Press release

Saudi Arabia Venture Capital Investment Market 2025 | Worth USD 13.4 Billion by 2033

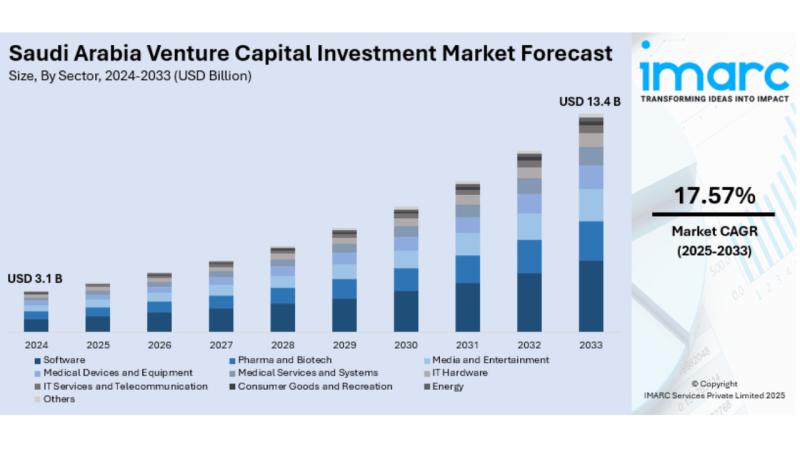

The latest report by IMARC Group, titled "Saudi Arabia Venture Capital Investment Market Size, Share, Trends and Forecast by Sector, Fund Size, Funding Type, and Region, 2025-2033," offers a comprehensive analysis of the Saudi Arabia venture capital investment market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Saudi Arabia venture capital investment market size reached USD 3.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.4 Billion by 2033, exhibiting a growth rate (CAGR) of 17.57% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 3.1 Billion

Market Forecast in 2033: USD 13.4 Billion

Market Growth Rate 2025-2033: 17.57%

Saudi Arabia Venture Capital Investment Market Overview

The Saudi Arabia wander capital venture showcase is encountering critical development, driven by strong government back beneath Vision 2030, expanding outside and corporate ventures, and a flourishing startup biological system. Key segments such as fintech, e-commerce, and wellbeing tech are pulling in considerable subsidizing, whereas administrative changes and startup quickening agents are advance increasing the showcase share, situating the Kingdom as a territorial advancement center.

Request For Sample Report:

https://www.imarcgroup.com/saudi-arabia-venture-capital-investment-market/requestsample

Saudi Arabia Venture Capital Investment Market Trends and Market Drivers

Growth of Venture Capital in Saudi Arabia's Startup Ecosystem:

Over the final decade, new companies in Saudi Arabia have pulled in USD 3.3 Billion in wander capital speculation, with the fintech division getting the biggest share. Strikingly, 53% of add up to financing went to groups with two co-founders, whereas solo originators captured fair 15%. The rise in subsidizing, fueled by Vision 2030 activities, outlines the developing offer of Saudi Arabia within the territorial wander capital scene and the potential for future unicorns. Substances such as the Saudi Wander Capital Company (SVC) and the National Innovation Advancement Program (NTDP) are giving financing and bolster to early-stage new businesses.

Increasing Foreign and Corporate Investments:

The convergence of remote and corporate capital is anticipated to quicken advancement and set Saudi Arabia's position as a key player within the worldwide wander capital scene. As cross-border bargains increment, Saudi new businesses are picking up get to to universal ability and markets, improving their adaptability.

Saudi Arabia Venture Capital Investment Market Segmentation

1. By Sector

• Software

• Pharma and Biotech

• Media and Entertainment

• Medical Devices and Equipment

• Medical Services and Systems

• IT Hardware

• IT Services and Telecommunication

• Consumer Goods and Recreation

• Energy

• Others

2. By Fund Size

• Under $50 Million

• $50 Million to $100 Million

• $100 Million to $250 Million

• $250 Million to $500 Million

• $500 Million to $1 Billion

• Above $1 Billion

3. By Funding Type

• First-Time Venture Funding

• Follow-On Venture Funding

4. By Region

• Northern and Central Region

• Western Region

• Eastern Region

• Southern Region

Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/saudi-arabia-venture-capital-investment-market

Saudi Arabia Venture Capital Investment Market News

January 2025: The Saudi Venture Capital Company (SVC) announced a new fund of USD 500 Million to support early-stage startups in the fintech and health tech sectors, aligning with the Vision 2030 objectives to diversify the economy and foster innovation.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current, and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=31753&flag=E

Other report by IMARC Group

https://www.imarcgroup.com/saudi-arabia-asphalt-pavers-market

https://www.imarcgroup.com/saudi-arabia-cutlery-market

https://www.imarcgroup.com/saudi-arabia-blankets-quilts-market

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic, and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Venture Capital Investment Market 2025 | Worth USD 13.4 Billion by 2033 here

News-ID: 4041758 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…