Press release

Strong Growth Ahead: Insurance Aggregators Market Size To Grow At Arecord 24.3% Cagr By 2029

The Insurance Aggregators Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].How Big Is the Insurance Aggregators Market Size Expected to Be by 2034?

The insurance aggregators market size has grown exponentially in recent years. It will grow from $35.73 billion in 2024 to $44.53 billion in 2025 at a compound annual growth rate (CAGR) of 24.6%. The growth in the historic period can be attributed to an increasing number of aggregators and digital brokers, an increase in internet usage, the deepening use of the internet, the rise of digital influence, and growing healthcare expenditures.

The insurance aggregators market is forecasted to experience exponential growth, reaching $106.24 billion by 2029 at a CAGR of 24.3%. Growth is attributed to the rising use of customer behavioral analysis to improve operations, a growing number of aggregators and digital brokers, a rise in internet users, and increased digital influence. Key trends will include the implementation of analytics solutions, business intelligence tools, a comparative quote-based system, and extensive advertising to increase visibility.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=16712

What Are the Emerging Segments Within the Insurance Aggregators Market?

The insurance aggregators market covered in this report is segmented -

1) By Insurance Type: Life Insurance, Automotive Insurance, Health Insurance, Other Insurance Types

2) By Enterprise Type: Lead Generators, Call-Center Agencies, Digital Agencies

3) By Enterprise Size: Large Enterprise, Small And Medium Enterprises (SMEs)

4) By Distribution Channel: Online, Offline

Subsegments:

1) By Life Insurance: Term Life Insurance, Whole Life Insurance, Endowment Policies, Universal Life Insurance

2) By Automotive Insurance: Vehicle Insurance, Collision Insurance, Comprehensive Coverage, Liability Insurance

3) By Health Insurance: Individual Health Insurance, Family Health Insurance, Critical Illness Insurance, Dental and Vision Insurance

4) By Other Insurance Types: Travel Insurance, Property Insurance, Pet Insurance, Business Insurance, Homeowners Insurance

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16712&type=smp

What Long-Term Drivers Are Shaping Insurance Aggregators Market Trends?

The growing presence of digital brokers is expected to foster the insurance aggregator market. Digital brokers are platforms that facilitate financial transactions such as stock and insurance sales through online tools. Their appeal lies in offering customers better deals and streamlining access to multiple insurers, increasing competitiveness. Insurance aggregators benefit from digital brokers by utilizing advanced tools and robo-advisors that improve the customer experience and expand product access. For instance, in March 2024, Insurance Business reported that the fifteen Fast Brokerages achieved an average growth of 144% over two years, with the four Fast Starters recording 452% growth. Therefore, the rise of digital brokers is accelerating the insurance aggregator market.

Who Are the Top Competitors in Key Insurance Aggregators Market Segments?

Major companies operating in the insurance aggregators market are InsuranceDekho Services Private Limited, One97 Communications Limited, Acko General Insurance Limited, TurtleMint Technologies Private Limited, CHECK24 Vergleichsportal GmbH, Go Digit General Insurance Limited, The Zebra Insurance Services LLC, Gocompare.com Limited, Hippo Comparative Services (Pty) Ltd, Huize Holding Limited, OneInsure Online Solutions Private Limited, Policybazaar Insurance Web Aggregator Private Limited, RenewBuy Insurance Services Private Limited, Acierto.com S.L.U., Toffee Insurance Broking Private Limited, Rastreator.com Correduría de Seguros S.L.U., PolicyX.com Insurance Web Aggregator Private Limited, Insurify Insurance Services Inc., LesFurets.com SAS, Covernest Insurance Web Aggregator Private Limited, Singsaver Insurance Brokers Pte. Ltd., GoBear Limited, LeLynx SAS, MoneyHero Insurance Brokers Limited, SureHits LLC, Tarifcheck.de AG

What Are the Major Trends Shaping the Insurance Aggregators Market?

Leading businesses within the insurance aggregator sector are implementing contemporary technologies like AI-empowered health insurance schemes to amplify plan contrasts and personalization, therefore refining the consumer experience. AI-powered health insurance schemes utilize artificial intelligence to improve facets such as risk evaluation, claim processing, individualized suggestions, fraud identification, and customer assistance. For instance, ICICI Lombard, an insurance firm based in India, unveiled Elevate in July 2024. The Elevate health insurance plan by ICICI Lombard provides personalized protection with benefits such as limitless insured sums, infinite claim amounts, and minimal waiting periods for pre-existing conditions. The scheme employs AI for proficient claim processing and incorporates wellness programs for encouraging healthy lifestyles. The plan's objective is to deliver all-inclusive financial safeguarding alongside tranquillity in managing medical expenses.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/insurance-aggregators-global-market-report

Which Regions Are Becoming Hubs for Insurance Aggregators Market Innovation?

North America was the largest region in the insurance aggregators market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the insurance aggregators market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Insurance Aggregators Market?

2. What is the CAGR expected in the Insurance Aggregators Market?

3. What Are the Key Innovations Transforming the Insurance Aggregators Industry?

4. Which Region Is Leading the Insurance Aggregators Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Strong Growth Ahead: Insurance Aggregators Market Size To Grow At Arecord 24.3% Cagr By 2029 here

News-ID: 4043964 • Views: …

More Releases from The Business Research Company

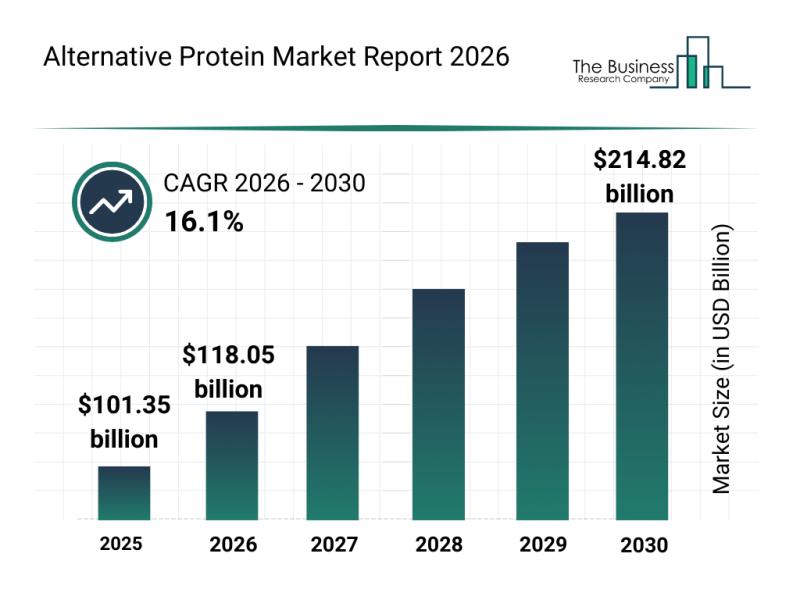

Alternative Protein Market Overview, Key Trends, and Insights on Top Players

The alternative protein sector is on the brink of remarkable expansion, driven by innovation and shifting consumer preferences toward sustainable nutrition. As new technologies emerge and applications broaden, this market is set to transform how protein sources are produced and consumed globally. Let's explore the anticipated market value, key players, influential trends, and segment breakdowns shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Alternative Protein Market …

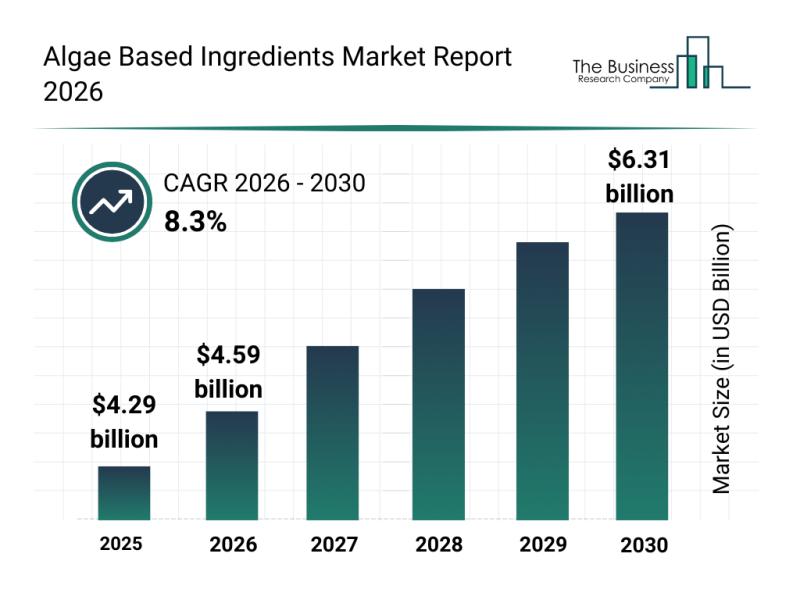

Leading Companies Enhancing Their Presence in the Algae Based Ingredients Market

The algae-based ingredients industry is gaining considerable traction as consumers and manufacturers alike seek more sustainable and innovative alternatives in various sectors. From food to pharmaceuticals, algae-derived components are becoming essential in meeting the rising demand for eco-friendly and health-conscious products. Let's explore the current market outlook, key players, influential trends, and segmentation within this expanding field.

Projected Market Size and Growth of the Algae Based Ingredients Market

The algae-based…

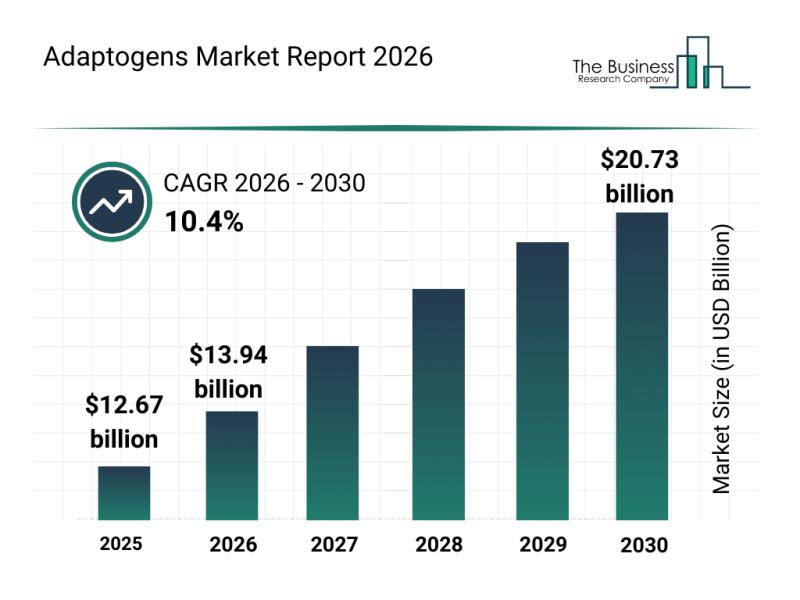

Global Factors Influencing the Rapid Development of the Adaptogens Market

The adaptogens market is on track for significant expansion over the coming years, driven by an increasing consumer interest in natural wellness solutions. As more people seek ways to manage stress and improve mental health, adaptogens are becoming a popular choice in various products. This growing trend is reflecting in the market's promising future outlook.

Projected Growth and Valuation of the Adaptogens Market by 2030

The adaptogens market is anticipated…

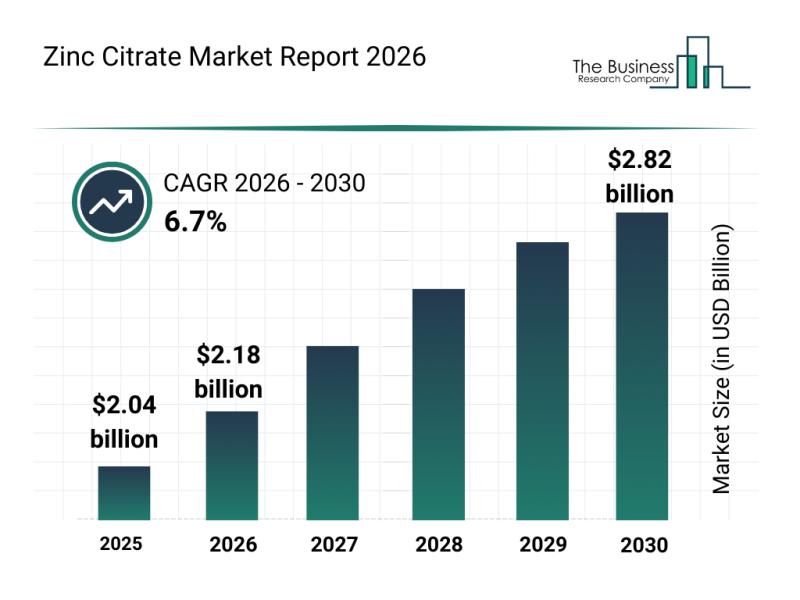

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the Z …

The zinc citrate market is set to experience significant growth over the coming years, driven by several health and regulatory factors. With increasing consumer interest in preventive healthcare and clean-label products, this market is evolving rapidly. Let's explore the current market size, major players, emerging trends, and the segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Zinc Citrate Market

The zinc citrate market is anticipated…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…