Press release

Growing International Trade Boosts AI in Trade Finance Market: Key Factor Driving The Growth In The Artificial Intelligence (AI) In Trade Finance Market

The Artificial Intelligence (AI) In Trade Finance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Expected Artificial Intelligence (AI) In Trade Finance Market Size During the Forecast Period?

The artificial intelligence (AI) in trade finance market has expanded rapidly in recent years. It is projected to rise from $11.46 billion in 2024 to $13.62 billion in 2025, with a CAGR of 18.8%. The past growth was driven by the increasing need for enhanced risk management, rising demand for process automation, the shift toward digitalization, increasing complexity in global trade, stronger regulatory compliance requirements, and growing concerns about fraud in financial transactions.

The artificial intelligence (AI) in trade finance market is forecasted to experience rapid growth in the coming years. It is projected to reach $26.91 billion by 2029 at a CAGR of 18.6%. This growth will be driven by the increasing demand for automation, enhanced risk management capabilities, greater adoption of digital platforms, a stronger focus on regulatory compliance, the heightened need for fraud detection, and growing investments in high-performance computing infrastructure. Key trends during this period will include AI-blockchain integration, the adoption of AI-powered predictive analytics, AI-driven automation expansion, increased use of machine learning models, and the development of AI-enhanced customer service solutions.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19314

What Are the High-Growth Segments in the Artificial Intelligence (AI) In Trade Finance Market?

The artificial intelligence (AI) in trade finance market covered in this report is segmented -

1) By Component: Software, Services

2) By Technology: Machine Learning, Natural Language Processing (NLP), Robotic Process Automation (RPA), Predictive Analytics, Blockchain

3) By Deployment Mode: Cloud, On-Premises

4) By Application: Trade Documentation And Validation, Fraud Detection And Risk Management, Supply Chain Finance, Trade Credit Insurance, Trade Compliance And Monitoring, Other Applications

5) By End-User: Bank, Financial Institutions, Insurance Companies, Other End-Users

Subsegments:

1) By Software: AI-powered Trade Finance Platforms, Risk Assessment and Management Tools, Fraud Detection and Prevention Software, Document Processing and Automation Tools, Payment Processing Solutions

2) By Services: Consulting Services, Implementation and Integration Services, Training and Support Services, Data Analytics and Insights Services, Compliance and Regulatory Advisory Services

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19314&type=smp

What Key Drivers Are Expected to Influence Future Artificial Intelligence (AI) In Trade Finance Market Growth?

The growing volume of international trade is expected to drive AI adoption in the trade finance market. International trade involves buying and selling goods and services across borders. The increase in trade volume is due to reduced trade barriers and enhanced economic interdependence. AI in trade finance automates document generation, processing, and verification, improving efficiency and reducing errors. For instance, in February 2023, the Bureau of Economic Analysis reported that the US trade deficit reached $948.1 billion in 2022, with exports rising to $3,009.7 billion and imports growing to $3,957.8 billion. Hence, the rising international trade volumes are accelerating AI adoption in trade finance.

Which Companies Hold the Largest Share Across Different Artificial Intelligence (AI) In Trade Finance Market Segments?

Major companies operating in the artificial intelligence (AI) in trade finance market are HSBC Holdings plc, accenture* plc, International Business Machines Corporation, BNP Paribas SA, Oracle Corporation, SAP SE, Infosys Limited, Genpact LLC, Asseco Poland SA, Finastra Group Holdings Limited, Pegasystems Inc., Temenos AG, Appian Corporation, Tungsten Automation Corporation, ABBYY Solutions Ltd., Tradeshift Holdings Inc., Nucleus Software Exports Limited, Demica, Rossum, Cleareye.ai, Tradeteq Limited, Previse Ltd., Newgen Software Technologies Limited, Traydstream, TradeSun Inc

What Are the Major Trends Shaping the Artificial Intelligence (AI) In Trade Finance Market?

In the AI-driven trade finance market, key players are developing automated trade finance platforms to improve operational efficiency and reduce processing times. These platforms simplify and automate trade finance tasks, enhancing the efficiency and security of transactions, documentation, and compliance. For example, in October 2022, HSBC Holdings plc, a UK-based financial services firm, introduced HSBC Trade Solutions (HTS), a digital platform that simplifies and secures trade finance operations by allowing clients to handle all activities online. Designed with a modular, API-based approach, HTS offers an intuitive self-service interface and enhances efficiency through automation, integrating risk management features like anti-money laundering and fraud prevention controls.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/artificial-intelligence-ai-in-trade-finance-global-market-report

What Are the Emerging Geographies for The Artificial Intelligence (AI) In Trade Finance Market Growth?

North America was the largest region in the artificial intelligence (AI) in trade finance market in 2024. The regions covered in the artificial intelligence (AI) in trade finance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Artificial Intelligence (AI) In Trade Finance Market?

2. What is the CAGR expected in the Artificial Intelligence (AI) In Trade Finance Market?

3. What Are the Key Innovations Transforming the Artificial Intelligence (AI) In Trade Finance Industry?

4. Which Region Is Leading the Artificial Intelligence (AI) In Trade Finance Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Growing International Trade Boosts AI in Trade Finance Market: Key Factor Driving The Growth In The Artificial Intelligence (AI) In Trade Finance Market here

News-ID: 4046308 • Views: …

More Releases from The Business Research Company

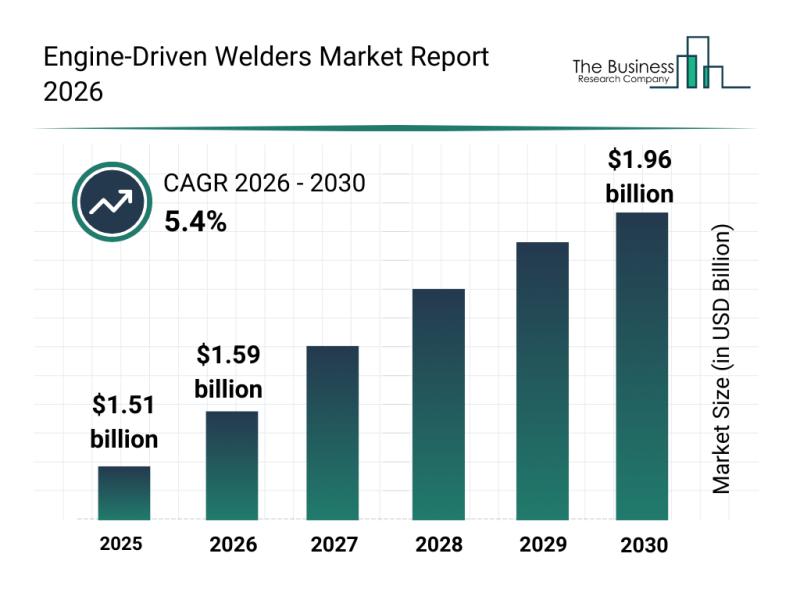

Top Players and Competitive Overview in the Engine-Driven Welders Market

The engine-driven welders market is set for notable expansion as demand across various industries continues to rise. With advancements in technology and growing infrastructure projects worldwide, this sector is poised for steady growth through 2030. Let's explore the market size forecasts, key players, emerging trends, and main segments shaping the future of engine-driven welders.

Projected Growth Trajectory of the Engine-Driven Welders Market

The engine-driven welders market is anticipated to reach a…

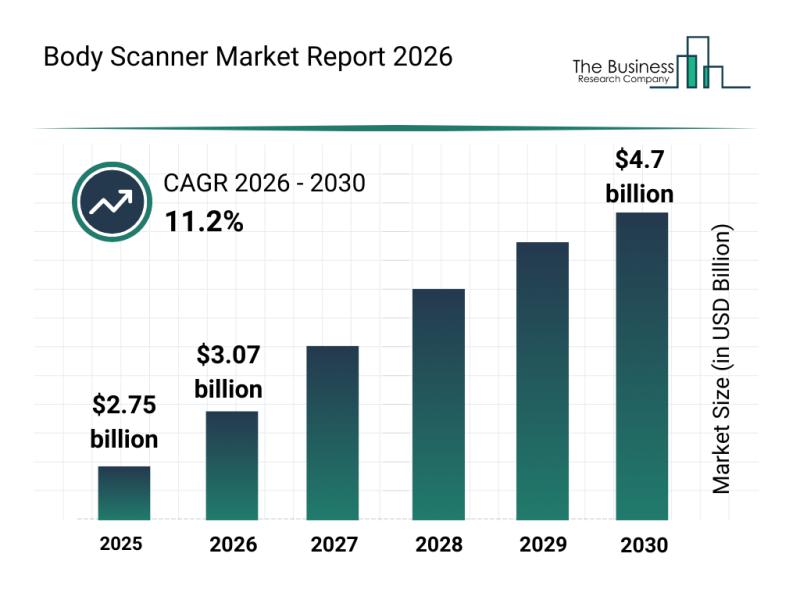

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Bo …

The body scanner market is gaining substantial momentum as security needs evolve worldwide. Driven by technological advances and increasing safety demands, this sector is set for notable expansion over the coming years. Let's explore the market's projected size, key players, emerging trends, and the main segments shaping its future.

Expected Market Size and Growth Trajectory of the Body Scanner Market

The body scanner industry is forecasted to grow significantly, reaching a…

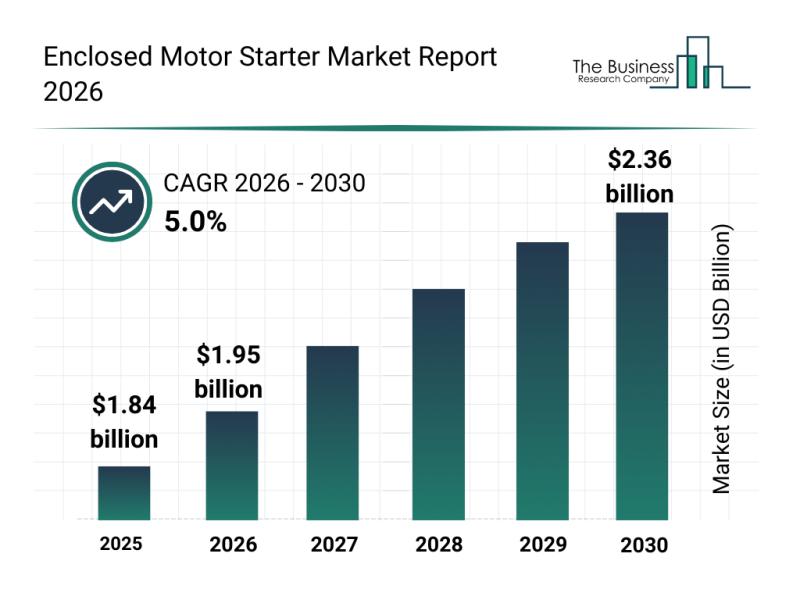

Future Perspectives: Key Trends Shaping the Enclosed Motor Starter Market Until …

The enclosed motor starter market is positioned for steady expansion over the coming years, driven by increasing adoption of advanced motor control technologies and industrial digitization. As industries seek more efficient and reliable motor management solutions, this market is set to witness notable growth. Below, we explore the market size projections, leading companies, emerging trends, and key segments shaping this sector's future.

Projected Growth and Market Size of the Enclosed Motor…

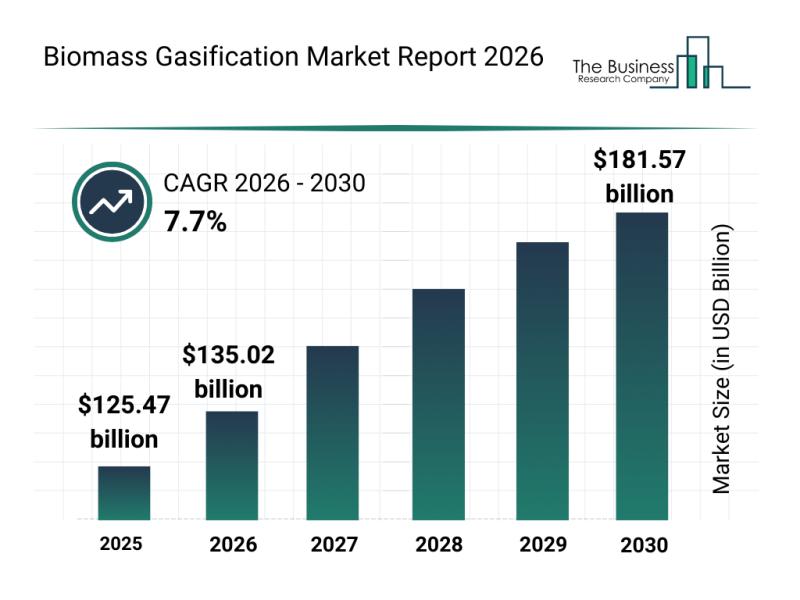

Leading Companies Reinforcing Their Presence in the Biomass Gasification Market

The biomass gasification sector is on the brink of substantial expansion, driven by a mix of technological progress and growing environmental concerns. As the world seeks cleaner and more sustainable energy sources, this market is set to play a critical role in the transition toward low-carbon alternatives. Here's an in-depth look at its anticipated growth, key players, emerging trends, and market segmentation.

Projected Market Size and Growth of the Biomass Gasification…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…