Press release

Petroleum Coke Manufacturing Cost Analysis Report 2025: Industry Trend and Raw Materials

Setting up a petroleum coke manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.IMARC Group's report titled "Petroleum Coke Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing a Petroleum coke manufacturing plant, covering everything from product overview and production processes to detailed financial insights.

Request For a Sample Report: https://www.imarcgroup.com/petroleum-coke-manufacturing-plant-project-report/requestsample

Petroleum coke, often referred to as petcoke, is a carbon-rich solid material derived from oil refining processes. It is produced during the thermal cracking of heavy oil fractions in a coker unit and exists in various grades, such as fuel-grade and calcined petcoke. Fuel-grade petcoke is primarily used as an energy source in power plants and cement kilns due to its high calorific value, while calcined petcoke is a critical material in the production of aluminum and steel, serving as a key input in anode manufacturing. As a byproduct of the oil refining process, petroleum coke plays a significant role in industries where high-energy fuels or carbon-rich raw materials are required.

The global petroleum coke market is witnessing notable growth, driven by rising demand from the cement and aluminum industries, particularly in emerging economies. Increasing infrastructure development across Asia-Pacific and the Middle East is fueling the consumption of petcoke as an affordable and efficient energy source. Furthermore, the growth of the aluminum industry, spurred by the expansion of electric vehicle manufacturing and renewable energy sectors, has heightened the need for calcined petcoke. While environmental regulations pose challenges, technological advancements in emissions control and a gradual shift toward low-sulfur grades are helping sustain market momentum. These dynamics reflect a complex but steadily evolving market landscape for petroleum coke.

Buy Now: https://www.imarcgroup.com/checkout?id=8386&method=402

Key Steps Required to Set Up a Petroleum Coke Plant

1. Market Analysis

The report provides insights into the landscape of the Petroleum coke industry at the global level. The report also provides a segment-wise and region-wise breakup of the global Petroleum coke industry. Additionally, it also provides the price analysis of feedstocks used in the manufacturing of Petroleum coke, along with the industry profit margins.

• Segment Breakdown

• Regional Insights

• Pricing Analysis and Trends

• Market Forecast

2. Product Manufacturing: Detailed Process Flow

Detailed information related to the process flow and various unit operations involved in the Petroleum coke manufacturing plant project is elaborated in the report. These include:

• Land, Location, and Site Development

• Plant Layout

• Plant Machinery

• Raw Material Procurement

• Packaging and Storage

• Transportation

• Quality Inspection

• Utilities

• Human Resource Requirements and Wages

• Marketing and Distribution

3. Project Requirements and Cost

The report provides a detailed location analysis covering insights into the plant location, selection criteria, location significance, environmental impact, and expenditure for Petroleum coke manufacturing plant setup. Additionally, the report also provides information related to plant layout and factors influencing the same. Furthermore, other requirements and expenditures related to machinery, raw materials, packaging, transportation, utilities, and human resources have also been covered in the report.

Machinery and Equipment

• List of machinery needed for Petroleum coke production

• Estimated costs and suppliers

Raw Material Costs

• Types of materials required and sourcing strategies

Utilities and Overheads

• Electricity, water, labor, and other operational expenses

4. Project Economics

A detailed analysis of the project economics for setting up a Petroleum coke manufacturing plant is illustrated in the report. This includes the analysis and detailed understanding of capital expenditure (CAPEX), operating expenditure (OPEX), income projections, taxation, depreciation, liquidity analysis, profitability analysis, payback period, NPV, uncertainty analysis, and sensitivity analysis.

Capital Expenditure (CAPEX)

• Initial setup costs: land, machinery, and infrastructure

Operating Expenditure (OPEX)

• Recurring costs: raw materials, labor, maintenance

Revenue Projections

• Expected income based on production capacity, target market, and market demand

Taxation

Depreciation

Financial Analysis

• Liquidity Analysis

• Profitability Analysis

• Payback Period

• Net Present Value (NPV)

• Internal Rate of Return

• Profit and Loss Account

Uncertainty Analysis

Sensitivity Analysis

Economic Analysis

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=8386&flag=C

5. Legal and Regulatory Compliance

• Licenses and Permits

• Regulatory Procedures and Approval

• Certification Requirement

6. Hiring and Training

• Total human resource requirement

• Salary cost analysis

• Employee policies overview

The report also covers critical insights into key success and risk factors, which highlight the aspects that influence the success and potential challenges in the industry. Additionally, the report includes strategic recommendations, offering actionable advice to enhance operational efficiency, profitability, and market competitiveness. A comprehensive case study of a successful venture is also provided, showcasing best practices and real-world examples from an established business, which can serve as a valuable reference for new entrants in the market.

About Us:

IMARC is a global market research company offering comprehensive services to support businesses at every stage of growth, including market entry, competitive intelligence, procurement research, regulatory approvals, factory setup, company incorporation, and recruitment. Specializing in factory setup solutions, we provide detailed financial cost modeling to assess the feasibility and financial viability of establishing new manufacturing plants globally. Our models cover capital expenditure (CAPEX) for land acquisition, infrastructure, and equipment installation while also evaluating factory layout and design's impact on operational efficiency, energy use, and productivity. Our holistic approach offers valuable insights into industry trends, competitor strategies, and emerging technologies, enabling businesses to optimize operations, control costs, and drive long-term growth.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Petroleum Coke Manufacturing Cost Analysis Report 2025: Industry Trend and Raw Materials here

News-ID: 4040377 • Views: …

More Releases from IMARC Group

India Plastic Pipes Market Outlook 2026-2034: Size, Share, Growth, Trends, Deman …

According to IMARC Group's report titled "India Plastic Pipes Market Size, Share, Trends and Forecast by Type, Diameter, End Use, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Plastic Pipes Market Report

The India plastic pipes market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 3.65 Billion by 2034, exhibiting a CAGR…

India Robotics Market Expanding at 15.74% CAGR by 2034, Driven by Make in India …

Summary

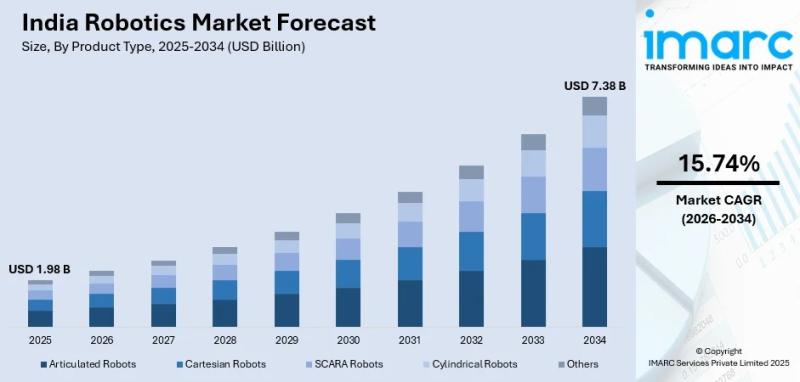

The India robotics market size reached USD 1.98 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a massive push toward manufacturing modernization, rising labor costs, and robust government support for digital transformation, the market is projected to reach an impressive USD 7.38 Billion by 2034. This highlights a rapid compound annual growth rate (CAGR) of 15.74% during the forecast period (2026-2034).

Request a…

India Robotic Sensors Market Growing at 7.75% CAGR Through 2034, Driven by AI & …

Summary

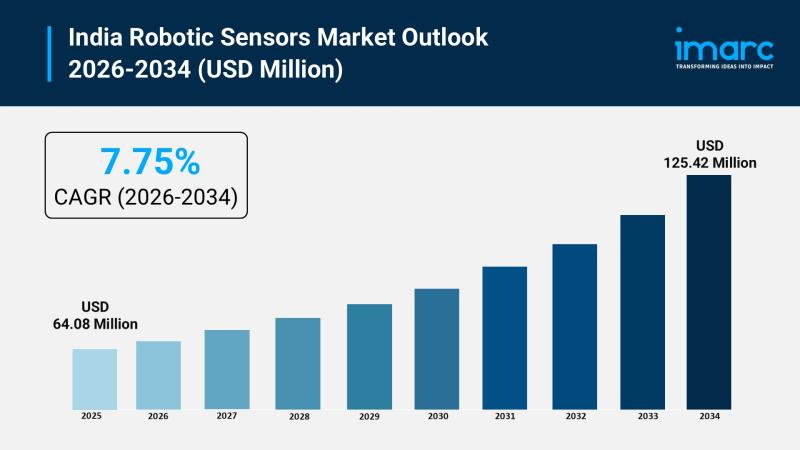

The India robotic sensors market size reached USD 64.08 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by robust government initiatives, escalating labor costs, and the rapid integration of artificial intelligence in industrial automation, the market is projected to reach USD 125.42 Million by 2034. This highlights a steady compound annual growth rate (CAGR) of 7.75% during the forecast period (2026-2034).

Request a Free Sample…

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

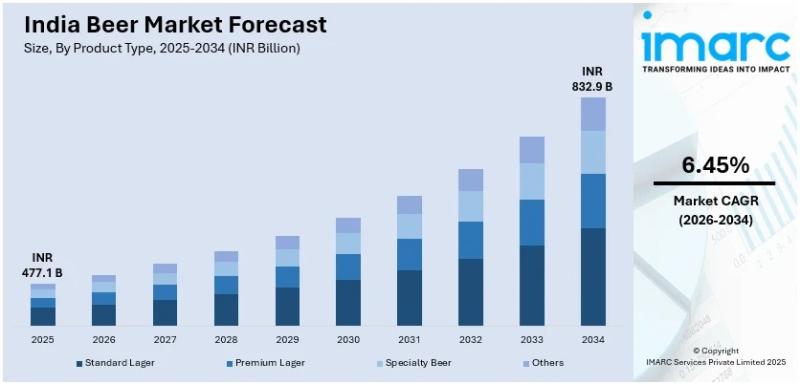

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

More Releases for Petroleum

Green Petroleum Coke and Calcined Petroleum Coke Market : An Overview

Introduction:

Green petroleum coke (GPC) and calcined petroleum coke (CPC) are key by-products of the oil refining process. GPC, a carbon-rich material, is used primarily as a fuel in industries such as power generation and cement manufacturing. When subjected to high temperatures, GPC is transformed into CPC, which finds applications in aluminum smelting, steel manufacturing, and titanium dioxide production. Both materials are critical in various industrial processes due to their high…

Green Petroleum Coke and Calcined Petroleum Coke Market : An Overview

Introduction:

The green petroleum coke (GPC) and calcined petroleum coke (CPC) market is a critical segment of the global energy and materials industries. Green petroleum coke, a byproduct of crude oil refining, is an unprocessed carbon material used in various industrial applications. Calcined petroleum coke, produced by heating GPC at high temperatures, is primarily used in aluminum smelting, steel manufacturing, and chemical processes. With increasing demand for energy and industrial materials,…

Petroleum Jelly Petroleum Jelly Market Innovative Strategy by 2031 | Major Giant …

Petroleum Jelly Market: Introduction

Transparency Market Research delivers key insights on the global petroleum jelly market. In terms of value, the global petroleum jelly market is expected to expand at a CAGR of 4.26% during the forecast period, owing to numerous factors regarding which TMR offers thorough insights and forecasts in its report on the global petroleum jelly market.

Get a Sample Copy of the Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=72726

Petroleum jelly is used in the…

Global Liquefied Petroleum Gas Market 2020 Business Strategies – Chevron Corpo …

The market report titled “Liquefied Petroleum Gas Market By Source (Refinery, Associated Gas, and Non-Associated Gas) and By End-User (Residential & Commercial, Petrochemical & Refineries, Industrial, and Transportation): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018–2025” and published by Zion Market Research will put forth a systematizedevaluation of the vital facets of the global Liquefied Petroleum Gas Market market. The report willfunction as a medium for the better assessment of…

Natural Gas Market to Witness Huge Growth by 2025 | Qatar Petroleum, Sempra Ener …

The Global Natural Gas Market has witnessed continuous growth in the past few years and may grow further during the forecast period (2019-2025). The assessment provides a 360° view and insights, outlining the key outcomes of the industry, current scenario witnesses a slowdown and study aims to unique strategies followed by key players. These insights also help the business decision-makers to formulate better business plans and make informed decisions for…

Petroleum Coke Market Players British Petroleum, Marathon Petroleum Corporation

Introduction:

Petroleum coke or petcoke, a solid rock material is a byproduct of crude oil refining and other cracking processes. Although a refining byproduct, petroleum coke is considered as a valued commodity since 2008, all over the world. Crude oil remained after separating other valuable petroleum products from refining process such as diesel, lubricants, waxes, etc. can be processed further in cokers or other cracking processes to produce petroleum coke. Different…