Press release

Car Leasing Market Size Projected at USD 1369.9 Billion by 2034 as Consumers Shift to Cost-Efficient Transportation - TMR Forecast

Market Size-According to Transparency Market Research, the global car leasing market is projected to grow from USD 594.1 billion in 2023 to USD 1,369.9 billion by 2034, registering a compound annual growth rate (CAGR) of 7.8% during the forecast period

Don't miss out on the latest market intelligence. Get your sample today@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=42395

Market Overview-

The Car Leasing Market involves leasing cars to consumers and businesses for fixed periods in exchange for periodic payments. This market has gained popularity as an alternative to car ownership, allowing individuals and companies to access vehicles without large upfront costs or long-term commitments. Leasing offers flexibility, financial benefits, and maintenance packages, making it an attractive option for both individual and corporate customers.

Market Description-

Car leasing offers a convenient and cost-effective alternative to owning a vehicle. Leasing options range from short-term rentals to long-term leases (often two to five years). During the lease term, lessees benefit from lower monthly payments compared to loan payments, potential tax benefits (for businesses), and access to newer vehicle models with the latest features and technology. Lease agreements typically include maintenance packages, insurance, and warranties, further adding to the convenience.

Key Players-

• Ayvens Group

• American Electric Power Company, Inc.

• Arval BNP Paribas Group

• Avis Budget Group, Inc.

• The Caldwell Company

• Mercedes-Benz Financial Services

• Deutsche Leasing AG

• Element Fleet Management Corp.

• Emkay Global Financial Services Ltd.

• Enterprise Holdings, Inc.

• Europcar Mobility Group

• Ewald Automotive Group

• Lex Autolease Limited

Key Player Strategies-

• Digitalization: Investing in mobile apps and online platforms to streamline the leasing process, enabling customers to choose and manage leases remotely.

• Flexible Leasing Options: Providing customizable terms, mileage limits, and vehicle choices to cater to a wide range of customers.

• Expansion into Emerging Markets: Capitalizing on rising demand in Asia-Pacific and Latin America with localized services.

• Sustainability: Incorporating electric and hybrid vehicle options in their fleet to cater to environmentally conscious customers.

• Fleet Management Solutions: For corporate clients, offering tools to monitor, analyze, and optimize fleet performance and cost-efficiency.

Discuss Implications for Your Industry Request Sample Research PDF@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=42395

Key Drivers of Market Growth

Cost-Effective Mobility Solutions: Car leasing offers consumers and businesses a flexible alternative to vehicle ownership, reducing upfront costs and providing predictable monthly payments. This model appeals to those seeking financial efficiency and adaptability in transportation.

Shift Towards Access Over Ownership: There's a growing trend, especially among younger demographics, favoring access to vehicles without the long-term commitment of ownership. Leasing aligns with this preference, offering the latest vehicle models without the responsibilities of ownership.

Rise of Electric and Hybrid Vehicles: Environmental concerns and stringent emission regulations are driving the demand for electric and hybrid vehicles. Leasing provides an accessible avenue for consumers to experience these vehicles without the higher upfront costs associated with purchasing.

Technological Advancements: The integration of digital platforms and AI-powered leasing models is streamlining the leasing process, enhancing customer experience, and expanding market reach.

GlobeNewswire

Corporate Fleet Solutions: Businesses are increasingly adopting leasing for fleet management, benefiting from cost savings, flexibility, and the ability to regularly update their vehicle inventory.

Market Segmentation Insights

Lease Types: The market encompasses various lease types, including closed-end, open-end, single-payment, subvented, and high-mileage leases, catering to diverse consumer needs.

Leasing Models: Both finance leases (subscription-based and traditional) and operating leases are prevalent, offering options based on usage patterns and financial considerations.

Challenges-

• Depreciation Costs: Leasing companies bear the risk of depreciation, which can be unpredictable due to market fluctuations.

• Mileage Limits and Wear-and-Tear: Striking a balance between favorable lease terms and protecting against high mileage or excessive wear and tear.

• Residual Value Risks: Residual values may not meet initial projections due to changes in demand or economic downturns, impacting profitability.

• Rising Competition: The market faces intense competition from car subscription services and other alternative mobility solutions.

Opportunities-

• Growing Demand for EV Leases: Rising interest in electric vehicles (EVs) creates new leasing opportunities, with companies offering EV-specific packages.

• Urbanization and Rising Middle-Class Income: Urban population growth and increased disposable incomes drive leasing demand, especially in emerging markets.

• Flexible Lease Terms: Short-term, flexible leasing options cater to gig economy workers, travelers, and businesses looking to reduce long-term commitments.

• Corporate Leasing and Fleet Management: Companies seek cost-effective fleet solutions, presenting growth potential in the corporate leasing segment.

Market Segmentations-

By Lease Type

• Open-End Lease: Primarily used by businesses, allowing flexibility with a less restrictive mileage cap.

• Closed-End Lease: Common among individuals, involving fixed terms and mileage limits, with no obligation to buy at lease-end.

By Vehicle Type

• Passenger Cars: Includes sedans, hatchbacks, SUVs, and luxury cars primarily leased for personal use.

• Commercial Vehicles: Includes trucks, vans, and light-duty vehicles used by companies for business operations.

By Lease Duration

• Short-Term Leasing: Leases typically lasting up to 24 months, often used by individuals or companies with short-term needs.

• Long-Term Leasing: Leases exceeding 24 months, popular among businesses and individuals seeking a more permanent vehicle solution.

By End User

• Individual: People leasing cars for personal use, attracted by the flexibility and lower financial commitment.

• Corporate: Companies leasing vehicles for employees or fleet purposes, seeking tax advantages, and reduced operational costs.

By Region

• North America: High demand due to rising vehicle prices, awareness of leasing benefits, and adoption by businesses.

• Europe: Established market with a significant share in corporate leasing, fueled by high ownership costs and environmental considerations.

• Asia-Pacific: Fast-growing segment, driven by increasing awareness, urbanization, and demand for convenient transportation.

• Latin America and Middle East & Africa: Emerging markets with opportunities for growth due to rising middle-class income levels and demand for affordable vehicle access.

To buy this comprehensive market research report, click here to inquire@ https://www.transparencymarketresearch.com/checkout.php?rep_id=42395<ype=S

Why Buy This Report?

• Detailed Market Insights: Underst

and the Car Leasing Market dynamics, including growth factors, market size, and emerging trends.

• Comprehensive Segment Analysis: Get in-depth insights into different leasing types, vehicle types, lease durations, and customer segments.

• Competitive Landscape Overview: Analyze leading players and their strategies to navigate competition and leverage market opportunities.

• Projections and Forecasts: Access future market projections and forecasts to aid strategic planning and decision-making.

• Opportunity Identification: Recognize potential growth areas, from EV leasing to corporate fleet solutions and emerging markets.

• Actionable Recommendations: Gain valuable insights into market challenges and recommendations for maximizing growth and profitability.

More Trending Research Reports-

• Remote Operated Vehicle (ROV) Market - https://www.prnewswire.com/news-releases/remote-operated-vehicle-rov-market-to-expand-at-a-cagr-of-3-11-during-forecast-period-opines-tmr-301396817.html

• Automotive Electronics Control Management Market - https://www.globenewswire.com/news-release/2024/10/21/2966588/32656/en/Automotive-Electronics-Control-Management-Market-Size-Expected-to-Attain-USD-48-0-Billion-by-2031-Growing-at-a-5-7-CAGR-Amid-Rising-EV-Adoption-Transparency-Market-Research-Project.html

About Us Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. The firm scrutinizes factors shaping the dynamics of demand in various markets. The insights and perspectives on the markets evaluate opportunities in various segments. The opportunities in the segments based on source, application, demographics, sales channel, and end-use are analysed, which will determine growth in the markets over the next decade.

Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision-makers, made possible by experienced teams of Analysts, Researchers, and Consultants. The proprietary data sources and various tools & techniques we use always reflect the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in all of its business reports.

Contact us

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Blog: https://tmrblog.com

Email: sales@transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Car Leasing Market Size Projected at USD 1369.9 Billion by 2034 as Consumers Shift to Cost-Efficient Transportation - TMR Forecast here

News-ID: 4043344 • Views: …

More Releases from Transparency Market Research Pvt Ltd

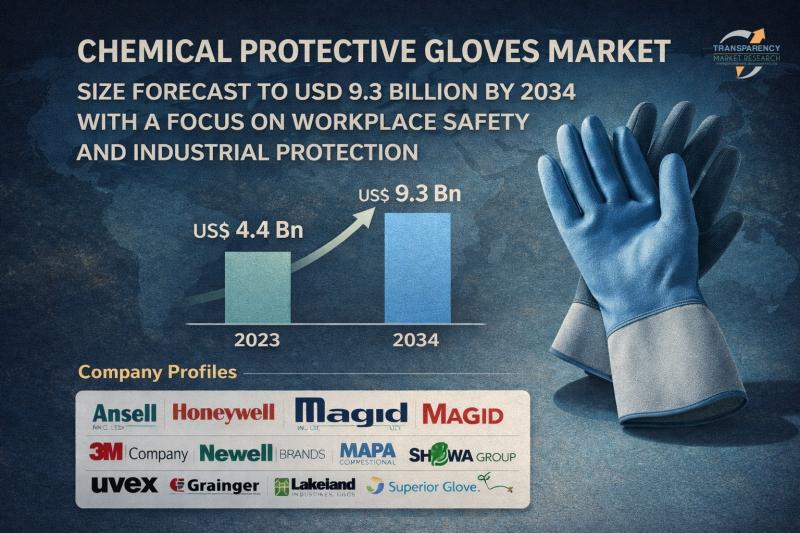

Chemical Protective Gloves Market Size Forecast to USD 9.3 Billion by 2034 with …

Chemical Protective Gloves Market Outlook 2034

The global chemical protective gloves industry was valued at US$ 4.4 Bn in 2023 and is projected to reach US$ 9.3 Bn by the end of 2034, expanding at a steady CAGR of 7.0% from 2024 to 2034. Market growth is primarily driven by stringent workplace safety regulations, rising awareness regarding occupational hazards, and increasing demand across chemical, healthcare, oil & gas, and manufacturing industries.

👉…

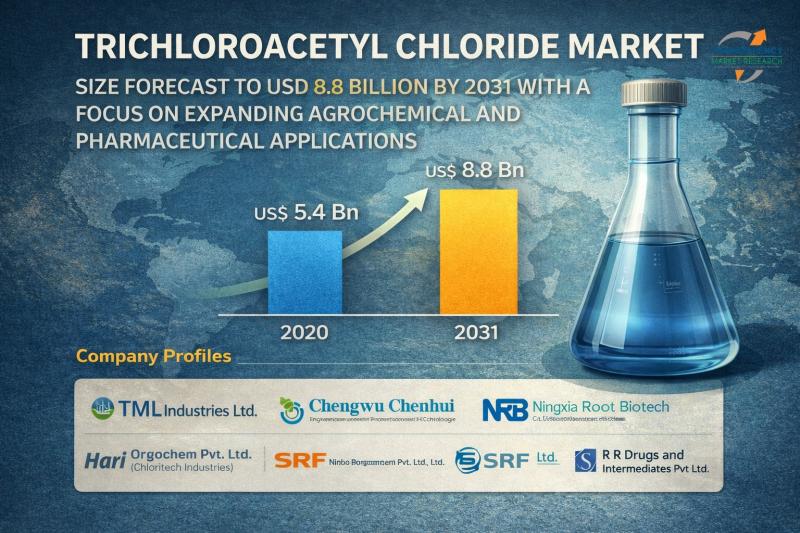

Trichloroacetyl Chloride Market Size Forecast to USD 8.8 Billion by 2031 with a …

Trichloroacetyl Chloride Market Market Size to 2031

The global trichloroacetyl chloride market was valued at over US$ 5.4 billion in 2020. It is estimated to expand at a CAGR of 4.6% from 2021 to 2031, and is expected to surpass US$ 8.8 billion by the end of 2031. Sustained growth is driven by increasing industrial chemical demand, rising pharmaceutical and agrochemical production, and expanding applications in specialty chemical synthesis worldwide.

👉 Get…

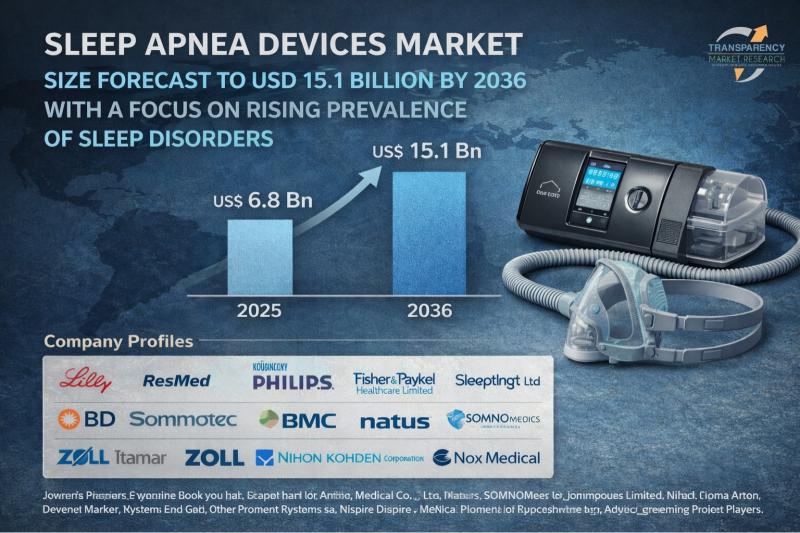

Sleep Apnea Devices Market Size Forecast to USD 15.1 Billion by 2036 with a Focu …

Sleep Apnea Devices Market Outlook 2036

The global sleep apnea devices market was valued at US$ 6.8 Bn in 2025 and is projected to reach US$ 15.1 Bn by 2036, expanding at a steady CAGR of 7.5% from 2026 to 2036. Market growth is primarily driven by the rising prevalence of obstructive sleep apnea (OSA), increasing awareness about sleep disorders, and technological advancements in positive airway pressure (PAP) devices and wearable…

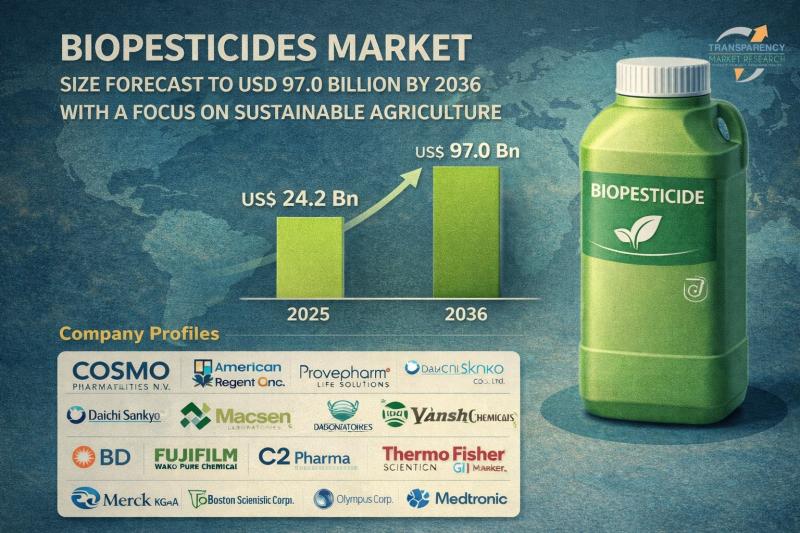

Biopesticides Market Size Forecast to USD 97.0 Billion by 2036 with a Focus on S …

Biopesticides Market Outlook 2036

The global biopesticides market was valued at US$ 24.2 Bn in 2025 and is projected to reach US$ 97.0 Bn by 2036, expanding at a robust CAGR of 13.5% from 2026 to 2036. The market growth is primarily driven by the increasing shift toward sustainable agriculture, rising demand for organic food products, and stringent regulations on synthetic chemical pesticides worldwide.

👉 Do not miss the latest market intelligence.…

More Releases for Leasing

Financial Leasing Market: A Compelling Long-Term Growth Story | Minsheng Financi …

The latest 94+ page survey report on Financial Leasing Market is released by HTF MI covering various players of the industry selected from global geographies like North America, US, Canada, Mexico, Europe, Germany, France, U.K., Italy, Russia, Nordic Countries, Benelux, Rest of Europe, Asia, China, Japan, South Korea, Southeast Asia, India, Rest of Asia, South America, Brazil, Argentina, Rest of South America, Middle East & Africa, Turkey, Israel, Saudi Arabia,…

Financial Leasing Market 2019 Global Major Players: CDB Leasing, ICBC Financial …

The Global Financial Leasing Industry, 2019-2024 Market Research Report is a professional and in-depth study on the current state of the Global Financial Leasing industry with a focus on the Global market. The report provides key statistics on the market status of the Financial Leasing manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

The report displays significant strategies which are…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report: https://www.researchreportsinc.com/sample-request?id=177516

Over the next five years, RRI…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

Oct 2018, New York USA (News) - A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report:…

Financial Leasing Market by Top Key Participant CDB Leasing, ICBC Financial Leas …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Get Sample Copy of this Report @ https://www.researchbeam.com/global-financial-leasing-by-manufacturers-countries-type-and-application-forecast-to-2023-market/request-sample?utm_source=Anil

Scope of the Report:

This report studies the Financial Leasing market…