Press release

Debt Financing Market Size Forecasted To Achieve $30.1 Billion By 2029 With Steady Growth

The Debt Financing Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Debt Financing Market Size and Projected Growth Rate?

Recent years have seen a substantial expansion in the size of the debt financing market. The market is predicted to increase from $21.12 billion in 2024 to $22.45 billion in 2025, signifying a compound annual growth rate (CAGR) of 6.3%. Economic expansion, globalization, entrepreneurial endeavors, real estate progression, and government incentives have all played key roles in the growth experienced during the historical period.

Expectations indicate that the debt financing market size will experience significant growth in the approaching years. The projection is for the market to expand to $30.1 billion by 2029, with a compound annual growth rate (CAGR) of 7.6%. Factors contributing to this projected growth during the forecast period include initiatives for climate change, expansion in the healthcare sector, the undertaking of renewable energy projects, government expenditures on infrastructure, and the broadening of global trade. The forecast period is likely to witness major trends such as sustainable and green financing, low-interest rates paired with monetary policies, the rise of technology-driven lending platforms, covenant-lite loan structures, and an increase in funding for innovation and research.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=13170

What Are the Major Segments in the Debt Financing Market?

The debt financing market covered in this report is segmented -

1) By Sources: Private, Public

2) By Type: Bank Loans, Bonds, Debenture, Bearer Bond, Other Types

3) By Duration: Short-Term, Long-Term

Subsegments:

1) By Private: Private Equity Firms, Venture Capital, Private Debt Funds

2) By Public: Public Bond markets, Government Loans, Publicly Issued Debentures

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=13170&type=smp

What Are The Driving Debt Financing Market Evolution?

The rise in small businesses is anticipated to boost the debt financing market's expansion. A small business, defined as a privately-owned corporation, partnership, or single proprietorship with a reduced staff complement and lower annual revenue than larger companies, benefits from debt financing as it provides essential capital without ownership dilution. This allows such businesses to focus on expansion, product development, and operational growth while retaining business control. The Small Business Administration (SBA) Office of Advocacy reported in August 2022 that the count of small businesses in the US rose by 1.98% from 32,540,953 in 2021 to 33,185,550 in 2022. These small entities also provided employment to 61.7 million Americans, which is 46.4% of the private-sector workforce. Consequently, the growth in small businesses is expected to stimulate the debt financing market's growth. Debt Financing Market Driver: Escalating healthcare expenses drive The Debt Financing Market

Which Firms Dominate The Debt Financing Market Segments?

Major companies operating in the debt financing market report are JPMorgan Chase & Co, Citigroup Inc., Bank of America Corporation, Wells Fargo & Company, Morgan Stanley, HSBC Holdings PLC, BNP Paribas SA, Royal Bank of Canada, The Goldman Sachs Group Inc., ING Groep N.V., Mitsubishi UFJ Financial Group Inc., UBS Group AG, Deutsche Bank AG, The Bank of Nova Scotia, Barclays PLC, Societe Generale SA, Sumitomo Mitsui Financial Group Inc., Mizuho Financial Group Inc., BlackRock Inc., Credit Suisse AG, The Bank of New York Mellon Corporation, Nomura Holdings Inc., Blackstone Inc., ABN AMRO Bank N.V., DNB Bank ASA, Jefferies Financial Group Inc., Rothschild & Co SCA, Evercore Inc., Lazard Ltd., Houlihan Lokey Inc.

What Trends Are Expected to Dominate the Debt Financing Market in the Next 5 Years?

Leading firms in the debt finance sector are concentrating on the formation of unique advancements such as eLoans solutions to offer high-level services to their client base. eLoans is a digital system that allows qualified customers to attain liquidity to sustain their commercial entities, which also gives them the ability to control their existing loans via repayment capabilities. For example, in July 2023, the U.S.-headquartered investment banking corporation, Citigroup Inc., unveiled its Trade and Working Capital eLoans solution for U.S. Citi Commercial Bank (CCB) clients, delivered via treasury and trade solutions (TTS) on the CitiDirect platform. This highly scalable solution promotes international trade flows and helps clients to secure liquidity, oversee their current loans, and boost self-service reporting via automated alerts. The platform's goal is to minimize manual interactions, enhance self-service reporting, and meet the working capital requirements of CCB clients. The use of Citi's digital platform for eLoans is provided at no cost, which can assist clients in obtaining greater authority and clearness concerning loan financing.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/debt-financing-global-market-report

Which Is The Largest Region In The Debt Financing Market?

North America was the largest region in the debt financing market in 2024. The regions covered in the debt financing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Debt Financing Market?

2. What is the CAGR expected in the Debt Financing Market?

3. What Are the Key Innovations Transforming the Debt Financing Industry?

4. Which Region Is Leading the Debt Financing Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Debt Financing Market Size Forecasted To Achieve $30.1 Billion By 2029 With Steady Growth here

News-ID: 4022873 • Views: …

More Releases from The Business Research Company

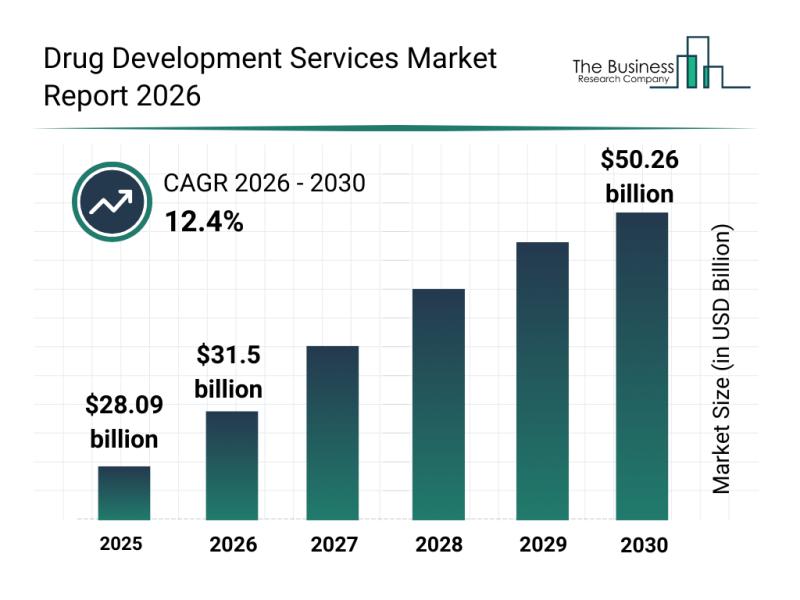

Leading Companies Fueling Growth and Innovation in the Drug Development Services …

The drug development services market is on track for significant expansion in the coming years, driven by technological advancements and evolving healthcare needs. This sector plays a crucial role in accelerating the discovery and development of new medicines, supported by innovations that enhance efficiency and precision. Let's explore the current market size, key drivers, major players, prevailing trends, and the segmentation that defines this industry's landscape.

Expected Market Size and Growth…

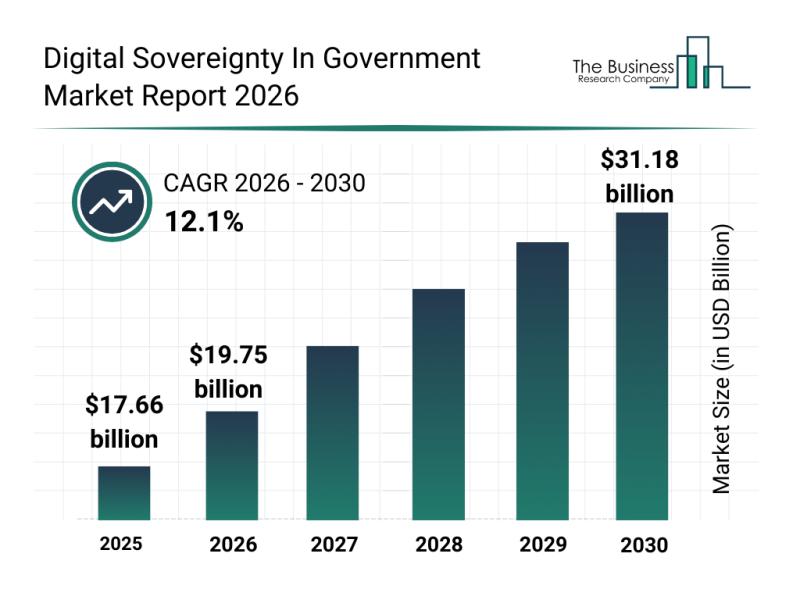

Government Digital Sovereignty Market Outlook: Major Segments, Strategic Develop …

The concept of digital sovereignty is becoming increasingly vital for governments worldwide as they look to safeguard their data and infrastructure in an era dominated by digital transformation. This growing emphasis on control, security, and compliance within public-sector IT systems is driving significant market developments. Let's explore the market's size, key players, future trends, and segmentation to understand this evolving landscape better.

Projected Growth Trajectory of the Digital Sovereignty in Government…

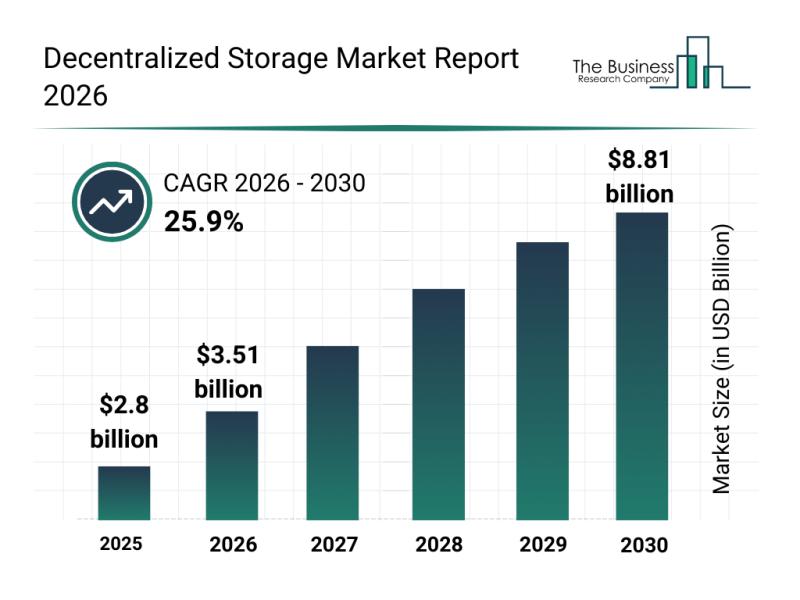

Segment Breakdown and Major Growth Areas in the Decentralized Storage Market

The decentralized storage market is on the brink of remarkable expansion as emerging technologies and growing demand for secure, tamper-proof data solutions drive its evolution. This sector is expected to play a crucial role in supporting the Web3 ecosystem and addressing modern data storage challenges. The following analysis explores market size projections, key players, influential trends, and segment-specific insights shaping this dynamic industry.

Forecasted Market Size and Growth Trajectory of the…

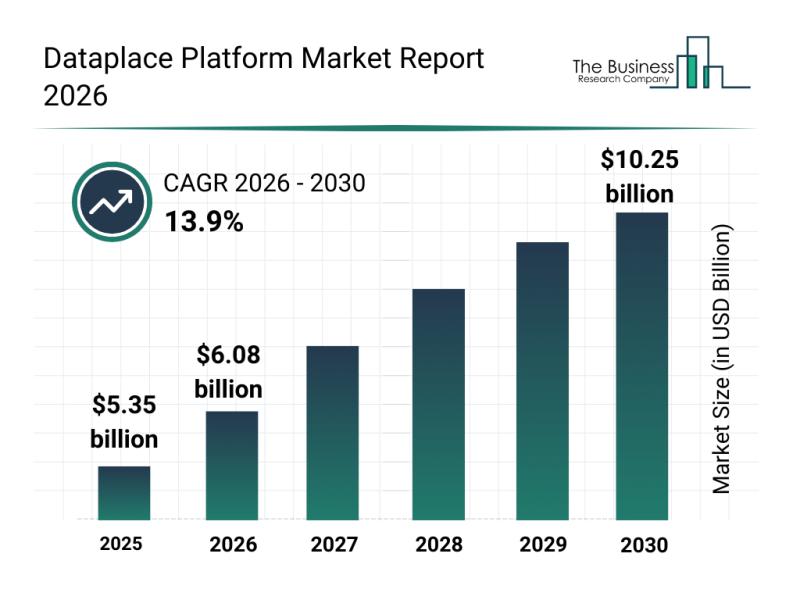

Key Strategic Developments and Emerging Changes Shaping the Dataplace Platform M …

The dataplace platform market is gaining substantial attention as data-driven solutions become increasingly vital across industries. With evolving technologies and growing emphasis on data governance and monetization, this sector is set to expand significantly in the coming years. Here's an overview of its projected growth, key players, market trends, and segment analysis.

Projected Market Size and Growth Trajectory of the Dataplace Platform Market

The dataplace platform market is poised for…

More Releases for Debt

Debt Settlement Solution Market Impressive Growth 2021-2028 | National Debt Reli …

The Insight Partners announces the research on Global Debt Settlement Solution Market [Report Page Link as it covers the key boundaries Required for your Research Need. This Global Debt Settlement Solution Market Report covers worldwide, local, and nation level market size, pieces of the overall industry, ongoing pattern, the effect of covid19 on worldwide

Market Research Report Investigations Research Methodology review comprises of Secondary Research, Primary Research, Company Share Analysis,…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market 2019 By Freedom Debt Relief National Debt Relief Rescue O …

This report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full.

Request a Sample of this Report @ https://www.orbisresearch.com/contacts/request-sample/2575396 …

Debt Settlement Market 2018-National Debt Relief, Freedom Debt Relief, New Era D …

The report on Debt Settlement, documents a detailed study of different aspects of the ‘Debt Settlement’ market. It shows the steady growth in market in spite of the fluctuations and changing market trends. In the past four years the ‘Debt Settlement’ market has grown to a booming value of $xxx million and is expected to grow more.

Request a Sample of this Report@ http://www.orbisresearch.com/contacts/request-sample/2335800

Every market intelligence report is based on certain…

Debt Settlement Market 2018 | Global Demand, Top Companies Analysis- National De …

Global Debt Settlement Market Research Report 2018 is a professional and in-depth study on the current state of the global Debt Settlement industry with a focus on the regional market, analysis of industry share, growth factors, development trends, size, majors manufacturers and 2025 forecast. The report also analyze innovative business strategies, value added factors and business opportunities. The Debt Settlement report introduces market revenue, product & services, latest developments and…