Press release

Microfinance Market Anticipated To Witness Robust Growth, Surpassing $368.02 Billion By 2029

The Microfinance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Current Microfinance Market Size and Its Estimated Growth Rate?

The microfinance market size has expanded rapidly in recent years. It is projected to grow from $215.51 billion in 2024 to $240.49 billion in 2025 at a compound annual growth rate (CAGR) of 11.6%. The historical growth can be credited to rising digital adoption, commercialization and sustainability initiatives, increased focus on responsive lending, broader access to credit facilities, and the rising use of online lending platforms.

The microfinance market is expected to grow rapidly, reaching $368.02 billion by 2029, with a compound annual growth rate (CAGR) of 11.2%. This growth is driven by evolving regulatory frameworks, a rising focus on environmental sustainability, increasing interest in socially responsible investing, growing demand for microfinance loans, and financial inclusion. Key trends include the integration of cloud computing, biometrics, and digital identity, microinsurance and parametric insurance, embedded payments and insurance, and the standardization of digital operations.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18671

How Are Emerging Segments Shaping the Microfinance Market Landscape?

The microfinance market covered in this report is segmented -

1) By Service Type: Group And Individual Micro Credit, Leasing, Micro Investment Funds, Insurance, Savings And Checking Accounts, Other Service Types

2) By Providers: Banks, Micro Finance Institutions (MFI), NBFC (Non-Banking Financial Institutions), Other Provider

3) By Purpose: Agriculture, Manufacturing Or Production, Trade And Services, Household, Other Purposes

4) By End-Users: Small Enterprises, Micro Enterprises, Solo Entrepreneurs Or Self-Employed

Subsegments:

1) By Group And Individual Micro Credit: Group Lending Programs Or Individual Micro Loans

2) By Leasing: Equipment Leasing Or Vehicle Leasing Or Real Estate Leasing

3) By Micro Investment Funds: Equity Funds Or Debt Funds Or Hybrid Funds

4) By Insurance: Micro Life Insurance Or Micro Health Insurance Or Micro Property Insurance

5) By Savings And Checking Accounts: Micro Savings Accounts Or Micro Checking Accounts

6) By Other Service Types: Remittance Services Or Payment Solutions Or Financial Literacy Programs

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18671&type=smp

Which Growth Factors Are Influencing Microfinance Market Expansion?

In the microfinance market, the growth of small and medium-sized enterprises (SMEs) is expected to be a key driver. SMEs, characterized by smaller revenue, assets, and employee numbers, are increasing due to entrepreneurial innovation, technological advancements, and supportive government policies. Microfinance provides vital financial services, such as small loans, that help these businesses grow and thrive. According to a report, new SME businesses surged by 19.5% in 2023, demonstrating a rise in entrepreneurship. This trend is driving demand for microfinance services to support business growth.

Who Are the Dominant Players Across Different Microfinance Market Segments?

Major companies operating in the microfinance market are Bank Rakyat Indonesia (BRI), Oliver Wyman Group, Bandhan Bank Limited, LendingClub Corporation, ASA International Group PLC, Accion International, Annapurna Finance Private Limited, PRASAC Microfinance Institution Ltd., Prosper Marketplace Inc, Madura Microfinance Ltd., Compartamos Banco, Pro Mujer International, Oikocredit International, Ujjivan Financial Services, Fundación Génesis Empresarial (FGE), Kiva Microfunds, Gojo & Company Inc., FINCA International, Fonkoze Financial Services S.A., Cashpor Micro Credit, Opportunity International, BSS Microfinance Limited, Asirvad Microfinance Limited

What Are the Major Trends Shaping the Microfinance Market?

Key enterprises within the microfinance market are concentrating on creating innovative solutions through technological advancement, such as electronic platforms, to increase accessibility, optimize operations, and boost the financial integration for underserved communities. These digital platforms, which are online systems allowing users to network, communicate and exchange commodities, services or data, simplify business dealings, communication and the sharing of content. For example, in August 2023, The Reserve Bank of India (RBI), the central bank of India, initiated the Public Tech Platform for Frictionless Credit. The objective of this platform is to enhance credit accessibility for micro, small, and medium enterprises (MSMEs). The program is intended to optimize credit distribution through financial establishments, thereby advancing financial inclusion.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/microfinance-global-market-report

Which Geographic Regions Are Expected to Dominate the Microfinance Market in the Coming Years?

Asia-Pacific was the largest region in the microfinance market in 2024, and is expected to be the fastest-growing region in the forecast period. The regions covered in the microfinance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Microfinance Market?

2. What is the CAGR expected in the Microfinance Market?

3. What Are the Key Innovations Transforming the Microfinance Industry?

4. Which Region Is Leading the Microfinance Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microfinance Market Anticipated To Witness Robust Growth, Surpassing $368.02 Billion By 2029 here

News-ID: 4042000 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Approaches Influencing the R …

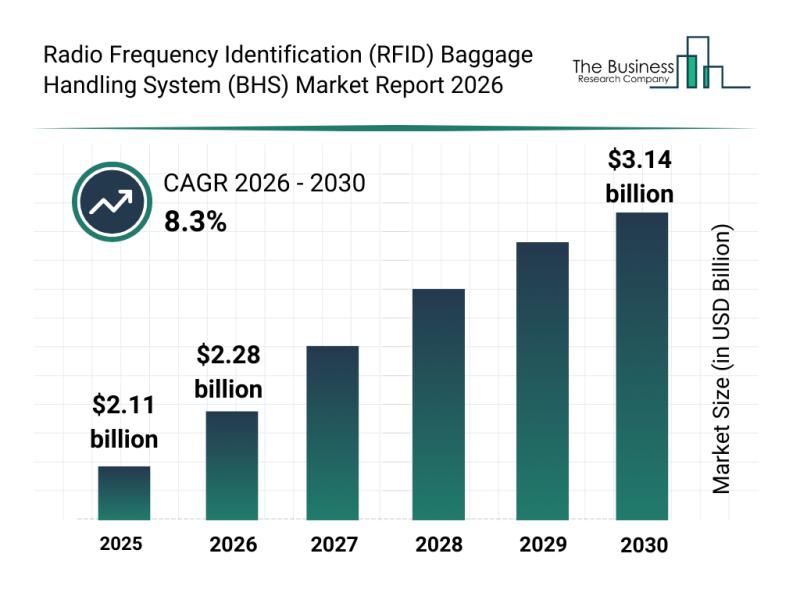

The radio frequency identification (RFID) baggage handling system (BHS) market is set to experience significant growth over the coming years, driven by advancements in airport technology and evolving passenger needs. As airports continue to modernize and automate their operations, the demand for efficient baggage handling solutions is increasing rapidly. This overview explores the market's size, influential players, emerging trends, and key segments shaping its future.

Projecting the Radio Frequency Identification Baggage…

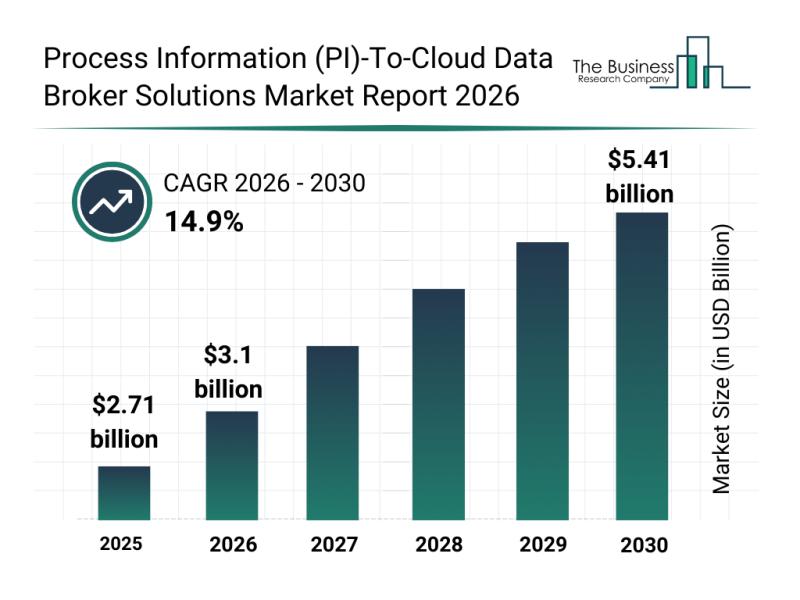

Leading Industry Participants Reinforce Their Presence in the Process Informatio …

The process information (PI)-to-cloud data broker solutions industry is positioned for significant expansion as digital transformation accelerates across industrial sectors. Increasing demand for real-time data access and seamless integration between operational technology (OT) and information technology (IT) systems is driving rapid innovations and investments. Let's explore the market size projections, key players, emerging trends, and segment insights shaping this evolving landscape.

Projected Market Size Growth in the Process Information (PI)-To-Cloud Data…

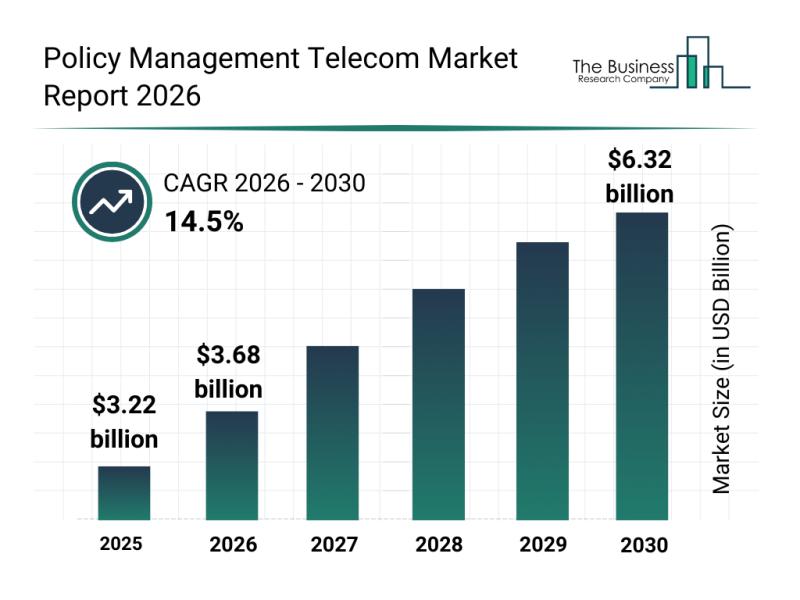

Future Perspective: Key Trends Shaping the Policy Management Telecom Market Up t …

The policy management telecom sector is set to experience significant expansion over the coming years, driven by technological advances and growing network demands. This evolving market is playing a crucial role in supporting the complex needs of modern telecom operators, enabling more efficient management and automation of network policies. Below, we explore the current market size projections, leading companies, key trends, and segmentation details that define this dynamic industry.

Strong Growth…

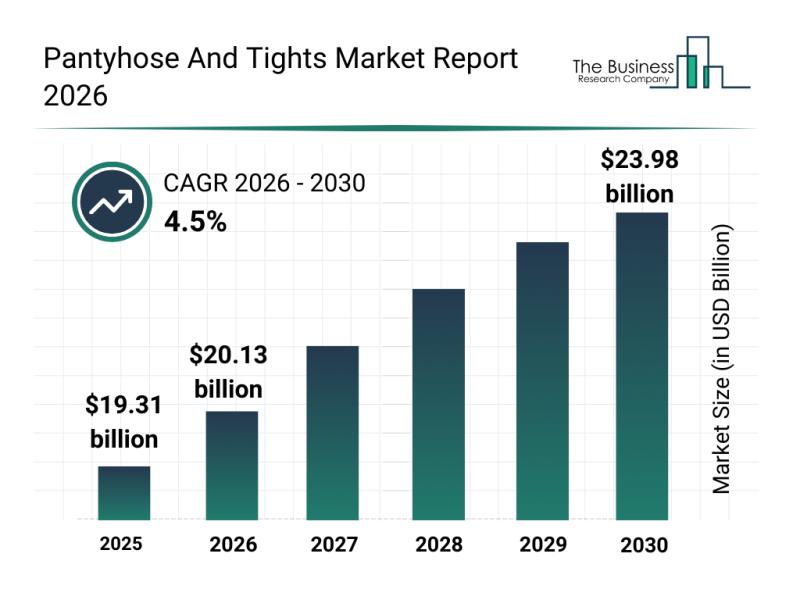

Competitive Analysis: Key Market Leaders and New Entrants in the Pantyhose and T …

The pantyhose and tights market is set to witness consistent growth as consumer preferences evolve and new trends gain traction. With increasing emphasis on sustainability, comfort, and style, this sector is poised for meaningful expansion through 2030. Let's dive into the market's valuation, key players, emerging trends, and segmentation to understand the trajectory of this dynamic industry.

Forecasted Market Value and Growth Rate of the Pantyhose and Tights Market

The…

More Releases for Micro

Micro and Ultra-Micro Balances Market Size Report 2025

"Global Micro and Ultra-Micro Balances Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Micro and Ultra-Micro Balances market, including Micro and Ultra-Micro Balances market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings,…

Micro Mobility Revolution: Exploring the Growing Micro Cars Market

The term micro car is used for small-sized and lightweight cars, with an engine small than 700 cc. Bubble cars, cycle cars and quadricycles are defined as micro cars. This is usually three-wheeled and four-wheeled vehicle, available for personal and commercial usage. It is often used as a second or commuter car due to its low cost and fuel efficiency. This car is suitable for urban and suburban environment, as…

Micro Injection Molded Plastic Market worth $1,692 million by 2026 | Key players …

According to recent market research the "Micro Injection Molded Plastic Market by Material Type (Liquid-Crystal Polymer (LCP), Polyether Ether (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM)), Application and Region - Global Forecast to 2026", published by MarketsandMarkets, the micro injection molded plastic market is projected to reach USD 1,692 million by 2026, at a CAGR of 11.2% from USD 995 million in 2021.

Micro injection molded plastics are made of micro…

Micro Combined Heat & Power (Micro CHP) Market 2022 | Detailed Report

The Micro Combined Heat & Power (Micro CHP) research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the Micro Combined Heat & Power (Micro CHP) research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope,…

Micro-Invasive Glaucoma Implants Micro-Invasive Glaucoma Implants

Global Micro-Invasive Glaucoma Implants Market Definition: Micro-invasive glaucoma implants is performed for the treatment of the open- angle glaucoma and is done through an ab- interno approach. It is very safe and provides faster recovery as compared to the traditional methods. They usually lower the intraocular by increasing the flow or reducing the production of the aqueous humor. Increasing cases of the glaucoma worldwide is the major factor fueling the…

Comprehensive Analysis On Micro Welding Equipment Market 2019 : Pro-Fusion, OR L …

Up Market Research added a new Micro Welding Equipment Market research report for the period of 2019 – 2026. Report focuses on the major drivers and restraints providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

Get Sample Copy Of This Report @

https://www.upmarketresearch.com/home/requested_sample/108038

The report contains 112 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing…