Press release

Global Trade Finance Market Outlook 2025-2034: Trends, Innovations, And Future Outlook

The Trade Finance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Trade Finance Market Size and Projected Growth Rate?

In the past years, the trade finance market has experienced significant expansion. Its worth is expected to rise from $49.48 billion in 2024 to $52.61 billion in 2025, with a compound annual growth rate (CAGR) of 6.3%. The noticeable growth in the past intervals can be traced back to factors such as globalization, an increase in global trade, regulatory modifications, economic instability, and changes in supply chain behavior.

The market for trade finance is poised for robust expansion in the coming years, with projections estimating it will reach $66.37 billion by 2029, registering a compound annual growth rate (CAGR) of 6.0%. Several factors are expected to contribute to this growth in the anticipated period, including the implementation of pricing and structuring tools, growth of emerging markets, sustainable trade, and consideration of ESG (environmental, social, and governance) factors, geopolitical changes, and trade policies. Furthermore, risk management and supply chain resilience also play a pivotal role. The growth trajectory is likely to be shaped by several emerging trends such as the integration of blockchain, digital transition, the adoption of artificial intelligence (AI) and machine learning (ML), technology improvements, and innovations in cross-border payments.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=14812

What Are the Major Segments in the Trade Finance Market?

The trade finance market covered in this report is segmented -

1) By Type: Supply Chain Finance, Structured Trade Finance, Traditional Trade Finance

2) By Service Provider: Banks, Financial Institutions, Trading Houses, Other Services

3) By Application: Domestic, International

4) By Industry: Banking, Financial Services, And Insurance (BFSI), Construction, Wholesale Or Retail, Manufacturing, Automobile, Shipping And Logistics, Other Industries

Subsegments:

1) By Supply Chain Finance: Reverse Factoring, Invoice Discounting, Payables Financing, Receivables Financing

2) By Structured Trade Finance: Pre-Export Financing, Pre-Shipping Financing, Inventory Financing, Trade Receivables Securitization

3) By Traditional Trade Finance: Letter of Credit (LC), Trade Credit Insurance, Documentary Collection, Bank Guarantees

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=14812&type=smp

What Are The Driving Trade Finance Market Evolution?

The surge in demand for security in financial operations is anticipated to stimulate the expansion of the trade finance market in the future. The concept of financial activity security covers the strategies and procedures set up to shield financial transactions from illegal intrusion, deception, and larceny. The escalating financial interdependence is causing a surge for safety and security in trading activities, warranting measures to guard traders and transactions from emerging hazards and risks. Trade finance introduces safe payment methodologies that ensure the sound and trustable completion of trade dealings. Moreover, it proffers access to trade credit and financing alternatives that allow companies to oversee cash flow, alleviate liquidity hazards, and broaden their trading activities. For example, in February 2024, as per the Federal Trade Commission, an autonomous government organization based in the US, it was stated that in 2023, consumers experienced over $10 billion loss due to fraud, recording the foremost time such fraud losses have hit the particular milestone. This indicates a 14% incline compared to the losses reported in the prior year, 2022. Almost 1 in 5 individuals accounted for a financial deficit because of an imposter con. Consequently, the augmented demand for security in financial operations is propelling the expansion of the trade finance market.

Which Firms Dominate The Trade Finance Market Segments?

Major companies operating in the trade finance market are JPMorgan Chase & Co., China Construction Bank, Bank of America Corporation, Citigroup Inc., BNP Paribas S.A., HSBC Holdings plc, Mitsubishi UFJ Financial Inc., Credit Agricole Group, Union Bank of Switzerland, Deutsche Bank AG, Unicredit SpA, Societe Generale SA, Standard Chartered plc, Asian Development Bank, Internationale Nederlanden Groep, Development Bank of Singapore Limited, Nordea Group Abp, Euler Hermes Group, The Royal Bank of Scotland Group plc, The Bank of Nova Scotia, TD Bank, Coöperatieve Rabobank U.A., Commerzbank AG, Rand Merchant Bank, Arab Bank

What Trends Are Expected to Dominate the Trade Finance Market in the Next 5 Years?

Companies playing a significant role in the trade finance market are progressively focusing on innovating new technologies like digital trade finance solutions to stand out from their competition. This digital trade finance solution is a tool that utilizes advanced technologies including blockchain, artificial intelligence (AI), digital signatures, and optical character recognition (OCR) to improve operational efficiency and resolve issues inherent in the industry, while also mitigating transaction expenses. In September 2023, the Hong Kong and Shanghai Banking Corporation Limited (HSBC) - a British commercial banking corporation, introduced HSBC TradePay. This is a trade finance solution developed to provide businesses a more streamlined, fully digital method of paying suppliers, enhancing working capital situations, and bolstering relationships with trading partners using efficient finance solutions. The innovative HSBC TradePay simplifies the loan drawdown process, eases supplier payments, and provides businesses full control over the timing of their trade payables.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/trade-finance-global-market-report

Which Is The Largest Region In The Trade Finance Market?

North America was the largest region in the trade finance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the trade finance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Trade Finance Market?

2. What is the CAGR expected in the Trade Finance Market?

3. What Are the Key Innovations Transforming the Trade Finance Industry?

4. Which Region Is Leading the Trade Finance Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Trade Finance Market Outlook 2025-2034: Trends, Innovations, And Future Outlook here

News-ID: 4030208 • Views: …

More Releases from The Business Research Company

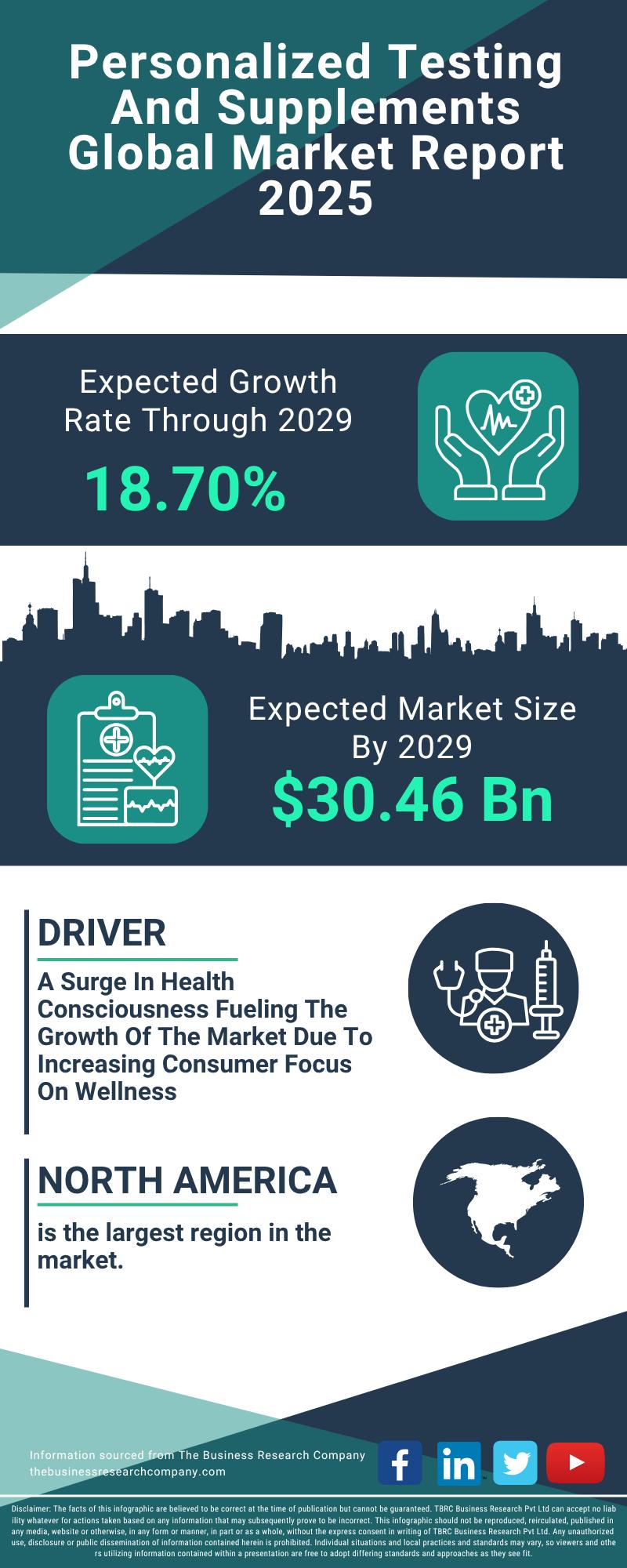

Segment Evaluation and Major Growth Areas in the Personalized Testing and Supple …

The personalized testing and supplements sector is gaining remarkable traction, driven by advancements in technology and a rising consumer focus on tailored health solutions. As more individuals seek customized wellness options, this market is set to experience substantial expansion in the coming years. Here's an in-depth look at its current valuation, key players, significant trends, and the main market segments shaping its future.

Market Valuation and Expansion Forecast for Personalized Testing…

Top Players and Market Competition in the Skin Microbiome Industry

The skin microbiome market is emerging as a significant area of interest due to growing awareness about the critical role of skin health and innovative skincare technologies. As research advances and consumer preferences shift towards more natural and science-backed products, this market is set to undergo substantial growth. Let's explore the current market size, key players, driving factors, and upcoming trends shaping the skin microbiome industry.

Projected Expansion in the Skin…

Key Strategic Developments and Emerging Changes Shaping the Upadacitinib Market …

The upadacitinib market is poised for significant expansion over the coming years, driven by advances in treatment options and increasing awareness of autoimmune diseases. This report delves into the market's current size, key drivers, major players, and the emerging trends shaping its future trajectory.

Steady Growth Expected in Upadacitinib Market Size Through 2029

The market for upadacitinib is projected to reach $2.54 billion by 2029, growing at a robust compound annual…

Analysis of Key Market Segments Driving the Alzheimer's Disease Diagnostic Marke …

The Alzheimer's disease diagnostic sector is rapidly evolving as advancements in technology and healthcare infrastructure open new possibilities for early detection and personalized treatment. With rising awareness and innovative approaches, this market is poised for significant growth in the coming years. Let's explore the current market size, key drivers, leading companies, and emerging trends that are shaping this critical healthcare field.

Projected Market Size and Growth Trends in Alzheimer's Disease Diagnostics…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…