Press release

Marine Insurance Market Size Forecasted To Achieve $45.73 Billion By 2029 With Steady Growth

The Marine Insurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Expected Marine Insurance Market Size During the Forecast Period?

In recent times, there has been a robust growth in the marine insurance market size. The market, which is currently valued at $32.2 billion in 2024, is projected to increase to $34.34 billion in 2025, representing a compound annual growth rate (CAGR) of 6.6%. Factors influencing this growth during the historic period include expansions in global trade, an increase in international shipping, concerns over piracy and maritime security, strict regulatory demands, and the risk of natural disasters and climate-related hazards.

In the coming years, the marine insurance market is projected to witness substantial growth, reaching a valuation of $45.73 billion by 2029 with a 7. 4% CAGR. Factors contributing to this anticipated growth include the advent of unmanned ships, concerns over cybersecurity, response to climate change, sustainable shipping measures, and renewable energy's rising prominence. In the same forecast period, the prominent trends identified are the increased digitalisation and insurance technology, the prevalence of data analytics and predictive modeling, the rise of autonomous ships and their associated technological risks, changes in economic and trade landscapes, and the deployment of alternative risk transfer mechanisms.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=7626

What Are the High-Growth Segments in the Marine Insurance Market?

The marine insurance market covered in this report is segmented -

1) By Type: Cargo Insurance, Hull And Machinery Insurance, Marine Liability Insurance, Offshore or Energy Insurance

2) By Policy Type: Time Policy, Voyage Policy, Floating Policy, Valued Policy, Others Policy Types

3) By Distribution Channel: Wholesalers, Retail Brokers, Others Distribution Channels

4) By End User: Ship Owners, Traders, Others End Users

Subsegments:

1) By Cargo Insurance: All Risks Cargo Insurance, Named Perils Cargo Insurance

2) By Hull and Machinery Insurance: Total Loss Coverage, Partial Loss Coverage

3) By Marine Liability Insurance: Protection and Indemnity Insurance (P&I), Charterers Liability Insurance

4) By Offshore or Energy Insurance: Offshore Construction Insurance, Energy Liability Insurance

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=7626&type=smp

What Key Drivers Are Expected to Influence Future Marine Insurance Market Growth?

The growth of the maritime insurance market is predicted to be fueled by the escalating international trade. This refers to the exchange of goods and services across national borders. The increasing reliance on ships for such imports and exports is powering the marine insurance industry because all shipping firms are insuring to guard against uncertain damages to both the vessels and their contents. For example, in October 2024, GOV.UK, a provider of UK government services and information, reported that the total goods imported in August 2024 saw a surge to £51.2 ($66.27) billion, exhibiting a rise of £2.7 ($3.49) billion (6%) from August 2023. Consequently, the expansion in international trade is steering the advancement of the marine insurance market.

Which Companies Hold the Largest Share Across Different Marine Insurance Market Segments?

Major companies operating in the marine insurance market include Berkshire Hathaway Specialty Insurance, Axa S.A., American International Group Inc., Tokio Marine Holdings Inc., Swiss Reinsurance Company Ltd., Chubb Limited, Zurich Insurance Group, Sompo International Holdings Ltd, The Travelers Indemnity Company, Fairfax Financial Holdings Limited, The Hartford Financial Services Group Inc., Intact Financial Corporation, Everest Reinsurance Group Ltd., Aon plc, Arch Capital Group Ltd., HDI Global SE, Markel Corporation, Arthur J. Gallagher & Co, American Financial Group Inc., The Hanover Insurance Group Inc., AXIS Capital Holdings Limited, RenaissanceRe Holdings Ltd., Aspen Insurance Holdings Limited, ProSight Global Inc., Allianz SE, Bermudan Insurance Holding Company Ltd., Validus Holdings Inc., Argo Group International Holdings Ltd.

What Trends Are Driving Growth in The Marine Insurance Market?

Primary players in the marine insurance market are turning their attention to providing cargo war risk insurance services. These services offer all-inclusive insurance for goods in transit against possible losses arising from piracy or conflict. The term cargo war risk insurance facilities refers to a unique type of insurance that safeguards cargo owners and maritime shipping firms against losses or damages to goods transported by sea due to war-related activities. For instance, in April 2024, Howden Insurance Brokers LLC, a company based in the UK, launched a new product called Red Sea cargo war insurance. This insurance covers up to $50 million per insured ship, but the highest limit quoted so far has been $150 million. This range allows for varying degrees of coverage according to individual client needs. This is the first insurance product specifically designed for cargo ships in an active conflict zone, which includes key maritime routes like the Bab al Mandab Strait, the Red Sea, and certain parts of the Indian Ocean.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/marine-insurance-global-market-report

What Are the Emerging Geographies for The Marine Insurance Market Growth?

Europe was the largest region in the marine insurance market in 2024. Asia-Pacific is expected to be the fastest growing region in the forecast period. The regions covered in the marine insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Marine Insurance Market?

2. What is the CAGR expected in the Marine Insurance Market?

3. What Are the Key Innovations Transforming the Marine Insurance Industry?

4. Which Region Is Leading the Marine Insurance Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Marine Insurance Market Size Forecasted To Achieve $45.73 Billion By 2029 With Steady Growth here

News-ID: 4012155 • Views: …

More Releases from The Business Research Company

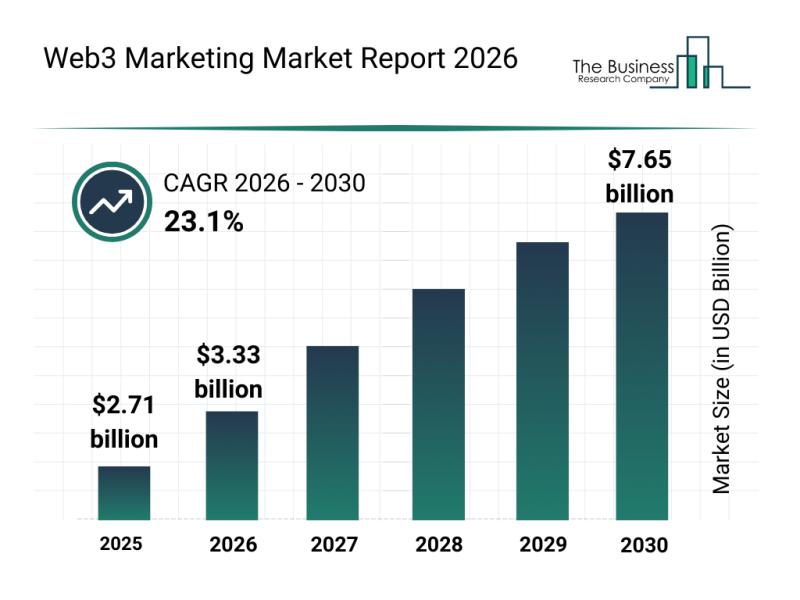

Emerging Growth Patterns Driving the Expansion of the Web3 Marketing Market

The Web3 marketing sector is on the brink of remarkable expansion, driven by the evolving digital landscape and innovative technologies. As brands and enterprises increasingly tap into blockchain solutions and decentralized platforms, the market is poised for significant growth and transformation. Here's a detailed overview of the market's size, leading players, trends, and key segments shaping its future.

Projected Growth Trajectory of the Web3 Marketing Market

The Web3 marketing market…

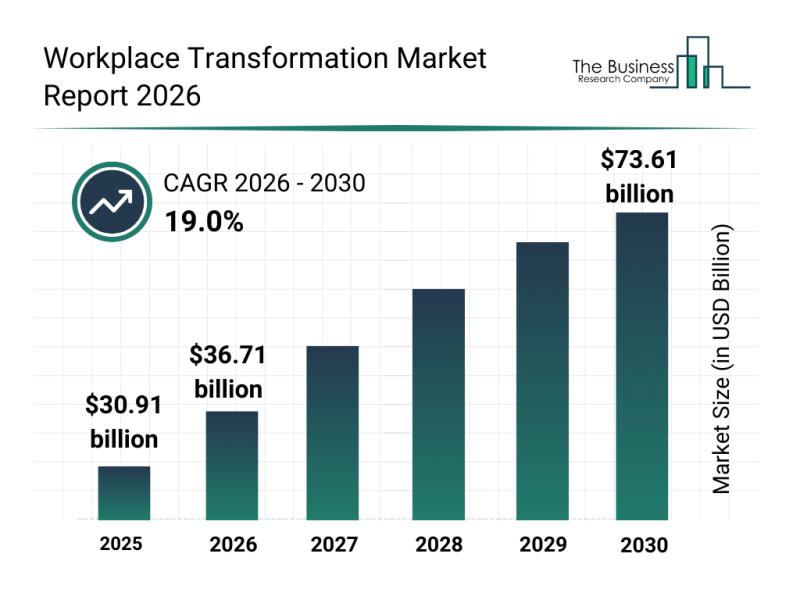

Emerging Sub-Segments Driving Change in the Workplace Transformation Market

The workplace transformation market is undergoing a significant evolution as organizations adapt to changing work environments and technology advancements. With the rise of hybrid models and digital tools, this market is set to experience rapid expansion in the coming years. Below, we explore its projected growth, key players, emerging trends, and detailed segmentation to provide a comprehensive overview of the sector's future direction.

Projected Market Size and Growth Trajectory of the…

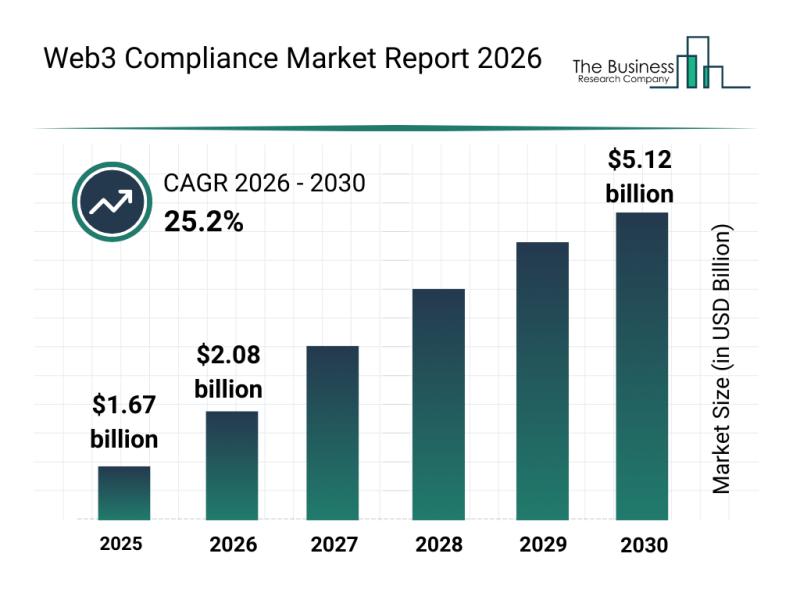

Analysis of Segmentation, Market Dynamics, and Competitive Landscape in the Web3 …

Exploring the promising future of the Web3 compliance sector reveals a landscape set for rapid expansion driven by technological advancements and increasing institutional interest. As blockchain technology and digital assets become more deeply embedded in global finance and governance, the demand for robust compliance solutions is soaring. Below is a detailed overview of the Web3 compliance market's current trajectory, key players, evolving trends, and primary segments shaping its growth.

Projected Market…

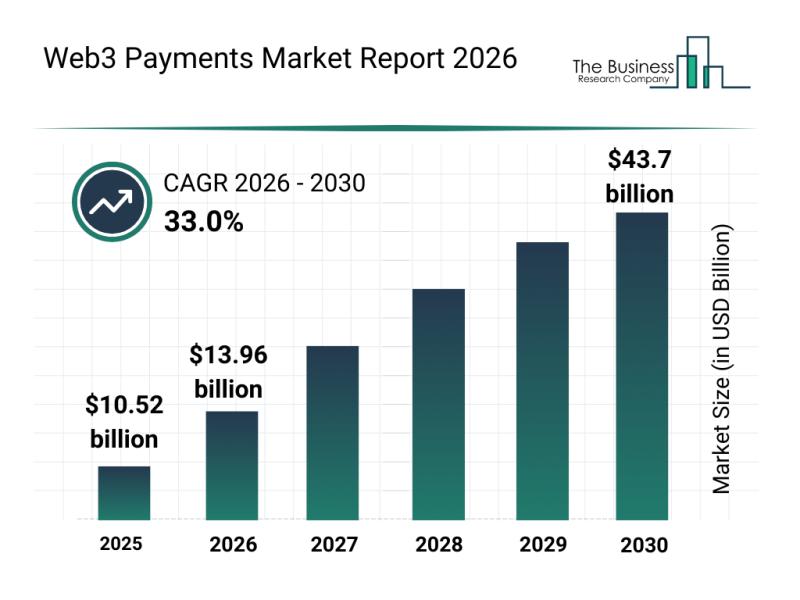

Top Companies and Market Competition in the Web3 Payments Sector

The Web3 payments market is on the brink of remarkable expansion as digital finance continues to evolve. This sector is experiencing rapid innovation driven by the increasing adoption of blockchain technologies and the growing demand for secure, efficient, and decentralized payment solutions. Let's explore the current market size, key drivers, prominent companies, trends, and growth opportunities shaping the future of Web3 payments.

Forecasted Growth and Market Size of the Web3 Payments…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…