum congestion, and the need for secure communication in sensitive environments. Technological advancements, such as improved…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…