Press release

Strong Growth Ahead: Consumer Mobile Payment Market Size To Grow At Arecord 30.2% Cagr By 2029

The Consumer Mobile Payment Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].How Big Is the Consumer Mobile Payment Market Size Expected to Be by 2034?

The size of the consumer mobile payment market has seen a remarkable expansion in recent years. It is anticipated to surge from $82 billion in 2024 to $107.08 billion in 2025, demonstrating a compound annual growth rate (CAGR) of 30.6%. The growth during the historical period can be traced back to the enhanced penetration of smartphones and internet, rise of digital wallets and mobile payment applications, convenience and simplicity provided in transacting, the embracing of cashless payments by merchants and businesses, the escalating consumer inclination for contactless and secure payment mechanisms, the growth of e-commerce and online shopping venues, and the government strategies encouraging the adoption of digital payments.

In the forTH*Coming years, the consumer mobile payment market size is anticipated to experience substantial growth, escalating to $307.71 billion in 2029 with a compound annual growth rate (CAGR) of 30.2%. Multiple factors can be attributed to this predicted surge during the forecast period including the ongoing spread of smartphones and mobile internet access, the increase of mobile payment adoption in the retail and service sectors, the rise of peer-to-peer payment platforms and social commerce, the boosted demand for financial inclusion and accessibility, and the adoption of mobile payments in developing markets and among unbanked populations. Significant trends observed during this forecast period include the incorporation of biometric authentication, the increasing demand for peer-to-peer platforms, the evolution of solutions for in-store and online purchases, collaboration between providers and merchants, the proliferation of options for transportation services, the adoption of QR code technology, the integration into messaging platforms, and an increased focus on cybersecurity.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=14683

What Are the Emerging Segments Within the Consumer Mobile Payment Market?

The consumer mobile payment market covered in this report is segmented -

1) By Mode of Payment: Remote, Proximity

2) By Technology: Near Field Communication (NFC), Direct Mobile Billing, Mobile Web Payment, Short Message Services, Interactive Voice Response System, Mobile App, Other Technologies

3) By End-User Industry: Retail, Hospitality And Tourism, Information Technology And Telecommunication, Banking, Financial Services, and Insurance (BFSI), Media And Entertainment, HealTH*Care, Airline, Other End Users

Subsegments:

1) By Remote Payment: Mobile Wallets, Bank Transfers via Mobile Apps, QR Code-Based Payments, Peer-to-Peer Payment Services, Subscription Payments via Mobile Apps, Online Payment Gateways

2) By Proximity Payment: NFC (Near Field Communication) Payments, Bluetooth-Enabled Payments, QR Code Scanning For In-Store Purchases, Contactless Credit Or Debit Card Payments via Mobile, Mobile-Based Ticketing, Mobile Point of Sale (mPOS) Systems

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=14683&type=smp

What Long-Term Drivers Are Shaping Consumer Mobile Payment Market Trends?

The increasing infiltration of contactless payments is predicted to catalyze the expansion of the consumer mobile payment market. Contactless payment, a safe transaction method allowing customers to tap or wave their card, smartphone, or wearable device near a compatible terminal for making a purchase without physically swiping or inserting the card, is becoming more popular. The adoption of contactless payment provides comfort, security, and enhanced consumer experiences, positioning it as an essential feature of modern payment systems. This increase in the uptake of contactless payments bolsters convenience and safety, promoting the growth of the consumer mobile payment market by encouraging the adoption of mobile payment platforms and hastening the transition to cashless dealings. For example, in September 2023, reports from the Consumer Financial Protection Bureau (CFPB), an independent US governmental agency, disclosed that US consumers spent $65.2 billion in stores using Google Pay in 2022, a jump from $24.8 billion in 2021. Therefore, the growing penetration of contactless payment is propelling the expansion of the consumer mobile payment market.

Who Are the Top Competitors in Key Consumer Mobile Payment Market Segments?

Major companies operating in the consumer mobile payment market are Amazon.com Inc., Apple Inc., Alphabet Inc., Samsung Electronics Co. Ltd., Alibaba Group Holdings Limited, American Express Company, Visa Inc., PayPal Holdings Inc., MasterCard Incorporated, Thales Group, Fiserv Inc., Square Inc., Bharti Airtel Ltd., Fidelity National Information Services Inc., Orange Polska SA, Grubhub Inc., Jack Henry & Associates Inc., Block Inc., ACI Worldwide Inc., Money Gram International Inc., Dawood Hercules Corporation Limited, Oxigen S.ervices Pvt. Ltd., Mobikwik Systems Ltd., ZipCash Card Services Pvt. Ltd., Vodafone M-pesa Limited, One97 Communication India Ltd., Citrus Payment Solutions Pvt. Ltd

What Consumer Mobile Payment Market Trends Are Gaining Traction Across Different Segments?

Leading corporations in the consumer mobile payment market are emphasizing the adoption of sophisticated payment solutions like microPay to streamline digital transactions. A micropayment is an online financial transaction, ordinarily under a dollar, carried out for a variety of goods or services such as e-commerce purchases, freelance tasks, or digital content. For example, Axis Bank Ltd., a multinational banking and financial services firm based in India, inaugurated MicroPay, a 'Pin on Mobile' technology for receiving digital payments in March 2023. It turns a vendor's smartphone into a point-of-sale (POS) terminal to facilitate digital transactions. It provides them with an economical way to accept payments through card, UPI, BQR code, and so on, while upholding the most rigorous security standards.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/consumer-mobile-payment-global-market-report

Which Regions Are Becoming Hubs for Consumer Mobile Payment Market Innovation?

North America was the largest region in the consumer mobile payment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the consumer mobile payment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Consumer Mobile Payment Market?

2. What is the CAGR expected in the Consumer Mobile Payment Market?

3. What Are the Key Innovations Transforming the Consumer Mobile Payment Industry?

4. Which Region Is Leading the Consumer Mobile Payment Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Strong Growth Ahead: Consumer Mobile Payment Market Size To Grow At Arecord 30.2% Cagr By 2029 here

News-ID: 4022229 • Views: …

More Releases from The Business Research Company

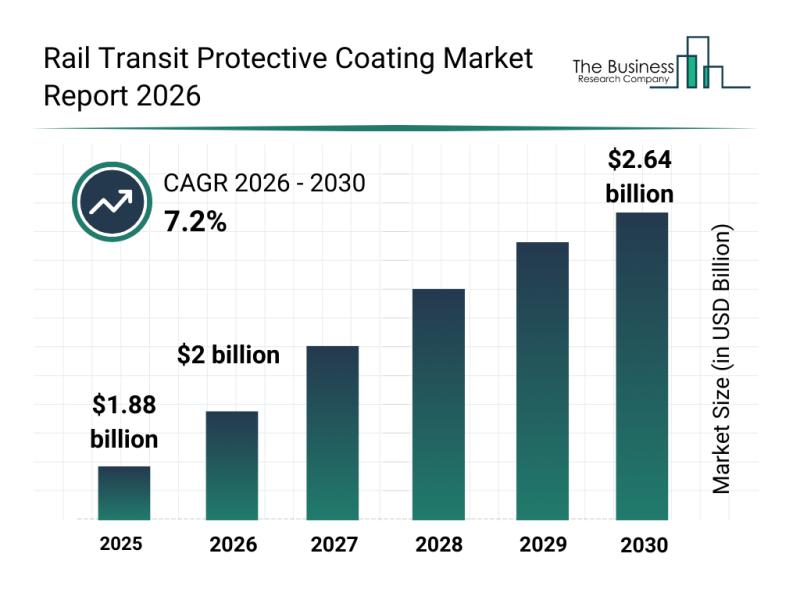

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

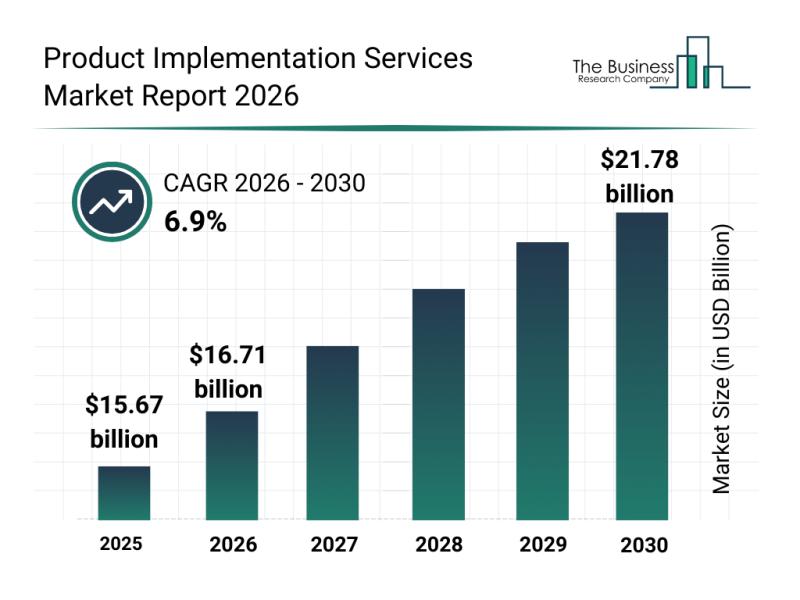

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

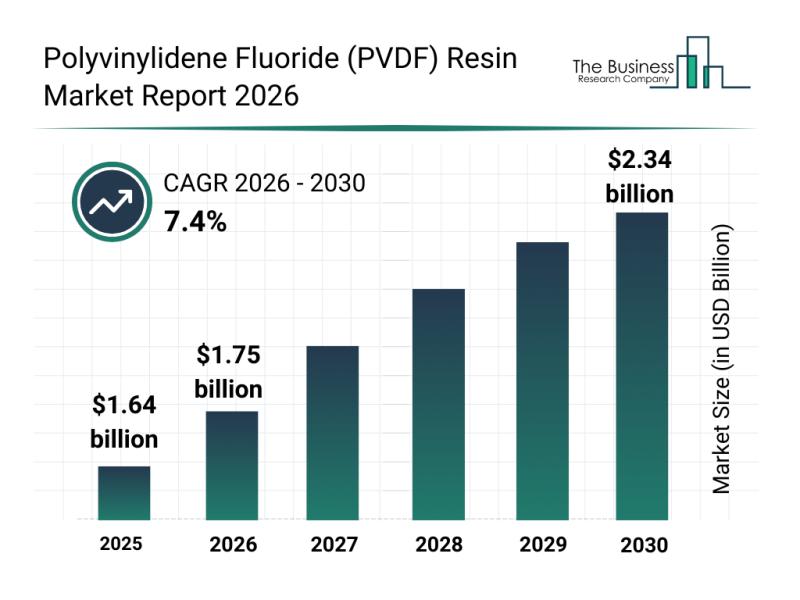

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

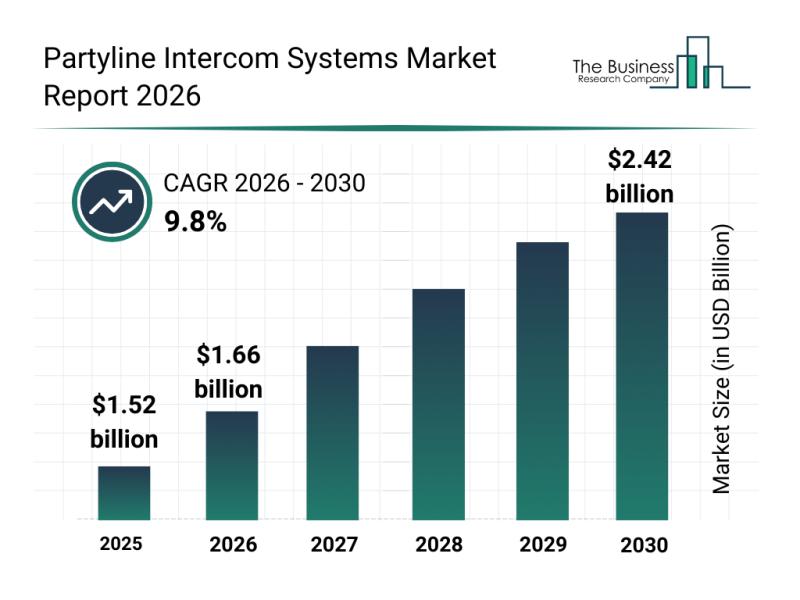

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…