Press release

Reinsurance Market to Reach $1344.3 Billion at 10.8% CAGR by 2031 | Size, Share, Industry

Allied Market Research recently published a report, titled, "Reinsurance Market by Type (Facultative Reinsurance, Treaty Reinsurance), by Application (Property & Casualty Reinsurance, Life & Health Reinsurance), by Distribution Channel (Direct Writing, Broker), by Mode (Online, Offline): Global Opportunity Analysis and Industry Forecast, 2022-2031". As per the report, the global reinsurance industry was pegged at $498.7 billion in 2021, and is expected to reach $1,344 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.Request Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/6653

Major Determinants of the Reinsurance Market Growth

Rise in demand for various insurance plans and increased awareness due to Covid-19 pandemic drive the growth of the global reinsurance market. Moreover, demand for artificial intelligence in reinsurance and conduit reinsurance would open new opportunities in the future.

The Treaty Reinsurance segment to Manifest the highest CAGR through 2031

By type, the treaty reinsurance segment is estimated to portray the highest CAGR of 11.9% during the forecast period. In addition, the segment held the largest share in 2021, accounting for more than two-thirds of the global reinsurance market, and is expected to continue its dominance throughout the forecast period. The lack of individual underwriting on the part of the assuming insurer is the main feature of a treaty arrangement. The report includes analysis of the facultative reinsurance segment.

The Property & Casualty Reinsurance Segment Dominated the Market

By application, the property & casualty reinsurance segment held the largest share in 2021, contributing to nearly two-thirds of the global reinsurance market, and is expected to maintain leading position during the forecast period. Commercial property & casualty reinsurance either pays to repair or rebuild property with materials of the same or pays the current value of the damaged property. Hence, this is a major factor driving the growth of the market. However, the life & health reinsurance segment is projected to manifest the highest CAGR of 12.8% during the forecast period, owing to increase in demand for life and health insurance during the forecast period. The COVID-19 pandemic has increased awareness of the value of and demand for life insurance among consumers.

The Broker Segment to Showcase the Highest CAGR through 2031

By distribution channel, the broker segment is projected to manifest the highest CAGR of 13.0% during the forecast period. Brokers use their marketing skills and knowledge about reinsurance to sell policies to the end customers. These intermediaries search for potential buyers and explain the advantages, benefits, disadvantages, and other details for reinsurance coverage, which fuels the growth of the market. However, the direct writing segment held the largest share in 2021, accounting for nearly three-fourths of the global reinsurance market, and is expected to continue its dominance from 2022 to 2031. This is due to awareness among the insurers regarding reinsurance policies to cover business risks and losses.

North America held the Lion's Share

By region, the global reinsurance market across North America held the largest share in 2021, accounting for more than two-fifths of the market. This is due to surge in the life & health insurance, property & casualty insurance, and other insurance policies and advent of increase in demand for artificial intelligence and technologies. However, the market across Asia-Pacific is expected to register the highest CAGR of 14.2% during the forecast period, owing to developing market, underwriting procedures, and innovations across the region.

Request Customization: https://www.alliedmarketresearch.com/request-for-customization/6653

Major Market Players

AXA XL

Barents Re Reinsurance Company, Inc.

Berkshire Hathaway Inc.

BMS Group

China Reinsurance (Group) Corporation

Everest Re Group, Ltd.

Hannover Re

Lloyd's

MAPFRE

Markel Corporation

Munich RE

RGA Reinsurance Company

Swiss Re

The Canada Life Assurance Company

Tokio Marine HCC

SCOR

Next Insurance, Inc.

The report analyzes these key players of the global satellite connectivity market. These players have adopted various strategies such as expansion, new product launches, partnerships, and others to increase their market penetration and strengthen their position in the industry. The report is helpful in determining the business performance, operating segments, product portfolio, and developments by every market player.

Inquire Before Buying : https://www.alliedmarketresearch.com/purchase-enquiry/6653

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the reinsurance market analysis from 2021 to 2031 to identify the prevailing reinsurance market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the reinsurance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global reinsurance market trends, key players, market segments, application areas, and market growth strategies.

Key Market Segments

Type

Facultative Reinsurance

Treaty Reinsurance

Treaty Reinsurance

Proportional Reinsurance

Non-proportional Reinsurance

Application

Property & Casualty Reinsurance

Life & Health Reinsurance

Life & Health Reinsurance

Disease Insurance

Medical Insurance

Distribution Channel

Direct Writing

Broker

Mode

Online

Offline

Top Reports:

Medical Loans Market https://www.alliedmarketresearch.com/medical-loans-market-A323693

Biometric Payment Market https://www.alliedmarketresearch.com/biometric-payment-market-A323044

Self-Driving Car Insurance Market https://www.alliedmarketresearch.com/self-driving-car-insurance-market-A320163

NFC Payments Market https://www.alliedmarketresearch.com/nfc-payments-market-A08282

Embedded Banking Market https://www.alliedmarketresearch.com/embedded-banking-market-A283373

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Reinsurance Market to Reach $1344.3 Billion at 10.8% CAGR by 2031 | Size, Share, Industry here

News-ID: 4013548 • Views: …

More Releases from Allied Market Research

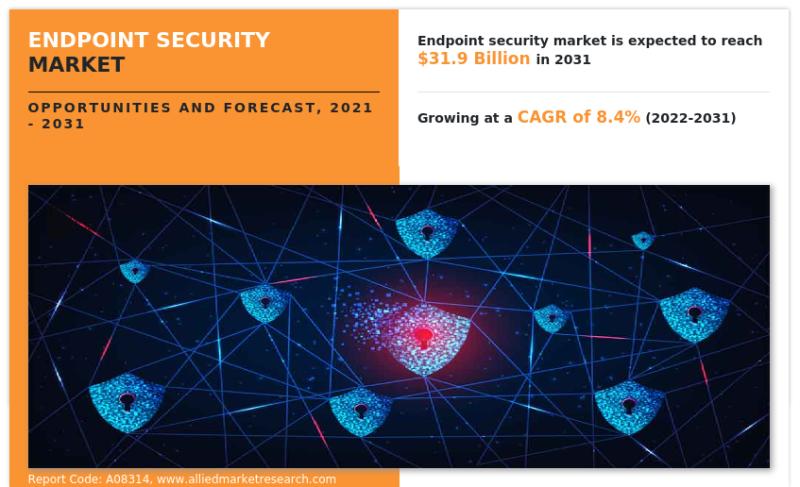

Endpoint Security Market Size Growing at 8.4% CAGR Reach USD 31.9 Billion by 203 …

Allied Market Research published a new report, titled, "Endpoint Security Market Size Growing at 8.4% CAGR Reach USD 31.9 Billion by 2031." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

Smart Manufacturing Market Size Growing at 13.7% CAGR Reach USD 860 Billion by 2 …

Allied Market Research published a new report, titled, "Smart Manufacturing Market Size Growing at 13.7% CAGR Reach USD 860 Billion by 2031." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

Data Virtualization Market Sizze Growing at 21.7% CAGR Reach USD 22.2 Billion by …

According to the report published by Allied Market Research, Data Virtualization Market Sizze Growing at 21.7% CAGR Reach USD 22.2 Billion by 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

Driving Factors…

Europe IoT Market Growing at 19.0% CAGR Reach USD 12.30 Billion by 2031

According to the report published by Allied Market Research, Europe IoT Market Growing at 19.0% CAGR Reach USD 12.30 Billion by 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

The Europe IoT…

More Releases for Reinsurance

Reinsurance Services Market SWOT Analysis by Key Players Hannover Re, Korean Rei …

The Latest research coverage on Reinsurance Services Market provides a detailed overview and accurate market size. The study is designed considering current and historical trends, market development and business strategies taken up by leaders and new industry players entering the market. Furthermore, study includes an in-depth analysis of global and regional markets along with country level market size breakdown to identify potential gaps and opportunities to better investigate market status,…

Crop Reinsurance Market Is Booming So Rapidly | Munich Reinsurance, Swiss Reinsu …

The Crop Reinsurance Market study with 65+ market data Tables, Pie charts & Figures is now released by HTF MI. The research assessment of the Market is designed to analyze futuristic trends, growth factors, industry opinions, and industry-validated market facts to forecast till 2029. The market Study is segmented by key a region that is accelerating the marketization. This section also provides the scope of different segments and applications that…

Agriculture Reinsurance Market Is Booming Worldwide : Agroinsurance, Swiss Reins …

The Latest Released Agriculture Reinsurance market study has evaluated the future growth potential of Agriculture Reinsurance market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers, challenges,…

Recent Reinsurance Market Investment Activity From Established Companies Are to …

The latest release from WMR titled Reinsurance Market Research Report 2022-2028 (by Product Type, End-User / Application, and Regions / Countries) provides an in-depth assessment of the Reinsurance including key market trends, upcoming technologies, industry drivers, challenges, regulatory policies, key players company profiles, and strategies. Global Reinsurance Market study with 100+ market data Tables, Pie Chat, Graphs & Figures is now released BY WMR. The report presents a complete assessment…

Life Reinsurance Market is Going to Boom | Swiss Re, Munich Reinsurance, Korean …

Advance Market Analytics published a new research publication on “Life Reinsurance Market Insights, to 2026″ with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Life Reinsurance market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in…

Reinsurance Market To See Stunning Growth | Munich, Korean Reinsurance, Swiss

Latest Market Research on “Reinsurance Market” is now released to provide hidden gems performance analysis in recent years and years to come. The study explains a detailed overview of market dynamics, segmentation, product portfolio, business plans, and the latest development in the industry. Staying on top of market trends & drivers is always remain crucial for decision-makers and marketers to hold emerging opportunity.

Get the inside scoop with Sample report https://www.htfmarketreport.com/sample-report/3185812-global-reinsurance-market-26

Know…