Press release

Financial Wellness Software Market Size Forecasted To Achieve $4.57 Billion By 2029 With Steady Growth

The Financial Wellness Software Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Financial Wellness Software Market Size and Projected Growth Rate?

The financial wellness software market has seen significant growth in recent years. It is projected to grow from $2.68 billion in 2024 to $2.99 billion in 2025, at a CAGR of 11.6%. This growth is driven by employers' increasing recognition of financial wellness, greater focus on employee well-being, rising personal debt levels, regulatory support and incentives, and the ongoing shift toward digital transformation.

The financial wellness software market size is expected to see rapid growth in the coming years, reaching $4.57 billion by 2029, at a compound annual growth rate (CAGR) of 11.2%. Growth is driven by rising financial literacy, increasing demand for holistic financial wellness solutions, higher adoption of mobile financial wellness apps, rising financial stress, and expanding debt management programs. Key trends include the integration of extended reality (XR), the expansion of edge computing, customization for diverse demographics, cybersecurity innovation, and robotic process automation (RPA).

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18362

What Are the Major Segments in the Financial Wellness Software Market?

The financial wellness software market covered in this report is segmented -

1) By Type: On Premise, Cloud-Based, Web-Based

2) By Application: Small Business, Midsize Enterprise, Large Enterprise, Other Application

3) By End Use: Corporate, Institutional, Government, Other End Uses

Subsegments

1) By On-Premise: Self-Hosted, Customizable On-Premise Solutions

2) By Cloud-Based: Public Cloud, Private Cloud, Hybrid Cloud

3) By Web-Based: Browser-Based Applications, SaaS (Software-as-a-Service) Platforms

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18362&type=smp

What Are The Driving Financial Wellness Software Market Evolution?

The rise in financial stress is projected to enhance the growth of the financial wellness software market. Financial stress arises when individuals face challenges or uncertainty in managing their personal finances. Factors such as rising living costs, debt levels, job instability, and healthcare expenses contribute to increased financial anxiety. Financial wellness software addresses these issues by offering personalized planning tools, coaching, and insights that improve overall financial well-being. For instance, in November 2022, a report from the Australian National University showed that the percentage of Australians identifying rising prices as a major concern increased from 37.4% in January 2022 to 56.9% in October 2022. As a result, escalating financial pressures are bolstering the financial wellness software market.

Which Firms Dominate The Financial Wellness Software Market Segments?

Major companies operating in the financial wellness software market are Intuit Inc., Voya Financial Inc., Alight Solutions LLC, MoneyLion Inc., PlanSource Holdings Inc., DailyPay Inc., Wealthfront Corporation, PayActiv Inc., Tapcheck Inc., Wellable Labs Inc., ZayZoon Inc., BrightPlan LLC, Ramsey Solutions SmartDollar, SmartPath, Aztec Software, Sum180 Inc., LearnLux Inc., Savology Inc., Edukate Inc., LearnLux Inc., Your Money Line Inc., Best Money Moves LLC, HoneyBee HR Inc., Enrich Financial Wellness Inc., BrightDime Inc.

What Are the Major Trends Shaping the Financial Wellness Software Market?

Key players in the financial wellness software industry are prioritizing the development of advanced tools such as financial wellness programs, which are designed to enhance individual financial management skills and boost overall well-being. The concept of a financial wellness program is an organized effort aimed at improving the financial health and welfare of employees across multiple organizations. For example, in August 2024, Ally Financial Inc., an American financial service provider, rolled out MoneyRoots. This complimentary financial wellness program spotlights the psychological elements of managing finances. The overall goal of this program is to assist people in understanding how their financial mindset can impact their financial actions, including their spending, saving, and investment choices. MoneyRoots is composed of four, one-hour digital workshops that are conducted by specialists in the field of behavioral finance and financial therapy. The discussions during these workshops touch on subjects like recalling early financial memories, distinguishing core values, and addressing typical financial stress factors.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/financial-wellness-software-global-market-report

Which Is The Largest Region In The Financial Wellness Software Market?

North America was the largest region in the financial wellness software market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the financial wellness software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Financial Wellness Software Market?

2. What is the CAGR expected in the Financial Wellness Software Market?

3. What Are the Key Innovations Transforming the Financial Wellness Software Industry?

4. Which Region Is Leading the Financial Wellness Software Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Wellness Software Market Size Forecasted To Achieve $4.57 Billion By 2029 With Steady Growth here

News-ID: 4037068 • Views: …

More Releases from The Business Research Company

Leading Companies Fueling Growth and Innovation in the Automotive Solenoid Marke …

The automotive solenoid market is on the verge of significant expansion as advancements in technology and vehicle electrification continue to accelerate. Increasing integration of smart systems and the growing demand for efficient, eco-friendly automotive solutions are set to drive this market's development through the end of the decade.

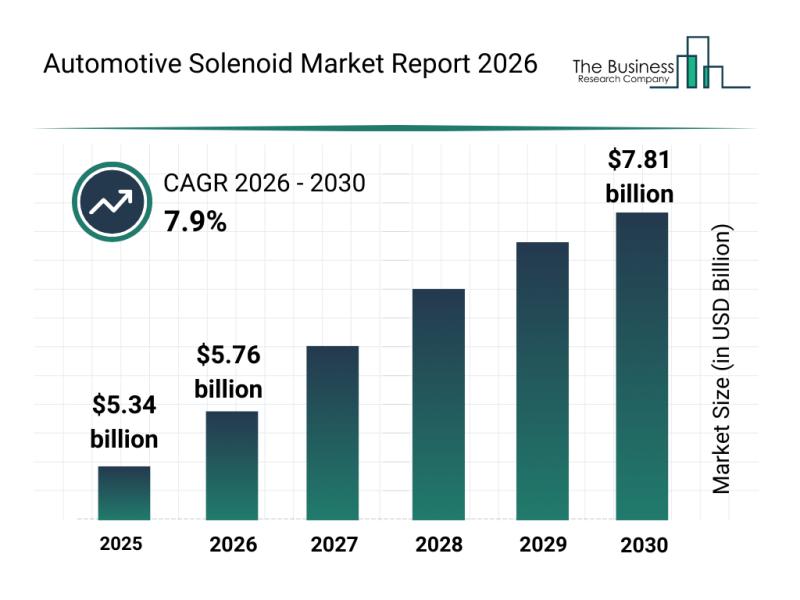

Expected Growth Trajectory for the Automotive Solenoid Market by 2030

The automotive solenoid market is projected to reach a valuation of $7.81 billion…

Automotive Night Vision System Market Analysis: Major Segments, Strategic Develo …

The automotive night vision system market is set to experience significant expansion over the coming years, driven by technological advancements and growing safety demands. As vehicle manufacturers continue to integrate more sophisticated safety features, this market shows promising potential for rapid growth and innovation through 2030.

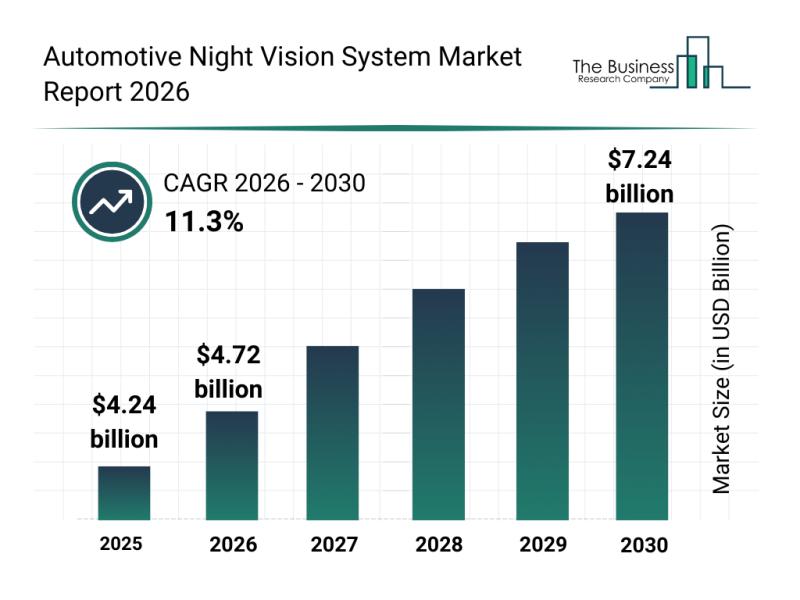

Projected Expansion of the Automotive Night Vision System Market Size Through 2030

The market size for automotive night vision systems is anticipated to reach $7.24…

Segment Analysis and Major Growth Areas in the Automotive HVAC Market

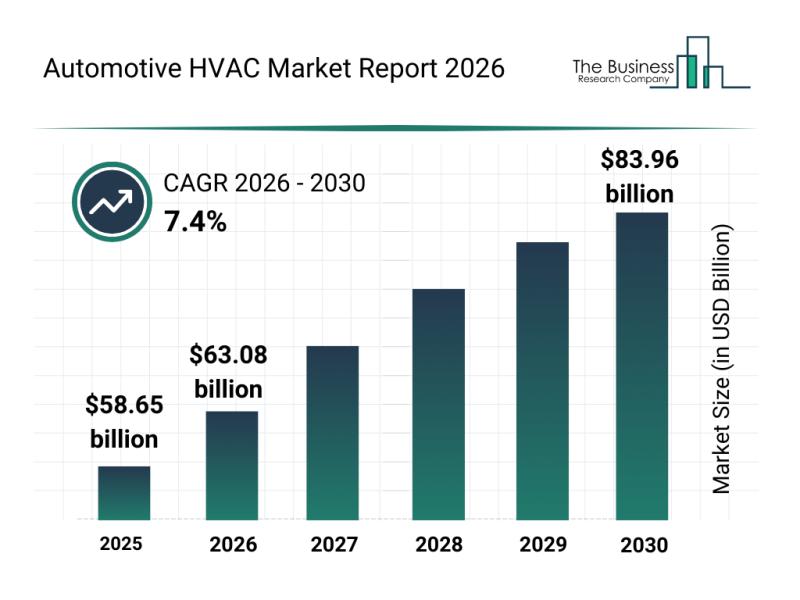

The automotive HVAC market is on a trajectory of significant growth as vehicle climate control systems evolve with advanced technologies. Innovations aimed at improving energy efficiency and passenger comfort are driving the sector forward, setting the stage for substantial expansion through 2030. Let's explore the current market size, key players, influential trends, and detailed segment insights shaping this dynamic industry.

Automotive HVAC Market Size and Growth Outlook Through 2030

The automotive…

Key Strategic Developments and Emerging Changes Shaping the Automotive Electroni …

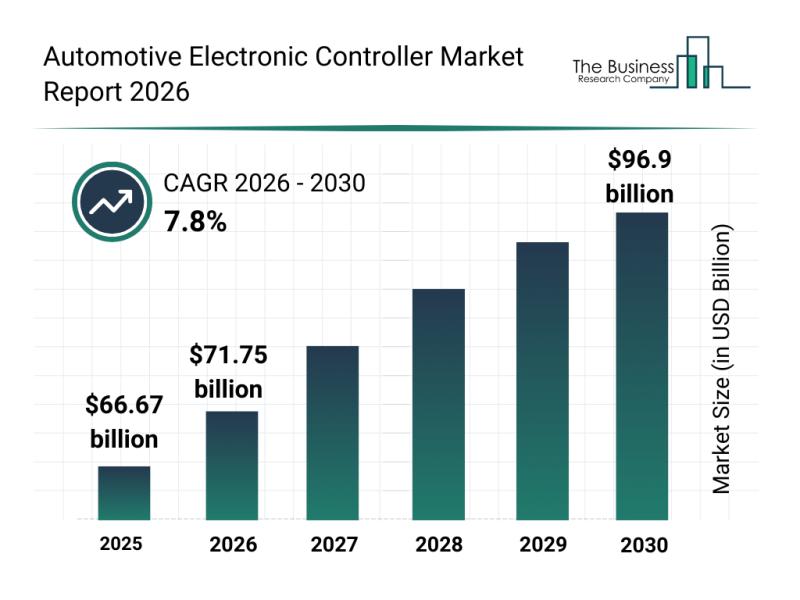

The automotive electronic controller market is on track for impressive expansion as technology continues to transform the automotive sector. With the industry embracing smarter and more connected vehicle systems, the demand for advanced controllers that manage and optimize vehicle functions is rapidly increasing. Below, we explore the market's projected growth, key players, notable trends, and the main segments shaping this dynamic field.

Projected Market Size and Growth of the Automotive Electronic…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…