Press release

Energy Storage Systems Market Projections 2025: Global Revenues Poised to Hit USD 494.3 GW by 2033

IMARC Group's latest research report, titled "Energy Storage Systems Market Report by Technology (Pumped Hydro, Electrochemical Storage, Electromechanical Storage, Thermal Storage), Application (Stationary, Transportation), End-User (Residential, Non-Residential, Utilities), and Region 2025-2033," offers a comprehensive analysis of the energy storage systems market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. the global energy storage systems market size reached 254.7 GW in 2024. Looking forward, IMARC Group expects the market to reach 494.3 GW by 2033, exhibiting a growth rate (CAGR) of 7.27% during 2025-2033. The market is experiencing steady growth driven by the growing demand for electricity during emergency power cuts, grid modernization and decentralization, escalating utilization of renewable energy, and rising concerns about reducing harmful emissions worldwide.Request Free Sample Report (Exclusive Offer on this report): https://www.imarcgroup.com/energy-storage-systems-market/requestsample

Technological Innovation and Digital Integration:

The energy storage systems market is undergoing a seismic shift propelled by breakthroughs in electrochemical technologies, power electronics, and digital intelligence. At the forefront, lithium ion battery chemistries continue to dominate utility scale and behind the meter applications due to their high energy density, rapid response times, and declining per kilowatt hour costs. Innovations in silicon anode and solid state electrolytes promise to further enhance cycle life, thermal stability, and safety, driving adoption across residential, commercial, and industrial segments. Parallel advances in flow battery architectures-most notably vanadium redox and emerging metal organic redox couples-address the industry's need for long duration storage (exceeding eight hours) and guaranteed depth of discharge stability over tens of thousands of cycles. Complementary to electrochemical systems, mechanical storage solutions such as compressed air energy storage (CAES), pumped hydro, and emerging gravity based modules are being optimized through advanced materials and control systems to achieve greater efficiency and modularity.

Digital integration has become equally transformative: state of the art battery management systems (BMS) leverage Internet of Things (IoT) sensors, edge computing, and artificial intelligence to monitor cell performance in real time, forecast degradation pathways, and orchestrate dynamic charging strategies that prolong asset life. Cloud native energy management platforms aggregate data across distributed installations, enabling predictive maintenance, automated demand response, and seamless participation in ancillary service markets. Furthermore, digital twins of storage assets allow operators to simulate grid contingencies, optimize dispatch schedules, and validate investment scenarios before committing capital. Integration with virtual power plant (VPP) frameworks and blockchain backed energy trading protocols is also gaining traction, lowering barriers for small scale participants to monetize flexibility. This convergence of hardware innovation and digital intelligence not only decreases total cost of ownership but also unlocks new revenue streams-paving the way for a resilient, responsive, and decentralized energy ecosystem.

Regulatory Landscape and Sustainability Mandates:

Evolving regulatory frameworks and intensifying sustainability mandates are shaping the trajectory of energy storage investments and deployments worldwide. Governments and regulators are increasingly mandating energy storage procurement targets alongside renewable portfolio standards (RPS), recognizing storage as essential to grid reliability and decarbonization goals. In the European Union, the Clean Energy Package and Fit for 55 directives have enshrined storage-specific targets and streamlined permitting processes, while in North America, federal incentives such as Investment Tax Credits (ITC) and state level "storage only" incentives in California, New York, and New Jersey are catalyzing project pipelines. Concurrently, carbon pricing mechanisms and stricter emissions standards for peaking plants are making fossil fuel dependent grid balancing services less competitive, favoring zero emission storage assets.

Sustainability is no longer a peripheral consideration; life cycle assessments, end of life recycling programs, and circular economy principles are central to procurement decisions. Industry associations and certification bodies are collaborating on standardized metrics for battery second life applications and end of line material recovery rates, ensuring that environmental impacts are transparently reported and managed. Institutional investors, guided by Environmental, Social, and Governance (ESG) criteria, are channeling capital into projects that demonstrate robust sustainability credentials, such as low carbon manufacturing footprints and commitments to battery recycling partnerships. In emerging economies, multilateral development banks and climate funds are tying concessional financing to storage enabled mini grids that deliver reliable power while meeting community development goals. As policy frameworks mature, the alignment between regulation and sustainability imperatives is fostering a virtuous cycle of innovation, investment, and environmental stewardship-establishing energy storage as a cornerstone of the global energy transition.

Infrastructure Investment and Sectoral Diversification:

Robust investment flows into energy storage infrastructure are underpinning rapid market growth, with financing sourced from traditional utilities, private equity, corporate offtakers, and green bond issuances. Large scale battery installations co located with solar and wind farms are now commonplace, facilitating firm renewable energy output and enabling capacity firming services. Power developers are bundling storage with generation assets under long term offtake agreements, leveraging capacity markets and ancillary service revenues to stabilize project cash flows. Meanwhile, distributed energy storage-including residential and commercial behind the meter systems-is scaling up as decarbonization goals and peak demand charges incentivize businesses and homeowners to invest in self consumption and demand charge management. Innovative business models, such as energy as a service (EaaS) and "storage rental" platforms, are lowering upfront costs and simplifying customer adoption. The transportation sector is another key diversification vector: grid supportive electric vehicle (EV) charging stations paired with stationary storage buffers are smoothing distribution network loads and unlocking vehicle to grid (V2G) potential. Industrial users, particularly in manufacturing and data centers, are deploying on site storage for uninterruptible power supply (UPS), power quality improvement, and microgrid integration-enhancing resilience against grid outages and price volatility.

Furthermore, niche applications in oil & gas, mining, and agriculture are emerging, leveraging hybrid solar storage microgrids to reduce diesel dependence in remote operations. Infrastructure investment is also catalyzed by ecosystem partnerships: energy storage manufacturers, system integrators, and software providers are forging alliances to deliver turnkey solutions, mitigate integration risks, and shorten deployment timelines. As the market diversifies across geographies and end use sectors, cross sectoral synergies are delivering scale efficiencies and driving down levelized cost of storage-fueling a virtuous cycle of expansion and technological refinement.

Leading key Players Operating in the Energy Storage Systems Industry:

• Altair Nanotechnologies Inc.

• Eguana Technologies

• Electrovaya Inc.

• Exide Industries Limited

• Furukawa Electric Co. Ltd.

• General Electric Company

• Kokam Ltd.

• LG Chem Ltd.

• Saft (TotalEnergies SE)

• Samsung SDI Co. Ltd.

• Schneider Electric SE

• Showa Denko K. K.

• Tata Power Company Limited

Energy Storage Systems Market Trends:

Current trends reflect a concerted focus on flexibility, environmental stewardship, and seamless grid integration. Long duration storage solutions are moving from pilot projects into commercial reality, addressing winter peak challenges in cold climates and enabling seasonal energy shifting. Second life batteries-redeployed from electric vehicles-are gaining legitimacy through standardized testing protocols and guaranteed performance benchmarks, reducing lifecycle costs and promoting circularity. Hybrid energy systems that co optimize solar, wind, storage, and flexible loads are increasingly common in microgrid and utility scale applications, offering reliability under diverse weather conditions. Artificial intelligence and advanced analytics are being used to optimize asset dispatch in real time, navigating dynamic price signals and grid constraints with minimal human intervention. Financing innovations continue to lower barriers: green bonds, ESG linked loans, and performance based incentives provide alternative capital channels and align stakeholder interests around operational outcomes.

In urban environments, behind the meter aggregation platforms are virtualizing residential and commercial systems into grid scale resources, empowering prosumers to monetize flexibility services. Meanwhile, heightened attention on supply‐chain transparency and critical mineral sourcing is driving manufacturers to secure ethically vetted raw materials and explore cobalt free and sodium ion chemistries. Cybersecurity protocols, once optional, are now embedded in system specifications to protect vital infrastructure from evolving digital threats. Collectively, these trends underscore a market that values adaptability, environmental responsibility, and technological maturity-positioning energy storage as an indispensable enabler of a resilient, decarbonized power system.

Ask Analyst for Instant Discount and Download Full Report with TOC & List of Figure: https://www.imarcgroup.com/energy-storage-systems-market

Key Market Segmentation:

Breakup by Technology:

• Pumped Hydro

• Electrochemical Storage

• Electromechanical Storage

• Thermal Storage

Breakup by Application:

• Stationary

• Transportation

Breakup by End User:

• Residential

• Non-Residential

• Utilities

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

Key Highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Porter's Five Forces Analysis

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain

• Comprehensive Mapping of the Competitive Landscape

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Energy Storage Systems Market Projections 2025: Global Revenues Poised to Hit USD 494.3 GW by 2033 here

News-ID: 4019437 • Views: …

More Releases from IMARC Group

United States AI Governance Market Size, Growth, Latest Insights and Forecast 20 …

IMARC Group's Latest Research Reveals a CAGR of 28.10% from 2026-2034, Supported by Expanding Certification, Auditing, and Impact Assessment Processes

NEW YORK, USA - The United States artificial intelligence (AI) governance industry is witnessing rapid expansion as organizations intensify efforts to implement responsible AI practices. According to the latest market intelligence report by IMARC Group, the United States AI Governance Market, valued at USD 81.6 Million in 2025, is projected to…

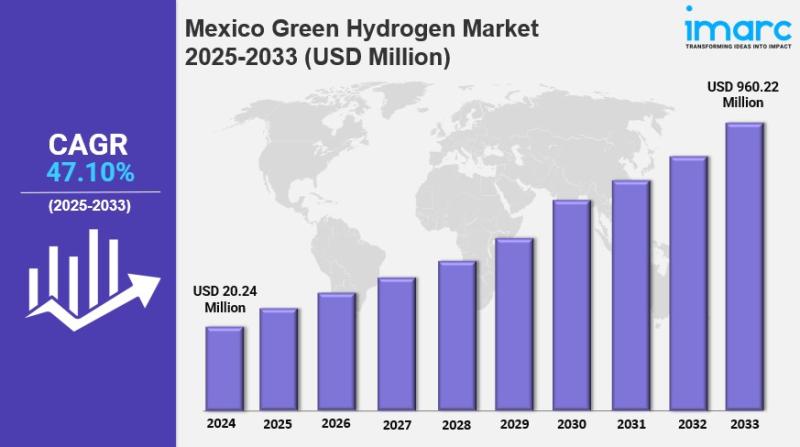

Mexico Green Hydrogen Market Size, Share, Demand, Trends & Forecast to 2033

IMARC Group's Latest Research Reveals a CAGR of 47.10% from 2025-2033, with Renewable-Powered Electrolysis and Export-Oriented Projects Accelerating Market Expansion

NEW YORK, USA - The Mexico green hydrogen industry is entering a high-growth phase, supported by national decarbonization initiatives and rising global demand for clean fuels. According to the latest report by IMARC Group, the Mexico Green Hydrogen Market reached a value of USD 20.24 Million in 2024 and is projected…

U.S. Pet Insurance Market Growth, Outlook & Key Players Analysis 2033

IMARC Group's Latest Research Reveals a CAGR of 10.8% from 2025-2033, with Customized Coverage Plans and Digital Platforms Accelerating Market Expansion

NEW YORK, USA - The U.S. pet insurance industry is witnessing rapid and sustained growth. According to a new market intelligence report by IMARC Group, the U.S. Pet Insurance Market, valued at USD 2.0 Billion in 2024, is projected to reach USD 5.1 Billion by 2033, registering a compound annual…

United States Home Healthcare Market Set to Reach USD 186.5 Billion by 2034, Dri …

PRESS RELEASE

FOR IMMEDIATE RELEASE

Date: February 24, 2026

Contact: sales@imarcgroup.com | +1-201-971-6302 | www.imarcgroup.com

IMARC-Style Industry Analysis Reveals a CAGR of 6.70% During 2026-2034, Supported by Expansion of Telehealth and Remote Patient Monitoring

The United States Home Healthcare Market reached a value of USD 103.7 Billion in 2025 and is projected to grow to USD 186.5 Billion by 2034, exhibiting a steady CAGR of 6.70% during 2026-2034.

Market growth is primarily driven by the rapidly…

More Releases for Storage

Vehicle Storage Unit Market Size, Trends 2031 By Key Players- U-Haul, CubeSmart, …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲: According to Verified Market Reports analysis, the global Vehicle Storage Unit Market size was valued at USD 13.64 Billion in 2023 and is projected to reach USD 22.85 Billion by 2030, growing at a CAGR of 5.90% during the forecasted period 2024 to 2031.

What is the current outlook for the Vehicle Storage Unit Market, and how is it projected to grow?

The Vehicle Storage Unit Market is experiencing robust growth…

Business Storage Market | Access Self Storage, Big Yellow Self Storage Company, …

The global business storage market report is a comprehensive report that provides a detailed analysis of the current status and future trends of the business storage market worldwide. This report provides valuable information to industry stakeholders by offering an in-depth perspective on market dynamics, competitive landscape, growth opportunities, and key challenges faced by industry participants.

From the perspective of market dynamics, this report explores the factors driving the growth of the…

2023 Business Storage Market Revenue and Future Demands- CubeSmart, Public Stora …

The Business Storage market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development…

Household Storage Market 2022 by Keyplayers and Vendors:Ward North American, Eas …

The Global Household Storage Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Household Storage market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Household Storage market industry report includes details about the historical analysis…

Video Surveillance Storage Market Growing Up By Storage Technology: Network atta …

Acumen Research and Consulting has announced the addition of the "Video Surveillance Storage Market” report to their offering.

The Video Surveillance Storage Market Report 2018 is an in depth study analyzing the current state of the Video Surveillance Storage Market. It provides brief overview of the market focusing on definitions, market segmentation, end-use applications and industry chain analysis. The study on Video Surveillance Storage Market provides analysis of China market covering…

Self-Storage Software Market Trends, Developments, Future Prospects and Prominen …

The Self-Storage Software Market is a category of management software. It has user-friendly and bendable functions to meet the needs of small to large facilities. Some of the leading self-storage software programs offer structures, such as facility maps, specialized payment options, online access for customers, and gate access integration as well.

You can get a sample copy of this report @ https://www.orianresearch.com/request-sample/1498463

Emergence of cloud-based self-storage software and mobile applications are…