Press release

BFSI Security Market to Surpass Expectations, Growing at 15.2% CAGR from 2025 to 2032 - Persistence Market Research

✅ BFSI Security Market Overview and Growth OutlookThe BFSI (Banking, Financial Services, and Insurance) security market is poised for substantial expansion, projected to grow at a CAGR of 15.2% between 2025 and 2032, according to Persistence Market Research. This surge in growth stems from increasing digital transformation, rising cyberattacks, and the growing need for advanced fraud prevention systems across banking and financial institutions. The rise in mobile banking and cloud adoption is further accelerating the demand for integrated security solutions in this sector.

As financial institutions become more digitized, the need to safeguard data, prevent identity theft, and maintain compliance has never been more critical. The market's rapid growth is supported by robust investments in cybersecurity technologies, AI-powered analytics, and regulatory compliance software. The network security segment is expected to lead due to the rising number of DDoS attacks and phishing attempts. Regionally, North America holds the largest market share, primarily driven by early technological adoption, stringent regulations, and a mature financial ecosystem that prioritizes cyber resilience.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/10472

✅ Key Highlights from the Report

➤ The global BFSI security market is expected to grow at a CAGR of 15.2% during 2025-2032.

➤ Network security is projected to remain the dominant segment due to increasing cyber threats.

➤ North America leads the market, backed by a strong regulatory environment and digital infrastructure.

➤ Growing reliance on cloud services in BFSI is fueling the demand for cloud-based security.

➤ Asia Pacific is emerging as the fastest-growing region due to expanding digital banking services.

➤ The integration of AI and ML technologies is improving threat detection and response capabilities.

✅ Market Segmentation

The BFSI security market can be segmented by security type, deployment mode, and end-user. By security type, the market includes physical security and information security. Information security further branches into network security, endpoint security, application security, content security, and database security. Among these, network security accounts for the largest share due to the increasing frequency of cyberattacks such as phishing, malware intrusions, and ransomware. As digital banking services expand, the demand for real-time monitoring and advanced firewall solutions is increasing significantly.

In terms of deployment, the market is divided into on-premise and cloud-based security solutions. While on-premise deployments have been traditionally preferred by large banks for tighter control, the trend is shifting toward cloud-based models due to scalability, cost efficiency, and seamless integration with other digital platforms. Regarding end-users, commercial banks, insurance companies, cooperative credit institutions, and investment firms are the primary adopters. Commercial banks dominate this segment, driven by their high transaction volumes and extensive digital engagement with consumers.

✅ Regional Insights

North America dominates the BFSI security market due to its advanced cybersecurity frameworks, high digital banking penetration, and proactive regulatory environment. Financial institutions in the U.S. and Canada are investing heavily in endpoint and data security solutions to prevent financial fraud and comply with standards like the Gramm-Leach-Bliley Act and PCI-DSS. This region's mature fintech ecosystem and early adoption of AI-based security tools contribute significantly to market leadership.

Meanwhile, Asia Pacific is witnessing the fastest growth in the BFSI security market. Rising internet penetration, increasing use of digital wallets, and the proliferation of neobanking platforms across countries like India, China, and Southeast Asia are driving demand. Governments and financial regulatory bodies in these regions are strengthening cybersecurity mandates, further fueling market expansion. Local players are partnering with global cybersecurity firms to enhance capabilities, creating a dynamic and competitive market landscape.

✅ Market Drivers

One of the most significant market drivers is the growing sophistication of cyber threats targeting the BFSI sector. As banks and financial institutions embrace digital transformation, they become prime targets for ransomware, insider threats, and phishing attacks. The need to protect sensitive customer data and maintain public trust is pushing these institutions to upgrade their security frameworks continuously. Additionally, the adoption of cloud computing, mobile banking, and fintech innovations has created a larger threat surface, demanding multilayered security solutions.

Furthermore, compliance with global and regional regulations such as GDPR, SOX, and PCI DSS is compelling financial entities to invest in advanced security measures. With increasing awareness about data privacy and the financial repercussions of breaches, organizations are proactively adopting AI-driven threat intelligence platforms and behavior analytics tools to stay ahead of potential attacks.

✅ Market Restraints

Despite its rapid growth, the BFSI security market faces several challenges. One major restraint is the high cost of implementation and maintenance of sophisticated security infrastructure, which can be a barrier for small and medium-sized financial firms. Many such institutions struggle to balance operational costs with investments in cybersecurity, often leading to underdeveloped defenses.

Moreover, the complexity of integrating new security solutions with legacy systems continues to hinder adoption. Older IT frameworks in traditional banks are not always compatible with modern, cloud-native, AI-enabled security tools, creating friction in deployment and ongoing operations. Also, a shortage of skilled cybersecurity professionals adds to the operational risk, as many firms lack internal expertise to manage and monitor these systems effectively.

✅ Market Opportunities

The BFSI security market offers ample opportunities, particularly with the rise of AI and machine learning integration into cybersecurity platforms. These technologies enable predictive analytics, anomaly detection, and automated incident response-capabilities that are crucial in the high-risk BFSI environment. Vendors that offer integrated AI-powered solutions are well-positioned to capitalize on this trend.

Another promising area is the growing demand for managed security services (MSS), especially among small and mid-sized banks that lack in-house security expertise. Outsourcing cybersecurity to specialized service providers allows these firms to access advanced tools and threat intelligence without bearing the full infrastructure cost. Additionally, expansion in emerging markets where digital banking is booming provides significant room for growth, especially for vendors that can tailor scalable, region-specific security offerings.

For Customized Insights on Segments, Regions, or Competitors, Request Personalized Purchase Options @ https://www.persistencemarketresearch.com/request-customization/10472

✅ Frequently Asked Questions (FAQs)

➤ How Big is the BFSI Security Market?

➤ Who are the Key Players in the Global Market for BFSI Security?

➤ What is the Projected Growth Rate of the BFSI Security Market?

➤ What is the Market Forecast for BFSI Security through 2032?

➤ Which Region is estimated to dominate the BFSI Security Industry through the Forecast Period?

✅ Company Insights

✦ Booz Allen Hamilton Inc.

✦ Broadcom Inc.

✦ Dell Technologies Inc.

✦ FireEye, Inc.

✦ HCL Technologies Ltd.

✦ IBM Corporation

✦ McAfee, LLC

✦ Microsoft Corporation

✦ NortonLifeLock Inc.

✦ Palo Alto Networks Inc.

✦ Sophos Ltd.

✦ Trend Micro Inc.

✅ Recent Developments

■ In 2024, IBM launched a zero-trust security platform tailored specifically for financial institutions, focusing on AI-driven threat detection.

■ Palo Alto Networks partnered with HSBC to strengthen their global threat intelligence operations through cloud-native security integration.

This comprehensive article captures the growing complexity and innovation within the BFSI security market, helping stakeholders understand the forces shaping the industry and navigate future investment decisions with confidence. Let me know if you'd like this formatted into a blog-ready version or need help generating visual infographics or report summaries.

✅Explore the Latest Trending "Exclusive Article" @

• https://www.linkedin.com/pulse/exploring-future-connected-living-room-market-webrank-media-eaugf/

• https://medium.com/@apnewsmedia/how-smart-devices-are-transforming-the-living-room-experience-1ac039b098c4

• https://techxpresstoday.wordpress.com/2025/05/20/key-trends-driving-growth-in-the-connected-living-room-market/

• https://webrankmedia.blogspot.com/2025/05/the-impact-of-iot-on-modern-living-room.html

• https://vocal.media/stories/challenges-facing-the-connected-living-room-market-today

✅Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

✅About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release BFSI Security Market to Surpass Expectations, Growing at 15.2% CAGR from 2025 to 2032 - Persistence Market Research here

News-ID: 4031006 • Views: …

More Releases from Persistence Market Research

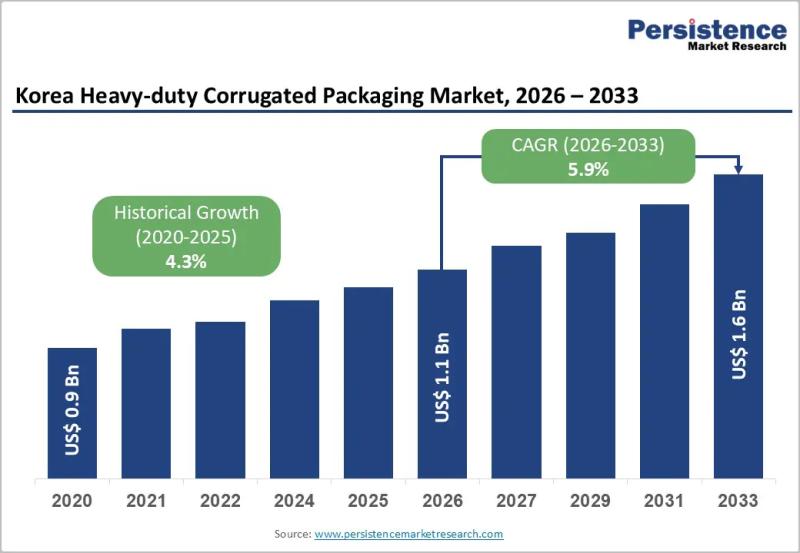

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for BFSI

Evolving Market Trends In The Robotic Process Automation In BFSI Industry: Advan …

The Robotic Process Automation In BFSI Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Robotic Process Automation In BFSI Market Size During the Forecast Period?

In recent times, the market size for robotic process automation in bfsi has witnessed a significant surge.…

Evolving Market Trends In The Banking, Financial Services and Insurance (BFSI) S …

The Banking, Financial Services and Insurance (BFSI) Security Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Banking, Financial Services and Insurance (BFSI) Security Market Size During the Forecast Period?

The market size for security within the banking, financial services and insurance (BFSI)…

Key Trend Reshaping the AI in BFSI Market in 2025: Transforming The BFSI Sector …

What combination of drivers is leading to accelerated growth in the ai in bfsi market?

The anticipated surge in the AI in BFSI market may be traced back to the mounting use of AI in improving efficiency. Artificial intelligence (AI) comprises various technologies and algorithms that simulate human intelligence, including problem-solving, drawing insights from data, and making effective decisions. This growing usage of AI for enhancing efficiency could be attributed to…

Mumbai's BFSI Sector Gears Up for Transformation at the 24th Edition of BFSI IT …

Mumbai: The banking, financial services, and insurance (BFSI) sector in Mumbai is currently undergoing a profound transformation, fueled by rapid technological advancements and a significant increase in digital adoption. Emphasizing a strong commitment to digitalization, key stakeholders in Mumbai are championing initiatives akin to advancements in digital payments and the establishment of the Digital Banking Transformation Office. These efforts are propelling the BFSI landscape forward, fostering innovation and paving the…

Empowering BFSI Security: Safeguarding Futures Amid Evolving Threats, BFSI Secu …

Guarding the financial backbone against evolving cyber threats fuels the burgeoning, emergence of tailored solutions, biometrics, and IoT-based cybersecurity solutions significantly enhancing online banking Opportunities for the market.

The BFSI Security Market, valued at USD 61.6 billion in 2022, is poised to witness exponential growth, reaching USD 166.2 billion by 2030, reflecting a robust CAGR of 13.2%. This escalating trajectory is primarily attributed to the stringent regulatory environment governing the banking,…

IoT in BFSI Market : How the Business Will Grow in 2026?�Top Players in IoT in B …

The global internet of things (IoT) in banking, financial services, and insurance (BFSI) market is predicted to reach USD 116.27 billion by 2026, exhibiting a CAGR of 26.5% during the forecast period. The increasing investment of banks and financial institutions in IoT technologies will stimulate the growth of the market in the foreseeable future. According to the studies conducted by Tata consultancy services, financial institutions spend an average IoT budget…