Press release

Telecommunication Insurance Market Report 2025-2034: Industry Overview, Trends, And Forecast Analysis

The Telecommunication Insurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Current Telecommunication Insurance Market Size and Its Estimated Growth Rate?

The telecommunication insurance market will grow from $10.84 billion in 2024 to $12.63 billion in 2025 at a CAGR of 16.6%. The growth in recent years is driven by the deployment of 4G and LTE networks, the rising risk of liability claims in the telecommunication sector, the expansion of telecommunication services, the increase in frequency and sophistication of cyber attacks, and heightened competition.

The telecommunication insurance market is forecast to grow rapidly to $23.07 billion by 2029 at a CAGR of 16.2%, supported by more cellular infrastructure, climate risks, regulatory changes, and data privacy concerns. Key trends include 5G network support, IoT integration, advanced technology use, and innovative insurance products.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18754

How Are Emerging Segments Shaping the Telecommunication Insurance Market Landscape?

The telecommunication insurance market covered in this report is segmented -

1) By Coverages: General Liability, Commercial Liability, Professional Liability Insurance, Other Coverages

2) By Enterprise Size: Large Enterprises, Small And Medium-Sized Enterprises

3) By Application: Equipment Manufacturer, Service Provider, Consultant

Subsegments:

1) By General Liability: Bodily Injury Coverage, Property Damage Coverage, Advertising Injury Coverage, Product Liability Coverage

2) By Commercial Liability: Premises Liability, Operations Liability, Completed Operations Liability, Workers' Compensation Coverage

3) By Professional Liability Insurance: Errors And Omissions (E And O) Insurance, Directors And Officers Liability (D&O), Cyber Liability Insurance

4) By Other Coverages: Equipment Breakdown Insurance, Business Interruption Insurance, Property Insurance, Vehicle Fleet Insurance, Network Infrastructure Insurance

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18754&type=smp

Which Growth Factors Are Influencing Telecommunication Insurance Market Expansion?

The expansion of the telecommunication sector is expected to stimulate the telecommunication insurance market. This sector, which facilitates data transmission and communication services, is growing due to higher data consumption and smartphone usage. Telecommunication insurance helps mitigate risks, covering areas such as property, liability, employee protection, and cyber threats. In July 2024, Ofcom reported that mobile telephony services in the UK generated £3.41 billion in retail revenues in the first quarter of 2024, reflecting a 7.2% increase from 2023. This expansion is propelling the telecommunication insurance market.

Who Are the Dominant Players Across Different Telecommunication Insurance Market Segments?

Major companies operating in the telecommunication insurance market are Allianz SE, Zurich Insurance Group Ltd., Liberty Mutual Insurance Company, The Travelers Companies Inc., Sompo International Holdings Ltd., Aon PLC, CNA Financial Corporation, Arthur J. Gallagher & Co., Chubb Limited, McGriff Insurance Services Inc., EMC Insurance Group Inc., The Hartford Financial Services Group Inc., QBE Insurance Group Limited, Acera Insurance, Farmers Union Insurance Company, CoverWallet Inc., Insureon, Tech Insurance, Bluestone Insurance Services Ltd., Anderson Lloyd International Ltd., Tower Street Insurance

What Are the Major Trends Shaping the Telecommunication Insurance Market?

Companies in the telecommunication insurance market are focusing on innovative policies like satellite in-orbit third-party liability insurance to address the risks associated with satellite launches, operations, and potential failures. This specialized insurance covers financial liabilities if a satellite damages third-party property or injures individuals while in orbit. In May 2024, Tata AIG, an India-based insurance company, launched its Satellite In-Orbit Third-Party Liability Insurance, which offers extensive coverage throughout a satellite's lifecycle and protects satellite manufacturers and operators from third-party claims.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/telecommunication-insurance-global-market-report

Which Geographic Regions Are Expected to Dominate the Telecommunication Insurance Market in the Coming Years?

North America was the largest region in the telecommunication insurance market in 2023. The regions covered in the telecommunication insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Telecommunication Insurance Market?

2. What is the CAGR expected in the Telecommunication Insurance Market?

3. What Are the Key Innovations Transforming the Telecommunication Insurance Industry?

4. Which Region Is Leading the Telecommunication Insurance Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Telecommunication Insurance Market Report 2025-2034: Industry Overview, Trends, And Forecast Analysis here

News-ID: 4044396 • Views: …

More Releases from The Business Research Company

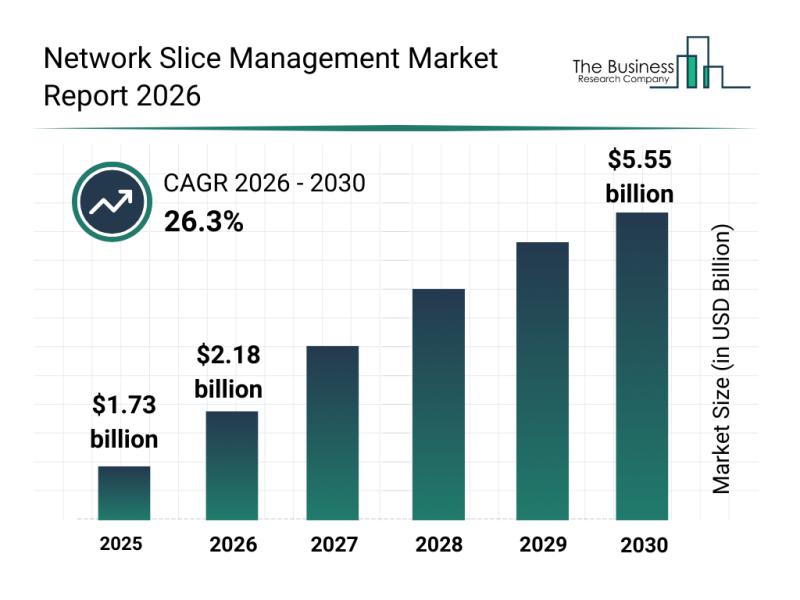

Future Perspectives: Key Trends Shaping the Network Slice Management Market Up t …

The network slice management market is positioned for remarkable expansion as demand for advanced, customizable network solutions continues to rise. This sector's growth is fueled by the surge in private 5G deployments, evolving network requirements driven by IoT, and cutting-edge AI applications enhancing network performance. Below, we explore the market's projected size, key players, emerging trends, and important segment details shaping its future.

How Large the Network Slice Management Market Will…

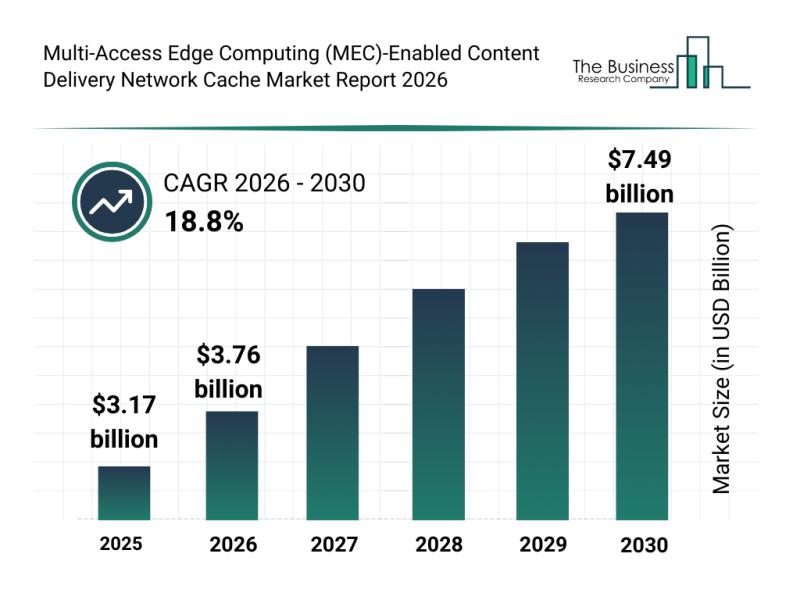

Analysis of Key Market Segments Driving the Multi-Access Edge Computing (MEC)-En …

The multi-access edge computing (MEC)-enabled content delivery network (CDN) cache market is set to expand rapidly in the coming years, driven by technological advancements and increasing demand for faster, more efficient content delivery. This sector is evolving as more industries embrace edge computing to enhance user experiences and reduce latency, creating significant growth opportunities.

Market Size Outlook of the MEC-Enabled Content Delivery Network Cache Market

The MEC-enabled content delivery network…

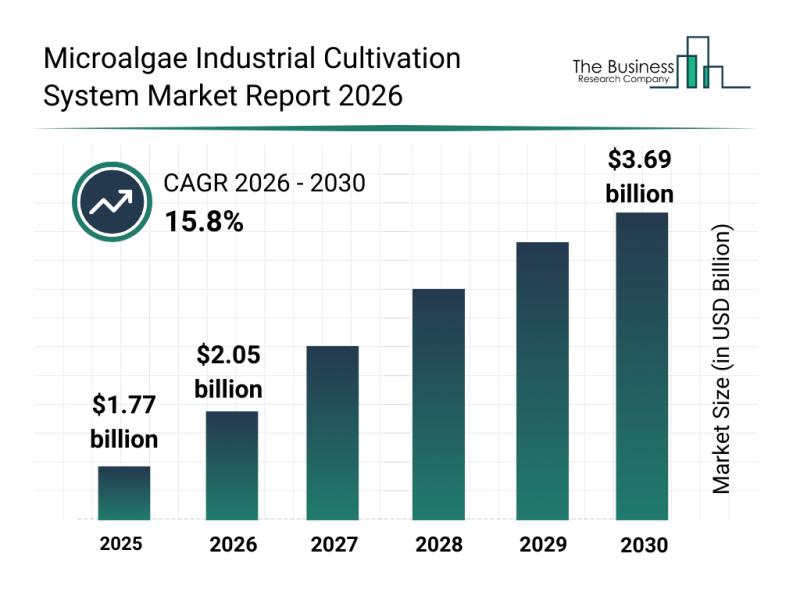

Global Trends Overview: The Rapid Evolution of the Microalgae Industrial Cultiva …

The microalgae industrial cultivation system market is on track for significant expansion in the coming years, driven by advances in technology and growing demand across various industries. This sector is evolving rapidly as companies innovate to boost biomass production and meet rising environmental standards. Let's explore the current market outlook, key players, emerging trends, and important segments shaping the future of microalgae cultivation systems.

Expected Market Valuation and Growth Trajectory of…

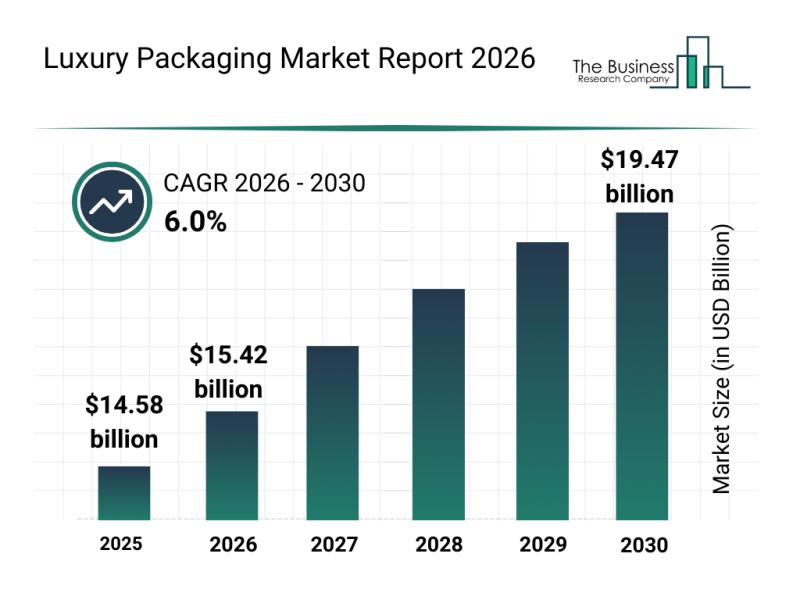

Leading Companies Reinforcing Their Presence in the Luxury Packaging Market

The luxury packaging sector is experiencing notable momentum as consumer preferences shift toward more refined and sustainable packaging solutions. With innovations in materials and technology, this market is set to expand significantly in the coming years. Here, we explore the market's anticipated size, key players, predominant trends, and the various segments that define this dynamic industry.

Projected Growth and Market Size of the Luxury Packaging Market

The luxury packaging market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…