Press release

Bancassurance Market Size Projected To Reach $238 Billion By 2034 With A Cagr Of 7.7%

The Bancassurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Projected Growth of the Bancassurance Market?

The bancassurance market has grown strongly in recent years. It will rise from $162.78 billion in 2024 to $176.76 billion in 2025, at a CAGR of 8.6%. The historical growth is attributed to regulatory changes, customer trust, market competition, strategic partnerships, and economic conditions.

The bancassurance market is expected to grow to $238 billion by 2029, at a CAGR of 7.7%. This growth is driven by regulatory reforms, demographic changes, customer expectations, globalization, and evolving regulations. Key trends include digital transformation, personalized services, integration with financial services, product innovation, and the use of data analytics.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=16354

What Are the Different Bancassurance Market Segments?

The bancassurance market covered in this report is segmented -

1) By Insurance Type: Life Insurance, Non-Life Insurance

2) By Model Type: Pure Distributor Model, Strategic Alliance Model, Joint Venture Model, Financial Holding, Other Model Types

3) By End User: Personal, Business

Subsegments:

1) By Life Insurance: Term Life Insurance, Whole Life Insurance, Endowment Policies, Universal Life Insurance, Unit-Linked Insurance Plans (Ulips), Pension Plans, Critical Illness Insurance, Annuities

2) By Non-Life Insurance: Health Insurance, Motor Insurance, Property Insurance, Travel Insurance, Homeowners Insurance, Liability Insurance, Personal Accident Insurance, Commercial Insurance (Including Business Insurance), Marine And Aviation Insurance

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16354&type=smp

What Are the Primary Drivers Shaping the Bancassurance Market?

The increasing demand for insurance is anticipated to drive the growth of the bancassurance market. Insurance is a financial arrangement where an individual or entity pays premiums to an insurer in return for protection against specified risks. The growing need for insurance stems from rising uncertainties, such as health problems, natural disasters, economic instability, and increasing asset values. Bancassurance addresses this demand by using banks' extensive customer networks and trust to offer tailored insurance products. For instance, in February 2024, LIMRA Inc. reported that in 2023, new U.S. life insurance premiums grew by 1%, reaching $15.6 billion, while the policy count increased by 4%. Notably, the sale of indexed universal life policies surged by 20%. Hence, the growing need for insurance will propel the bancassurance market.

Which Companies Are Leading in the Bancassurance Market?

Major companies operating in the bancassurance market are Allianz SE, AXA Group (AXA SA), Wells Fargo & Company, HSBC Holdings plc, Citigroup Inc., MetLife Inc., Assicurazioni Generali S.p.A., Prudential Financial Inc., American Express Company, BNP Paribas SA, ING Groep N.V., Mitsubishi UFJ Financial Group Inc. (MUFG), Crédit Mutuel, Barclays PLC, Crédit Agricole SA, Intesa Sanpaolo S.p.A., Banco Bradesco S.A., Standard Chartered PLC, Nordea Bank Abp, Australia and New Zealand Banking Group Limited (ANZ), CNA Financial Corporation, Lloyds Banking Group plc, Bank of Nova Scotia (Scotiabank), ABN AMRO Group N.V., Yes Bank Ltd.

What Bancassurance Market Trends Are Gaining Traction Across Different Segments?

Prominent companies in the bancassurance market are investing in digital insurance platforms to enhance customer experience and streamline operations. These platforms simplify insurance management through online systems that automate processes such as buying, managing, and claiming policies. For example, in October 2023, NCBA Bancassurance Intermediary LTD, a Kenya-based company, launched a digital insurance portal. The platform offers secure, self-service features such as quote comparisons, portfolio access, claim submissions, and premium payments.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/bancassurance-global-market-report

What Are the Top Revenue-Generating Geographies in the Bancassurance Market?

Asia-Pacific was the largest region in the bancassurance market in 2023. Middle East And Africa is expected to be the fastest-growing region in the forecast period. The regions covered in the bancassurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Bancassurance Market?

2. What is the CAGR expected in the Bancassurance Market?

3. What Are the Key Innovations Transforming the Bancassurance Industry?

4. Which Region Is Leading the Bancassurance Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bancassurance Market Size Projected To Reach $238 Billion By 2034 With A Cagr Of 7.7% here

News-ID: 4034844 • Views: …

More Releases from The Business Research Company

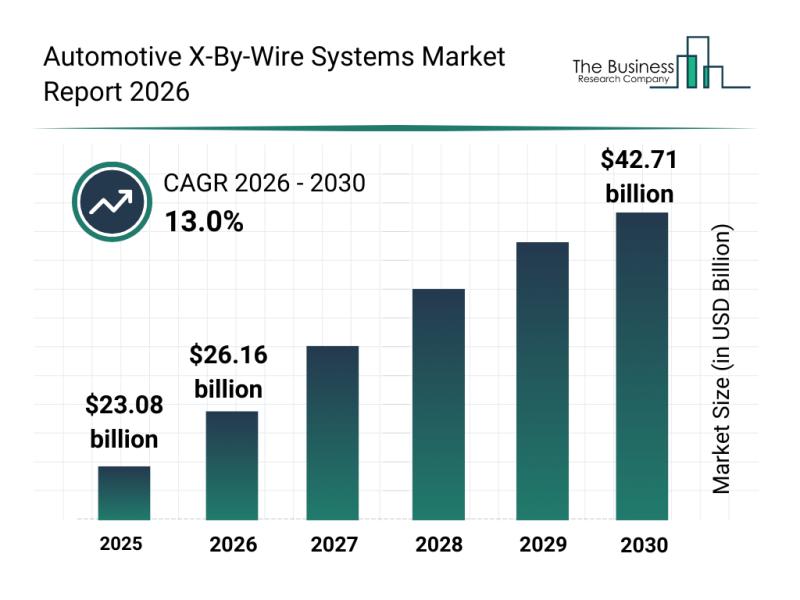

Leading Companies Spearheading Innovation and Growth in the Automotive X-By-Wire …

The automotive industry is undergoing a major transformation driven by innovative technologies that replace traditional mechanical linkages with electronic controls. Among these advancements, automotive x-by-wire systems are gaining significant attention for their potential to improve vehicle performance, safety, and efficiency. Let's explore the market size, key players, dominant trends, and segmentation within this rapidly evolving sector.

Projected Market Size and Growth of the Automotive X-By-Wire Systems Market

The automotive x-by-wire…

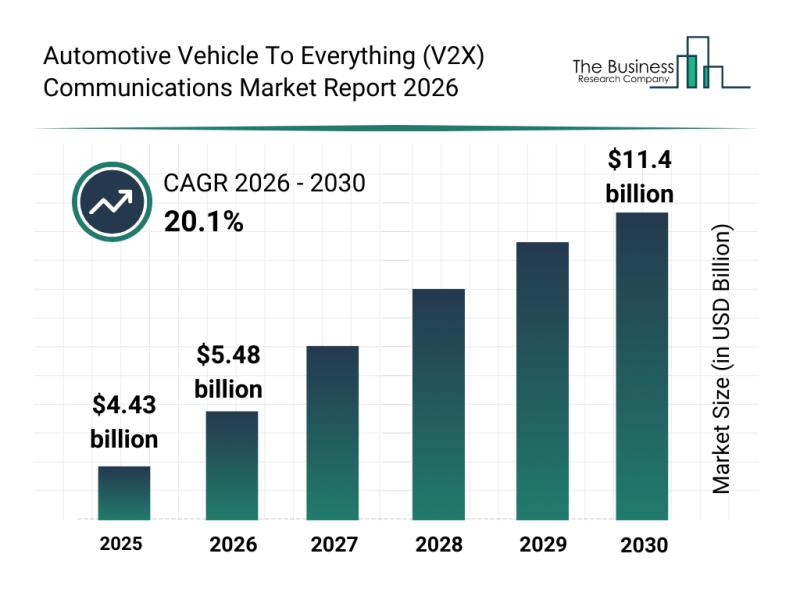

Automotive Vehicle to Everything (V2X) Communications Market Overview: Major Seg …

The automotive vehicle-to-everything (V2X) communications market is positioned for rapid expansion over the coming years as advanced technologies reshape transportation. With innovations in connectivity and safety playing critical roles, the market is set to evolve significantly, impacting how vehicles interact with each other and their surroundings. Below is an overview of the market's growth prospects, leading companies, emerging trends, and key segments shaping this dynamic industry.

Forecast for Growth in the…

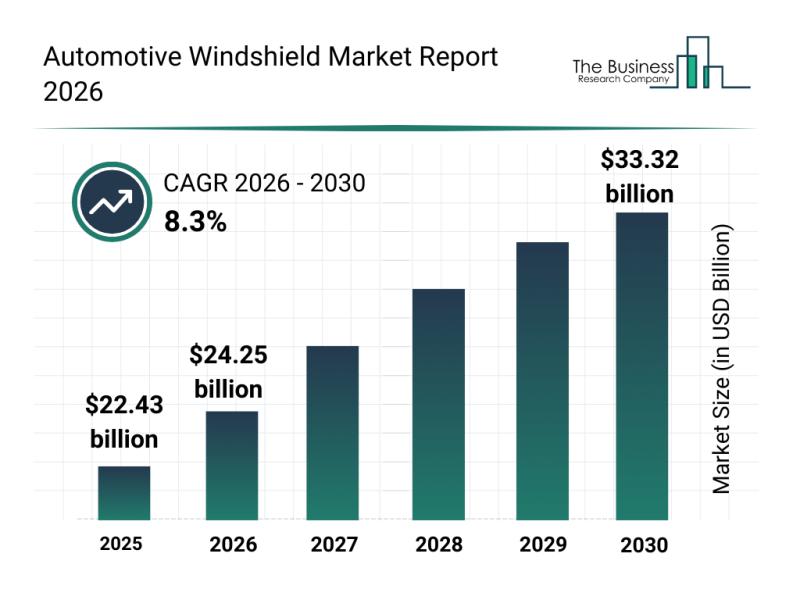

Key Players and Competitive Environment in the Automotive Windshield Market

The automotive windshield market is on track for significant expansion in the coming years, driven by technological advancements and evolving vehicle designs. With the rise of electric and autonomous vehicles, alongside innovations in safety and display integration, this sector is set to see remarkable growth. Let's explore the market size forecasts, key players, emerging trends, and the segmentation that shapes this dynamic industry.

Forecasted Growth and Market Size of the Automotive…

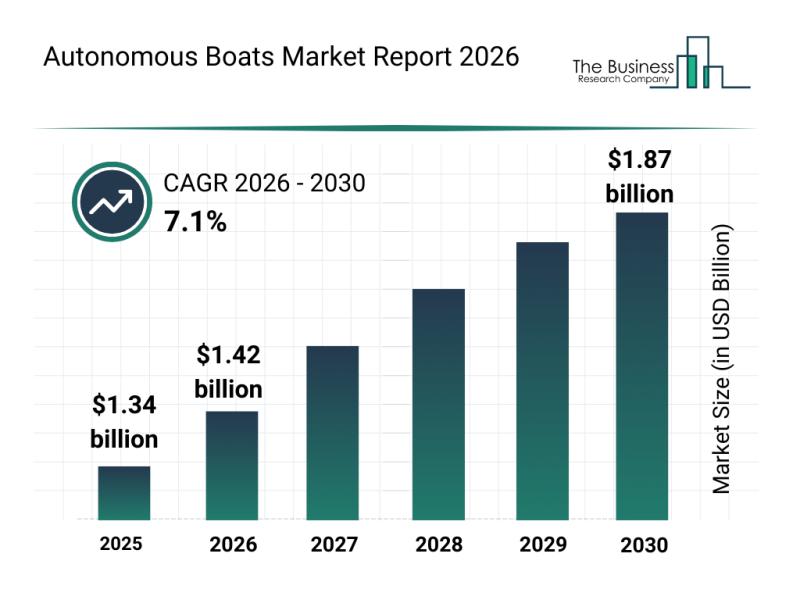

Leading Companies Solidify Their Presence in the Autonomous Boats Market

The autonomous boats sector is gaining significant traction as technological advancements and industry demands evolve. With increasing interest in unmanned operations and sustainable marine solutions, this market is set for notable expansion over the coming years. Let's explore the current market size, key players, emerging trends, and segmentation to understand the direction this innovative industry is heading.

Projected Growth and Market Size of Autonomous Boats

The autonomous boats market is…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…