Press release

Robo Advisory Market Global Opportunity Analysis and Industry Forecast, 2023-2032

Allied Market Research published a report, titled, "Robo Advisory Market by Business Model (Pure Robo Advisors and Hybrid Robo Advisors), Provider (Fin-Tech Robo-Advisors, Banks, Traditional Wealth Managers, and Others), Service Type (Direct Plan-based/Goal-based and Comprehensive Wealth Advisory), and End User (Retail Investor and High Net Worth Individuals (HNIs)): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the global robo advisory industry generated $7.94 billion in 2022, and is anticipated to generate $129.46 billion by 2032, witnessing a CAGR of 32.5% from 2023 to 2032.Request PDF Brochure: https://www.alliedmarketresearch.com/request-sample/2105

Prime determinants of growth

The growth of the robo advisory market is driven by rapid digitalization in financial services and shift in preferences from traditional investment services to robo advisory services. The growth potential of the robo advisory market may be limited by the slower adoption rate among older investors. On the contrary, innovations in robo advisory services have revolutionized businesses in the financial sector and helped banks and other investors to streamline the processes and improve the quality of their services. These innovations are constantly being developed, thereby providing potential opportunities for the growth of the sector.

The hybrid robo advisors segment to maintain its leadership status throughout the forecast period

Based on business model, the hybrid robo advisors segment held the highest market share in 2022, accounting for around two-thirds of the global robo advisory market revenue, and is estimated to maintain its leadership status throughout the forecast period, owing to the rise in international trades & investments and the increase in requirements for customized portfolios for funds. However, the pure robo advisors segment is projected to manifest the highest CAGR of 35.4% from 2023 to 2032, owing to the factors such as diversification, systematic investments & withdrawals, and professional money management with analyzing current & potential holdings for funds are driving the growth of the segment.

The fintech robo advisors segment to maintain its leadership status throughout the forecast period

Based on provider, the fintech robo advisors segment held the highest market share in 2022, accounting for around three-fifths of the global robo advisory market revenue, and is estimated to maintain its leadership status throughout the forecast period, owing to the rise of FinTech firms that are opening opportunities for new and existing companies to introduce robo-advisors. However, the banks segment is projected to manifest the highest CAGR of 37.4% from 2023 to 2032, owing to the increase in focus on digitalization of financial processes that have transformed traditional banking systems. Banks are significantly adopting online investment platforms to support rise in consumer requirements. The digital investment platforms have helped in filling existing gaps in financial services and increased efficiency for better customer experience, thus driving segment growth.

Procure Complete Report (273 Pages PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/3OGWsSS

The direct plan-based/goal-based segment to maintain its leadership status throughout the forecast period

Based on service type, the direct plan-based/goal-based segment held the highest market share in 2022, accounting for more than two-thirds of the global robo advisory market revenue, and is estimated to maintain its leadership status throughout the forecast period, owing to the high rate of return, less operating costs as compared to other services, and greater value-added services. Furthermore, direct plan-based robo advisory services provide numerous benefits, which include regular monitoring of the portfolio, providing value-added services, and providing convenience in selecting the services, which drive the growth of the segment. However, the comprehensive wealth advisory segment is projected to manifest the highest CAGR of 34.9% from 2023 to 2032, owing to the increase in adoption of comprehensive wealth advisory services among the youth of emerging countries to reduce and eliminate financial stress.

North America to maintain its dominance by 2032

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for nearly two-fifths of the global robo advisory market revenue, owing to the rise of digital-native generations, such as millennials and Generation Z, who are comfortable with technology and value convenience. However, the Asia-Pacific region is expected to witness the fastest CAGR of 37.1% from 2023 to 2032, owing to the increased high net-worth individual (HNWI) across countries such as Australia, Japan, China, and India. Moreover, banks and other providers in this region are witnessing high adoption of advanced analytics technologies for increasing the wealth of individuals and identifying qualified investors for both secured and unsecured digital investments which fuel the growth of the market in the region.

Leading Market Players: -

Fincite GmbH

Betterment

Charles Schwab & Co., Inc.

SigFig Wealth Management, LLC

Social Finance, Inc.

Wealthfront Corporation

Wealthify Limited

The Vanguard Group, Inc.

Ginmon Vermögensverwaltung GmbH

Axos Financial, Inc.

The report provides a detailed analysis of these key players of the global robo advisory market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Want to Access the Statistical Data and Graphs, Key Players Strategies: https://www.alliedmarketresearch.com/robo-advisory-market/purchase-options

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the robo advisory market analysis from 2022 to 2032 to identify the prevailing market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the robo advisory market segmentation assists to determine the prevailing robo advisory market opportunity.

Major countries in each region are mapped according to their revenue contribution to the market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as robo advisory market trends, key players, market segments, application areas, and market growth strategies.

Robo Advisory Market Report Highlights

By Service Type

Direct Plan-based/Goal-based

Comprehensive Wealth Advisory

By Business Model

Pure Robo Advisors

Hybrid Robo Advisors

By Provider

Fintech Robo Advisors

Banks

Traditional Wealth Managers

Others

By End User

Retail Investor

High Net Worth Individuals (HNIs)

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Key Market Players : Fincite Gmbh, Axos Financial, Inc., The Vanguard Group, Inc., Social Finance, Inc., Charles Schwab & Co., Inc., Ginmon Vermögensverwaltung GmbH, Wealthify Limited, Betterment, SigFig Wealth Management, LLC, Wealthfront Corporation.

Trending Reports:

Insurance Market https://www.alliedmarketresearch.com/insurance-market-A17037

Pet Insurance Market https://www.alliedmarketresearch.com/pet-insurance-market

Forex Brokers Market https://www.alliedmarketresearch.com/forex-brokers-market-A323400

Cyber Insurance Market https://www.alliedmarketresearch.com/cyber-insurance-market

Peer to Peer Lending Market https://www.alliedmarketresearch.com/peer-to-peer-lending-market

Investment Banking Market https://www.alliedmarketresearch.com/investment-banking-market-A06710

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Robo Advisory Market Global Opportunity Analysis and Industry Forecast, 2023-2032 here

News-ID: 4016211 • Views: …

More Releases from Allied Market Research

Winter Footwear Market 2026 : Expeditious Growth Expected in 2021 - 2031 | UGG, …

According to a new report published by Allied Market Research, titled, "Winter Footwear Market," The winter footwear market was valued at $8.6 billion in 2021, and is estimated to reach $13.6 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

"Numerous varieties of winter footwear are expected to boost the market growth in the foreseeable future. Moreover, incorporation of customization, as well as innovative winter footwear is…

Ergonomic Chair Market Research Insights: Uncovering CAGR and USD Growth Drivers …

An ergonomic office chair is mostly utilized in different firms and other business areas where employees operate in a sitting position for extended hours. Adjustable seats, brackets and natural postures, which minimize back discomfort and stress in the lengthy seating time, are the ergonomic chairs. Currently, the offices are selecting ergonomic office chairs over the standard office chair to make the workplace healthier, happier, and to boost employer productivity. The…

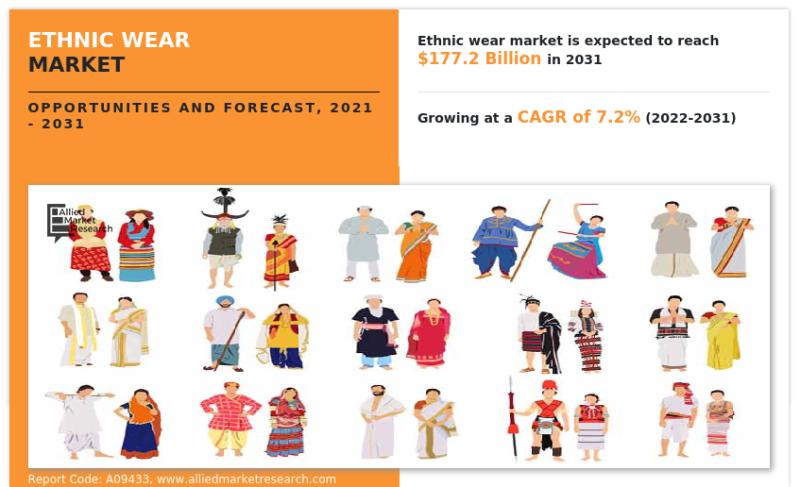

Ethnic Wear Market Forecasting Essentials: Interpreting CAGR and USD Projections …

According to a new report published by Allied Market Research, titled, "Ethnic Wear Market," The ethnic wear market size was valued at $89.3 billion in 2021, and is estimated to reach $177.2 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031.

The market for ethnic wear is mostly driven by the rising number of fashion influencers across the globe. It is difficult to overlook the importance of…

$8.9+ Billion Commercial Janitorial Equipment Market Value by 2031 with a 4.6% C …

According to a new report published by Allied Market Research, titled, "Commercial Janitorial Equipment Market," The commercial janitorial equipment market size was valued at $5.7 billion in 2021, and is estimated to reach $8.9 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031. There has been a surge in the number of restaurants, hotels, and hospitals across the globe, which further contribute to the demand for…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…