Press release

Exchange Traded Fund Industry Report 2025-2034: Market Dynamics, Trends, And Forecasts

The Exchange Traded Fund Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Expected Exchange Traded Fund Market Size During the Forecast Period?

The exchange-traded fund market has grown rapidly in recent years. It will rise from $19.34 billion in 2024 to $23.5 billion in 2025, with a compound annual growth rate (CAGR) of 21.5%. The growth during the historical period is linked to the rise in passive investing, increased market liquidity, continuous trading activity, and the increasing use of equity ETFs.

The exchange-traded fund (ETF) market is set for exponential growth, reaching $50.57 billion by 2029 at a CAGR of 21.1%. This growth can be attributed to the rise of bond ETFs, regulatory complexities, quick exposure to diversified portfolios, and the ongoing digital transformation and shift to e-commerce. Major trends include new ETF launches, technological advancements, improvements in online trading platforms, the rise of robo-advisors for ETF trading, and an increasing reliance on digital technologies.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=16677

What Are the High-Growth Segments in the Exchange Traded Fund Market?

The exchange traded fund market covered in this report is segmented -

1) By Investment Style: Passive Exchange Traded Funds (ETFs), Active Exchange Traded Funds (ETFs), Smart Beta Exchange Traded Funds (ETFs)

2) By Asset Class: Equity Exchange Traded Funds (ETFs), Fixed-Income Exchange Traded Funds (ETFs), Commodity Exchange Traded Funds (ETFs), Currency Exchange Traded Funds (ETFs), Real Estate Exchange Traded Funds (ETFs), Hybrid Exchange Traded Funds (ETFs)

3) By Bond Type: Government Bond Exchange Traded Funds (ETFs), Corporate Bond Exchange Traded Funds (ETFs), Municipal Bond Exchange Traded Funds (ETFs), High-Yield Bond Exchange Traded Funds (ETFs)

4) By Investor Type: Individual Investor, Institutional Investor

5) By Distribution Channel: Retail, Institutional

Subsegments:

1) By Passive Exchange Traded Funds (ETFs): Index-based ETFs, Sector-based ETFs, International and Global ETFs, Fixed-income ETFs, Commodity ETFs

2) By Active Exchange Traded Funds (ETFs): Actively Managed Equity ETFs, Actively Managed Bond ETFs, Actively Managed Multi-asset ETFs, Actively Managed Thematic ETFs, Actively Managed Sector ETFs

3) By Smart Beta Exchange Traded Funds (ETFs): Factor-based ETFs (e.g., value, growth, momentum), Dividend-focused ETFs, Volatility-focused ETFs, Low Volatility ETFs, Equal-weighted ETFs

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16677&type=smp

What Key Drivers Are Expected to Influence Future Exchange Traded Fund Market Growth?

The increase in total asset management is expected to drive the growth of the exchange-traded fund (ETF) market. Asset management involves professionally managing investments for others, driven by the need for superior risk management and higher returns. ETFs offer benefits like diversification, low costs, and improved portfolio management, which makes them a popular choice for investors. For instance, in February 2024, the State Street Corporation reported a record $11.6 trillion in global ETF assets under management, reflecting a 15% increase from 2022. The rise in asset management is driving the growth of the ETF market.

Which Companies Hold the Largest Share Across Different Exchange Traded Fund Market Segments?

Major companies operating in the exchange traded fund market are JPMorgan Chase & Co., Bank of America, Wells Fargo & Company, BNP Paribas SA, Morgan Stanley, The Goldman Sachs Group Inc., UBS Group AG, Barclays PLC, FMR LLC, Hartford Funds, The Charles Schwab Corp., BlackRock Inc., State Street Corporation, The Vanguard Group Inc., Blackstone Inc., T. Rowe Price, Invesco Ltd., Morningstar Inc., Abrdn plc, BMO Global Asset Management, Virtus Investment Partners, VictoryShares (Victory Capital), WisdomTree Inc., Tata Mutual Fund, Van Eck Associates Corp

What Are the Latest Developing Trends in the Exchange Traded Fund Market?

Leading firms in the exchange-traded fund market are concentrating on inventive ETFs centered around electric vehicles (EVs) and new-age automotive sectors with the objective of leveraging emerging market trends and addressing investor desire for eco-friendly investment alternatives. ETFs that focus on electric vehicles (EVs) aim to facilitate long-term capital growth for investors by channeling funds into companies leading the fast-paced transformation of the automotive industry and its value chain. To illustrate, Mirae Asset Financial Group, a financial services firm based in South Korea, introduced India's first ETF that is specifically geared towards the electric vehicles (EV) and new-age automotive sectors in June 2024. The new ETF, named the Mirae Asset Nifty EV and New Age Automotive ETF, is an open-ended initiative that follows the Nifty EV and New Age Automotive Total Return Index.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/exchange-traded-fund-global-market-report

What Are the Emerging Geographies for The Exchange Traded Fund Market Growth?

North America was the largest region in the exchange traded fund market in 2023. The regions covered in the exchange traded fund market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Exchange Traded Fund Market?

2. What is the CAGR expected in the Exchange Traded Fund Market?

3. What Are the Key Innovations Transforming the Exchange Traded Fund Industry?

4. Which Region Is Leading the Exchange Traded Fund Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Exchange Traded Fund Industry Report 2025-2034: Market Dynamics, Trends, And Forecasts here

News-ID: 4041387 • Views: …

More Releases from The Business Research Company

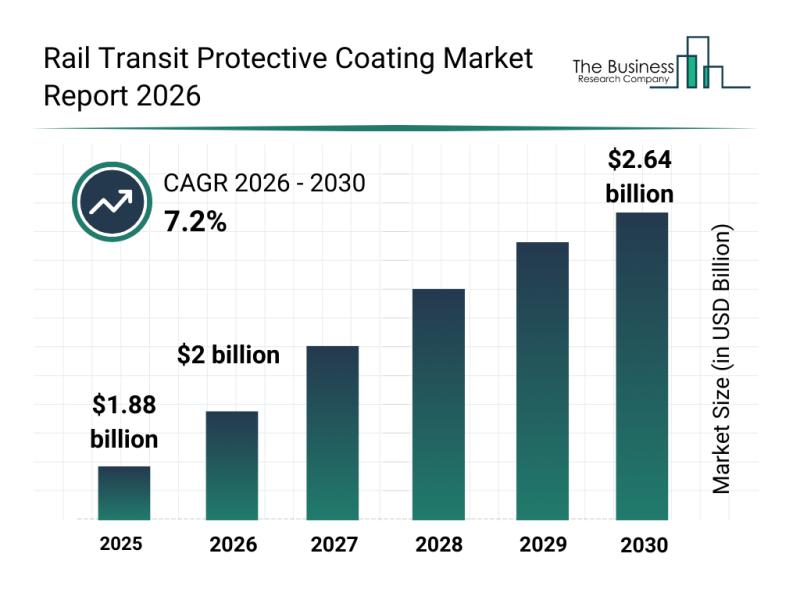

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

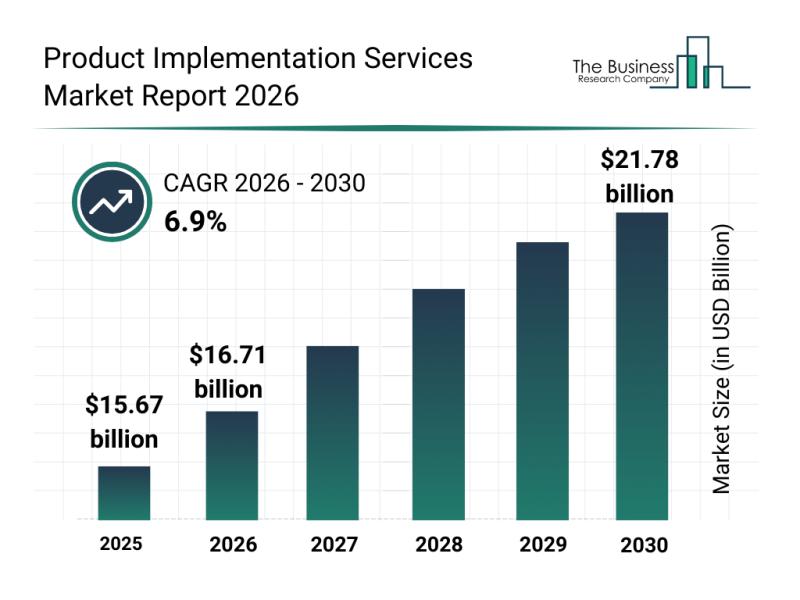

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

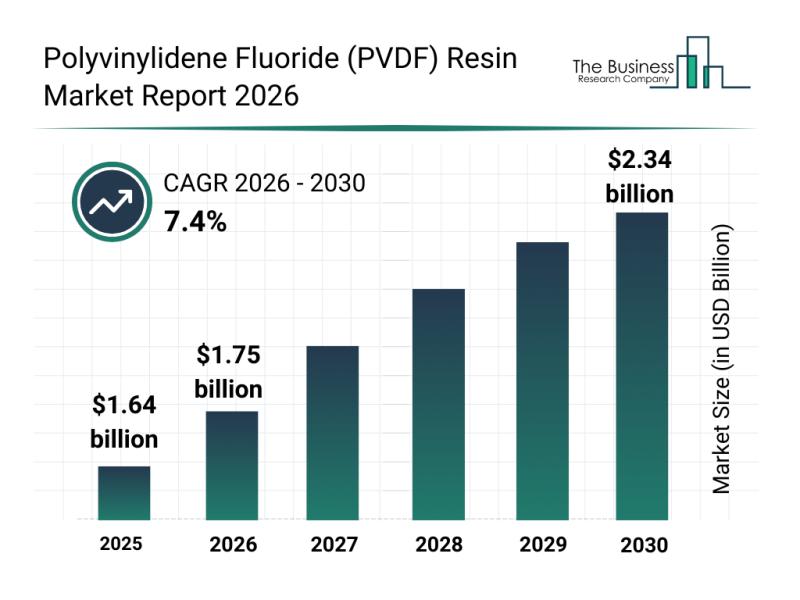

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

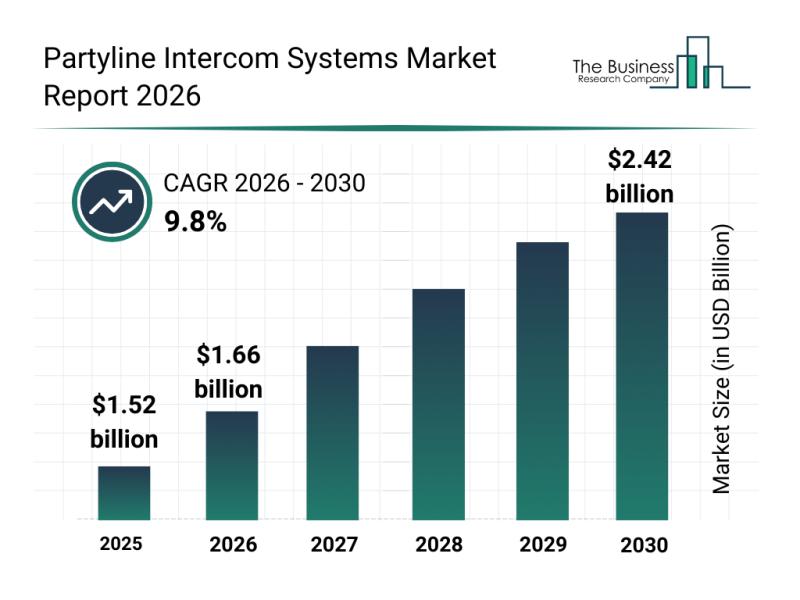

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for ETF

Market Makers Eye $0.40 for BlockDAG While Solana ETF Inflows Increase & Hedera …

The crypto market continues to draw strong institutional interest as both Solana (SOL) price momentum and the Hedera (HBAR) price outlook advance with major ETF inflows. Traders now study shifting liquidity patterns and search for the best crypto to buy right now, with data showing that sentiment is leaning toward networks with proven utility.

At the same time, BlockDAG (BDAG) https://blockdag.network/ is reshaping expectations through its ongoing presale progress. With a…

XRP Price Prediction: Momentum Builds While ETF Expectations Grow

XRP is back in the spotlight. After a period of subdued trading, the token is hovering around $2.26 with a market cap near $136 billion, as ETF chatter draws fresh capital into its orbit. With its significant market size and established function in cross‐border payments, the token remains a key barometer for crypto assets tied to actual utility. Each meaningful move in XRP's valuation tends to reignite speculation about revisiting…

XRP Price Prediction: Government Shutdown Delays Ripple ETF Approvals

The United States government shutdown is beginning to affect the cryptocurrency market, especially in areas that depend on regulatory decisions. Several XRP-linked ETF applications have now been delayed, creating uncertainty in the short term.

Despite the holdup, confidence in XRP remains strong. The REX-Osprey XRP ETF (XRPR) has officially passed 100 million dollars in assets under management, showing that institutional investors are continuing to accumulate exposure.

That growth supports a bullish XRP…

ETF Approval Sparks Institutional Mining Rush, PAIRMiner Scales Up

More offline retail inverter community can now participate in the mining economy without the hassle of hardware or technical knowledge using PAIRMiner, a UK-regulated cloud mining platform, as Bitcoin experiences a surge driven by growing institutional adoption and recent approval of spot Bitcoin ETFs.

Founded in 2009, PAIRMiner offers users remote access to hash power for mining Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and other cryptocurrencies. Interest in the platform sharply…

Title: What's the Difference Between Bitcoin Spot ETF and Bitcoin Futures ETF?

Bitcoin Exchange Traded Funds (ETFs) have developed as a financial innovation to bridge the divide between conventional investments and the digital frontier. These products give investors the chance to profit from fluctuations in the price of Bitcoin without having to deal with concerns related to direct cryptocurrency ownership. Financial gurus like BlackRock, Invesco, Ark Invest, and Fidelity, who have submitted proposals for their development, have shown much interest in Bitcoin…

X Fertilizers Potash Etf Market

Plant diseases are the cause of crop and plant damage which is caused by plant pathogenic (disease causing organism). Fungi are the most common pathogenic organism that damages the productivity of crop or plant. Other pathogenic organism causing damage to the crop and plants are viruses, nematodes and bacteria. Within the agricultural sector, manufacturers of fertilizers are the most important channel in the food supply chain. Quality fertilizers are responsible…