Press release

Carbon Credit Market Set to Reach US$2.5 Trillion by 2032, Driven by Corporate Sustainability and Global Climate Commitments | Persistence Market Research

The global carbon credit/carbon offset market is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 12.1% from 2025 to 2032. This market, valued at approximately US$ 1,124.4 billion in 2025, is expected to reach a staggering US$ 2,507.1 billion by the end of 2032. Carbon credits and offsets are a crucial part of global efforts to reduce carbon emissions and mitigate the impacts of climate change. Companies, governments, and individuals purchase carbon credits to offset their own emissions, supporting environmental projects that reduce or capture an equivalent amount of CO2 from the atmosphere.The increasing focus on sustainability, climate goals set by international agreements like the Paris Agreement, and rising environmental concerns have created an accelerating demand for carbon credits and offsets. These credits represent a reduction of one metric ton of CO2 or its equivalent in other greenhouse gases. As companies strive to meet their sustainability targets, carbon credits provide a cost-effective and scalable way to compensate for emissions that cannot be avoided or reduced internally. Moreover, regulatory pressures, along with consumer preferences for environmentally responsible businesses, are expected to propel the growth of this market.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/33769

✅Key Highlights from the Report:

➤ The global carbon credit market is projected to reach US$ 2,507.1 billion by 2032, growing at a CAGR of 12.1%.

➤ A significant rise in corporate sustainability efforts is driving the demand for carbon offsets.

➤ Governments worldwide are implementing stricter environmental regulations, increasing the market's growth potential.

➤ The voluntary carbon credit market is expanding rapidly, with more companies aiming for carbon neutrality.

➤ North America and Europe are leading regions in the carbon credit market, driven by strong regulatory frameworks and corporate sustainability efforts.

➤ New carbon credit methodologies and innovations in emission reduction projects are opening up new market opportunities.

✅Market Segmentation

The carbon credit market can be segmented based on the type of carbon credit, the sector in which the credits are used, and the geographical region. The two main categories of carbon credits are compliance and voluntary credits. Compliance credits are purchased by companies or governments that are legally required to meet emissions reduction targets set by international agreements or national regulations. In contrast, voluntary credits are bought by organizations or individuals who aim to offset their emissions voluntarily, often as part of a corporate sustainability initiative or personal carbon footprint reduction.

The market is also segmented by end-users or the industries that purchase carbon credits. Major sectors include energy (including oil and gas, electricity), transportation, manufacturing, and consumer goods. The energy sector is one of the largest purchasers of carbon credits due to the high levels of emissions generated from fossil fuel consumption. Companies in the transportation and manufacturing sectors also make significant investments in carbon offset programs to comply with regulations or to boost their environmental image. Additionally, industries with large-scale supply chains, such as retail and food production, are increasingly participating in carbon offsetting to meet sustainability targets.

✅Regional Insights

In terms of regional growth, North America and Europe are currently leading the carbon credit market. These regions have established regulatory frameworks that mandate emissions reductions, which have spurred the demand for carbon credits. Governments in both North America and Europe have implemented policies to drive carbon neutrality, including carbon pricing schemes, cap-and-trade systems, and carbon taxes. As a result, both voluntary and compliance-based carbon offset initiatives are gaining traction.

On the other hand, the Asia-Pacific region is expected to experience rapid growth in the carbon credit market. With countries like China, India, and Japan setting ambitious climate goals, the region is becoming a key player in the global carbon offset market. These countries are increasingly investing in carbon credit initiatives as part of their commitment to reducing carbon emissions and promoting sustainable development. Additionally, growing industrialization and urbanization in the region create a significant demand for carbon offset projects, particularly in sectors like energy, transportation, and manufacturing.

✅Market Drivers

Several factors are driving the growth of the carbon credit market. The most significant driver is the increasing global awareness of climate change and the need to reduce carbon emissions. Governments around the world are putting pressure on corporations to lower their carbon footprints through stricter regulations and policies. The Paris Agreement and other international climate accords are setting more aggressive targets for reducing emissions, creating a larger market for carbon credits.

Another important driver is the growing corporate commitment to sustainability. Companies across industries are increasingly making pledges to become carbon-neutral or achieve net-zero emissions. This has led to a surge in demand for carbon credits, as organizations look to offset their emissions by investing in environmental projects. With more companies facing consumer scrutiny and investor expectations regarding their environmental impact, the need to purchase carbon credits is expected to rise significantly.

Lastly, the increasing availability of carbon credit projects is enhancing market growth. New technologies and methodologies are emerging to increase the efficiency and scope of carbon reduction initiatives. Projects such as renewable energy installations, reforestation programs, and carbon capture and storage (CCS) are gaining momentum, making it easier for companies and individuals to invest in carbon offset programs.

✅Market Restraints

Despite the promising growth trajectory, the carbon credit market faces some key challenges. One of the primary restraints is the lack of standardized regulations across different countries. While some regions have well-established frameworks for carbon offset programs, others lack clear regulations or have inconsistent policies, which can create uncertainty for businesses and investors. This lack of uniformity can result in inefficiencies and prevent the market from reaching its full potential.

Another restraint is the potential for carbon credit fraud and concerns about the credibility of certain carbon offset projects. In some cases, projects may claim to reduce emissions but fail to deliver on their promises. This has raised concerns about the effectiveness of certain carbon credits, undermining trust in the market. As such, robust verification systems and the development of internationally recognized standards for carbon credits will be crucial in addressing these concerns.

✅Market Opportunities

The carbon credit market presents several opportunities for growth, particularly in innovative carbon offset solutions. Technologies such as direct air capture (DAC), renewable energy projects, and bioenergy with carbon capture and storage (BECCS) are becoming more prevalent, opening new pathways for carbon offsetting. These technologies have the potential to capture and sequester large amounts of CO2, providing high-quality credits for businesses and governments looking to offset their emissions.

Moreover, emerging markets in Asia-Pacific, Africa, and Latin America represent significant opportunities for expansion. Many of these regions are still in the early stages of implementing carbon credit schemes but are increasingly looking to do so as part of their commitment to global climate targets. Companies that can tap into these new markets, particularly in sectors like agriculture, forestry, and waste management, will have a competitive advantage.

Finally, the development of blockchain technology in carbon credits is also creating new opportunities for the market. Blockchain can enhance transparency and traceability in the carbon offset market, ensuring that credits are not double-counted or misused. This innovation could increase trust in carbon credit programs and attract more investors and participants.

✅Reasons to Buy the Report:

☑ In-depth analysis of market trends, drivers, and challenges shaping the carbon credit market.

☑ Comprehensive market segmentation to understand key market dynamics and opportunities.

☑ Insights into regulatory frameworks that are influencing the carbon credit market worldwide.

☑ Overview of emerging technologies and innovations in carbon offset projects.

☑ Regional analysis to help businesses identify profitable opportunities in key global markets.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/33769

✅Key Players

✦ Chevron Corporation

✦ BP (British Petroleum)

✦ Shell PLC

✦ Gold Standard

✦ Verra

■Recent Developments:

■ Verra recently launched a new carbon credit standard to ensure the long-term sustainability and transparency of carbon offset projects.

■ Shell announced an increase in its investment in carbon capture and storage (CCS) projects, aiming to create more high-quality carbon credits.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Carbon Credit Market Set to Reach US$2.5 Trillion by 2032, Driven by Corporate Sustainability and Global Climate Commitments | Persistence Market Research here

News-ID: 4012647 • Views: …

More Releases from Persistence Market Research

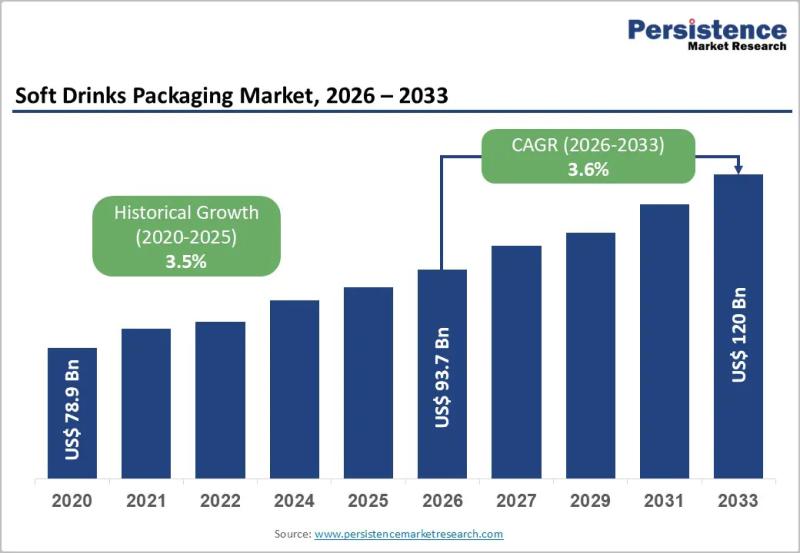

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

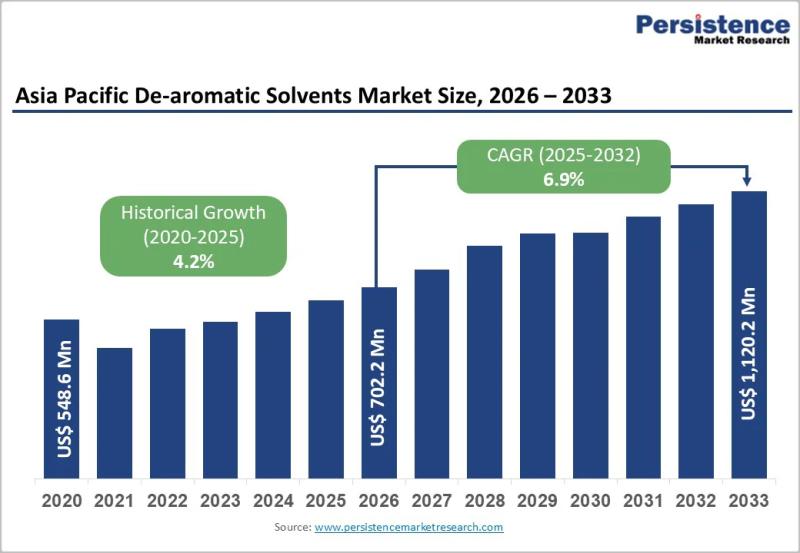

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Carbon

Carbon-Carbon Composite Market to Reach $3.31 Billion by 2031 | SGL Carbon, Toyo …

NEW YORK, (UNITED STATES) - QY Research latest 'Carbon-Carbon Composite Market 2025 Report' offers an unparalleled, in-depth analysis of the industry, delivering critical market insights that empower businesses to enhance their knowledge and refine their decision-making processes. This meticulously crafted report serves as a catalyst for growth, unlocking immense opportunities for companies to boost their return rates and solidify their competitive edge in an ever-evolving market. What sets this report…

Carbon Black Market Next Big Thing | Cabot, Tokai Carbon, Jiangxi Black Carbon, …

Market Research Forecast published a new research publication on "Global U.S. U.S. Carbon Black Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the U.S. U.S. Carbon Black Market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Carbon-Carbon Composite Material Market Size, Share 2024, Impressive Industry Gr …

Report Description: -

QY Research's latest report 'Carbon-Carbon Composite Material Market 2024 Report' provides a comprehensive analysis of the industry with market insights will definitely facilitate to increase the knowledge and decision-making skills of the business, thus providing an immense opportunity for growth. Finally, this will increase the return rate and strengthen the competitive advantage within. Since it's a personalised market report, the services are catered to the particular difficulty. The…

Carbon Black Market Scenario & Industry Applications 2020-2025 | Phillips Carbon …

The global carbon black market size is projected to surpass USD 18 billion by 2025. Carbon black act as a reinforcement material for tires and rubber, and possess electrical conductive properties. Carbon black provide pigmentation, conductivity, and UV protection for a number of coating applications along with toners and printing inks for specific color requirements. Its multiple application across various end product along with rising economic outlook has significantly enhanced…

Global Carbon-Carbon Composite Market 2020-2026 SGL Carbon, Toyo Tanso, Tokai Ca …

Global Carbon-Carbon Composite Market 2020-2026 analysis Report offers a comprehensive analysis of the market. It will therefore via depth Qualitative insights, Historical standing and verifiable projections regarding market size. The projections featured inside the report square measure derived victimisation verified analysis methodologies and assumptions. Report provides a progressive summary of the Carbon-Carbon Composite business 2020 together with definitions, classifications, Carbon-Carbon Composite market research, a decent vary of applications and Carbon-Carbon…

Global Carbon Black Market to 2026| Cabot, Orion Engineered Carbons, Birla Carbo …

Albany, NY, 10th January : Recent research and the current scenario as well as future market potential of "Carbon Black Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2018 - 2026" globally.

Carbon Black Market - Overview

Carbon black (CB) is manufactured through partial combustion of heavy hydrocarbons under controlled temperature and pressure to obtain fine particles and aggregates having a wide range of structure and surface properties. This…