Press release

UK Anti-Money Laundering Market 2025 | Worth USD 225.10 Million by 2033

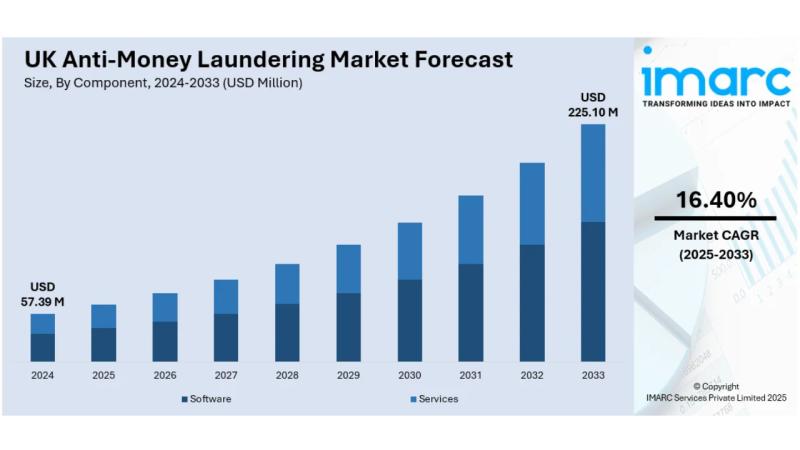

The latest report by IMARC Group, titled "UK Anti-Money Laundering Market Size, Share, Trends and Forecast by Component, Product, Deployment, Enterprise Size, End Use, and Region, 2025-2033," offers a comprehensive analysis of the UK anti-money laundering market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The UK anti-money laundering market size reached USD 57.39 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 225.10 Million by 2033, exhibiting a growth rate (CAGR) of 16.40% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 57.39 Million

Market Forecast in 2033: USD 225.10 Million

Market Growth Rate 2025-2033: 16.40%

UK Anti-Money Laundering Market Overview

The UK anti-money washing (AML) advertise is seeing critical development, driven by stricter directions, expanded corporate obligation, progressed

mechanical appropriation, rising cross-border exchanges, monetary globalization, improved due constancy prerequisites, and more grounded authorization measures pointed at avoiding cash washing, extortion, and illegal money related exercises within the UK's advancing administrative scene.

Request For Sample Report:

https://www.imarcgroup.com/uk-anti-money-laundering-market/requestsample

UK Anti-Money Laundering Market Trends and Market Drivers

Key trends and drivers influencing the UK anti-money laundering market include:

Strengthened Legislative Framework and Corporate Accountability:

The UK's AML showcase is encountering striking development due to improved administrative measures pointed at controling monetary wrongdoing. Administrative specialists are fixing compliance necessities, expanding corporate risk, and growing the scope of AML requirement. Businesses over money related administrations, legitimate, and corporate segments are confronting stricter commitments to anticipate unlawful budgetary exercises, driving request for progressed AML arrangements. Improved due constancy, exchange checking, and hazard appraisal conventions are getting to be basic to guarantee compliance with advancing controls.

Economic Crime and Corporate Transparency Act 2023:

Successful from October 2023, this Act presented major changes, extending corporate obligation for cash washing and extortion and making companies responsible for avoiding such offenses or confronting punishments. It moreover reinforced law authorization powers to seize and recoup crypto resources connected to illegal exercises, reflecting the government's center on handling rising money related wrongdoing dangers. These changes are compelling organizations to contribute in AI-driven AML advances, robotized compliance instruments, and blockchain-based extortion discovery frameworks to moderate dangers successfully.

UK Anti-Money Laundering Market Segmentation

1. By Component

• Software

• Services

2. By Product

• Transaction Monitoring

• Currency Transaction Reporting

• Customer Identity Management

• Compliance Management

• Others

3. By Deployment

• On-premises

• Cloud-based

4. By Enterprise Size

• Small and Medium-sized Enterprises

• Large Enterprises

5. By End Use

• BFSI

• Defense

• Healthcare

• IT and Telecom

• Retail

• Others

6. By Region

• England

• Scotland

• Wales

• Northern Ireland

Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/uk-anti-money-laundering-market

UK Anti-Money Laundering Market News

October 2023: The UK government enacted the Economic Crime and Corporate Transparency Act 2023, introducing major reforms to expand corporate liability for money laundering and fraud, and strengthening law enforcement powers to seize and recover crypto assets linked to illicit activities.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=32509&flag=E

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC's offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UK Anti-Money Laundering Market 2025 | Worth USD 225.10 Million by 2033 here

News-ID: 4027599 • Views: …

More Releases from IMARC Group

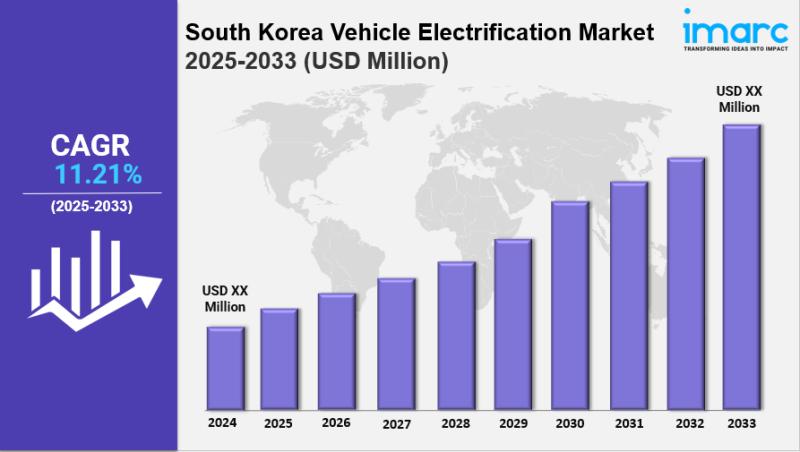

South Korea Vehicle Electrification Market Size, Growth, Key Players, Latest Tre …

IMARC Group has recently released a new research study titled "South Korea Vehicle Electrification Market Report by Product Type (Starter Motor, Alternator, Electric Car Motors, Electric Water Pump, Electric Oil Pump, Electric Vacuum Pump, Electric Fuel Pump, Electric Power Steering, Actuators, Start/Stop System), Vehicle Type (Internal Combustion Engine (ICE) and Micro-Hybrid Vehicle, Plug-in Hybrid Electric Vehicle (PHEV) and Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV)), Sales Channel (Original Equipment…

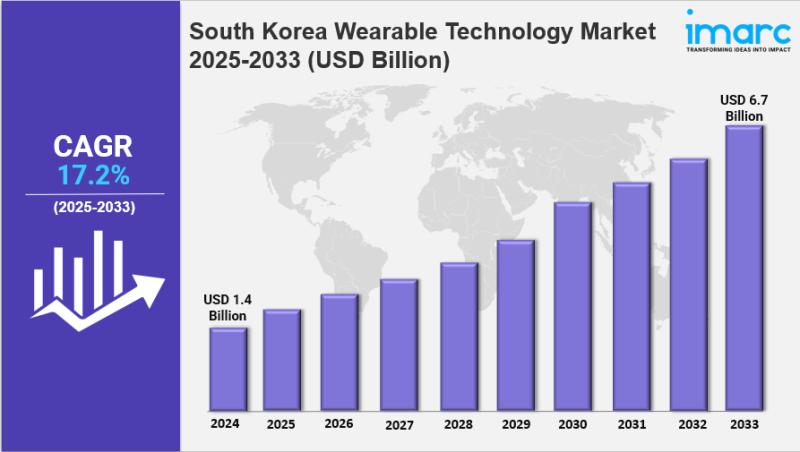

South Korea Wearable Technology Market Size, Share, Industry Overview, Trends an …

IMARC Group has recently released a new research study titled "South Korea Wearable Technology Market Report by Product (Wrist-Wear, Eye-Wear and Head-Wear, Foot-Wear, Neck-Wear, Body-Wear, and Others), Application (Consumer Electronics, Healthcare, Enterprise and Industrial Application, and Others), and Region 2025-2033" This report offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wearable Technology Market Overview

The…

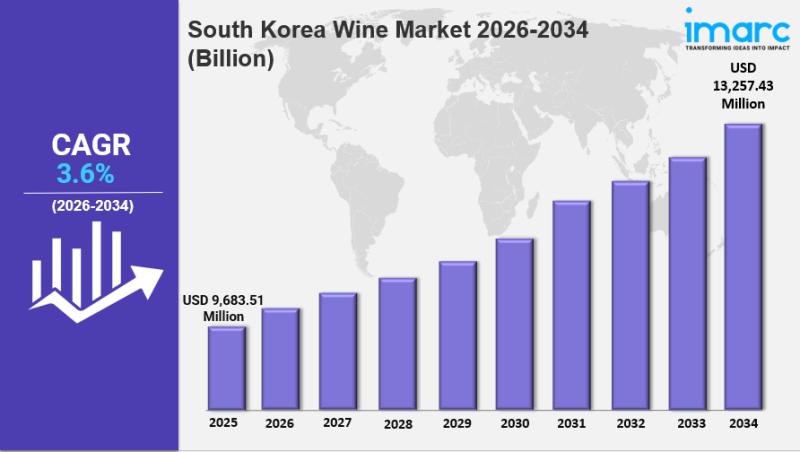

South Korea Wine Market Size, Share, Industry Overview, Trends and Forecast 2026 …

IMARC Group has recently released a new research study titled "South Korea Wine Market Size, Share, Trends and Forecast by Product Type, Color, Distribution Channel, and Region, 2026-2034", which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wine Market Report Overview

The South Korea wine market size was valued at USD 9,683.51 Million in 2025.…

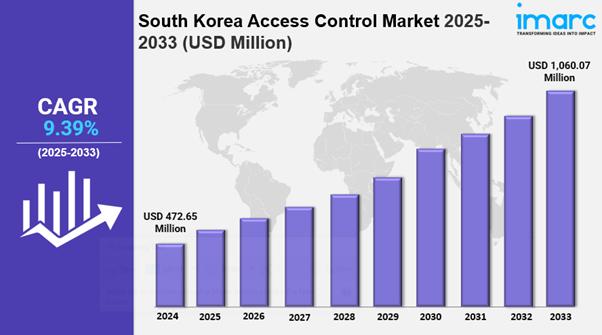

South Korea Access Control Market Size, Share, Industry Overview, Trends and For …

IMARC Group has recently released a new research study titled "South Korea access control market Size, Share, Trends and Forecast by Component, Deployment Mode, SMS Traffic, Application, End User, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Access Control Market Overview

The South Korea access control market size was valued at USD…

More Releases for Laundering

Surge In Money Laundering Cases Drives Growth Of Anti-Money Laundering Software …

Use code ONLINE20 to get 20% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Anti-Money Laundering Software Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The market size for anti-money laundering software has seen swift expansion in the past few years. Its growth is expected to rise from $2.85 billion in 2024 to $3.22 billion in 2025, with a…

Prominent Anti-Money Laundering Market Share Trend for 2025: SaaS Anti-Money Lau …

What industry-specific factors are fueling the growth of the anti-money laundering market?

The increasing emphasis on internet banking and digital transactions is anticipated to drive the anti-money laundering market's expansion in the future. Digital transactions involve money transfer from one payment account to another via a computer, mobile phone, or other digital device. Technologies aimed at preventing money laundering are employed to deter online fraud and mitigate risks associated with digital…

Leading Growth Driver in the Anti-Money Laundering Software Market in 2025: Surg …

Which drivers are expected to have the greatest impact on the over the anti-money laundering software market's growth?

The surge in incidents related to money laundering is anticipated to boost the anti-money laundering software industry. Money laundering typically involves transforming unlawfully obtained capital into lawful funds. The significant growth in money laundering incidents has facilitated the widespread use of anti-money laundering software programs to meet the regulatory demands of organizations seeking…

Anti-Money Laundering: Global Market Outlook

Summary:

Anti-money laundering (AML) comprises laws, policies, and regulations to safeguard financial frauds and illegal activity. Organizations must comply with these regulations even though compliance led financial institutions do have compliance departments and purchase software solutions. As times are changing, organizations are becoming more adaptive to the AML technologies and the end-user industry is reflecting various important trends shaping how they are being utilized. Increasing stringent regulations and compliance obligations for…

Rising Money Laundering Cases To Boost Anti-Money Laundering Market Growth

Factors such as the surging number of money laundering cases and mounting information technology (IT) expenditure will facilitate the anti-money laundering (AML) market growth during the forecast period (2021-2030). According to P&S Intelligence, the market generated a revenue of $2.4 billion revenue in 2020. Moreover, the surging volume of digital payments, rising technological advancements, and mounting internet traffic will also accelerate the market growth in the foreseeable future. Financial institutions…

Increasing Prevalence of Money Laundering Driving Anti-Money Laundering Market G …

The global anti-money laundering market reached a value of $3 billion in 2020 and it is predicted to exhibit huge expansion between 2021 and 2030 (forecast period). The market is being driven by the surging incidence of money laundering cases and the burgeoning demand for monitoring money laundering activities. Additionally, the soaring information technology (IT) expenditure in several countries is also pushing up the requirement for anti-money laundering (AML) solutions…