Press release

Mobile Phone Insurance Market Growth, Share, and Forecast 2025-2033

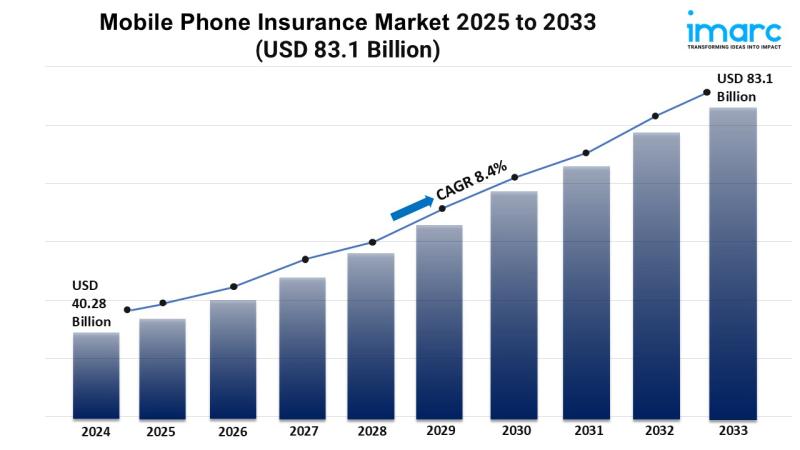

Market Overview:The mobile phone insurance market is experiencing rapid growth, driven by rising smartphone premiumization, e-commerce & digital adoption, and sustainability & repair culture. According to IMARC Group's latest research publication, "Mobile Phone Insurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033′′. The global mobile phone insurance market size was valued at USD 40.28 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 83.1 Billion by 2033, exhibiting a CAGR of 8.4% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/mobile-phone-insurance-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Factors Affecting the Growth of the Mobile Phone Insurance Industry:

● Rising Smartphone Premiumization:

The global mobile phone insurance market is growing fast. This rise is due to the increasing premium prices of smartphones. Flagship devices from brands like Apple, Samsung, and Google now cost over $1,000. As a result, consumers want to protect their investments more. Insurance plans for accidental damage, theft, and liquid spills are now essential. Repair costs are rising, making this coverage important. The trend toward foldable and high-end 5G devices also boosts demand. These gadgets are pricier to replace or repair. Insurers are meeting this need with flexible, tiered coverage options. This makes policies attractive to a wider audience.

● E-Commerce & Digital Adoption:

Online smartphone sales have increased the demand for mobile phone insurance. E-commerce platforms and OEMs now sell insurance at checkout. This makes it easier for consumers. Digital-first insurers use AI and fast claims processing. This boosts customer experience and makes policy management easier. Many buyers prefer subscription models, pay-as-you-go plans, and embedded insurance. This trend is especially strong among younger, tech-savvy customers. They enjoy seamless digital solutions instead of traditional paperwork.

● Sustainability & Repair Culture:

Growing environmental awareness is changing mobile phone insurance trends. Consumers now prioritize sustainability over frequent upgrades. Insurance providers respond by offering extended warranty plans and eco-friendly repair services. They partner with certified repair centers and refurbishment programs. This reduces e-waste and lowers claim costs. Governments and regulators push for "right-to-repair" laws, encouraging insurers to adopt greener practices. This shift responds to consumer demand for sustainable choices. It also boosts brand loyalty in a competitive market.

Buy Full Report: https://www.imarcgroup.com/checkout?id=1292&method=1670

Leading Companies Operating in the Global Mobile Phone Insurance Industry:

● American International Group, Inc

● Allianz SE

● AmTrust International Limited

● Apple Inc., AT&T Inc.

● AXA Group

● Deutsche Telekom AG

● Liberty Mutual Insurance Group

● Pier Insurance Managed Services Ltd.

● Samsung Electronics Co. Ltd.

● SoftBank Group Corp.

● Sprint Corporation

● Telefónica Insurance S.A.

● Verizon Communications Inc.

● Vodafone Group Plc

● Xiaomi Corporation

● Orange S.A.

Mobile Phone Insurance Market Report Segmentation:

By Phone Type:

● New Phone

● Refurbished

The new phone represented the largest segment due to the rising need to reduce high replacement costs.

By Coverage:

● Physical Damage

● Electronic Damage

● Virus Protection

● Data Protection

● Theft Protection

Physical damage accounted for the largest market share as it provides protection for mobile phones against external harm, such as accidental drops and spills.

By Distribution Channel:

● Mobile Operators

● Device OEMs

● Retailers

● Online

● Others

Online exhibits a clear dominance in the market on account of the increasing focus on enhanced convenience and accessibility.

By End User:

● Corporate

● Personal

Personal holds the biggest market share as mobile phone insurance provides protection against numerous risks, such as accidental damage, theft, loss, and damage caused by environmental factors.

Regional Insights:

● North America: (United States, Canada)

● Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America: (Brazil, Mexico, Others)

● Middle East and Africa

North America enjoys the leading position in the mobile phone insurance market due to the presence of numerous insurance providers.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=1292&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Phone Insurance Market Growth, Share, and Forecast 2025-2033 here

News-ID: 4010211 • Views: …

More Releases from IMARC Group

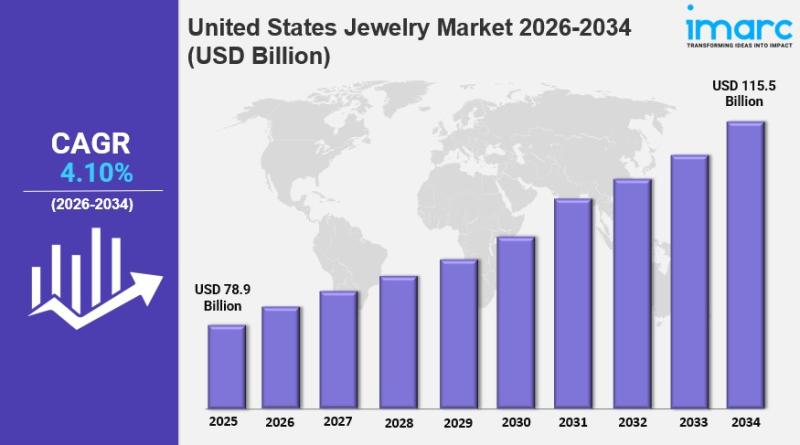

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…