Press release

Online Insurance Market Expected to Hit $330.1 Billion by 2031

According to a new report published by Allied Market Research, titled, "Online Insurance Market," The online insurance market was valued at $53.2 billion in 2021, and is estimated to reach $330.1 billion by 2031, growing at a CAGR of 20.2% from 2022 to 2031.Get a Sample Copy of this Report

https://www.alliedmarketresearch.com/request-sample/A31675

The online insurance platform is a business model that acts as an enabler for insurers to shift from traditional business processes toward the digital mode, in addition, it helps insurers in scaling their operations with built-in end-to-end functionalities. Moreover, online insurance platforms empower insurers by providing the efficiency of central-core systems and the differentiation of easy-to-compose customer experience. The online insurance platform providers' prime responsibility to ensure the proper deployment and integration of digital insurance solutions as per the specific requirements of clients.

Furthermore, increasing internet penetration and increase in smartphone usage are boosting the growth of the global online insurance market. However, digital transformation is time-consuming and privacy and security concerns are hampering the online insurance market growth. On the contrary, the increasing adoption of digital solutions is expected to offer remunerative opportunities for the expansion of the online insurance market during the forecast period.

Depending on insurance type, the large life insurance segment holds the largest online insurance market share as it helps to improve mortality and lapse predictions and optimize decision-making. However, the health insurance segment is expected to grow at the highest rate during the forecast period, owing to increasing adoption of a technology revolution and increase in data availability.

Region-wise, the online insurance market size was dominated by North America in 2021, and is expected to retain its position during the forecast period, large scale adoption of IoT and other technology solutions. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to growing economies such as India and China and increasing demand to buy insurance online.

Buy Now:

https://www.alliedmarketresearch.com/checkout-final/84e1fdd41988ada25d57f1f65d563c93

Key players operating in the market are facing the negative impact of the COVID-19 outbreak and are experiencing a severe decline in their revenue. For instance, as AI becomes more deeply integrated into the industry, carriers must position themselves to respond to the changing business landscape. Insurance executives must understand the factors that will contribute to this change and how AI will reshape claims, distribution, and underwriting and pricing. With this understanding, they can start to build the skills and talent, embrace the emerging technologies, and create the culture and perspective needed to be successful players in the insurance industry of the future.

For instance, on August 29, 2022, India Inc. is increasingly looking at dedicated cyber security insurance coverage to address pervasive cyber threats including malware attacks, compromised emails, cryptojacking, or instances of disgruntled employees or adversaries attacking software systems and machinery. The outbreak of COVID-19 is expected to provide numerous opportunities for the market to grow during the forecast period due to an increase in demand for insurance industry digitization and to provide insurance quotes online. The changing (and growing) demands of policyholders are, besides pure efficiency, the important second driver of innovation. In addition, insurers have mainly used IoT capabilities to aid interactions with customers and to accelerate and simplify underwriting and claims processing. Increasingly, however, new IoT-based services and business models are emerging that are highly attractive to insurers. In the context of these new business models, digital networking through the IoT could become a strategic component for insurers. For example, insurers could partner with companies to provide improved or new cross-industry products and services that harness IoT technologies and the new ecosystems.

Speak To Analyst

https://www.alliedmarketresearch.com/connect-to-analyst/A31675

The key players that operate in the online insurance market are Allianz SE, assicurazioni generali spa, AXA Group, Munich Re, Swiss Re, Aviva, Zurich Insurance Group, Esurance Insurance Services, Inc, Lemonade, Inc., RooT. These players have adopted various strategies to increase their market penetration and strengthen their position in the online insurance industry.

Trending Reports:

P&C Insurance Software Market https://www.alliedmarketresearch.com/p&c-insurance-software-market-A31324

Wireless POS Terminal Market https://www.alliedmarketresearch.com/wireless-pos-terminal-market-A14686

Business Analytics in FinTech Market https://www.alliedmarketresearch.com/business-analytics-in-fintech-market-A31471

Tax Advisory Services Market https://www.alliedmarketresearch.com/tax-advisory-services-market-A31503

Commercial Banking Market https://www.alliedmarketresearch.com/commercial-banking-market-A06184

Sustainable Finance Market https://www.alliedmarketresearch.com/sustainable-finance-market-A19436

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Insurance Market Expected to Hit $330.1 Billion by 2031 here

News-ID: 4029205 • Views: …

More Releases from Allied Market Research

Aerial Imaging Market Rapidly Increasing Worldwide With Leading Key Players

According to the report, the global aerial imaging industry generated $2.26 billion in 2020, and is anticipated to generate $8.52 billion by 2030, witnessing a CAGR of 14.2% from 2021 to 2030.

Rise in demand for aerial imaging in varied commercial applications, surge in use of aerial imaging for disaster risk reduction & prevention, and use of aerial imaging technology in setting up 5G infrastructure drive the growth of the global…

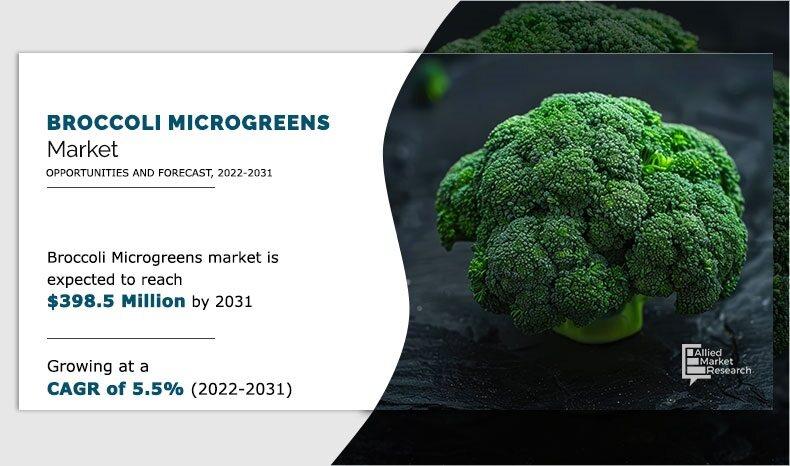

Broccoli Microgreens Market Size, Demands, Latest Trend, Growth Rate and Forecas …

According to the report, the global broccoli microgreens industry generated $237.20 million in 2021, and is estimated to reach $398.5 million by 2031, witnessing a CAGR of 5.5% from 2022 to 2031.

Increase in popularity of the health benefits of broccoli microgreens, the adoption of roof gardens and park gardens to grow microgreens, the need of less resources to grow broccoli microgreens, increase in spending on healthy, fresh, and nutritious agricultural…

Winter Footwear Market 2026 : Expeditious Growth Expected in 2021 - 2031 | UGG, …

According to a new report published by Allied Market Research, titled, "Winter Footwear Market," The winter footwear market was valued at $8.6 billion in 2021, and is estimated to reach $13.6 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

"Numerous varieties of winter footwear are expected to boost the market growth in the foreseeable future. Moreover, incorporation of customization, as well as innovative winter footwear is…

Ergonomic Chair Market Research Insights: Uncovering CAGR and USD Growth Drivers …

An ergonomic office chair is mostly utilized in different firms and other business areas where employees operate in a sitting position for extended hours. Adjustable seats, brackets and natural postures, which minimize back discomfort and stress in the lengthy seating time, are the ergonomic chairs. Currently, the offices are selecting ergonomic office chairs over the standard office chair to make the workplace healthier, happier, and to boost employer productivity. The…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…