Press release

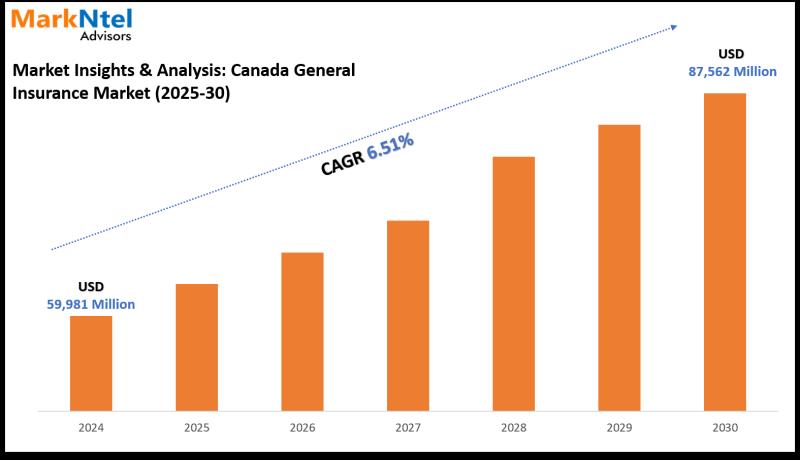

Canada General Insurance Market to Reach USD 87.56 Billion by 2030 | CAGR 6.51% Forecast (2025-30)

Canada General Insurance Market Overview and InsightsThe Canada General Insurance Market is anticipated to grow steadily during the forecast period [2025-2030], with a base year of [2024]. This growth is driven by evolving technologies, changing consumer preferences, and expanding applications across various industries.

Our market research reports deliver in-depth analysis and strategic insights to help businesses navigate changing market conditions, seize growth opportunities, and make data-driven decisions. The report provides comprehensive coverage of:

• Target Market Identification

• Consumer Behavior & Preferences

• Competitive Landscape Analysis

• Market Size, Share, and Forecasting

• Segment-Level Insights

• Actionable Recommendations for Strategy Development

[Stay informed about USA tariff changes with expert insights and timely information.]

Request Sample Report Today! https://www.marknteladvisors.com/query/request-sample/canada-general-insurance-market.html

What's Driving Canada General Insurance Market Growth?

Rising Awareness About the Losses Due to Catastrophic Events - The rising frequency of natural disasters such as hurricanes, floods, wildfires, storms, etc. has caused substantial losses and raised awareness among the citizens of the country to protect their legacy, health, and property. It has increased the demand for general insurance in Canada. As per the Insurance Bureau of Canada (IBC) (2022), the Derecho storm caused more than USD675 million of losses to the areas of Ontario and Quebec in Canada. Additionally, the drastic events of flooding in Nova Scotia in 2023 have caused about USD170 million in infrastructural damage.

Moreover, there were two more disastrous events reported by IBC in 2023, called Hurricane Fiona and Alberta Wildfires, which had about USD580 million and USD640 million in insured damages, respectively. These events have encouraged customers to adopt insurance policies for financial protection.

Canada General Insurance Market Size, Share & Revenue

The size of Canada General Insurance market was valued at USD 59,981 Million in 2024, and it and is projected to reach USD 87,562 Million by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.51% during the forecast period 2025-2030.

Time Frame Covered in the Report:

• Historical Years: [2020-2023]

• Base Year: [2024]

• Forecast Period: [2025-2030]

Key Players in the Canada General Insurance Market

Prominent Canada General Insurance companies contributing to market development include:

• TD Insurance

• Intact Financial Corporation

• Aviva Canada

• The Co-operators

• Wawanesa Mutual Insurance

• Definity Financial

• Northbridge Financial

• Allstate Canada

• Chubb Canada

• Zurich Canada

• Others

These players are investing in innovation, expanding their geographical footprint, and adapting to dynamic market needs.

Access the Full Report in One Click! https://www.marknteladvisors.com/research-library/canada-general-insurance-market.html

("Engage with our team using your official business email to unlock full access and priority support.")

Canada General Insurance Industry Segment and Geographical Breakdown

By Insurance Type

> Home (accounting for more than 40% market share)

> Motor

> Health

> Others

By Distribution Channel

> Direct

> Agency

> Banks

> Online

> Others

By End User

> Individual Customers (holds the largest market share of more than 55%)

> Commercial and Industrial

By Region

> North

> East

> West

> South

Growth Challenge in the Canada General Insurance Market:

High Cost for Insurance Premiums and Lesser Benefits - The cost of insurance premiums is continuously rising due to various factors such as frequent natural disasters, fluctuating inflation rates, high risks of cyber threats, etc.

Cyberattacks have increased the prices of insurance premiums in the country; therefore, the budget-conscious population now has limited access to general insurance. As per ICB (2023), the price for cyber insurance has increased by 3000% over the past 8 years since 2015, with almost USD20 million to more than USD545 million in insurance cost in 2023.

A larger number of Canadian citizens are unable to get general insurance due to high prices. As per CAFII (2024), more than 45% of Canadians admitted that they cannot afford high-premium insurance. Other than these individuals, some of them are unaware of insurance policies. Therefore, a cumulative 80% of the citizens are uninsured in the country as of 2024. It is restraining Canada's general insurance market growth.

Schedule a Consultation with Our Experts! https://www.marknteladvisors.com/query/talk-to-our-consultant/canada-general-insurance-market.html

Table of Contents: Canada General Insurance

• Table 1: Canada General Insurance Market Size & Analysis

• Table 2: Market Revenues (USD Million)

• Table 3: Market Share & Analysis by Insurance Type

• Table 4: Home Insurance Market Size & Forecast 2020-2030 (USD Million)

• Table 5: Motor Insurance Market Size & Forecast 2020-2030 (USD Million)

• Table 6: Health Insurance Market Size & Forecast 2020-2030 (USD Million)

• Table 7: Others Insurance Market Size & Forecast 2020-2030 (USD Million)

• Table 8: Market Share & Analysis by Distribution Channel

• Table 9: Direct Insurance Market Size & Forecast 2020-2030 (USD Million)

• Table 10: Agency Insurance Market Size & Forecast 2020-2030 (USD Million)

• Table 11: Banks Insurance Market Size & Forecast 2020-2030 (USD Million)

• Table 12: Online Insurance Market Size & Forecast 2020-2030 (USD Million)

• Table 13: Individual Customers Market Size & Forecast 2020-2030 (USD Million)

• Table 14: Commercial and Industrial Market Size & Forecast 2020-2030 (USD Million)

• Table 15: Competitive Outlook

• Table 16: Company Profiles Overview

"Report Delivery Format: Market research reports from MarkNtel Advisors are available in PDF, Excel, and PowerPoint formats. Once payment is successfully processed, the report will be delivered to your email address within 24 hours"

Browse More Related Market Research Report:

• Malaysia Online Insurance Market Size and Outlook (2024-2030) - https://www.marknteladvisors.com/research-library/malaysia-online-insurance-market.html

• UAE Health Insurance Market Size and Outlook (2025-2030) - https://www.marknteladvisors.com/research-library/uae-health-insurance-market.html

Key Benefits for Clients

• Tailored Insights: We offer customized research based on your specific industry, target audience, and business needs.

• Competitive Advantage: Identify your key competitors and benchmark your position to stay ahead in the market.

• Risk Mitigation: Anticipate potential risks and prepare mitigation strategies with accurate forecasting and market trend analysis.

• Strategic Decision Support: Drive investments, product launches, and market entry strategies with confidence using our actionable data.

• Access to Experts: Collaborate with industry specialists and analysts for detailed consultations and support throughout your journey.

Contact Us:

MarkNtel Advisors LLP

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

For Sales Enquiries: sales@marknteladvisors.com

About US:

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Canada General Insurance Market to Reach USD 87.56 Billion by 2030 | CAGR 6.51% Forecast (2025-30) here

News-ID: 4013210 • Views: …

More Releases from MarkNtel Advisors LLP

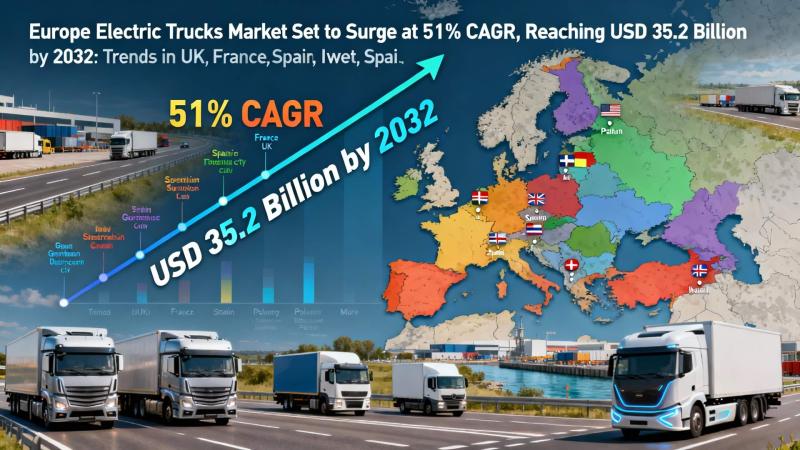

Europe Electric Trucks Market Set to Surge at 51% CAGR, Reaching USD 35.2 Billio …

Latest Research Report of European Electric Trucks Market Size and CAGR

According to MarkNtel Advisors latest market research report data, the Europe Electric Trucks Market is projected to grow from USD 1.96 billion in 2025 to USD 35.2 billion by 2032, registering a remarkable CAGR of 51.07%. Growth is primarily driven by stringent EU emission standards, expansion of high-capacity charging networks, and fleet electrification by major OEMs like Volvo Trucks and…

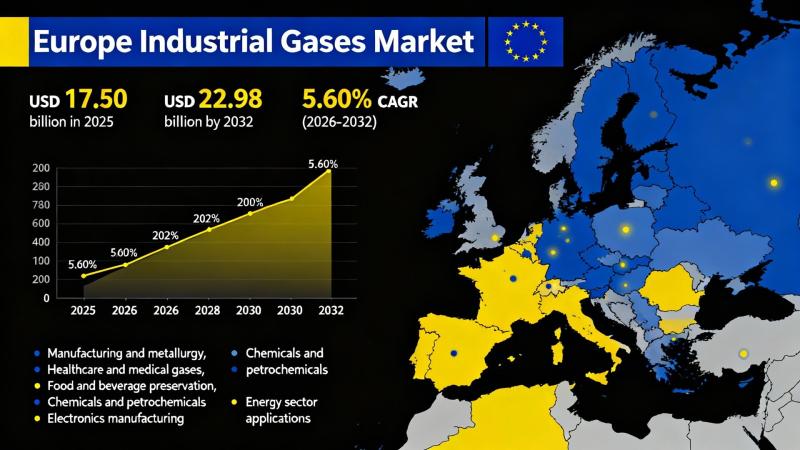

Europe Industrial Gases Market Expected to Reach Nearly $22.98 Billion by 2032: …

Europe Industrial Gases Market: Trends, Insights, and Future Outlook

The Europe Industrial Gases Market is seeing robust growth, driven by increasing demand across key sectors such as petrochemicals, healthcare, and steelmaking. Innovations in hydrogen production and carbon capture technologies are prominent factors influencing market dynamics. A shift towards renewable and low-carbon sources presents significant opportunities amid growing environmental regulations. Additionally, the rise in energy costs is reshaping the landscape for industrial…

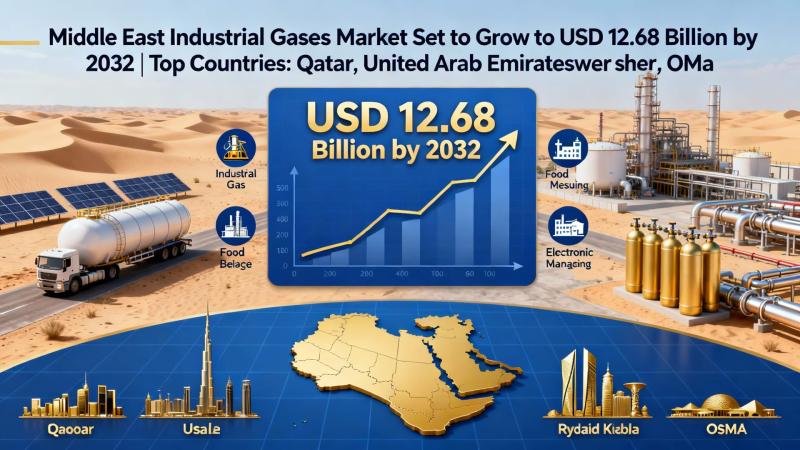

Middle East Industrial Gases Market Set to Grow to USD 12.68 Billion by 2032 | T …

The Middle East Industrial Gases Market is forecasted to expand from USD 10.06 billion in 2025 to USD 12.68 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.72% during the period of 2026 to 2032. The primary drivers fueling this growth are the increasing demand for hydrogen and the robust expansion of the petrochemical industry, which necessitates high-purity gases for various applications such as chemical synthesis and…

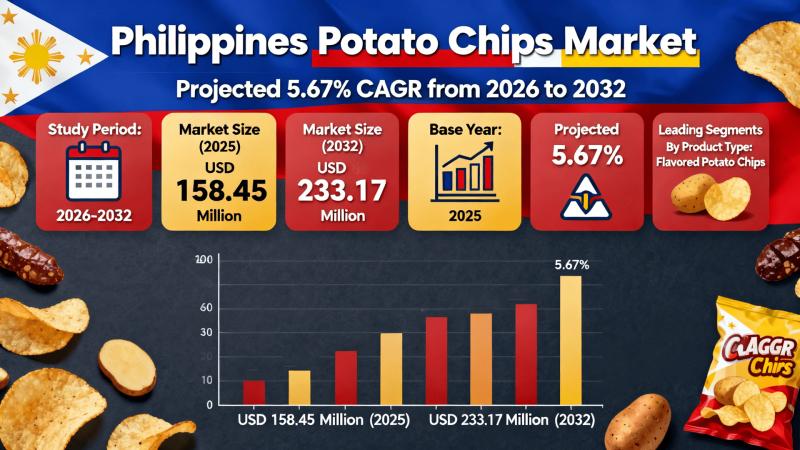

Potato Chips Market in Philippines Set to Grow to USD 233.17 Million by 2032 as …

The Philippines Potato Chips Market is entering a significant growth phase, projected to expand from USD 158.45 million in 2025 to USD 233.17 million by 2032, with a robust compound annual growth rate (CAGR) of 5.67%. Key growth drivers include government initiatives aimed at bolstering local potato production and the rising popularity of flavored varieties among consumers.

Philippines Potato Chips Market Growth Outlook:

As snack food preferences evolve, the Philippines Potato Chips…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…