Press release

Insurtech Market Expected to Reach $158.99 Billion by 2030 | Share, Growth, Size

According to a recent report published by Allied Market Research, titled, "Insurtech Market by Offering, Deployment Model, Technology, End User, and Application: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global Insurtech market size was valued at $9.41 billion in 2020, and is projected to reach $158.99 billion by 2030, growing at a CAGR of 32.7% from 2021 to 2030.Get a Sample Copy of this Report

https://www.alliedmarketresearch.com/request-sample/A12373

Insurtech is the emergence of new technologies engages in transforming the insurance industry, reducing costs for consumers & insurance companies, and enhancing better customer experience. With an implementation of Insurtech, customers can research, compare policies, and make a purchase online without having to physically visit a local agent. Moreover, Insurtech companies have streamlined process of buying all types of insurance with easier & convenient options.

Factors such as rapid digitalization of business models and saturation of the insurance industry propel the global Insurtech market growth. In addition, incorporation of technologies in existing product lines among insurance companies and untapped potential of emerging economies are expected to provide lucrative opportunities for the Insurtech solution providers in the coming years.

On the basis of application, sales & marketing segment dominated the Insurtech market share in 2020 and is projected to maintain its dominance during the forecast period. This is attributed to the fact that Insurtech helps in customer acquisition, using upsell & cross sell model and planning & forecasting sales of insurance policies. This is promoting the adoption of Insurtech in the sales & marketing application.

Region wise, the Insurtech market share was dominated by North America in 2021, and is expected to maintain this trend during the forecast period. This is attributed to increased adoption of Insurtech among insurance companies and surge in partnership of Insurtech with traditional insurers are the major factors that influence the growth of the market in this region. However, Asia-Pacific is expected to grow at the fastest CAGR during the forecast period, as several insurers are adopting & heavily investing in Insurtech to boost business efficiency, lowering compliance risk exposure and improving claim settlement process in the region.

Enquire Before Buying

https://www.alliedmarketresearch.com/purchase-enquiry/A12373

The Insurtech growth has increased tremendously during the COVID-19 pandemic situation. This is attributed to insurance carriers are accelerating business operations in areas such as digital customer interactions in distribution channel, improving customer service, and hassle-free claims settlements. Moreover, with the help of Insurtech, insurers are able to access remote imaging in assessing underwriting risk & evaluate claims through online channels. Therefore, insurance companies have adopted Insurtech to meet changing customer's demand, which had a positive impact on the market growth. As a result, these are the major factors promoted the Insurtech market growth during the pandemic situation.

Key Findings of the Study

By technology, the cloud computing segment led the Insurtech industry, in terms of revenue in 2020.

On the basis of application, the claims management segment is expected to exhibit the fastest growth rate during the forecast period.

Region wise, North America generated the highest revenue in 2020.

The top companies in the Insurtech market analysis are Damco Group, DXC Technology Company, Majesco, Oscar Insurance, OutSystems, Quantemplate, Shift Technology, Trov Insurance Solutions, LLC, Wipro Limited, and Zhongan Insurance. These players have adopted various strategies to increase their market penetration and strengthen their position in the Insurtech industry.

Request Customization

https://www.alliedmarketresearch.com/request-for-customization/A12373

Top Trending Reports:

Commercial Auto Insurance Market https://www.alliedmarketresearch.com/commercial-auto-insurance-market-A14156

Regulatory Data Market https://www.alliedmarketresearch.com/regulatory-data-market-A325412

Southeast Asia POS Payment Market https://www.alliedmarketresearch.com/southeast-asia-pos-payment-market-A325612

Green, Social, Sustainability, and Sustainability-linked Bond (GSSSB) Market https://www.alliedmarketresearch.com/green-social-sustainability-and-sustainability-linked-bond-market-A325543

Mortgage Brokerage Services Market https://www.alliedmarketresearch.com/mortgage-brokerage-services-market-A06699

RegTech Market https://www.alliedmarketresearch.com/regtech-market

Home Banking Market https://www.alliedmarketresearch.com/home-banking-market-A324245

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurtech Market Expected to Reach $158.99 Billion by 2030 | Share, Growth, Size here

News-ID: 4011099 • Views: …

More Releases from Allied Market Research

Winter Footwear Market 2026 : Expeditious Growth Expected in 2021 - 2031 | UGG, …

According to a new report published by Allied Market Research, titled, "Winter Footwear Market," The winter footwear market was valued at $8.6 billion in 2021, and is estimated to reach $13.6 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

"Numerous varieties of winter footwear are expected to boost the market growth in the foreseeable future. Moreover, incorporation of customization, as well as innovative winter footwear is…

Ergonomic Chair Market Research Insights: Uncovering CAGR and USD Growth Drivers …

An ergonomic office chair is mostly utilized in different firms and other business areas where employees operate in a sitting position for extended hours. Adjustable seats, brackets and natural postures, which minimize back discomfort and stress in the lengthy seating time, are the ergonomic chairs. Currently, the offices are selecting ergonomic office chairs over the standard office chair to make the workplace healthier, happier, and to boost employer productivity. The…

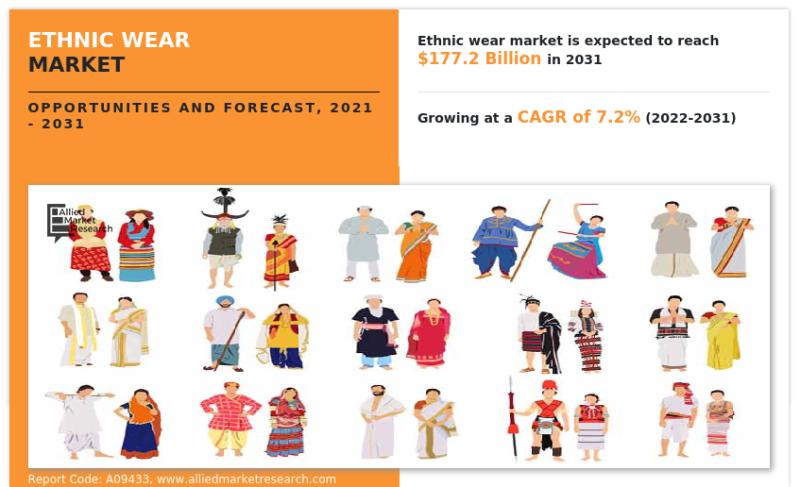

Ethnic Wear Market Forecasting Essentials: Interpreting CAGR and USD Projections …

According to a new report published by Allied Market Research, titled, "Ethnic Wear Market," The ethnic wear market size was valued at $89.3 billion in 2021, and is estimated to reach $177.2 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031.

The market for ethnic wear is mostly driven by the rising number of fashion influencers across the globe. It is difficult to overlook the importance of…

$8.9+ Billion Commercial Janitorial Equipment Market Value by 2031 with a 4.6% C …

According to a new report published by Allied Market Research, titled, "Commercial Janitorial Equipment Market," The commercial janitorial equipment market size was valued at $5.7 billion in 2021, and is estimated to reach $8.9 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031. There has been a surge in the number of restaurants, hotels, and hospitals across the globe, which further contribute to the demand for…

More Releases for Insurtech

Insurtech Accelerators Market Hits New High | Major Giants Plug and Play, Startu …

HTF MI just released the Global Insurtech Accelerators Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Insurtech Accelerators Market are: Plug and Play,…

Insurtech Market: A Comprehensive Overview

The global insurtech market was valued at approximately USD 10.3 billion in 2024 and is projected to reach around USD 152.9 billion by 2033, growing at a compound annual growth rate (CAGR) of about 31.5% from 2025 to 2033.

Insurtech Market Overview

The global Insurtech market is undergoing explosive growth, fueled by the insurance industry's rapid digitization and rising customer demand for seamless, personalized digital experiences. Advanced technologies like artificial intelligence (AI),…

Top Trends Transforming the InsurTech (Insurance Technology) Market Landscape in …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the InsurTech (Insurance Technology) Industry Market Size Be by 2025?

The volume of the insurtech (insurance technology) market has expanded significantly in the past few years. The market, currently valued at $19.23 billion in 2024, is projected to reach $25.95 billion in 2025, demonstrating a compound annual…

Emerging Trends Influencing The Growth Of The Insurtech Market: Innovative AI-Po …

The Insurtech Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Insurtech Market Size Expected to Be by 2034?

In recent times, the insurtech market has seen substantial expansion. The projected growth indicates an increase from $17.08 billion in 2024 to $22.08 billion…

Top Factor Driving Insurtech Market Growth in 2025: Rising Tide Of Insurance Cla …

How Are the key drivers contributing to the expansion of the insurtech market?

The expected surge in insurance claims is projected to directly contribute to the expanded growth of the insurtech market. Insurtech plays a critical role in claim management, risk assessment, contract processing, and policy underwriting. The increase in hospitalizations during the COVID-19 pandemic has resulted in a steep rise in insurance claims. An illustrative example of this could be…

Insurtech, Market Dynamics, Global Opportunities, Forecast 2024

The Business Research Company recently released a comprehensive report on the Global Insurtech Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…