Press release

Blockchain In Insurance Market Anticipated To Witness Robust Growth, Surpassing $20.3 Billion By 2029

The Blockchain In Insurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Current Blockchain In Insurance Market Size and Its Estimated Growth Rate?

The blockchain in insurance market size has grown exponentially in recent years. It will rise from $1.94 billion in 2024 to $3.11 billion in 2025, at a CAGR of 60.1%. The growth can be attributed to improvements in fraud prevention, streamlined claims processing, enhanced data security, greater transparency and trust, regulatory compliance, cost reductions, and better customer satisfaction.

The blockchain in insurance market is projected to grow exponentially, reaching $20.3 billion by 2029, at a CAGR of 59.8%. The growth is driven by smart contracts, IoT integration, parametric insurance, regulatory changes, and digital insurance. Key trends include blockchain interoperability, tokenization of assets, AI integration, decentralized insurance models, and the development of privacy-preserving solutions.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=16362

How Are Emerging Segments Shaping the Blockchain In Insurance Market Landscape?

The blockchain in insurance market covered in this report is segmented -

1) By Component: Solution, Services

2) By Enterprise Size: Large Enterprises, Small And Medium-sized Enterprises

3) By Application: Identity Management And Fraud Detection, Claims Management, Payments, Governance Risk And Compliance (GRC) Management, Other Applications

4) By Sector: Life Insurance, Health Insurance, Title Insurance

Subsegments:

1) By Solution: Claims Management Solutions, Policy Management Solutions, Underwriting Solutions, Fraud Detection And Prevention Solutions, Reinsurance Solutions, Smart Contract Solutions, Decentralized Insurance Platforms

2) By Services: Consulting Services, Blockchain Integration And Implementation Services, Blockchain-As-A-Service (Baas), Support And Maintenance Services, Training And Education Services, Smart Contract Auditing Services

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16362&type=smp

Which Growth Factors Are Influencing Blockchain In Insurance Market Expansion?

The rise in fraudulent insurance claims is expected to spur blockchain growth in the insurance sector. Fraudulent claims are dishonest attempts by policyholders to gain financial benefits they are not entitled to. This increase is attributed to economic pressures, the perceived ease of fraud, and insufficient detection measures. Blockchain helps reduce fraud by providing a transparent, immutable ledger to verify and authenticate claims. Allianz Insurance reported in February 2024 that claims fraud amounted to $98.04 million in 2023, an increase from $89.55 million in 2022. Therefore, the rise in fraudulent claims is propelling blockchain's growth in the insurance market.

Who Are the Dominant Players Across Different Blockchain In Insurance Market Segments?

Major companies operating in the blockchain in insurance market are Microsoft Corporation, Amazon Web Services Inc. (AWS), accen*ture plc, International Business Machines Corporation (IBM), Deloitte Touche Tohmatsu Limited, PricewaterhouseCoopers (PwC), Ernst & Young Global Limited, Oracle Corporation, KPMG International Cooperative, SAP SE, Capgemini SE, Lemonade Inc., R3 LLC, Metromile Inc., OneConnect Financial Technology Co. Ltd., Bitfury Group Limited, Guardtime AS, Insurwave, MetLife Insurance, Symbiont.io Inc., FidentiaX, ChainThat Limited, BTL Group, ConsenSys, Etherisc GmbH, Stratumn SAS, Kaleido Inc., Factom Inc., Auxesis Group, Everledger Ltd.

What Are the Major Trends Shaping the Blockchain In Insurance Market?

In the blockchain insurance market, companies are focusing on developing blockchain-based solutions to improve transparency, speed up claims processing, and enhance security. For instance, in January 2022, Etherisc, a Germany-based blockchain insurance company, launched a blockchain-backed insurance app that autonomously processes policies and payouts for flight delays, offering a secure, transparent experience without intermediaries.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/blockchain-in-insurance-global-market-report

Which Geographic Regions Are Expected to Dominate the Blockchain In Insurance Market in the Coming Years?

North America was the largest region in the blockchain in insurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the blockchain in insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Blockchain In Insurance Market?

2. What is the CAGR expected in the Blockchain In Insurance Market?

3. What Are the Key Innovations Transforming the Blockchain In Insurance Industry?

4. Which Region Is Leading the Blockchain In Insurance Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Blockchain In Insurance Market Anticipated To Witness Robust Growth, Surpassing $20.3 Billion By 2029 here

News-ID: 4035264 • Views: …

More Releases from The Business Research Company

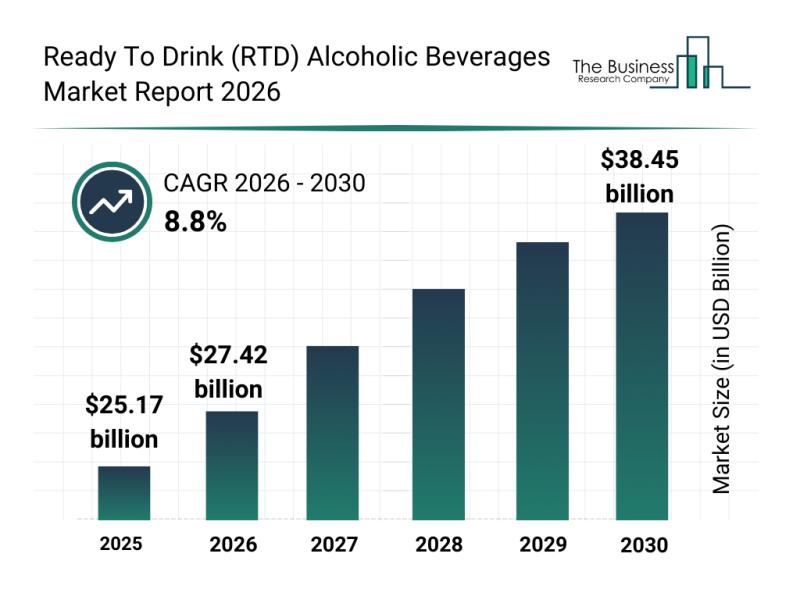

Outlook for the Ready To Drink (RTD) Alcoholic Beverages Market: Major Segments, …

The ready-to-drink (RTD) alcoholic beverages market is on track to experience significant growth over the coming years, driven by evolving consumer preferences and industry innovations. This sector is rapidly expanding as more consumers seek premium, convenient, and sustainable options in their alcoholic beverage choices. Let's explore the market's projected size, key drivers, major players, emerging trends, and segmentation details shaping its future.

Projected Expansion and Market Size of the Ready To…

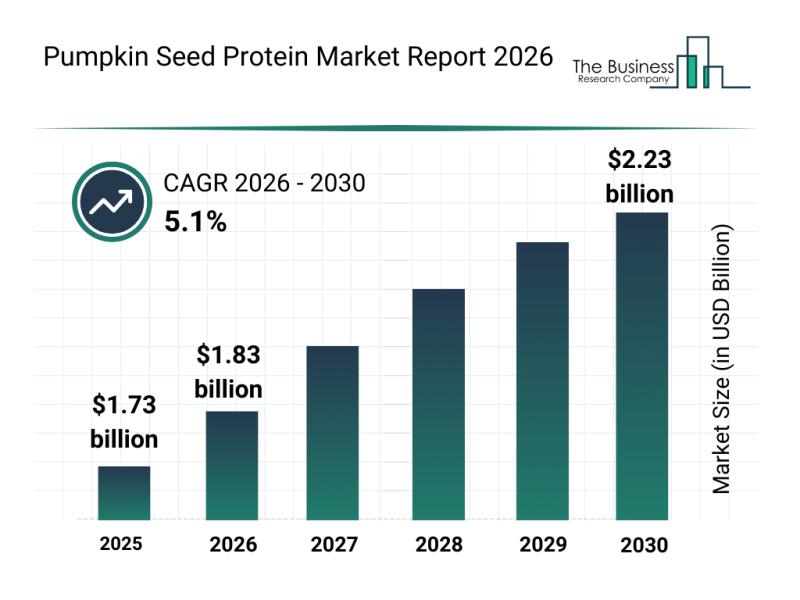

Emerging Sub-Segments Transforming the Pumpkin Seed Protein Market Landscape

The pumpkin seed protein market is emerging as a promising sector within the broader landscape of plant-based proteins. With increasing consumer interest in alternative, allergen-free protein sources and sustainable nutrition, this market is set to witness substantial growth and innovation. Let's explore the market size projections, key players, current trends, and major product segments shaping the future of pumpkin seed protein.

Projected Market Valuation and Growth Expectations for Pumpkin Seed Protein…

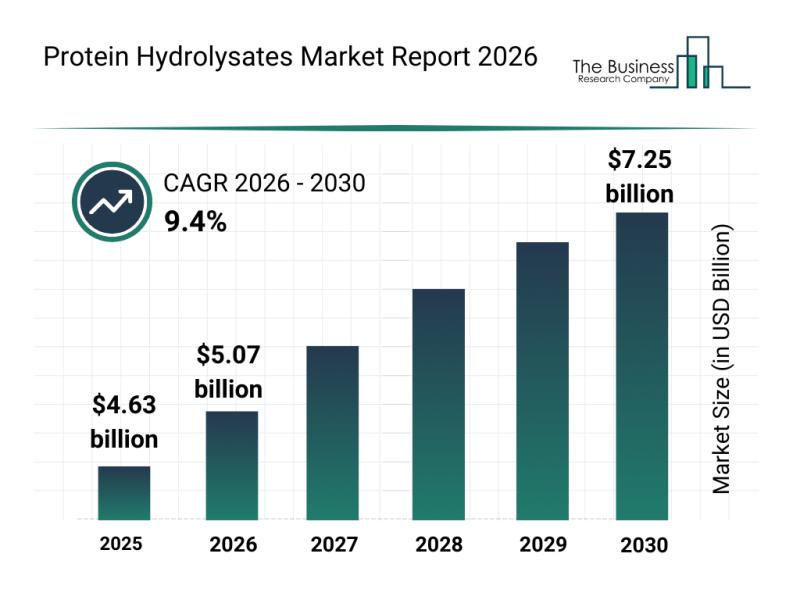

Top Players and Market Competition in the Protein Hydrolysates Industry

The protein hydrolysates market is positioned for significant expansion in the coming years as consumer preferences and nutritional science continue to evolve. With increasing attention on tailored nutrition solutions and the rise of plant-based options, this market is gearing up for robust growth and innovation.

Protein Hydrolysates Market Size Projections Through 2030

The protein hydrolysates market is forecasted to grow substantially, reaching a value of $7.25 billion by 2030. This…

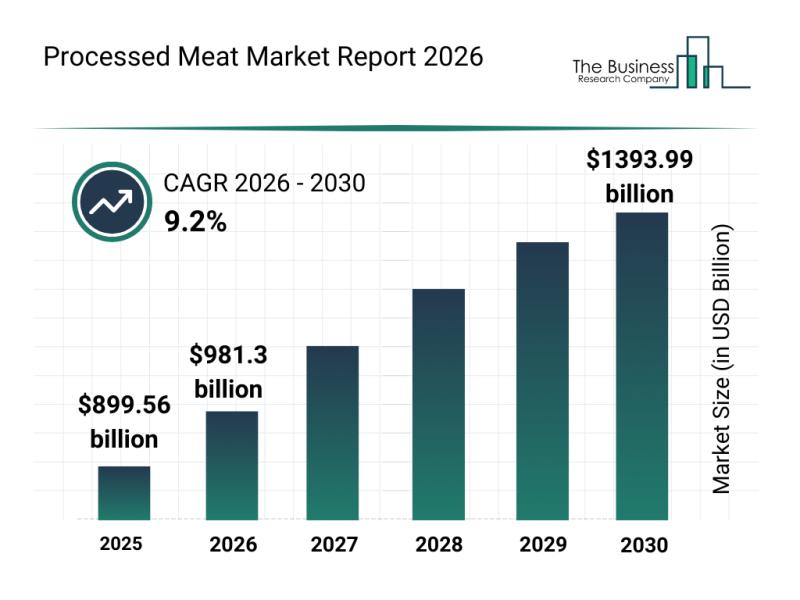

Processed Meat Market Overview: Major Segments, Strategic Developments, and Lead …

The processed meat industry is positioned for substantial expansion over the coming years, driven by evolving consumer preferences and technological advancements. As the market adapts to changing demands and regulatory landscapes, it is expected to reach impressive valuation milestones. Let's explore the current market size, key players, emerging trends, and detailed segment analyses shaping this sector's future.

Forecasted Market Size and Growth Trajectory of the Processed Meat Market

The processed…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…