Press release

UK Cyber Insurance Market Expected to Rise at a CAGR of 14.82% during 2025-2033

Cyber Insurance Market in UK 2025:How Big is the UK Cyber Insurance Market?

The UK cyber insurance market size is projected to exhibit a growth rate (CAGR) of 14.82% during 2025-2033. The market is expanding rapidly due to rising cyber threats, regulatory compliance needs, and increasing digital dependency across sectors.

Market Statistics

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate (CAGR) 2025-2033: 14.82%

Request Free Sample Report: https://www.imarcgroup.com/uk-cyber-insurance-market/requestsample

UK Cyber Insurance Market Trends and Drivers:

The UK cyber insurance market is posting consistent growth due to the rising frequency and complexity of cyberattacks, mounting regulatory pressures, and increased digital dependency among sectors. Essentially, with the swift digitalization of business processes and the widespread use of cloud computing, remote work, and interdependent systems, organizations are becoming increasingly susceptible to cyber threats like data breaches, ransomware, phishing, and insider attacks. In Addition, the requirement to implement more stringent data protection regulations like the UK GDPR and the increasing importance of cybersecurity compliance has necessitated that companies source cyber insurance as an essential risk management instrument.

Additionally, high-profile cyber breaches have considerably increased SME and large business awareness of the monetary and reputational costs associated with cyber threats, fuelling demand for insurance protection specifically designed to address cyber risks. Furthermore, as companies grow increasingly data-dependent, insurers are selling increasingly complex policies that extend beyond ordinary coverage into services such as incident response, forensic analysis, regulatory assistance, and cyber risk management assessments. Similarly, developments in data analytics, artificial intelligence, and machine learning are allowing insurers to more accurately gauge risk profiles and deliver dynamic, usage-based policies that are more attuned to an organization's digital presence.

In addition, alliances between insurers and cybersecurity companies are on the rise, adding to the value proposition for cyber insurance by including preventive offerings and services in conjunction with coverage. Adding to the above, the financial services, healthcare, and retail industries, which are most sensitive to data security and business continuity, are proving to be prime drivers of demand for cyber insurance solutions in the UK. Fundamentally, with growing costs and publicity surrounding cyberattacks, boards of directors and C-level leaders are making it a priority to manage cyber risk and are including insurance as part of enterprise-wide risk initiatives.

In addition, the increasing insurtech ecosystem is bringing forward digital platforms that simplify policy issuance, claims handling, and real-time monitoring of risk, which is making cyber insurance more convenient and efficient. Overall, the intersection of digital change, regulatory pressure, awareness of cyber risk, and technology-powered underwriting is creating a resilient and fast-changing cyber insurance market in the UK that is soon to be an integral part of risk management strategies for modern businesses.

UK Cyber Insurance Market Report and Segmentation:

The report has segmented the market into the following categories:

Component Insights:

• Solution

• Services

Insurance Type Insights:

• Packaged

• Stand-alone

Organization Size Insights:

• Small and Medium Enterprises

• Large Enterprises

End Use Industry Insights:

• BFSI

• Healthcare

• IT and Telecom

• Retail

• Others

Regional Insights:

• London

• South East

• North West

• East of England

• South West

• Scotland

• West Midlands

• Yorkshire and The Humber

• East Midlands

• Others

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Contact Our Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=24974&flag=C

Key highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Strategic Recommendations

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Explore More Research Reports & Get Your Free Sample Now:

Vietnam Dairy Alternatives Market Report: https://www.imarcgroup.com/vietnam-dairy-alternatives-market/requestsample

United States Business Travel Market Report: https://www.imarcgroup.com/united-states-business-travel-market/requestsample

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UK Cyber Insurance Market Expected to Rise at a CAGR of 14.82% during 2025-2033 here

News-ID: 4037782 • Views: …

More Releases from IMARC Group

Base Oil Price Trend Analysis: Current Prices, Index & Forecast 2026

The Base Oil Price Index has shown notable fluctuations in late 2025 and early 2026 due to shifts in crude oil markets, refinery output, and global demand. Tracking the price of Base Oil is essential for lubricants manufacturers, industrial users, and traders seeking insights into market dynamics. This report provides a comprehensive overview of Base Oil Prices, including historical data, price trends, forecasts for 2026, and regional variations. By analyzing…

Mexico Industrial Heaters Market Share, Size, In-Depth Insights, Trends and Fore …

IMARC Group has recently released a new research study titled "Mexico Industrial Heaters Market Size, Share, Trends and Forecast by Product, Technology, End User, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

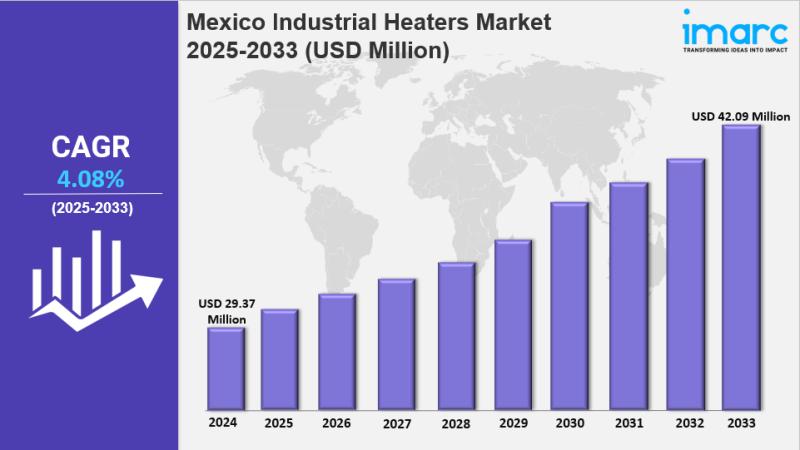

The Mexico industrial heaters market was valued at USD 29.37 Million in 2024 and is expected to reach USD 42.09…

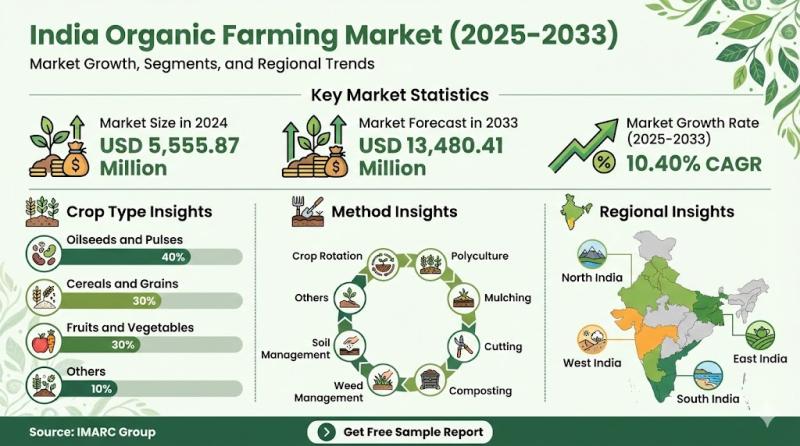

India Organic Farming Market 2025-2033: $13,480.41Mn Industry Growth, Trends & S …

Source: IMARC Group | Category: Agriculture | Author: Tarang

Report Introduction

According to IMARC Group's latest report titled "India Organic Farming Market Size, Share, Trends and Forecast by Crop Type, Method, and Region, 2025-2033", this study offers a granular analysis of the industry's rapid transition towards sustainable agricultural practices and chemical-free food production. The study offers a profound analysis of the industry, encompassing market share, size, India organic farming market growth factors,…

Electric Vehicle Manufacturing Plant DPR - 2026, Machinery Cost, ROI, and Market …

The global automotive industry stands at a historic inflection point as the world accelerates its transition from conventional internal combustion engines to electric mobility. Electric vehicles represent a transformative shift in personal and commercial transportation, offering zero tailpipe emissions, significantly lower operating costs, and quieter operation compared to traditional gasoline and diesel vehicles. As tightening emission regulations, rising fuel prices, government incentives for clean mobility, expanding charging infrastructure, and increasing…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…