Press release

Financial Leasing Services Market Size Projected To Reach $365.74 Billion By 2034 With A Cagr Of 10.5%

The Financial Leasing Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Projected Growth of the Financial Leasing Services Market?

The financial leasing services market has expanded rapidly in recent years. It will increase from $221.11 billion in 2024 to $245.05 billion in 2025, reflecting a CAGR of 10.8%. This growth is due to economic growth, tax benefits, improved asset utilization efficiency, industry-specific demand, and a stronger focus on risk management.

The financial leasing services market size is expected to grow rapidly in the next few years, reaching $365.74 billion by 2029, at a compound annual growth rate (CAGR) of 10.5%. The growth is driven by sustainability and green initiatives, increased infrastructure investment, urbanization, and global supply chain optimization. Key trends include digital transformation, the expansion of fintech solutions, the growth of SME leasing, circular economy practices, and customization.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18609

What Are the Different Financial Leasing Services Market Segments?

The financial leasing services market covered in this report is segmented -

1) By Type: Capital Lease, Operating Lease, Other Types

2) By Provider: Banks, Non-Banks

3) By Application: Transportation, Aviation, Information Technology (IT) And Telecommunication, Manufacturing, TH*Care, Construction, Other Applications

Subsegments:

1) By Capital Lease: Direct Capital Lease, Sale And Leaseback Agreements, Leveraged Lease, Finance Lease, Synthetic Lease

2) By Operating Lease: Short-term Operating Lease, Long-Term Operating Lease, Equipment Leasing, Vehicle Leasing, Real Estate Leasing

3) By Other Types: Leaseback Financing, Sub-Leasing, Cross-Border Leasing, Synthetic Lease, Tax-Lease Financing

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18609&type=smp

What Are the Primary Drivers Shaping the Financial Leasing Services Market?

The increasing number of small and medium-sized enterprises (SMEs) is expected to boost the financial leasing services market. SMEs are businesses with relatively limited staff and revenue, typically defined by national thresholds. Their growth is being fueled by a rise in entrepreneurship and supportive regulatory frameworks aimed at innovation and business development. Financial leasing services enable SMEs to acquire necessary equipment with manageable upfront investment and better cash flow control. For instance, in May 2024, the House of Commons Library, a UK government entity, reported that the number of private-sector businesses grew from 5,509 in 2022 to 5,555 in 2023, representing a net increase of 46 enterprises. Therefore, the growth in SMEs is contributing to the expansion of the financial leasing services market.

Which Companies Are Leading in the Financial Leasing Services Market?

Major companies operating in the financial leasing services market are JPMorgan Chase & Co, Bank of America Corporation, Banco Santander S.A, Wells Fargo & Company, Siemens AG, Citigroup Inc, International Business Machines Corporation, Royal Bank Of Canada, HSBC Holdings plc, Barclays plc, Société Générale Equipment Finance, U.S. Bancorp, Nordea Bank AB, KBC Lease, Bank of Beijing Co. Ltd., ABN AMRO Bank N.V., First American Equipment Finance, Macquarie Equipment Finance LLC, General Electric Capital Corporation, De Lage Landen International B.V., Deutsche Leasing AG, Crédit Agricole Leasing & Factoring, Hannover Leasing GmbH & Co. KG, BNP Paribas Lease Group S.A.

What Financial Leasing Services Market Trends Are Gaining Traction Across Different Segments?

Leading firms in the financial leasing services market are concentrating their efforts on establishing strategic partnerships designed to create innovative leasing solutions for large and midsize corporations. By working together, these companies can capitalize on each other's areas of expertise, improving their service offerings and increasing access to specialized financial options. To illustrate, in April 2024, U.S.-based power management solutions specialist, Eaton, formed a partnership with BNP Paribas Leasing Solutions. The objective of this alliance is to offer customized financing solutions which aid businesses in switching to sustainable energy models without impacting their cash flows. This partnership will make it easier for businesses to finance crucial infrastructure such as energy storage and electric vehicle charging stations, thereby helping them cut down on energy expenses and ensure steady operational continuity.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/financial-leasing-services-global-market-report

What Are the Top Revenue-Generating Geographies in the Financial Leasing Services Market?

North America was the largest region in the financial leasing services market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the financial leasing services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Financial Leasing Services Market?

2. What is the CAGR expected in the Financial Leasing Services Market?

3. What Are the Key Innovations Transforming the Financial Leasing Services Industry?

4. Which Region Is Leading the Financial Leasing Services Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Leasing Services Market Size Projected To Reach $365.74 Billion By 2034 With A Cagr Of 10.5% here

News-ID: 4040119 • Views: …

More Releases from The Business Research Company

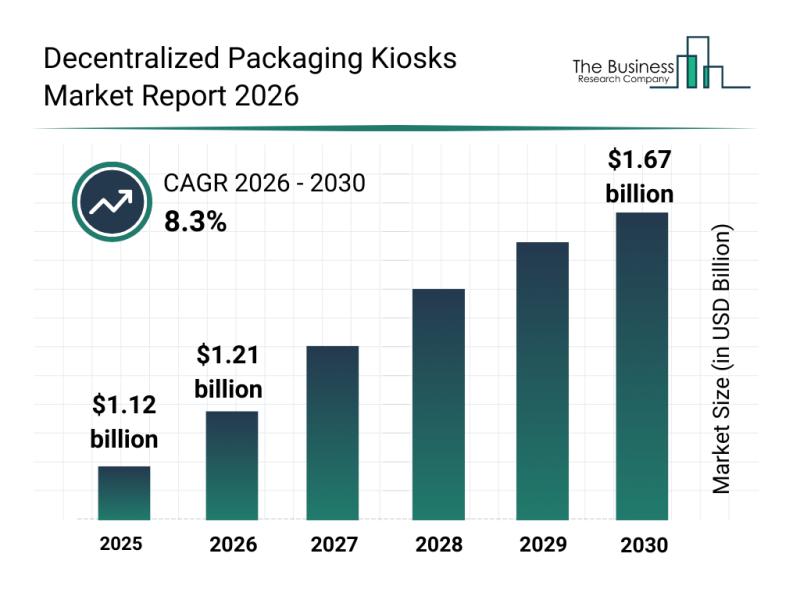

Leading Firms Fueling Growth and Innovation in the Decentralized Packaging Kiosk …

The decentralized packaging kiosks market is positioned for significant growth as industries increasingly adopt innovative packaging solutions. This market is evolving rapidly due to advancements in technology and shifting demands for efficiency and sustainability in packaging processes. Let's explore the market's size projections, the key players driving the industry, its segmentations, and the main trends shaping its future.

Expected Growth Trajectory of the Decentralized Packaging Kiosks Market by 2030

The…

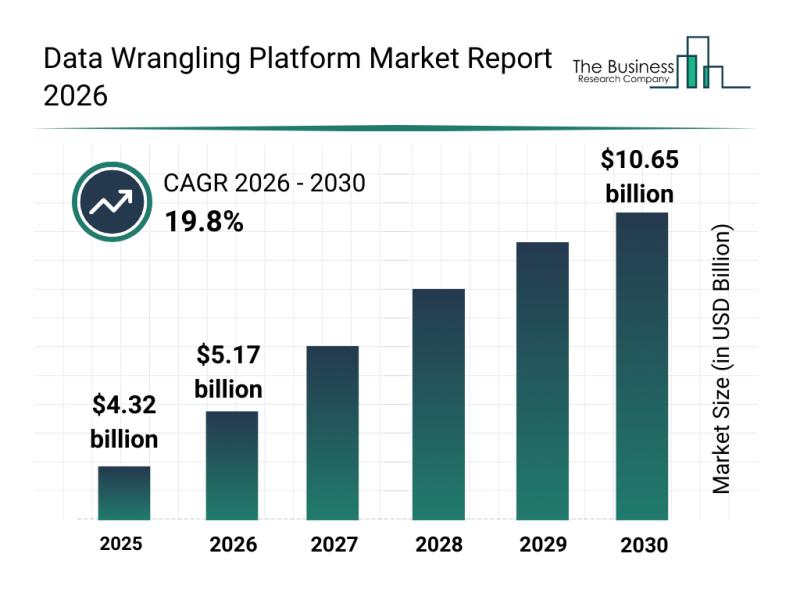

Outlook on the Data Wrangling Platform Market: Major Segments, Strategic Develop …

The data wrangling platform market is gaining significant momentum, driven by the increasing demand for streamlined data preparation and analytics solutions across various industries. Innovations in artificial intelligence and automation are transforming how organizations handle vast amounts of data, making these platforms essential for business intelligence and decision-making. Let's explore the market's projected growth, key players, emerging trends, and detailed segment insights.

Growth Outlook and Market Size of the Data Wrangling…

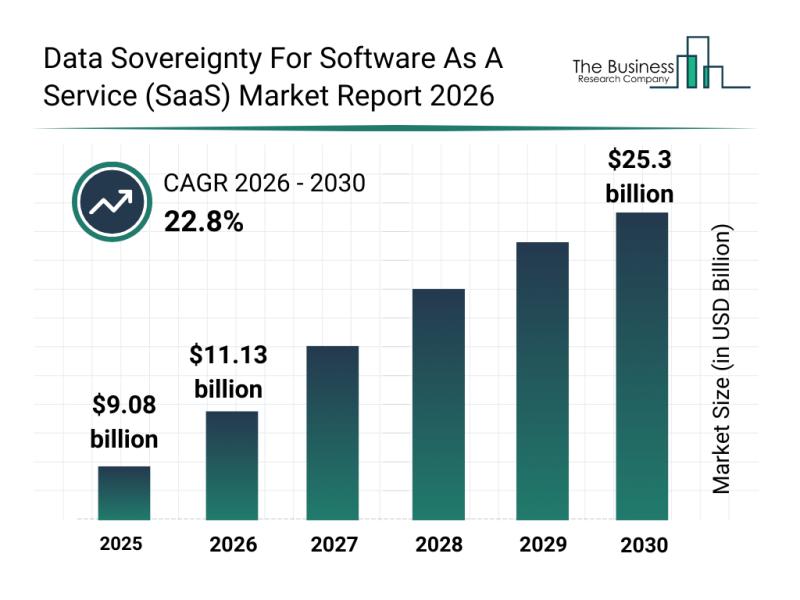

Segment Analysis and Major Growth Areas in the Data Sovereignty Market for Softw …

The growing importance of data sovereignty in cloud computing is reshaping how software as a service (SaaS) solutions are developed and deployed. As organizations face increasingly stringent regulations around data location and control, the market for data sovereignty in SaaS is set for remarkable expansion. Let's explore the market's size, the key players, emerging trends, and the main market segments shaping this critical industry.

Projected Market Size and Growth Prospects for…

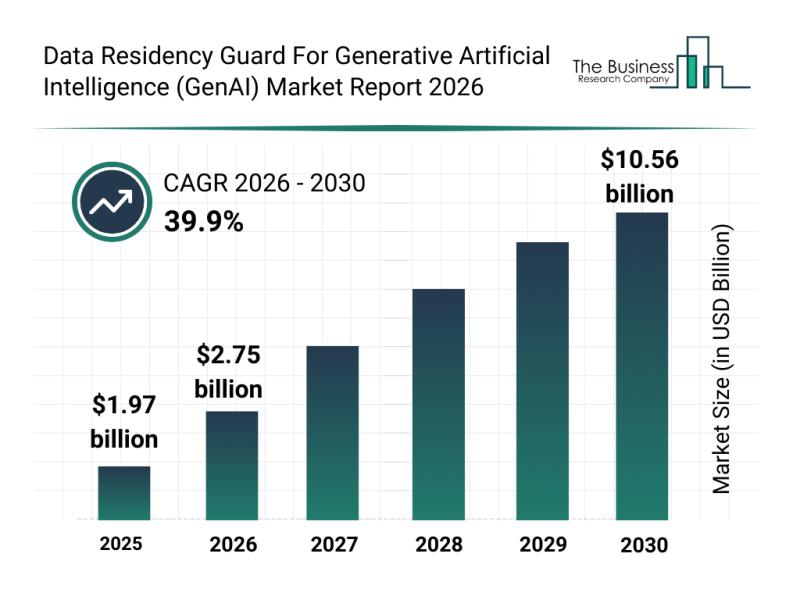

Key Strategic Trends and Emerging Changes Shaping the Data Residency Guard in th …

The rising importance of data privacy and regulatory compliance is transforming how generative artificial intelligence (GenAI) solutions manage and protect data. As AI technologies become more widespread, ensuring that data stays within specified regions and meets local regulations has become critical. This shift is driving rapid growth in the data residency guard market, which focuses on safeguarding data used in GenAI applications.

Projected Growth and Market Size of the Data Residency…

More Releases for Leasing

Financial Leasing Market: A Compelling Long-Term Growth Story | Minsheng Financi …

The latest 94+ page survey report on Financial Leasing Market is released by HTF MI covering various players of the industry selected from global geographies like North America, US, Canada, Mexico, Europe, Germany, France, U.K., Italy, Russia, Nordic Countries, Benelux, Rest of Europe, Asia, China, Japan, South Korea, Southeast Asia, India, Rest of Asia, South America, Brazil, Argentina, Rest of South America, Middle East & Africa, Turkey, Israel, Saudi Arabia,…

Financial Leasing Market 2019 Global Major Players: CDB Leasing, ICBC Financial …

The Global Financial Leasing Industry, 2019-2024 Market Research Report is a professional and in-depth study on the current state of the Global Financial Leasing industry with a focus on the Global market. The report provides key statistics on the market status of the Financial Leasing manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

The report displays significant strategies which are…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report: https://www.researchreportsinc.com/sample-request?id=177516

Over the next five years, RRI…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

Oct 2018, New York USA (News) - A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report:…

Financial Leasing Market by Top Key Participant CDB Leasing, ICBC Financial Leas …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Get Sample Copy of this Report @ https://www.researchbeam.com/global-financial-leasing-by-manufacturers-countries-type-and-application-forecast-to-2023-market/request-sample?utm_source=Anil

Scope of the Report:

This report studies the Financial Leasing market…